cost of capital questions financial management

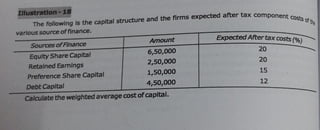

- 1. 1111.tlbadon- 18 r The following is the capital structure and the firms expected after tax component co . various source offinance. sts Of the SourcesofFinance Equity Share Capital Retained Earnings Amount 6,50,000 2,50,000 Preference Share Capital 1,50,000 DebtCapital 4,50,000 Calculate the weighted average costofcapital. ExpectedAftertaxco~(%) 20 20 15 12

- 2. 501,,t1on: Calculation ofWeighted Average Cost sourceofFunds Amount Proportion Aftert.axcost Product (f) w X xw Equity share capital 6,50,000 43.33 20 866.6 p.etainecl Earnings 2,50,000 16.67 20 333.4 preference Share Capital 1,50,000 10 15 150 oebtcapital 4,50,000 30 12 360 Total 15,00,000 100 1710 . :EXW 1,710 Weighted average costofcapital= :EW = 100 = 17.1o/o ~-11 Acompanyhasthe following capital structure. Find outtheweighted average cost ofcapital. - securities Book Value Aftert.axcost - - Equity 10,00,000 12% Retained earnings 4,00,000 8% Preference capital 4,00,000 14% Debentures 8,00,000 5% 26,00,000 - Statement Showing Weighted Average Costofcapital securities Proportion Aftertax WeightedAverage Cost Equity 38 12% (38x.12) = 4.56 Retained earnings 15 8% (15x.08) =1.20 Preference Shares 15 5% (lSx.05) =0.75 Debentures 32 5% (32x.0S) =1.60 100 8.11 Weighted Average cost=8.11% ~ Afirm hasthefollowing capital structureand aftertaxcostfordifferentsourcesoffunds used. SourceofFunds Amount AfterTax Cost Debt 15,00,000 5% Preference Shares 12,00,000 10% EquityShares 18,00,000 12% Retained Earnings 15,00,000 11% Total 60,00,000 You arerequired to computetheweighted averagecostofcapital.

- 3. Solution: calculation of Weighted Average Cost Source ofFunds Amount Proportion After Tax Cost Product ((') w X xw Debt 15,00,000 25 5 125 Preference Shares 12,00,000 20 10 200 Equity Shares 18,00,000 30 12 360 Retained Eamings 15,00,000 25 11 275 - Total 60,00,000 100 960 . 1:XW 960 We,ghtedaveragecostofcapital= 1:W = 100 =9.6%

- 4. zzsr:·srv ~ . . ~ Yhas on Its bookstllefollowing amounts andspecificcostsofeach type ofcapital. rypeofCiJpital Book Value MarketValue SpedficCosts(%) oebt 4,00,000 3,80,000 preference 1,00,000 1,10,000 EQUltY 6,00,000 12,00,000 Retained Earnings 2,00,000 13,00,000 16,90,000 oetermlnethe weighted average cost of capital using: ~) eookValue Weights and 5 8 15 13 {,) MarketValue Weights How are they differing? Can you think of a situation where the weighted average cost of capital wouldbethe same using either ofthe weights? Computation of Weighted Average Cost of Capital using Book Value Weights Type ofcapital Amount Proportion (w) SpecificCost(%) (x) Debt 4,00,000 30.77 5 Pre.ferenCe Shares 1,00,000 7.69 8 Equity Shares 6,00,000 46.15 15 Retained Earnings 2,00,000 15.39 13 13,00,000 100 LXW 1,108 Welghtedaveragecostofcapital = "i.W =100= 11.08% Computation ofWeighted Average Cost of Capital using MarketValue Weights Tn,edOJpital Amount Proportion (w) SpedficCost(%) (x) Debt 3,80,000 22.5 5 P:nlaaa Shares 1,10,000 6.5 8 --Shares 9,00,000 53.25 15 .._lidEarnings 3,00,000 17.75 13 16,90,000 100 "f,XW ~195 'lllll4liCl~ecostofcapltal = r.w = 100 = 11.95% Product xw 154 62 692 200 1108 Product xw 113 52 799 231 1195

