Surplus Note report - A.M. Best

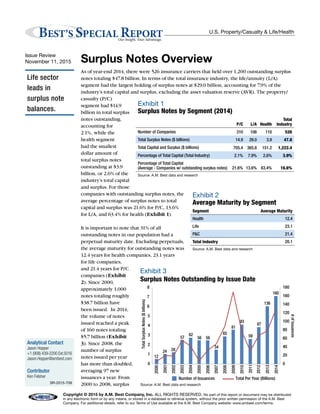

- 1. Copyright © 2015 by A.M. Best Company, Inc. ALL RIGHTS RESERVED. No part of this report or document may be distributed in any electronic form or by any means, or stored in a database or retrieval system, without the prior written permission of the A.M. Best Company. For additional details, refer to our Terms of Use available at the A.M. Best Company website: www.ambest.com/terms. U.S. Property/Casualty & Life/Health Surplus Notes Overview As of year-end 2014, there were 526 insurance carriers that held over 1,200 outstanding surplus notes totaling $47.8 billion. In terms of the total insurance industry, the life/annuity (L/A) segment had the largest holding of surplus notes at $29.0 billion, accounting for 7.9% of the industry’s total capital and surplus, excluding the asset valuation reserve (AVR). The property/ casualty (P/C) segment had $14.9 billion in total surplus notes outstanding, accounting for 2.1%, while the health segment had the smallest dollar amount of total surplus notes outstanding at $3.9 billion, or 2.6% of the industry’s total capital and surplus. For those companies with outstanding surplus notes, the average percentage of surplus notes to total capital and surplus was 21.6% for P/C, 13.6% for L/A, and 63.4% for health (Exhibit 1). It is important to note that 31% of all outstanding notes in our population had a perpetual maturity date. Excluding perpetuals, the average maturity for outstanding notes was 12.4 years for health companies, 23.1 years for life companies, and 21.4 years for P/C companies (Exhibit 2). Since 2000, approximately 1,000 notes totaling roughly $38.7 billion have been issued. In 2014, the volume of notes issued reached a peak of 160 notes totaling $5.7 billion (Exhibit 3). Since 2008, the number of surplus notes issued per year has more than doubled, averaging 97 new issuances a year. From 2000 to 2008, surplus Life sector leads in surplus note balances. Issue Review November 11, 2015 Analytical Contact Jason Hopper +1 (908) 439-2200 Ext.5016 Jason.Hopper@ambest.com Contributor Ken Felsher SR-2015-709 BEST’S SPECIAL REPORTOur Insight, Your Advantage. Exhibit 1 Surplus Notes by Segment (2014) P/C L/A Health Total Industry Number of Companies 310 106 110 526 Total Surplus Notes ($ billions) 14.9 29.0 3.9 47.8 Total Capital and Surplus ($ billions) 705.4 365.8 151.2 1,222.4 Percentage of Total Capital (Total Industry) 2.1% 7.9% 2.6% 3.9% Percentage of Total Capital (Average - Companies w/ outstanding surplus notes) 21.6% 13.6% 63.4% 16.6% Source: A.M. Best data and research Exhibit 2 Average Maturity by Segment Segment Average Maturity Health 12.4 Life 23.1 P&C 21.4 Total Industry 20.1 Source: A.M. Best data and research Exhibit 3 Surplus Notes Outstanding by Issue Date Source: A.M. Best data and research 12 24 28 57 62 56 56 34 65 81 93 59 87 136 160 0 20 40 60 80 100 120 140 160 180 0 1 2 3 4 5 6 7 8 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 #ofIssuances Number of Issuances Total Per Year (Billions) TotalSurplusNotes($billions)

- 2. 2 Special Report U.S. Property/Casualty & Life/Health note issuance fluctuated, with an average of 41 notes per year. In 2014, each sector reached a peak in terms of number of issuances, with P/C companies issuing 58 notes, L/A companies issuing 22 notes, and health companies issuing 80 notes. The health segment saw the most dramatic increase since 2011 following relatively constant issuance in earlier years and a significant dip in issuances in 2011 (Exhibit 4). In terms of total dollar amounts per year, L/A companies led the way as expected. After the sharp increase in 2009, there was a steady decline in the amount of surplus notes issued in this segment, declining to a low of $168.9 million in 2011 and remaining relatively flat at just over $1 billion for the subsequent two years (Exhibit 5). In 2014, another significant increase was seen as totals for L/A companies rose to $3.4 billion for the year. However, this was attributable to $2 billion of surplus notes issued by one company, Teachers Insurance and Annuity Association. In 2014, the P/C segment issued $1.4 billion in notes, which is the third largest total on record for one year. Prior