A Macro View Through the Micro Lens

•

2 likes•465 views

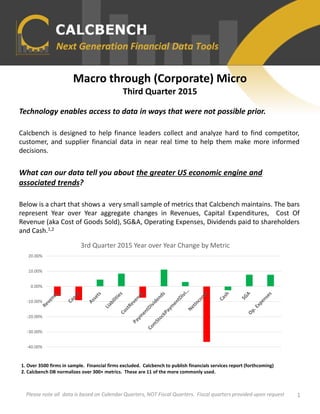

Calcbench takes all 3rd Quarter filings and does a year over year comparison of 11 commonly used metrics. Only industrial firms are analyzed (i.e. Financial firms are excluded)

Report

Share

Report

Share

Download to read offline

Recommended

This Week In Earnings - May 1, 2015

Thomson Reuters This Week in Earnings report on the S&P 500's earnings.

You can subscribe to more earnings reports here: http://www.trpropresearch.com/subscribe/

Please note: if you use our earnings data, please source Thomson Reuters I/B/E/S.

2018 MEDA Annual Conference - Economic Outlook - Sage Policy Group

2018 MEDA Annual Conference - Economic Outlook - Sage Policy GroupMaryland Economic Development Association (MEDA)

This document contains numerous charts and graphs related to economic indicators in the United States and globally. It shows data on consumer confidence, business confidence, GDP growth, monetary policy, jobs, profits and other topics. The data comes from sources like the OECD, IMF, Bureau of Labor Statistics, Census Bureau and others. Overall the data suggests moderate global economic growth and strengthening conditions in the US economy in recent months.Surplus Note report - A.M. Best

- As of 2014, over 500 insurance carriers held more than $47 billion in outstanding surplus notes. The life/annuity segment had the largest amount at $29 billion, while property/casualty had $14.9 billion and health had $3.9 billion.

- On average, surplus notes accounted for 21.6% of capital and surplus for property/casualty companies, 13.6% for life/annuity companies, and 63.4% for health companies.

- Since 2000, around 1,000 surplus notes totaling $38.7 billion have been issued, with 2014 seeing a peak of 160 notes totaling $5.7 billion issued.

Before the Open May 5 2017

- US and European stock futures fell and Asian markets dropped sharply due to concerns over global growth and the outcome of Greece's debt restructuring.

- European stocks declined with banks and resources stocks falling the most. Eurozone GDP contracted 0.3% QoQ in Q4, driven by declines in investment, exports and consumer spending.

- Private investors holding 20% of Greek bonds involved in the debt swap have agreed to participate in the restructuring, which runs through March 8th and aims to cut Greek debt by 53.5%.

- Asian stocks fell sharply led by miners, following global markets lower on growth worries. Japan's Nikkei shed 0.6% while Hong Kong's Hang Seng dropped

Ami latin american forecast 2014 se acabo la fiesta - time again to reform-...

Versailles Breakfast Club Presents "Se acabó la fiesta" Hosted by John Price, Managing Director of AMI

Travis Perkins PLC Research Report

Travis Perkins PLC is a UK-based company that operates in builders' merchant and home improvement markets. It is a leading supplier of basic products to the building and construction industries in the UK. Analysts recommend buying Travis Perkins stock, with a target price of 2150 GBX, representing 19.98% upside. Key risks include housing market conditions, supplier dependency, and competitive pressures. The company has seen strong revenue growth and is undertaking strategic transformations and acquisitions to capitalize on growth in the housing and construction industries.

Etude PwC Golden Age Index (juin 2015)

Dans sa dernière étude « PwC Golden Age Index : how well are OECD economies adapting to an older workforce ? », le cabinet d’audit et de conseil PwC compare l’emploi des seniors (travailleurs âgés de plus de 55 ans) dans 34 pays de l’OCDE.

LinkedIn Q4 2015 Earnings Call

Presentation given by CEO Jeff Weiner, and CFO Steve Sordello, at LinkedIn Q4 2015 Earnings Call. For more information, check out http://investors.linkedin.com/.

Recommended

This Week In Earnings - May 1, 2015

Thomson Reuters This Week in Earnings report on the S&P 500's earnings.

You can subscribe to more earnings reports here: http://www.trpropresearch.com/subscribe/

Please note: if you use our earnings data, please source Thomson Reuters I/B/E/S.

2018 MEDA Annual Conference - Economic Outlook - Sage Policy Group

2018 MEDA Annual Conference - Economic Outlook - Sage Policy GroupMaryland Economic Development Association (MEDA)

This document contains numerous charts and graphs related to economic indicators in the United States and globally. It shows data on consumer confidence, business confidence, GDP growth, monetary policy, jobs, profits and other topics. The data comes from sources like the OECD, IMF, Bureau of Labor Statistics, Census Bureau and others. Overall the data suggests moderate global economic growth and strengthening conditions in the US economy in recent months.Surplus Note report - A.M. Best

- As of 2014, over 500 insurance carriers held more than $47 billion in outstanding surplus notes. The life/annuity segment had the largest amount at $29 billion, while property/casualty had $14.9 billion and health had $3.9 billion.

- On average, surplus notes accounted for 21.6% of capital and surplus for property/casualty companies, 13.6% for life/annuity companies, and 63.4% for health companies.

- Since 2000, around 1,000 surplus notes totaling $38.7 billion have been issued, with 2014 seeing a peak of 160 notes totaling $5.7 billion issued.

Before the Open May 5 2017

- US and European stock futures fell and Asian markets dropped sharply due to concerns over global growth and the outcome of Greece's debt restructuring.

- European stocks declined with banks and resources stocks falling the most. Eurozone GDP contracted 0.3% QoQ in Q4, driven by declines in investment, exports and consumer spending.

- Private investors holding 20% of Greek bonds involved in the debt swap have agreed to participate in the restructuring, which runs through March 8th and aims to cut Greek debt by 53.5%.

- Asian stocks fell sharply led by miners, following global markets lower on growth worries. Japan's Nikkei shed 0.6% while Hong Kong's Hang Seng dropped

Ami latin american forecast 2014 se acabo la fiesta - time again to reform-...

Versailles Breakfast Club Presents "Se acabó la fiesta" Hosted by John Price, Managing Director of AMI

Travis Perkins PLC Research Report

Travis Perkins PLC is a UK-based company that operates in builders' merchant and home improvement markets. It is a leading supplier of basic products to the building and construction industries in the UK. Analysts recommend buying Travis Perkins stock, with a target price of 2150 GBX, representing 19.98% upside. Key risks include housing market conditions, supplier dependency, and competitive pressures. The company has seen strong revenue growth and is undertaking strategic transformations and acquisitions to capitalize on growth in the housing and construction industries.

Etude PwC Golden Age Index (juin 2015)

Dans sa dernière étude « PwC Golden Age Index : how well are OECD economies adapting to an older workforce ? », le cabinet d’audit et de conseil PwC compare l’emploi des seniors (travailleurs âgés de plus de 55 ans) dans 34 pays de l’OCDE.

LinkedIn Q4 2015 Earnings Call

Presentation given by CEO Jeff Weiner, and CFO Steve Sordello, at LinkedIn Q4 2015 Earnings Call. For more information, check out http://investors.linkedin.com/.

Global top-100-march-2015

El informe Las 100 mayores empresas cotizadas del mundo, elaborado por PwC, recoge la evolución de la capitalización bursátil de las 100 principales compañías a fecha de 31 de marzo de 2015. Las empresas estadounidenses y del sector tecnológico copan las primeras posiciones del ranking general.

Aim Italia market update 4Q 2017

- The 4th quarter of 2017 saw declines in the FTSE MIB, FTSE STAR, and FTSE AIM indexes in Italy, with the number of listed companies remaining steady.

- While the AIM Italia performed poorly in the 4th quarter, 2017 overall saw strong gains thanks to 24 IPOs and 2 business combinations, with total market capitalization reaching €6 billion.

- Eight new companies conducted IPOs on the AIM Italia in the 4th quarter, including two SPACs, bringing the total listed companies to 94.