- 5. T Ltd. has the following capitalstructure: Equity Snares cap:tai (10 laKhsshares) Retained Eamf.1gs 14% Debentures (70,000 Debentures) 16%Term Loan f (lakhs) 100 130 70 --~ 40Q -- . rhl shares is t' 25. The next expected dividend per share ls~ 2 an~ The marl<e'" pnce pay per eou,..., ' ' Th d b tu'"eS are redeemable aftersix years at par and the current market expected to grow at 8%. e e en . . ooA tatfon rsr 90 per debenture. The tax rate applicable to the firm rs 5 o. QUO . . • hted average cost ofcapital of the company using marketvalues You are reouired ~.o compute werg as weignts. Solutfon: ~ c:; (2/25}+8%=8%+8%= 16% K =Ke= 16% ~1 (Debenture)= [14(1-0.5) + (100-90)/6] + (100 + 90)/2 =9.12% Kd7 (Term Loan)= 16%(1-0.5) = 8% StatementShowing WACC CiJpitalStructure I Amount I Weights(W) Costof WACC- LK- w ' (rln /akhs) I Capltal(K) - Equity 100 I 0.25 16% 4% Reserves 130 I 0.325 16% 5.2% I 9.12% 1.596% Debentures 70 j 0.175 I 0.25 8% 2% Tenn Loan 100 I Total 400 1.00 - 12.796% IU..,alfon~at Swan Ltd. has assets off 3,20,000 whidt has been financed with t' 1,04,000 ofdebt, t' 1,80,000of equity and a genera/ reserve oft'36,000. The company's total profit afterinterestand taxes for the year ended 31.3.2021 were r 27,000. It pays8% interest on borrowed funds and is In the 30% tax bracket. rt has 1800 equity shares ofr100 pershare presently selling ata market price oft' 120 per share. What ; 5 the weighted average costofcapita/ ofSwan Ltd. Solution: EPS =PAT/No.ofequityshares= 27,000/1800 = f 15 Therefore, CostofEquity= (EPSJMPS) = 15/120 = 12.5% CostofDebt= Interestrate(l -Tax Rebate)= 8%(1-0.30) = 5.6% CostofRetained Earning = CostofEquity= 12.5%

- 6. Statement showing WACC under Book Value sources Amount(r) Weights(W) Cost of WACC-. W.K Capiti3I (K) equltY 1,04,000 0.325 12.5% 4.06% Retained Earning 36,000 0.113 12.5% 1.41% oebt capital 1,80,000 0.562 5.6% 3.15% rotal 3,20,000 1.00 - 8.62% Statementof WACC under MarketValue sources Amount(() Weights(W) Costof WACC= W.K Capital (K) - 2,16,000 6.25% EqUitY 0.50 12.5% Retained Earning 36,000 0.08 12.5 1.00% pebt capital 1,80,000 0.42 5.6% 2.35% Total 4,32,000 1.00 - 9.60% - Note: Since market value of equity shares becomes~ 2,16,000 (120 x 1800). So, increase in the value of equity shares by f 1,12,000(2,16,000 - 1,04,000) shall be treated as securities premium and hence may be added to the value of reserves and surplus. Hence, the market value of Equity Shares and reserves & surplus may be taken as f 1,04,000 and~ 1,48,000 respectively while calculating WACC and Its weights(W) may change accordingly. But as Ke and Kt are equal here, so overall cost of capital (WACC) at market value is unaffected and remain 9.60%. -•tM& The capital structure ofBombayTraders Ltd. as on 31.3.2021 is as follows: Equity capital: 100 lakh equityshares off 10 each Retained earnings 14%debentures ~ incrores 10 2 3 Forthe year ended 31.3.2021 the company has paid aequity dividend at 20% and the growth rate Is 5% every year. The equity shares are traded at ~ 80 per share in the stock exchange. Tax rate applicableto the company is 40%. Calculate the current weighted average cost ofcapital. Solution: (a) Cost ofequity capital 01 = 20(1 +0.5) Ke = 01 x 100 + G = 21 x 100 + 5 =26.25+5=31.250/o MP 80 (b} Costofdebentures (afterTax) Kd =J:....(1 - t) =14 (1-0.4) =8.4% a NP (c) Costof retained earnings Kr =k (1-t )(1-b)=31.25(1-04)(1-0)=31.25(0.6)=18.75 e P