to 2008, health companies did not issue surplus notes in large quantities, averaging only five notes a year. However, starting in 2008, there were substantial increases averaging 35 issuances a year. In 2014, there was a new peak of 80 notes issued, totaling $954.4 million, which is the highest total on record. (Exhibit 6) In terms of the total dollar amounts issued for the last 15 years, the L/A segment comprised 57.9%, while P/C accounted for 33.3% and health, 8.7%. Exhibit 4 Number of Issuances Per Year Exhibit 5 Surplus Note Totals Exhibit 6 Health Segment: Surplus Notes Outstanding by Issue Date Source: A.M. Best data and research Source: A.M. Best data and research Source: A.M. Best data and research Source: A.M. Best data and research Number of Issuances Total Per Year (Billions) # of Issuances Total Surplus Notes (Millions) 0 10 20 30 40 50 60 70 80 90 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 P/C L/A Health 0 1,000 2,000 3,000 4,000 5,000 6,000 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 P/C L/A Health 1 4 3 5 4 4 10 7 15 17 24 9 35 67 80 0 10 20 30 40 50 60 70 80 90 0 200 400 600 800 1,000 1,200 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 #ofIssuances ($millions)TotalSurplusNotes($millions) Exhibit 4 Number of Issuances Per Year Exhibit 5 Surplus Note Totals Exhibit 6 Health Segment: Surplus Notes Outstanding by Issue Date Source: A.M. Best data and research Source: A.M. Best data and research Source: A.M. Best data and research Source: A.M. Best data and research # of Issuances Total Surplus Notes (Millions) 0 10 20 30 40 50 60 70 80 90 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 P/C L/A Health 0 1,000 2,000 3,000 4,000 5,000 6,000 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 P/C L/A Health 1 4 3 5 4 4 10 7 15 17 24 9 35 67 80 0 10 20 30 40 50 60 70 80 90 0 200 400 600 800 1,000 1,200 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 #ofIssuances ($millions)TotalSurplusNotes($millions) Exhibit 4 Number of Issuances Per Year Exhibit 5 Surplus Note Totals Exhibit 6 Health Segment: Surplus Notes Outstanding by Issue Date Source: A.M. Best data and research Source: A.M. Best data and research Source: A.M. Best data and research Source: A.M. Best data and research # of Issuances Total Surplus Notes (Millions) 0 10 20 30 40 50 60 70 80 90 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 P/C L/A Health 0 1,000 2,000 3,000 4,000 5,000 6,000 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 P/C L/A Health 1 4 3 5 4 4 10 7 15 17 24 9 35 67 80 0 10 20 30 40 50 60 70 80 90 0 200 400 600 800 1,000 1,200 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 #ofIssuances ($millions)TotalSurplusNotes($millions)

- 3. 3 Special Report U.S. Property/Casualty & Life/Health In terms of issuance to affiliates, the insurance industry as a whole has issued 61.4% of all surplus notes to an affiliate or parent. An analysis by segment shows that 71.1% of health surplus notes outstanding are held by an affiliated company, compared to 52.6% within the L/A segment and 60.5% in the P/C segment (Exhibit 7). The average coupon rate for surplus notes held by affiliated entities was lower for P/C and L/A companies. For the P/C segment, the average coupon rate was 82 basis points lower for affiliates at 4.79%, compared to 5.61% for non-affiliates (Exhibit 8). Similarly, for L/A companies, the average coupon rate for surplus notes held by an affiliate was 5.56%, compared to 6.23% for non-affiliates. However, for health companies, the reverse was seen, with the average coupon rate for affiliates at 4.96%, much higher than the 1.73% for non-affiliates. This is mostly due to the launch and operation of Health Care Consumer Operated and Oriented Plans (CO-OPs) under the Patient Protection and Affordable Care Act. This law allowed the government to finance the startup of these companies at virtually no cost to the insurers in order for them to compete with the established insurers. With such an easy access to capital, the health insurance exchanges as well as outside companies offering these plans have issued a large quantity of surplus notes. Additionally, 2014 had the largest number of floating rate surplus notes since 2006 based on our population. Since 2011, the