ERC LEP-Growth-Dashboard

This document provides growth metrics for local enterprise partnerships (LEPs) in England, including the proportion of fast-growing firms, net job creation ratios, survival rates of startups, and the proportion of startups that reach £1 million in turnover. It finds that LEPs with above-average growth are a mix of London, major city regions, and more rural areas. While survival rates of startups are relatively consistent, city-based LEPs have above-average rates of startups reaching £1 million in turnover. The data comes from the Business Structure Database and aims to inform LEP priorities and business support.

Acxiom live ramp-investor roadshow deck_final_eod 3pm

This document provides an investor overview of LiveRamp, a subsidiary of Acxiom. It discusses how LiveRamp has built a large identity graph and data platform to help clients deliver personalized customer experiences across channels. LiveRamp has over 570 integrated platforms and provides identity solutions, data access and stewardship. It has a strong SaaS business model with high retention and growth. The opportunity for LiveRamp is to significantly expand by adding new customers, upselling existing customers to use more of its identity and data capabilities, and entering new use cases beyond marketing like customer experience, sales, risk, healthcare and government.

Evercore ISI

CyrusOne reported strong 4Q results that beat estimates, with revenue up 1.5% quarter-over-quarter and 20.2% year-over-year. Full year results showed growth of 25.6% in revenue, 22.1% in EBITDA, 42.2% in FFO, and 51.3% in AFFO. Guidance for 2015 implies mid-point revenue growth of 14.0% and EBITDA and FFO growth of around 12%. The company continues to execute well and achieve above-market growth while trading at a discount to peers. Leasing was solid in 4Q and for the full year, up 33.3% year-over-year

4Q16 EMEA ISG Index

The ISG Index™ provides a quarterly review of the latest sourcing industry data and trends for clients, service providers, analysts and the media. For more than a decade, it has been the authoritative source for marketplace intelligence related to outsourcing transaction structures and terms, industry adoption, geographic prevalence and service provider performance.

DL analysis of electricity profits 201116

This document analyzes profitability data from 2015 for the major UK electricity companies, known as the "Big Six". It finds that while the retail supply businesses showed relatively low returns due to increased competition, the generation businesses, which were not examined by regulators, reported much higher returns in many cases, with three companies earning EBITDA returns over 20%. The document argues this indicates an oligopoly in the wholesale electricity market, and that regulators should investigate generation profits and potential price manipulation.

Roth presentation jason tienor telkonet

This document provides an overview of an intelligent automation company. It discusses the company's history, leadership, financial performance, products, markets, growth strategy, and competitive advantages. The company has experienced significant revenue and profitability growth recently and aims to further penetrate existing markets and expand into new sectors through 2020. Key factors making it well-positioned for continued expansion include its technological capabilities, growing customer base, profitable financials, and experienced management team.

PwC Sustainability reporting - tips for private sector organisations

Raportul PricewaterhouseCoopers (PwC) cu tendinte si recomandari referitoare la modul in care companiile isi raporteaza performantele de sustenabilitate

Scaling to $100 Million

From Bessemer Venture Partners, Partner Mary D'Onofrio releases the definitive benchmarking report on how cloud companies grow operationally efficient businesses and scale to $100 million in ARR (and beyond).

RENT Report

- The original investment thesis for Rentrak Corporation remains intact but revenue growth expectations were significantly higher than realized performance and management guidance.

- While Rentrak saw considerable revenue growth in key areas, it was well below projections, and further growth may not be sustainable at the levels expected.

- The stock price is highly sensitive to news about revenue and guidance, with large swings that could impact any holding in the company.

- A revised discounted cash flow valuation was performed using updated financial results and expense assumptions, but Rentrak's performance remains hard to predict accurately.

2014 first quarter report

- The document provides an overview and financial discussion of AuRico Gold Inc. for the first quarter of 2014.

- Key highlights include gold production of 54,214 ounces, operating cash flow of $24.5 million, and cash costs per ounce of $870.

- Outlook for 2014 includes total gold production of 210,000-240,000 ounces at all-in sustaining costs of $1,100-$1,200 per ounce.

Krishna Srinivasan-Informe Perspectivas económicas-Las Américas FMI

El 17 de noviembre de 2015, organizamos en la Fundación Ramón Areces con el Fondo Monetario Internacional la jornada 'Perspectivas y desafíos de política económica en América Latina'. En ella se presentó y analizó el Informe del FMI 'Perspectivas económicas-Las Américas (octubre, 2015)'.

[Infographic] Why You Need to Leverage IoT in Healthcare![[Infographic] Why You Need to Leverage IoT in Healthcare](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![[Infographic] Why You Need to Leverage IoT in Healthcare](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Despite the healthcare industry experiencing steady growth year over year, many HHIT (Healthcare & Healthcare IT) providers are beginning to see the cracks in their traditional business models. This infographic outlines the various ways HHIT organizations can embrace the Internet of Things (IoT) through smart, connected to products to capture new revenue streams, including optimized customer processes, and improved business outcomes.

M&A Q1-Q3 2018

During the first nine months of 2018, the Global M&A deals was US$ 2.72tn. In Latin America, the activity was US$ 55.9bn. The report includes the financial advisor league table.

HCUK-mid-year-review

The document provides a mid-year review of policies relevant to fleet managers, covering the automotive market, recent budget, taxes, infrastructure, environment, technology, and safety. It summarizes that while economic forecasts have been downgraded, new car registrations continue to grow, especially for fleets. The budget froze fuel duty and invested in new infrastructure projects. Residual values for used cars may come under pressure due to high new registrations.

Nvta q3 2016 earnings final final fina lv2

Invitae Corporation held its third quarter earnings call on November 7, 2016. The company reported approximately 200% year-over-year growth in test volume, with 15,200 billable reports in the quarter. Invitae has expanded its genetic testing to over 1,000 genes and increased its in-network health plan coverage to over 160 million covered lives. The company's execution has positioned it to continue driving revenue growth and achieve positive cash flow by the end of 2018.

Before the Open July 19 2017

- US stock futures were higher in overnight trading as investors brace for more corporate earnings reports. Asian markets also closed higher.

- European markets opened higher as well, paring some losses from the previous session. Investors are monitoring a series of corporate announcements.

- In company news, Morgan Stanley reported second quarter earnings that beat estimates, helped by profits in its wealth management business. McCormick agreed to buy Reckitt Benckiser's North American food business for $4.2 billion. GM invested in autonomous vehicle software startup Nauto.

Nvta q3 2016 earnings

Invitae Corporation reported on its third quarter earnings call. It achieved strong revenue growth through increased testing volume and expanded insurance coverage. Volume grew over 200% year-over-year and the company is now billing at an annual run rate of $70 million. Invitae reduced costs per test and expanded its network of partners. It aims to reach positive cash flow by the end of 2018 through continued execution of its strategy.

Design Exercise_Weather Search Experience of Bing

This document proposes designs for improving Bing's mobile weather search experience. It analyzes competitors and identifies opportunities to make Bing's experience more interactive and shareable. The proposed design focuses on presenting concise, readable weather information at a glance through interactive and animated icons. Additional details and links are provided to encourage further exploration. The modular design is intended to work well across both mobile and PC platforms.

Rpp bab-2 (iman kepada allah)

Rencana pelaksanaan pembelajaran (RPP) ini membahas tentang materi iman kepada Allah SWT dan Asmaul Husna. Materi akan diajarkan melalui pendekatan scientific, model pembelajaran role playing, dan metode diskusi. Peserta didik akan diberikan pengetahuan tentang iman kepada Allah, dalil naqli, dan hikmah beriman. Mereka juga akan mempelajari pengertian dan makna Asmaul Husna seperti al-'Alim, al-Khabir,

More Related Content

What's hot

Global top-100-march-2015

El informe Las 100 mayores empresas cotizadas del mundo, elaborado por PwC, recoge la evolución de la capitalización bursátil de las 100 principales compañías a fecha de 31 de marzo de 2015. Las empresas estadounidenses y del sector tecnológico copan las primeras posiciones del ranking general.

