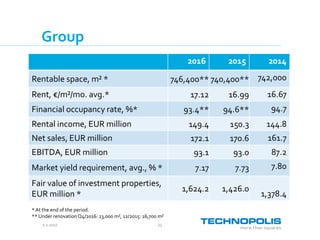

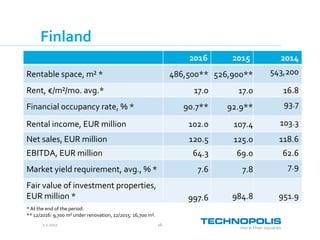

- Net sales for Technopolis increased 0.9% in 2016 while EBITDA increased 0.1%

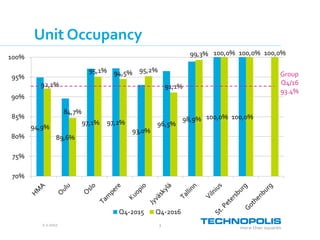

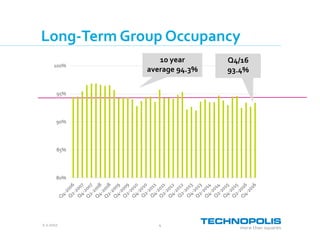

- Financial occupancy rate was 93.4% for the year

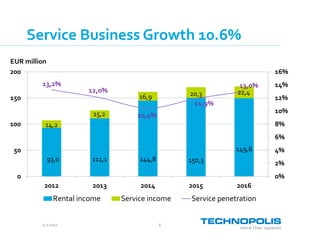

- Service income grew 10.6% and now makes up 13.0% of total sales, more than doubling the margin

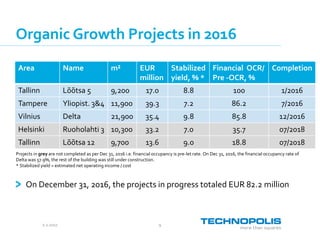

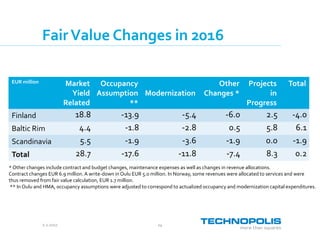

- New growth projects are on target and divestitures continued to realize fair value

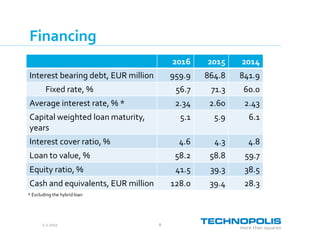

- Equity ratio improved to 41.5% due to a rights issue and divestitures