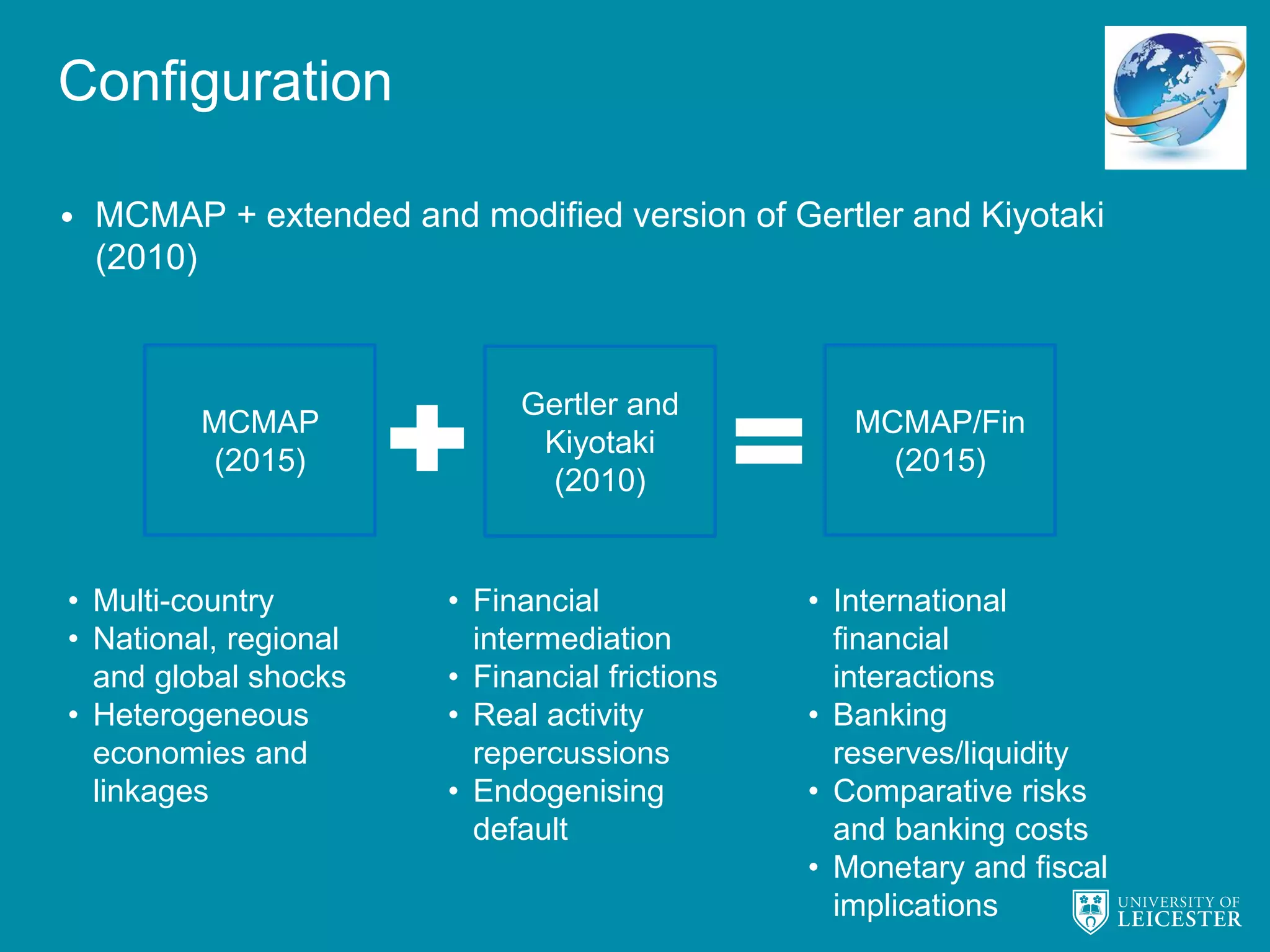

This document describes MCMAP/Fin, an extension of the MCMAP model that incorporates financial intermediation and inter-bank markets. MCMAP/Fin allows the exploration of monetary policy scenarios and their heterogeneous impacts across countries. It models financial frictions based on Gertler and Kiyotaki (2010) and introduces comparative international risk premiums that drive interest rate spreads and banking costs. The model has been estimated for regions in NAFTA, Europe, and Asia-Pacific to analyze the effects of shocks on deposit, lending, inter-bank, and capital rental rates, as well as real impacts across countries.