Aim Italia market update 4Q 2017

- The 4th quarter of 2017 saw declines in the FTSE MIB, FTSE STAR, and FTSE AIM indexes in Italy, with the number of listed companies remaining steady.

- While the AIM Italia performed poorly in the 4th quarter, 2017 overall saw strong gains thanks to 24 IPOs and 2 business combinations, with total market capitalization reaching €6 billion.

- Eight new companies conducted IPOs on the AIM Italia in the 4th quarter, including two SPACs, bringing the total listed companies to 94.

ERC LEP-Growth-Dashboard

This document provides growth metrics for local enterprise partnerships (LEPs) in England, including the proportion of fast-growing firms, net job creation ratios, survival rates of startups, and the proportion of startups that reach £1 million in turnover. It finds that LEPs with above-average growth are a mix of London, major city regions, and more rural areas. While survival rates of startups are relatively consistent, city-based LEPs have above-average rates of startups reaching £1 million in turnover. The data comes from the Business Structure Database and aims to inform LEP priorities and business support.

Acxiom live ramp-investor roadshow deck_final_eod 3pm

This document provides an investor overview of LiveRamp, a subsidiary of Acxiom. It discusses how LiveRamp has built a large identity graph and data platform to help clients deliver personalized customer experiences across channels. LiveRamp has over 570 integrated platforms and provides identity solutions, data access and stewardship. It has a strong SaaS business model with high retention and growth. The opportunity for LiveRamp is to significantly expand by adding new customers, upselling existing customers to use more of its identity and data capabilities, and entering new use cases beyond marketing like customer experience, sales, risk, healthcare and government.

Evercore ISI

CyrusOne reported strong 4Q results that beat estimates, with revenue up 1.5% quarter-over-quarter and 20.2% year-over-year. Full year results showed growth of 25.6% in revenue, 22.1% in EBITDA, 42.2% in FFO, and 51.3% in AFFO. Guidance for 2015 implies mid-point revenue growth of 14.0% and EBITDA and FFO growth of around 12%. The company continues to execute well and achieve above-market growth while trading at a discount to peers. Leasing was solid in 4Q and for the full year, up 33.3% year-over-year

4Q16 EMEA ISG Index

The ISG Index™ provides a quarterly review of the latest sourcing industry data and trends for clients, service providers, analysts and the media. For more than a decade, it has been the authoritative source for marketplace intelligence related to outsourcing transaction structures and terms, industry adoption, geographic prevalence and service provider performance.

DL analysis of electricity profits 201116

This document analyzes profitability data from 2015 for the major UK electricity companies, known as the "Big Six". It finds that while the retail supply businesses showed relatively low returns due to increased competition, the generation businesses, which were not examined by regulators, reported much higher returns in many cases, with three companies earning EBITDA returns over 20%. The document argues this indicates an oligopoly in the wholesale electricity market, and that regulators should investigate generation profits and potential price manipulation.

Roth presentation jason tienor telkonet

This document provides an overview of an intelligent automation company. It discusses the company's history, leadership, financial performance, products, markets, growth strategy, and competitive advantages. The company has experienced significant revenue and profitability growth recently and aims to further penetrate existing markets and expand into new sectors through 2020. Key factors making it well-positioned for continued expansion include its technological capabilities, growing customer base, profitable financials, and experienced management team.

PwC Sustainability reporting - tips for private sector organisations

Raportul PricewaterhouseCoopers (PwC) cu tendinte si recomandari referitoare la modul in care companiile isi raporteaza performantele de sustenabilitate

Scaling to $100 Million

From Bessemer Venture Partners, Partner Mary D'Onofrio releases the definitive benchmarking report on how cloud companies grow operationally efficient businesses and scale to $100 million in ARR (and beyond).

RENT Report

- The original investment thesis for Rentrak Corporation remains intact but revenue growth expectations were significantly higher than realized performance and management guidance.

- While Rentrak saw considerable revenue growth in key areas, it was well below projections, and further growth may not be sustainable at the levels expected.

- The stock price is highly sensitive to news about revenue and guidance, with large swings that could impact any holding in the company.

- A revised discounted cash flow valuation was performed using updated financial results and expense assumptions, but Rentrak's performance remains hard to predict accurately.

2014 first quarter report

- The document provides an overview and financial discussion of AuRico Gold Inc. for the first quarter of 2014.

- Key highlights include gold production of 54,214 ounces, operating cash flow of $24.5 million, and cash costs per ounce of $870.

- Outlook for 2014 includes total gold production of 210,000-240,000 ounces at all-in sustaining costs of $1,100-$1,200 per ounce.

Krishna Srinivasan-Informe Perspectivas económicas-Las Américas FMI

El 17 de noviembre de 2015, organizamos en la Fundación Ramón Areces con el Fondo Monetario Internacional la jornada 'Perspectivas y desafíos de política económica en América Latina'. En ella se presentó y analizó el Informe del FMI 'Perspectivas económicas-Las Américas (octubre, 2015)'.

[Infographic] Why You Need to Leverage IoT in Healthcare![[Infographic] Why You Need to Leverage IoT in Healthcare](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![[Infographic] Why You Need to Leverage IoT in Healthcare](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Despite the healthcare industry experiencing steady growth year over year, many HHIT (Healthcare & Healthcare IT) providers are beginning to see the cracks in their traditional business models. This infographic outlines the various ways HHIT organizations can embrace the Internet of Things (IoT) through smart, connected to products to capture new revenue streams, including optimized customer processes, and improved business outcomes.

M&A Q1-Q3 2018

During the first nine months of 2018, the Global M&A deals was US$ 2.72tn. In Latin America, the activity was US$ 55.9bn. The report includes the financial advisor league table.

HCUK-mid-year-review

The document provides a mid-year review of policies relevant to fleet managers, covering the automotive market, recent budget, taxes, infrastructure, environment, technology, and safety. It summarizes that while economic forecasts have been downgraded, new car registrations continue to grow, especially for fleets. The budget froze fuel duty and invested in new infrastructure projects. Residual values for used cars may come under pressure due to high new registrations.

Nvta q3 2016 earnings final final fina lv2

Invitae Corporation held its third quarter earnings call on November 7, 2016. The company reported approximately 200% year-over-year growth in test volume, with 15,200 billable reports in the quarter. Invitae has expanded its genetic testing to over 1,000 genes and increased its in-network health plan coverage to over 160 million covered lives. The company's execution has positioned it to continue driving revenue growth and achieve positive cash flow by the end of 2018.

Before the Open July 19 2017

- US stock futures were higher in overnight trading as investors brace for more corporate earnings reports. Asian markets also closed higher.

- European markets opened higher as well, paring some losses from the previous session. Investors are monitoring a series of corporate announcements.

- In company news, Morgan Stanley reported second quarter earnings that beat estimates, helped by profits in its wealth management business. McCormick agreed to buy Reckitt Benckiser's North American food business for $4.2 billion. GM invested in autonomous vehicle software startup Nauto.

Nvta q3 2016 earnings

Invitae Corporation reported on its third quarter earnings call. It achieved strong revenue growth through increased testing volume and expanded insurance coverage. Volume grew over 200% year-over-year and the company is now billing at an annual run rate of $70 million. Invitae reduced costs per test and expanded its network of partners. It aims to reach positive cash flow by the end of 2018 through continued execution of its strategy.