growth of fixed rate surplus notes has skyrocketed (Exhibit 9). Exhibit 7 Surplus Notes Issued to Affiliates vs. Non-Affiliates Exhibit 9 U.S Surplus Notes - Fixed vs. Floating Source: A.M. Best data and research Source: A.M. Best data and research Source: A.M. Best data and research Source: A.M. Best data and research Affiliate Non-Affiliate Affiliates Non-Affiliates (%) 4.96 5.56 4.79 1.73 6.23 5.61 Health L/A P/C 0 1 2 3 4 5 6 7 0 20 40 60 80 100 120 140 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 FloatingFixed 2 2 2 2 2 2 2 2 2 2 2 2 2 2 60.5 52.6 71.1 39.5 47.4 28.9 0 10 20 30 40 50 60 70 80 90 100 P/C L/A Health Exhibit 8 Coupon Rate of Affiliates vs. Non-Affiliates NumberofSurplusNotes(%) Exhibit 7 Surplus Notes Issued to Affiliates vs. Non-Affiliates Exhibit 9 U.S Surplus Notes - Fixed vs. Floating Source: A.M. Best data and research Source: A.M. Best data and research Source: A.M. Best data and research Source: A.M. Best data and research Affiliate Non-Affiliate Affiliates Non-Affiliates (%) 4.96 5.56 4.79 1.73 6.23 5.61 Health L/A P/C 0 1 2 3 4 5 6 7 0 20 40 60 80 100 120 140 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 FloatingFixed 200 20 200 200 200 200 200 200 200 200 201 201 201 201 201 60.5 52.6 71.1 39.5 47.4 28.9 0 10 20 30 40 50 60 70 80 90 100 P/C L/A Health Exhibit 8 Coupon Rate of Affiliates vs. Non-Affiliates NumberofSurplusNotes(%) Exhibit 7 Surplus Notes Issued to Affiliates vs. Non-Affiliates Exhibit 9 U.S Surplus Notes - Fixed vs. Floating Source: A.M. Best data and research Source: A.M. Best data and research Source: A.M. Best data and research Source: A.M. Best data and research Affiliate Non-Affiliate Affiliates Non-Affiliates (%) 4.96 5.56 4.79 1.73 6.23 5.61 Health L/A P/C 0 1 2 3 4 5 6 7 0 20 40 60 80 100 120 140 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 FloatingFixed 60.5 52.6 71.1 39.5 47.4 28.9 0 10 20 30 40 50 60 70 80 90 100 P/C L/A Health Exhibit 8 Coupon Rate of Affiliates vs. Non-Affiliates NumberofSurplusNotes(%)

- 4. Published by A.M. Best Company Special Report CHAIRMAN & PRESIDENT Arthur Snyder III EXECUTIVE VICE PRESIDENT Larry G. Mayewski EXECUTIVE VICE PRESIDENT Paul C. Tinnirello SENIOR VICE PRESIDENTS Douglas A. Collett, Karen B. Heine, Matthew C. Mosher, Rita L. Tedesco A.M. BEST COMPANY WORLD HEADQUARTERS Ambest Road, Oldwick, NJ 08858 Phone: +1 (908) 439-2200 WASHINGTON OFFICE 830 National Press Building 529 14th Street N.W., Washington, DC 20045 Phone: +1 (202) 347-3090 A.M. BEST AMÉRICA LATINA, S.A. de C.V. Paseo de la Reforma 412 Piso 23 Mexico City, Mexico Phone: +52-55-5208-1264 A.M. BEST EUROPE RATING SERVICES LTD. A.M. BEST EUROPE INFORMATION SERVICES LTD. 12 Arthur Street, 6th Floor, London, UK EC4R 9AB Phone: +44 (0)20 7626-6264 A.M. BEST ASIA-PACIFIC LTD. Unit 4004 Central Plaza, 18 Harbour Road, Wanchai, Hong Kong Phone: +852 2827-3400 A.M. BEST ASIA-PACIFIC (SINGAPORE) PTE. LTD. 6 Battery Road, #40-02B, Singapore Phone: +65 6589 8400 DUBAI OFFICE* (MENA, SOUTH & CENTRAL ASIA) Office 102, Tower 2 Currency House, DIFC PO Box 506617, Dubai, UAE Phone: +971 43 752 780 *Regulated by the DFSA as a Representative Office A Best’s Financial Strength Rating is an independent opinion of an insurer’s financial strength and ability to meet its ongoing insurance policy and contract obligations. It is based on a com- prehensive quantitative and qualitative evaluation of a company’s balance sheet strength, oper- ating performance and business profile. The Financial Strength Rating opinion addresses the relative ability of an insurer to meet its ongoing insurance policy and contract obligations. These ratings are not a warranty of an insurer’s current or future ability to meet contractual obligations. The rating is not assigned to specific insurance policies or contracts and does not address any other risk, including, but not limited to, an insurer’s claims-payment policies or procedures; the ability of the insurer to dispute or deny claims payment on grounds of misrepresentation or fraud; or any specific liability contractually borne by the policy or contract holder. A Financial Strength Rating is not a recommendation to purchase, hold or terminate any insurance policy, contract or any other financial obligation issued by an