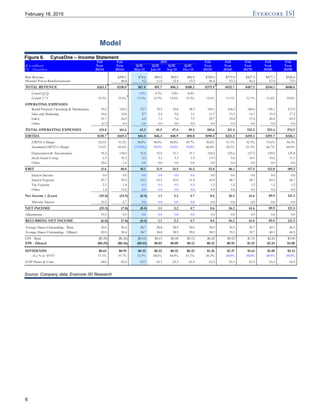

CyrusOne reported strong 4Q results that beat estimates, with revenue up 1.5% quarter-over-quarter and 20.2% year-over-year. Full year results showed growth of 25.6% in revenue, 22.1% in EBITDA, 42.2% in FFO, and 51.3% in AFFO. Guidance for 2015 implies mid-point revenue growth of 14.0% and EBITDA and FFO growth of around 12%. The company continues to execute well and achieve above-market growth while trading at a discount to peers. Leasing was solid in 4Q and for the full year, up 33.3% year-over-year