What's hot (19)

Acxiom live ramp-investor roadshow deck_final_eod 3pm

Acxiom live ramp-investor roadshow deck_final_eod 3pm

PwC Sustainability reporting - tips for private sector organisations

PwC Sustainability reporting - tips for private sector organisations

Krishna Srinivasan-Informe Perspectivas económicas-Las Américas FMI

Krishna Srinivasan-Informe Perspectivas económicas-Las Américas FMI

[Infographic] Why You Need to Leverage IoT in Healthcare![[Infographic] Why You Need to Leverage IoT in Healthcare](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![[Infographic] Why You Need to Leverage IoT in Healthcare](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

[Infographic] Why You Need to Leverage IoT in Healthcare

Viewers also liked

Design Exercise_Weather Search Experience of Bing

This document proposes designs for improving Bing's mobile weather search experience. It analyzes competitors and identifies opportunities to make Bing's experience more interactive and shareable. The proposed design focuses on presenting concise, readable weather information at a glance through interactive and animated icons. Additional details and links are provided to encourage further exploration. The modular design is intended to work well across both mobile and PC platforms.

Rpp bab-2 (iman kepada allah)

Rencana pelaksanaan pembelajaran (RPP) ini membahas tentang materi iman kepada Allah SWT dan Asmaul Husna. Materi akan diajarkan melalui pendekatan scientific, model pembelajaran role playing, dan metode diskusi. Peserta didik akan diberikan pengetahuan tentang iman kepada Allah, dalil naqli, dan hikmah beriman. Mereka juga akan mempelajari pengertian dan makna Asmaul Husna seperti al-'Alim, al-Khabir,

A Profit Maximization Scheme with Guaranteed Quality of Service in Cloud Com...

bulk ieee projects in pondicherry,ieee projects in pondicherry,final year ieee projects in pondicherry

Nexgen Technology Address:

Nexgen Technology

No :66,4th cross,Venkata nagar,

Near SBI ATM,

Puducherry.

Email Id: praveen@nexgenproject.com.

www.nexgenproject.com

Mobile: 9751442511,9791938249

Telephone: 0413-2211159.

NEXGEN TECHNOLOGY as an efficient Software Training Center located at Pondicherry with IT Training on IEEE Projects in Android,IEEE IT B.Tech Student Projects, Android Projects Training with Placements Pondicherry, IEEE projects in pondicherry, final IEEE Projects in Pondicherry , MCA, BTech, BCA Projects in Pondicherry, Bulk IEEE PROJECTS IN Pondicherry.So far we have reached almost all engineering colleges located in Pondicherry and around 90km

The Real Flo Post Final Copy

The document discusses Jacques Lacan's concept of "the Real" which refers to an unsymbolized aspect of human experience that resists representation. The Real precedes symbolization and provokes desire. It is the hard, impenetrable part of our unconscious that contains repressed memories, emotions, and unfulfilled desires. When something from the Real emerges into consciousness, it can feel traumatic. Advertising and consumer culture may manipulate our desires in ways that undermine individuality and promote dissociation from our true selves.

Heath A. Buswell Resume rev.1

Heath Buswell has over 22 years of experience in safety, logistics, transportation, training, administration, and quality assurance for the U.S. Marine Corps. He has a proven track record of identifying areas for improvement and implementing innovative processes to enhance safety standards and reduce incidents. As a senior non-commissioned officer, he has led over 150 personnel and coordinated complex operations involving hundreds of vehicles. Buswell has extensive experience conducting inspections, developing training programs, and collaborating with other agencies to ensure compliance with regulations and optimal support of operations.

Dstu n b v.2.5-37-2008

Russia petroleum, construction, development, import, export, customs, oil and gas, steel, metallurgy, mineral resources, railway, railroad, codes, rules, norms, laws, approval, certification, decrees, regulations

1 Assignment support

This document discusses an organization that provides global staffing and payroll administration services. It offers expertise in areas such as payroll administration, payroll funding, taxation and fiscal compliance, insurance provision, and emergency response. The organization guarantees to support contractors throughout their assignments by handling all logistical aspects to ensure clients have access to global talent. It has over 40 offices in 25 countries and can pay contractors in over 35 currencies worldwide. The organization aims to streamline payroll processes, ensure fiscal compliance, and provide support to both clients and contractors.

Seafood clerk performance appraisal

Seafood clerk job description,Seafood clerk goals & objectives,Seafood clerk KPIs & KRAs,Seafood clerk self appraisal

Viewers also liked (10)

A Profit Maximization Scheme with Guaranteed Quality of Service in Cloud Com...

A Profit Maximization Scheme with Guaranteed Quality of Service in Cloud Com...

Similar to A Macro View Through the Micro Lens

Managing Your Data to Improve Results - Scott Upfield & George Robertson

Managing Your Data to Improve Results - Scott Upfield & George RobertsonInsurance Technologies Corporation (ITC)

This document provides information on managing agency data to improve results. It discusses collecting the right data on lead sources, tools for collection, training employees, and tracking key performance indicators like revenue per employee. Financial benchmarks are presented for agencies of different sizes. The importance of retention, cancellation reports, and staff key performance indicators are covered. Overall, the document emphasizes using data to optimize agency performance in areas like revenue, profitability, growth, and efficiency.Intuit IR Deck - March 2015

The document is an investor presentation from Intuit given in March 2015 that provides an overview of the company's strategy, priorities, financial metrics and outlook. Some of the key points include:

- Intuit's mission is to improve customers' financial lives so profoundly that they can't imagine going back to the old way.

- The company's strategic priorities are to win online/mobile, grow globally, create a unified SMB profile, accelerate its "taxes are done" goal, and make everything a service.

- Intuit expects QuickBooks Online subscribers to grow to around 1 million in FY2015 and around 2 million in FY2017, with total revenue reaching approximately $5.8 billion.

- The presentation

May 2018 Investor Conference Presentation 2018

The document is May 2018 investor conference presentation from LKQ Corporation. It provides an overview of LKQ's operations, including its strategic focus areas of growing, expanding, rationalizing, and adapting its business. It discusses LKQ's historical financial performance, with consolidated revenue reaching $9.7 billion in 2017. It also reviews LKQ's operations in North America and Europe, highlighting the large size and fragmentation of both markets that provide opportunities for growth.

JBusch - Yield Leaders

The document describes a proprietary screen called Yield Leaders that ranks stocks based on their shareholder yield, which is the sum of the annual dividend yield and percentage of shares bought back over the past year. The screen provides a list of companies that aggressively return cash to shareholders through dividends and share buybacks. The top ranked stocks on the August 12, 2016 list are shown along with their shareholder yield and other relevant data.

Moving from What to Why

Every company, regardless of size or technical acumen, has an opportunity to increase the sophistication with which it makes use of its own data.

By starting with existing management reports, companies can start down the path of moving from simple reporting to the generation of actionable, data-driven insights.

Acxiom live ramp-investor roadshow deck_june_2018

This document provides an investor overview of LiveRamp, a subsidiary of Acxiom. It discusses how LiveRamp has built a large identity graph and data platform to power customer experiences across channels. LiveRamp has over 570 integrated platforms and provides identity solutions, data connectivity and stewardship. The company has a strong SaaS business model with high revenue growth and retention rates. LiveRamp sees significant opportunities to add new customers and use cases like TV, people-based marketing and data sharing.

ScottMadden Finance Shared Services Benchmark Highlights 2020

ScottMadden has joined forces with American Productivity & Quality Center (APQC), a benchmarking and best practices research organization, to conduct the fifth cycle of the Finance Shared Services Benchmarking Study. This study covers both trends and benchmarks, and is focused on the shared services delivery model. Topics covered include the delivery model, staffing and performance, technology, and scope of services. For more information, please visit www.scottmadden.com.

Zuora CFO Roundtable - Vancouver | Dec 9

This document summarizes key topics from a CFO roundtable event held in Vancouver on December 9th, 2015. The topics discussed include current market trends and valuation multiples, sales modeling and efficiency, business intelligence and analytics tools/best practices, and headcount trends related to churn and hiring. A section on subscription business models notes their advantages over traditional licensing models, including lower costs, longer-term planning ability, and higher valuations from investors. Retention is highlighted as the most powerful lever for improving customer lifetime value.

SaaS Sales Compensation Survey 2020

Our 2020 Survey on Sales Compensation in Israeli SaaS Companies revealed valuable insights about both the matureness of the Israeli industry in the past two years as well as the the effects of COVID-19. We encourage the industry to use this survey as a sanity check tool for CEOs, CROs and CFOs to see where they stand vis-à-vis their peers.

