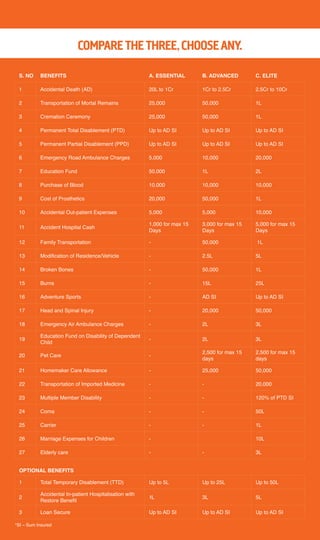

The document provides an overview of the Apollo Munich Individual Personal Accident insurance plan. It summarizes the plan's key benefits like accidental death coverage, income support for temporary disabilities, hospital cash allowances, and coverage for fractures and burns. It outlines three plan options - Essential, Advanced, and Elite - that vary based on the number of benefits and maximum sum insured. The document also highlights eligibility criteria, discounts available, exclusions from coverage, and renewal and cancellation terms.