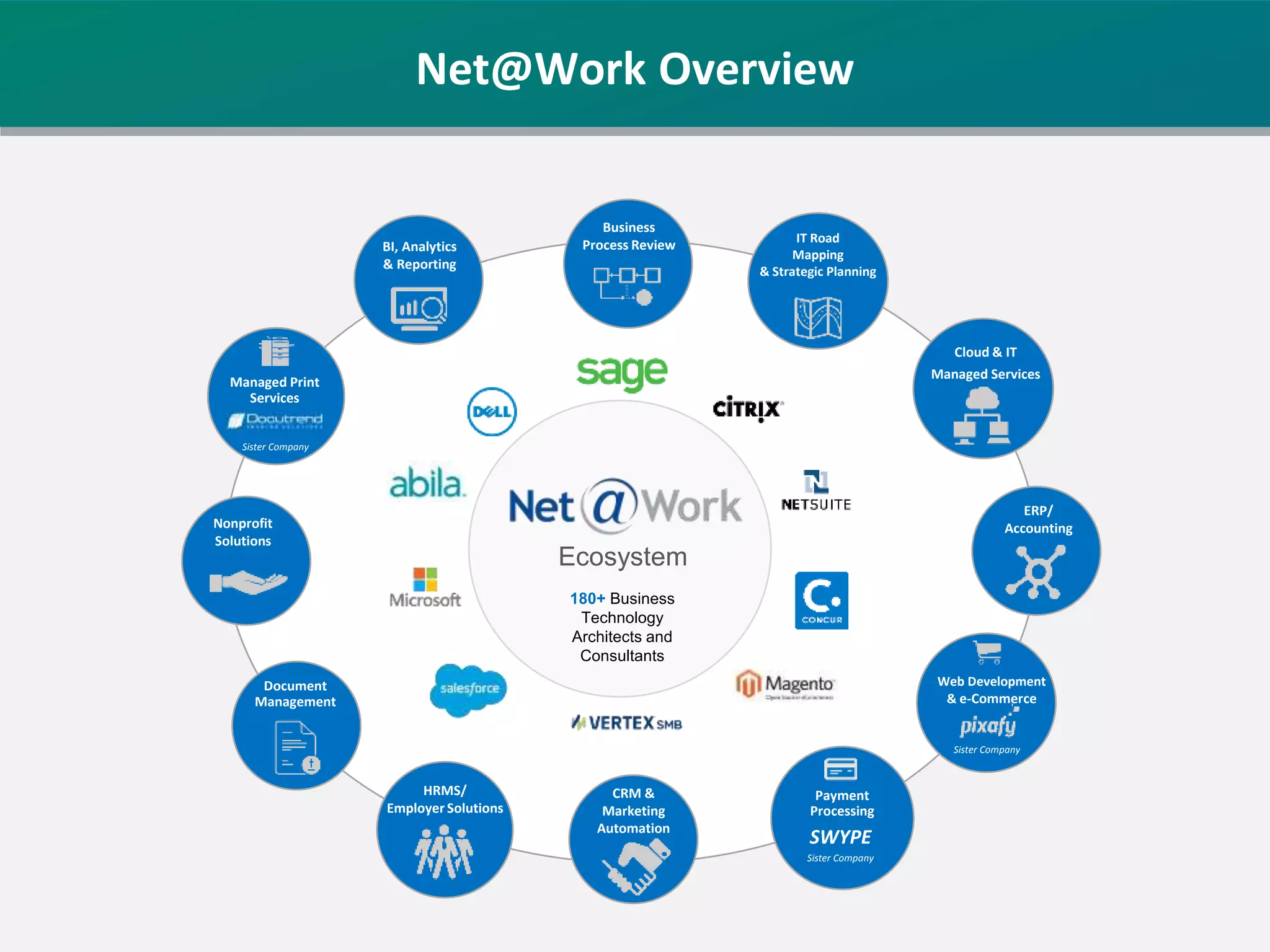

This webinar discusses how a nonprofit accounting system can help nonprofits track donor-restricted contributions, allocate expenses to programs and grants, create customized reports for funders, and other essential nonprofit accounting tasks. The presenter demonstrates the Abila MIP nonprofit accounting solution and how it meets requirements for fund accounting, standard financial reports, performance tracking, and other needs. Attendees are invited to ask questions during the Q&A portion at the end.