Intuit - Investor Day Presentation 2012

This document discusses forward-looking statements and non-GAAP financial measures. It cautions that actual results could differ from expectations and refers readers to risk factors in SEC filings. It also explains management's use of non-GAAP measures and provides reconciliations to GAAP measures. The agenda outlines a CEO perspective, discussions of various Intuit business units, and a financial perspective.

COF2015-10 (1)

This document contains an analysis of Capital One Financial Corporation (COF) stock. It begins with an agenda and macroeconomic review using various data sources. It then reviews COF's industry, business segments, and financial performance. Assumptions are made for projections of COF's income statement and balance sheet from 2015-2019. Comparable company analyses and valuation models like the dividend discount model are used to derive an implied share price of $84, indicating the stock is undervalued.

TCS Fact Sheet Q1 FY15

TCS reported financial results for the first quarter of fiscal year 2015, ending June 30, 2014. Revenue grew 2.6% quarter-over-quarter and 22.9% year-over-year in Indian Rupees. Operating margin was 26.3% and net income margin was 22.9%. Key highlights included strong growth in telecom, retail, and life sciences industries as well as an increase in large clients with over $50 million in annual revenues from TCS. The company added over 15,000 employees during the quarter.

Milwaukee Growth Fund-February Client Meeting Materials

The Milwaukee Growth Fund seeks to outperform its benchmark, the Russell 3000 Growth Index, through long-term capital appreciation by investing primarily in equity securities of companies positioned for growth. It utilizes a bottom-up fundamental analysis approach combined with macroeconomic and thematic overlays to identify high-quality companies with exceptional growth potential. The portfolio is actively managed through weekly reviews and formal reviews of holdings. Since its inception in October 2010, the fund has produced a total return of 67.81%, outperforming its benchmark by 2.58%.

Dreamforce 2013 Investment Community Presentation

Salesforce reported record quarterly revenue of over $1 billion and continued strong growth across key metrics like deferred revenue and customer retention rates. The company is making significant investments in technology, markets, and distribution to expand its total addressable market, especially in marketing automation through acquisitions like ExactTarget. Salesforce is developing the Salesforce1 platform to connect customers, partners, employees and devices through an "API first" approach.

[PREMONEY 2014] Institutional Venture Partners>> Jules Maltz, "SaaS Money Met...![[PREMONEY 2014] Institutional Venture Partners>> Jules Maltz, "SaaS Money Met...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![[PREMONEY 2014] Institutional Venture Partners>> Jules Maltz, "SaaS Money Met...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

This document discusses metrics that venture capital firms should focus on when evaluating SaaS companies, particularly retention rate over growth rate. It presents two key metrics: the magic number, which calculates how long until a company breaks even on sales and marketing spend; and LTV/CAC, which compares lifetime customer value to customer acquisition costs. The document argues that retention is more important than growth because companies with high retention will be more profitable over time even with less new customer acquisition. It analyzes case studies of companies with different retention and growth rates to show that high retention is often more valuable.

Business update final

- Maxim Integrated updated its business model to target revenue growth of 50% above market levels annually through focus on key markets like automotive, industrial, and data centers.

- The financial model update includes targets of 67-70% gross margin, operating expenses growing at less than half the revenue rate, and over 35% free cash flow margin.

- Maxim expects long term growth above market levels in automotive and industrial, and at market levels for communications and data centers. The updates aim to drive higher profitability and return more cash to shareholders.

Q4 2015 3 m earnings presentation

3M reported financial results for the fourth quarter of 2015. GAAP EPS was $1.66, down 8.3% year-over-year. Excluding restructuring charges, EPS was $1.80, down 0.6% year-over-year. Sales were $7.3 billion, down 5.4% in dollar terms and 1.1% in organic local currency. Operating margins were 20.5%, down 100 basis points year-over-year but up 60 basis points excluding restructuring. The company returned $1.8 billion to shareholders through dividends and share repurchases.

SIIA & OPEXEngine: Let the Data Set You Free!

Hear how Kelly Battles, CFO of Host Analytics, works with her finance team to track key financial and operating metrics data to drive performance and keep the company on track to deliver growth in 2011. In addition, Lauren Kelley, CEO of OPEXEngine will present key software industry benchmarks from OPEXEngine’s comprehensive financial and operating benchmarking report, developed in partnership with the SIIA. Join us for this informative webinar to learn more about how the benefits of metrics-driven, fact based decision making can help you drive better performance and efficiency within your own organization.

Presenters:

Lauren Kelley, CEO & Founder, OPEXEngine

Kelly Battles, CFO, Host Analytics

About the presenters:

Lauren Kelley is CEO and founder of OPEXEngine, the leading publisher of software financial and operating benchmarks. Ms. Kelley brings 25 years of successful experience in tech company management to OPEXEngine, as well as 6 years as an international economist at the US Department of Commerce’s Office of Computers early in her career, after entering Federal service through the prestigious Presidential Management Intern program. Prior to building OPEXEngine, she worked 2 years as an executive-in-residence at Grand Banks Capital, a venture fund focused on East Coast technology companies, evaluating potential investments. She has worked and lived extensively in Europe. She was previously Senior VP of WW Sales at ATG, including establishing field operations throughout Europe and Asia/Pacific, and was a General Manager for approximately 20 countries at Borland out of Paris in the early ’90s. Ms. Kelley also helped build Compaq’s Central and East European operations, based in Munich. Ms. Kelley is currently based in London, where she lives with her husband and two children.

Kelly Bodnar Battles is the CFO of Host Analytics, inc., the only provider of a CPM (Corporate Performance Management) suite of products delivered via software as a service.

Prior to Host Analytics, Kelly was VP, Finance at IronPort Systems where she was the first finance hire and was responsible for building and leading the finance, accounting, administrative and various operational functions during her six years there. During her tenure at IronPort, the company grew from $2M to $250M in annual bookings and was sold to Cisco Systems (NASDAQ: CSCO).

Before IronPort, Kelly was a Director in HP’s Strategy and Corporate Development group, a Strategy Consultant with McKinsey and Company, and a Corporate Finance Associate at J.P. Morgan. Kelly graduated with a B.S.E. from Princeton and M.B.A. from Harvard, both with honors. Kelly lives in the Bay Area with her husband, and their 2 children, labrador retriever and rescue cat.

Stock Pitch For Real Estate Powerpoint Presentation Ppt Slide Template

"You can download this product from SlideTeam.net"

Our Stock Pitch For Real Estate Powerpoint Presentation Ppt Slide Template is the perfect way to pitch your stock. We have researched thousands of stock pitches and designed the most impactful way to convince your investors to invest in your equity. https://bit.ly/3BbGbgx

Stock Pitch For Real Estate PowerPoint Presentation Ppt Slide Template

ABC Corp owns over 25 million square feet of prime office space across major Canadian cities. Over 65% of net operating income is generated from properties located in central business districts. The recommendation is to take a long position in ABC Corp as the market undervalues the company's portfolio in Alberta and Western Canada. Key strengths of ABC Corp include a desirable portfolio with attractive valuation and a diverse defensive tenant base managed by an experienced team.

Similar to A Macro View Through the Micro Lens (20)

Managing Your Data to Improve Results - Scott Upfield & George Robertson

Managing Your Data to Improve Results - Scott Upfield & George Robertson

ScottMadden Finance Shared Services Benchmark Highlights 2020

ScottMadden Finance Shared Services Benchmark Highlights 2020

Milwaukee Growth Fund-February Client Meeting Materials

Milwaukee Growth Fund-February Client Meeting Materials

[PREMONEY 2014] Institutional Venture Partners>> Jules Maltz, "SaaS Money Met...![[PREMONEY 2014] Institutional Venture Partners>> Jules Maltz, "SaaS Money Met...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![[PREMONEY 2014] Institutional Venture Partners>> Jules Maltz, "SaaS Money Met...](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

[PREMONEY 2014] Institutional Venture Partners>> Jules Maltz, "SaaS Money Met...