insurer, nor does it address the suitability of any particular policy or contract for a specific purpose or purchaser. A Best’s Debt/Issuer Credit Rating is an opinion regarding the relative future credit risk of an entity, a credit commitment or a debt or debt-like security. It is based on a comprehensive quantita- tive and qualitative evaluation of a company’s balance sheet strength, operating performance and business profile and, where appropriate, the specific nature and details of a rated debt security. Credit risk is the risk that an entity may not meet its contractual, financial obligations as they come due. These credit ratings do not address any other risk, including but not limited to liquidity risk, market value risk or price volatility of rated securities. The rating is not a recommendation to buy, sell or hold any securities, insurance policies, contracts or any other financial obligations, nor does it address the suitability of any particular financial obligation for a specific purpose or purchaser. Any and all ratings, opinions and information contained herein are provided “as is,” without any expressed or implied warranty. A rating may be changed, suspended or withdrawn at any time for any reason at the sole discretion of A.M. Best. In arriving at a rating decision, A.M. Best relies on third-party audited financial data and/or other information provided to it. While this information is believed to be reliable, A.M. Best does not independently verify the accuracy or reliability of the information. A.M. Best does not offer consulting or advisory services. A.M. Best is not an Investment Adviser and does not offer investment advice of any kind, nor does the company or its Rating Analysts offer any form of structuring or financial advice. A.M. Best does not sell securities. A.M. Best is compensated for its interactive rating services. These rating fees can vary from US$ 5,000 to US$ 500,000. In addition, A.M. Best may receive compensation from rated enti- ties for non-rating related services or products offered. Data sourced from the BestLink system is retrieved around the time of the report creation and is subject to revision. A.M. Best’s Special Reports and any associated spreadsheet data are available, free of charge, to all Best’s Insurance News & Analysis subscribers. Nonsubscribers can purchase the full report and spreadsheet data. Special Reports are available through our Web site at www.ambest.com/research or by calling Customer Service at (908) 439-2200, ext. 5742. Briefings and some Special Reports are offered to the general public at no cost. For press inquiries or to contact the authors, please contact James Peavy at (908) 439-2200, ext. 5644. 4 Special Report U.S. Property/Casualty & Life/Health Over the past 15 years, insurance companies have been able to effectively utilize surplus notes as opportunistic sources of capital. In the last five years, the launch and operation of CO-OPs has significantly changed the landscape of surplus note issuance not only in the health sector, but in the insurance industry as a whole. Easier access and better terms on surplus notes has made it more efficient for health companies to raise capital. The significant spike in the dollar amount of outstanding notes in 2009 can be attributed to the effects of the financial crisis and driven by two main forces. First, the capital issuance was needed to fund additional growth that was not able to be supported by existing capital. The new surplus note issuances were somewhat concentrated in insurers specializing in annuities, who reported declining profitability due to their exposure to equity markets through variable annuity products. This inflow of new capital allowed L/A insurers to maintain capitalization levels in line with their historical levels despite reporting declining profitability or operating losses. The second driving force of increased usage of surplus notes stems from the need to replace capital that had been depleted by losses from existing business and/or investment portfolios. While it can be said that the economy has been steadily recovering, the continued low interest rate environment allows surplus notes to remain an attractive option for insurers to maintain strong risk-adjusted capital.