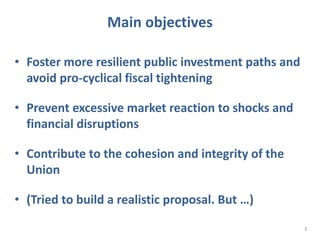

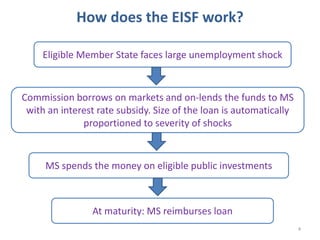

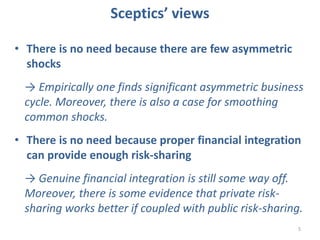

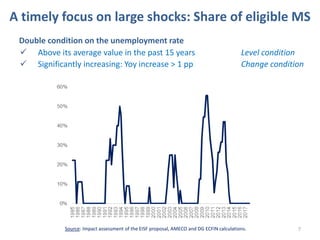

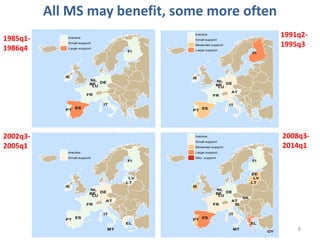

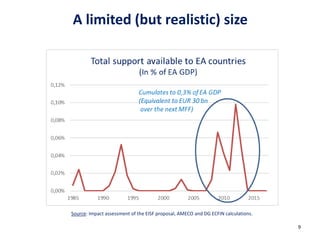

This document discusses the European Commission's proposal for a European Stabilization Function (EISF) and debates around it. The EISF aims to prevent pro-cyclical fiscal tightening during economic shocks, reduce market overreactions, and contribute to EU cohesion. It would provide loans to Member States facing large unemployment shocks, proportionate to shock severity, to fund public investments with interest subsidies. While some are skeptical due to perceived lack of need, the document argues asymmetric shocks do occur and risk-sharing would be improved with public and private mechanisms. The design aims to target severe shocks and avoid moral hazard through eligibility conditions. Charts show many Member States could benefit from the EISF,