Stock Pitch For Real Estate Powerpoint Presentation Ppt Slide Template

Stock Pitch For Real Estate Powerpoint Presentation Ppt Slide Template

Stock Pitch For Real Estate PowerPoint Presentation Ppt Slide Template

Stock Pitch For Real Estate PowerPoint Presentation Ppt Slide Template

More from Pranav Ghai

Corporate Stock Buybacks aka Share Repurchases

Looking at the last 25 quarters of corporate stock buybacks by US firms. Data collected from over 3000 firms.

Share Buybacks

Stock repurchase programs analyzed over the last 21 quarters. Data included for as many US firms as possible. Result set is greater than the S&P500 or the Russell 1000.

Stock Repurchases aka Share Buybacks for US Firms

This report will highlight the corporate share repurchases for US Corporations for the last 16 calendar quarters. Included are S&P 500 firms along with another 1500+.

Stock Repurchases aka Share Buybacks for US Firms

We examine the activity of US Corporations with respect to amount of their own stock (equity) that they are buying back over the last 15 quarters.

A Summary of the US Economy through Corporate Finance

Calcbench samples 11 metrics across more than 3500 (non-financial) companies to discern economic impact in the United States.

CB_Presentation_OperatingLeases_FINAL

Operating leases are not reported on company balance sheets but should be treated as liabilities. Calcbench provides analytics on operating lease obligations, including over $500 billion in lease commitments across S&P 500 companies in 2014. Their data shows lease amounts by sector and individual companies over time and allows comparison between firms. Calcbench helps analyze trends in companies' growing use of operating leases.

More from Pranav Ghai (6)

A Summary of the US Economy through Corporate Finance

A Summary of the US Economy through Corporate Finance

Recently uploaded

falcon-invoice-discounting-a-premier-investment-platform-for-superior-returns...

falcon-invoice-discounting-a-premier-investment-platform-for-superior-returns...Falcon Invoice Discounting

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.What's a worker’s market? Job quality and labour market tightness

What's a worker’s market? Job quality and labour market tightnessLabour Market Information Council | Conseil de l’information sur le marché du travail

In a tight labour market, job-seekers gain bargaining power and leverage it into greater job quality—at least, that’s the conventional wisdom.

Michael, LMIC Economist, presented findings that reveal a weakened relationship between labour market tightness and job quality indicators following the pandemic. Labour market tightness coincided with growth in real wages for only a portion of workers: those in low-wage jobs requiring little education. Several factors—including labour market composition, worker and employer behaviour, and labour market practices—have contributed to the absence of worker benefits. These will be investigated further in future work.Accounting Information Systems (AIS).pptx

An accounting information system (AIS) refers to tools and systems designed for the collection and display of accounting information so accountants and executives can make informed decisions.

Dr. Alyce Su Cover Story - China's Investment Leader

In World Expo 2010 Shanghai – the most visited Expo in the World History

https://www.britannica.com/event/Expo-Shanghai-2010

China’s official organizer of the Expo, CCPIT (China Council for the Promotion of International Trade https://en.ccpit.org/) has chosen Dr. Alyce Su as the Cover Person with Cover Story, in the Expo’s official magazine distributed throughout the Expo, showcasing China’s New Generation of Leaders to the World.

一比一原版(cwu毕业证书)美国中央华盛顿大学毕业证如何办理

原版一模一样【微信:741003700 】【(cwu毕业证书)美国中央华盛顿大学毕业证成绩单】【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

办理(cwu毕业证书)美国中央华盛顿大学毕业证【微信:741003700 】外观非常简单,由纸质材料制成,上面印有校徽、校名、毕业生姓名、专业等信息。

办理(cwu毕业证书)美国中央华盛顿大学毕业证【微信:741003700 】格式相对统一,各专业都有相应的模板。通常包括以下部分:

校徽:象征着学校的荣誉和传承。

校名:学校英文全称

授予学位:本部分将注明获得的具体学位名称。

毕业生姓名:这是最重要的信息之一,标志着该证书是由特定人员获得的。

颁发日期:这是毕业正式生效的时间,也代表着毕业生学业的结束。

其他信息:根据不同的专业和学位,可能会有一些特定的信息或章节。

办理(cwu毕业证书)美国中央华盛顿大学毕业证【微信:741003700 】价值很高,需要妥善保管。一般来说,应放置在安全、干燥、防潮的地方,避免长时间暴露在阳光下。如需使用,最好使用复印件而不是原件,以免丢失。

综上所述,办理(cwu毕业证书)美国中央华盛顿大学毕业证【微信:741003700 】是证明身份和学历的高价值文件。外观简单庄重,格式统一,包括重要的个人信息和发布日期。对持有人来说,妥善保管是非常重要的。

Exploring-Madhya-Pradesh-Culture-Heritage-and-Land-Records.pptx

Madhya Pradesh, the "Heart of India," boasts a rich tapestry of culture and heritage, from ancient dynasties to modern developments. Explore its land records, historical landmarks, and vibrant traditions. From agricultural expanses to urban growth, Madhya Pradesh offers a unique blend of the ancient and modern.

13 Jun 24 ILC Retirement Income Summit - slides.pptx

ILC's Retirement Income Summit was hosted by M&G and supported by Canada Life. The event brought together key policymakers, influencers and experts to help identify policy priorities for the next Government and ensure more of us have access to a decent income in retirement.

Contributors included:

Jo Blanden, Professor in Economics, University of Surrey

Clive Bolton, CEO, Life Insurance M&G Plc

Jim Boyd, CEO, Equity Release Council

Molly Broome, Economist, Resolution Foundation

Nida Broughton, Co-Director of Economic Policy, Behavioural Insights Team

Jonathan Cribb, Associate Director and Head of Retirement, Savings, and Ageing, Institute for Fiscal Studies

Joanna Elson CBE, Chief Executive Officer, Independent Age

Tom Evans, Managing Director of Retirement, Canada Life

Steve Groves, Chair, Key Retirement Group

Tish Hanifan, Founder and Joint Chair of the Society of Later life Advisers

Sue Lewis, ILC Trustee

Siobhan Lough, Senior Consultant, Hymans Robertson

Mick McAteer, Co-Director, The Financial Inclusion Centre

Stuart McDonald MBE, Head of Longevity and Democratic Insights, LCP

Anusha Mittal, Managing Director, Individual Life and Pensions, M&G Life

Shelley Morris, Senior Project Manager, Living Pension, Living Wage Foundation

Sarah O'Grady, Journalist

Will Sherlock, Head of External Relations, M&G Plc

Daniela Silcock, Head of Policy Research, Pensions Policy Institute

David Sinclair, Chief Executive, ILC

Jordi Skilbeck, Senior Policy Advisor, Pensions and Lifetime Savings Association

Rt Hon Sir Stephen Timms, former Chair, Work & Pensions Committee

Nigel Waterson, ILC Trustee

Jackie Wells, Strategy and Policy Consultant, ILC Strategic Advisory Board

Does teamwork really matter? Looking beyond the job posting to understand lab...

Does teamwork really matter? Looking beyond the job posting to understand lab...Labour Market Information Council | Conseil de l’information sur le marché du travail

Vicinity Jobs’ data includes more than three million 2023 OJPs and thousands of skills. Most skills appear in less than 0.02% of job postings, so most postings rely on a small subset of commonly used terms, like teamwork.

Laura Adkins-Hackett, Economist, LMIC, and Sukriti Trehan, Data Scientist, LMIC, presented their research exploring trends in the skills listed in OJPs to develop a deeper understanding of in-demand skills. This research project uses pointwise mutual information and other methods to extract more information about common skills from the relationships between skills, occupations and regions.Bridging the gap: Online job postings, survey data and the assessment of job ...

Bridging the gap: Online job postings, survey data and the assessment of job ...Labour Market Information Council | Conseil de l’information sur le marché du travail

OJP data from firms like Vicinity Jobs have emerged as a complement to traditional sources of labour demand data, such as the Job Vacancy and Wages Survey (JVWS). Ibrahim Abuallail, PhD Candidate, University of Ottawa, presented research relating to bias in OJPs and a proposed approach to effectively adjust OJP data to complement existing official data (such as from the JVWS) and improve the measurement of labour demand.一比一原版宾夕法尼亚大学毕业证(UPenn毕业证书)学历如何办理

挂科购买【微信号:176555708】【挂科购买(UPenn毕业证书)】【微信号:176555708】《成绩单、外壳、offer、真实留信官方学历认证(永久存档/真实可查)》采用学校原版纸张、特殊工艺完全按照原版一比一制作(包括:隐形水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠,文字图案浮雕,激光镭射,紫外荧光,温感,复印防伪)行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备,十五年致力于帮助留学生解决难题,业务范围有加拿大、英国、澳洲、韩国、美国、新加坡,新西兰等学历材料,包您满意。

【我们承诺采用的是学校原版纸张(纸质、底色、纹路)我们拥有全套进口原装设备,特殊工艺都是采用不同机器制作,仿真度基本可以达到100%,所有工艺效果都可提前给客户展示,不满意可以根据客户要求进行调整,直到满意为止!】

【业务选择办理准则】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理一份就读学校的毕业证【微信号:176555708】文凭即可

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理一份毕业证【微信号:176555708】即可

三、进国企,银行,事业单位,考公务员等等,这些单位是必需要提供真实教育部认证的,办理教育部认证所需资料众多且烦琐,所有材料您都必须提供原件,我们凭借丰富的经验,快捷的绿色通道帮您快速整合材料,让您少走弯路。

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

留信网服务项目:

1、留学生专业人才库服务(留信分析)

2、国(境)学习人员提供就业推荐信服务

3、留学人员区块链存储服务

【关于价格问题(保证一手价格)】

我们所定的价格是非常合理的,而且我们现在做得单子大多数都是代理和回头客户介绍的所以一般现在有新的单子 我给客户的都是第一手的代理价格,因为我想坦诚对待大家 不想跟大家在价格方面浪费时间

对于老客户或者被老客户介绍过来的朋友,我们都会适当给一些优惠。

选择实体注册公司办理,更放心,更安全!我们的承诺:客户在留信官方认证查询网站查询到认证通过结果后付款,不成功不收费!

Detailed power point presentation on compound interest and how it is calculated

Detailed information about compund interest

Governor Olli Rehn: Inflation down and recovery supported by interest rate cu...

Governor Olli Rehn

Bank of Finland

Press conference on the outlook for the Finnish economy

Helsinki, 11 June 2024

Using Online job postings and survey data to understand labour market trends

Using Online job postings and survey data to understand labour market trendsLabour Market Information Council | Conseil de l’information sur le marché du travail

[4:55 p.m.] Bryan Oates

OJPs are becoming a critical resource for policy-makers and researchers who study the labour market. LMIC continues to work with Vicinity Jobs’ data on OJPs, which can be explored in our Canadian Job Trends Dashboard. Valuable insights have been gained through our analysis of OJP data, including LMIC research lead

Suzanne Spiteri’s recent report on improving the quality and accessibility of job postings to reduce employment barriers for neurodivergent people.

Decoding job postings: Improving accessibility for neurodivergent job seekers

Improving the quality and accessibility of job postings is one way to reduce employment barriers for neurodivergent people.Optimizing Net Interest Margin (NIM) in the Financial Sector (With Examples).pdf

NIM is calculated as the difference between interest income earned and interest expenses paid, divided by interest-earning assets.

Importance: NIM serves as a critical measure of a financial institution's profitability and operational efficiency. It reflects how effectively the institution is utilizing its interest-earning assets to generate income while managing interest costs.

University of North Carolina at Charlotte degree offer diploma Transcript

办理美国UNCC毕业证书制作北卡大学夏洛特分校假文凭定制Q微168899991做UNCC留信网教留服认证海牙认证改UNCC成绩单GPA做UNCC假学位证假文凭高仿毕业证GRE代考如何申请北卡罗莱纳大学夏洛特分校University of North Carolina at Charlotte degree offer diploma Transcript

欧洲杯投注-欧洲杯投注买球-欧洲杯投注买球网|【网址🎉ac22.net🎉】

【网址🎉ac22.net🎉】欧洲杯投注 Sports 与其他博彩公司相比,其独特之处在于欧洲杯投注 Sports 基于低利润和高营业额的独一无二的体育博彩模式,该模式可以为玩家开出最高的赔率。欧洲杯投注的优势在于中文界面友好,接受人民币投注。他们的开户奖金和实时体育投注界面是大陆玩家的首选。

The state of welfare Resolution Foundation Event

How has Britain’s safety net changed since 2010 and what comes next?

Recently uploaded (20)

falcon-invoice-discounting-a-premier-investment-platform-for-superior-returns...

falcon-invoice-discounting-a-premier-investment-platform-for-superior-returns...

What's a worker’s market? Job quality and labour market tightness

What's a worker’s market? Job quality and labour market tightness

Dr. Alyce Su Cover Story - China's Investment Leader

Dr. Alyce Su Cover Story - China's Investment Leader

Exploring-Madhya-Pradesh-Culture-Heritage-and-Land-Records.pptx

Exploring-Madhya-Pradesh-Culture-Heritage-and-Land-Records.pptx

13 Jun 24 ILC Retirement Income Summit - slides.pptx

13 Jun 24 ILC Retirement Income Summit - slides.pptx

Does teamwork really matter? Looking beyond the job posting to understand lab...

Does teamwork really matter? Looking beyond the job posting to understand lab...

Bridging the gap: Online job postings, survey data and the assessment of job ...

Bridging the gap: Online job postings, survey data and the assessment of job ...

Detailed power point presentation on compound interest and how it is calculated

Detailed power point presentation on compound interest and how it is calculated

Governor Olli Rehn: Inflation down and recovery supported by interest rate cu...

Governor Olli Rehn: Inflation down and recovery supported by interest rate cu...

Using Online job postings and survey data to understand labour market trends

Using Online job postings and survey data to understand labour market trends

Power point analisis laporan keuangan chapter 7 subramanyam

Power point analisis laporan keuangan chapter 7 subramanyam

Optimizing Net Interest Margin (NIM) in the Financial Sector (With Examples).pdf

Optimizing Net Interest Margin (NIM) in the Financial Sector (With Examples).pdf

University of North Carolina at Charlotte degree offer diploma Transcript

University of North Carolina at Charlotte degree offer diploma Transcript

A Macro View Through the Micro Lens

- 1. Macro through (Corporate) Micro Third Quarter 2015 Technology enables access to data in ways that were not possible prior. Calcbench is designed to help finance leaders collect and analyze hard to find competitor, customer, and supplier financial data in near real time to help them make more informed decisions. What can our data tell you about the greater US economic engine and associated trends? Below is a chart that shows a very small sample of metrics that Calcbench maintains. The bars represent Year over Year aggregate changes in Revenues, Capital Expenditures, Cost Of Revenue (aka Cost of Goods Sold), SG&A, Operating Expenses, Dividends paid to shareholders and Cash.1,2 Please note all data is based on Calendar Quarters, NOT Fiscal Quarters. Fiscal quarters provided upon request 1 1. Over 3500 firms in sample. Financial firms excluded. Calcbench to publish financials services report (forthcoming) 2. Calcbench DB normalizes over 300+ metrics. These are 11 of the more commonly used. -40.00% -30.00% -20.00% -10.00% 0.00% 10.00% 20.00% 3rd Quarter 2015 Year over Year Change by Metric

- 2. App. Mat, (9%) AMD (4%) Revenue Drop Revenues at the corporate level are down by 6.25% year over year. In dollar terms, that reflects over $180 billion dollars in sales that did not happen in Q3 2015 as opposed to Q3 2014. Why? Let’s start with the commodities complex, specifically energy and more specifically oil. Close to 90% of the drop in sales is from 3 industry groups. Petroleum Refining, Crude Petroleum and Natural Gas. Petroleum Refiners, were the biggest contributors and shown in the table below contributing to more than 50% of the total drop! (Note : All values in $ mm): 2 1 Calcbench uses “net” capex. Small firms increase is over lower base. Please note all data is based on Calendar Quarters, NOT Fiscal Quarters. Fiscal quarters provided upon request Revenue PY_Revenue Rev Diff Exxon Mobil Corp 65,679.00$ 103,566.00$ 37,887.00-$ Chevron Corp 32,767.00$ 51,822.00$ 19,055.00-$ Phillips 66 25,792.00$ 40,417.00$ 14,625.00-$ Valero Energy Corp/TX 22,579.00$ 34,408.00$ 11,829.00-$ Marathon Petroleum Corp 18,716.00$ 25,438.00$ 6,722.00-$ Conocophillips 7,262.00$ 12,080.00$ 4,818.00-$ Total 172,795.00$ 267,731.00$ 94,936.00-$

- 3. Top 50 companies control 39.3% of all US Revenue in Q3 2015 versus 38.9% of all US Revenue in Q3 2015!* 3Please note all data is based on Calendar Quarters, NOT Fiscal Quarters. Fiscal quarters provided upon request Top 50 Revenue Firms with % of Revenue Top 50 Firms % Revenue The Rest *At time of publication, Wal-Mart had not published it’s revenue in the form of a 10-Q. WMT was not included in prior years results either. Exxon Mobil Corp 2.4% Johnson & Johnson 0.6% Apple Inc 1.9% Archer Daniels Midland Co 0.6% Mckesson Corp 1.8% PROCTER & GAMBLE Co 0.6% At&T Inc. 1.4% Pepsico Inc 0.6% General Motors Co 1.4% Intel Corp 0.5% CVS HEALTH Corp 1.4% United Parcel Service Inc 0.5% Ford Motor Co 1.4% United Technologies Corp 0.5% Costco Wholesale Corp 1.3% Cisco Systems, Inc. 0.5% Verizon Communications Inc 1.2% Sysco Corp 0.5% Chevron Corp 1.2% Fedex Corp 0.4% General Electric Co 1.2% Pfizer Inc 0.4% Walgreens Boots Alliance, Inc. 1.0% Dow Chemical Co /DE/ 0.4% Cardinal Health Inc 1.0% Lockheed Martin Corp 0.4% Boeing Co 0.9% Coca Cola Co 0.4% Phillips 66 0.9% Delta Air Lines Inc /DE/ 0.4% Amazon Com Inc 0.9% Caterpillar Inc 0.4% Express Scripts Holding Co. 0.9% Bunge LTD 0.4% Valero Energy Corp/TX 0.8% American Airlines Group Inc. 0.4% Fca Us Llc 0.8% Energy Transfer Equity, L.P. 0.4% Microsoft Corp 0.7% Ingram Micro Inc 0.4% Philip Morris Intl Inc. 0.7% Tyson Foods Inc 0.4% IBM 0.7% United Continental Holdings 0.4% Marathon Petroleum Corp 0.7% Merck & Co., Inc. 0.4% Google Inc. 0.7% HCA Holdings, Inc. 0.4% Comcast Corp 0.7% Honeywell International Inc 0.3%

- 4. App. Mat, (9%) AMD (4%) Capital Expenditures may serve as an indicator of the confidence of a firm. When taken as an aggregate, the confidence level of industry becomes apparent. In Q3 2015 CAPEX shrunk by 9% over Q3 2014. The trend holds across firm sizes as large and midsize firms are spending less year over year. A silver lining is in the small space (third quartile) with a 2.1% increase. 4 1 Calcbench uses “net” capex. Please note all data is based on Calendar Quarters, NOT Fiscal Quarters. Fiscal quarters provided upon request $185,000 $190,000 $195,000 $200,000 $205,000 $210,000 $215,000 $220,000 $225,000 Q3 2014 Q3 2015 Capex ($ MM) Large Mid Small Micro Q3 2014 $206,223,723,221 $12,140,737,197 $1,289,512,519 $46,825,982 Q3 2015 $187,217,517,994 $11,100,609,364 $1,316,932,927 $45,727,058 Pct Chg. -9.2% -8.6% 2.1% -2.3% -10.0% -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% $- $50,000,000,000 $100,000,000,000 $150,000,000,000 $200,000,000,000 $250,000,000,000 YoY Capital Expenditures By Firm Size Q3 2014 Q3 2015 Pct Chg. Capital Expenditures

- 5. Average cash on the balance sheet is down by 2.5% YoY. The chart below is aggregated by Sector (based on 2 digit SIC Code). But some sectors (e.g. Misc Retail) have increased their cash holdings. 5Please note all data is based on Calendar Quarters, NOT Fiscal Quarters. Fiscal quarters provided upon request Increased CashDecreased Cash -0.5 -0.4 -0.3 -0.2 -0.1 0 0.1 0.2 0.3 0.4 0.5 0 5 10 15 20 25 30 35 40 45 YoY % Change in Cash Change in Cash Cash Pct Change YoY Automative Dealers & Service Stations -23% Printing & Publishing -24% Communications -29% Paper & Allied Products -34% Coal Mining -42% Cash Pct Change YoY Miscellaneous Retail 45% Nonmetallic Minerals, Except Fuels 28% Wholesale Trade - Nondurable Goods 26% Motion Pictures 25% Water Transportation 20%

- 6. 6 Please note all data is based on Calendar Quarters, NOT Fiscal Quarters. Fiscal quarters provided upon request Operating Expenses Overall, Operating Expenses grew 7.7% Year over Year and SG&A expenses were up 7.7% but Costs of Revenues were down by 7.45%, indicating tighter input cost controls in the large firms. Large Mid Small Micro Q3 2014 $658,735,643,70 $59,462,948,858 $11,798,154,323 $1,044,837,195 Q3 2015 $707,647,382,84 $65,756,860,665 $12,782,973,841 $890,590,142 Pct Chg. 7.4% 10.6% 8.3% -14.8% -20.0% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% $- $200,000,000,000 $400,000,000,000 $600,000,000,000 $800,000,000,000 YoY Operating Expenses By Firm Size Q3 2014 Q3 2015 Pct Chg. Large Mid Small Micro Q3 2014 $355,601,316,54 $37,928,525,580 $7,182,049,983 $758,241,196 Q3 2015 $363,523,685,92 $40,493,486,550 $7,712,932,376 $643,130,307 Pct Chg. 2.2% 6.8% 7.4% -15.2% -20.0% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% $- $100,000,000,000 $200,000,000,000 $300,000,000,000 $400,000,000,000 YoY SG&A By Firm Size Q3 2014 Q3 2015 Pct Chg. Large Mid Small Micro Q3 2014 $1,677,789,847 $140,010,023,1 $14,323,783,31 $533,780,982 Q3 2015 $1,538,272,140 $143,607,610,6 $13,594,697,73 $572,914,536 Pct Chg. -8.3% 2.6% -5.1% 7.3% -10.0% -5.0% 0.0% 5.0% 10.0% $- $500,000,000,000 $1,000,000,000,000 $1,500,000,000,000 $2,000,000,000,000 YoY Cost of Revenue By Firm Size Q3 2014 Q3 2015 Pct Chg.

- 7. Try Calcbench Today! ABOUT THIS REPORT: This report was created using data analyzed via Calcbench’s Premium Suite, an online interactive platform that helps finance leaders access and analyze financial data thoroughly and efficiently. Our accessible and intuitive platform can aid in better understanding competitor financials, identifying potential risk areas, analyzing trends across industry sectors, or conducting more effective due diligence. Sign up for a 2 week free trial at www.calcbench.com/trial or contact us at us@calcbench.com or via www.calcbench.com CALCBENCH PREMIUM SUITE 7Please note all data is based on Calendar Quarters, NOT Fiscal Quarters. Fiscal quarters provided upon request