- 7. Oomputatlon of WACC V" !IC Wd{lht r re-. R (am 'lv ]4~0~!K' t ~ JO 0 61 2 0 13 J 02 1S ~-·~-·. Kl !'l n um.:u~d wzs.~ to ralse edd ttonal finance oft' 20 lakh ror meeting Its in has, 4 70 000 tn the ram, 0 1 r:ctal!led cam ngs aV"a1lablc for Investment purpose 1 ..,~unl!nt , , s. hct P~ mave? .lah;.c Ollo""'ng<I!. 1, Oclr. /equJymtx 30%: 70% ~ 2. Cost of dclJt u:tu>, 3,60,000 - 10% (Beforetax) Costa' deot beyond, 3,60,000-16% (Before tax) 3 E.am ngs pershare: 4 ,=, Oh dend payo;;t~ 50% of earnings S E.Xt>ectedgrowttirateo1 dMdend: 10% 6. Cument market p:i.ce: 44 7. Tax rate: 50% Yov arerequired: n) lo determine the pattern for raisfng the additional finance. b) To determine the post-tax average costofadditional cost. c} lo determine the cost of retained earnings and cost ofequity. d) Compute the overall weighted average after tax cost ofadditional finance. Solution: a) Pattern for raising the addltlonal finance Dcbitors 30% off 20,00,000 = 6,00,000 Equlty70% oft 20,00,000 = 14,00,000 20,00,000 The pattern offinanang with costs Sources Amount(() Debt Debt Retained earnings Equity (14,00,000-4,20,000) b) Poat tax average cost of additional debt: Formula: Kd (1-t) Kd • 3,60,000@ 10% = 36,000 = 2.40,000@ 16% = 38,400 6,00,000 74,400 3,60,000 2,40,000 4,20,000 9,80,000 20,00,000 Cost 10% 16%

- 8. Cost II:? 74,1100 f>,oo,000 x Joo 12..'1% PoS t-tax aver c.1ge cost of debt • 12.4 (1 -0 r>) 6. I% c) cost of retained earnInga: D1 Ke"" R +g o 10% Hcnc.~,atttie The dividend payout ratio is 50% of~ 4 i.e. ~ 2.00 per share. Growth rate being . end ofthe year, dividend wtll be-= t 2+l0% -~ 2 . 20 2.20 Kr= 44 +O.lO==o.so+o.10-o.1sor1S% d) weighted Average After tax cost of Add"tl Ifl 1 ona nance: - sources Amount Proportion - oebt 6,00,000 30.0% Retained Earnings 4,20,000 21.0% equity 9,80,000 49.0% - 20,00,000 100 - ~n-27 MN Ltd. has the following capital structure: Equityshare capital (20,000) shares , 40,00,000 10% Preference share capital t 10,00,000 14% Debentures t 30,00,000 80,00,000 WACC Aftertax cost 0.3 X 6.2-l.86 6.2% 15.0% 0.21 X 15=3.15 15.0% 0.49 X 15""'7.35 12.36 The share of the company sells fort 20. It is expected that the company will pay next year a dividend oft 2 per share which will grow at 7% forever. Assume 50% tax rate. a) Compute the weighted average cost ofcapital based on the existing capital structure. b) Compute the new Weighted Average Cost of capital if the company raises an additional t 20,00,000 debt by issuing 15% debentures. This would increase the expected dividend to~ 3 and leave the growth rate unchanged butthe price ofshare will fall tot 15 per share. Solution: (a) WACC: Existing Capital Structure: After-taxcost Weights Weighted Cost Ordinary 0.17* 0.500 0.0850 10% Preference 0.10 0.125 0.0125 14% Debentures 0.07 0.375 0.0262 WACC 0.1237 or12.37% *Cost of ordinary share is: ke = (DIVl/Po) +g =(2/20) +0.07 =0.17

- 9. (b) W~CC: NewC.pltalStnlcture: After- Weights Weight;; taxcost Amounts ______J--:-:-:-:::::--t--;:;:-:;:;;:--1-~~1--~Cost Ordinary 40,00,000 0.27* 0.40 0,108 10% Preference 10,00,000 O.lO O.lO 0,010 14% Debentures 30,00,000 o.o 7 o. 3 o 0,021 ~----1:.::.S...:%:...:D:::.:e::b.:en:t:ure=.s__..L_...:2::.:o::,o:....o.:..,o_o_o_...1---o-._o 7 _ 5 _ __.____o_._ 20 _t-__o.a15 WACC 0,1S4 --------------------------..L-._o_r1s,4% *Cost ofordinary share Is. ke = (DIVl/Po) +g= (3/15) +0.07 =0.20 +0.07 =0.27 m,,~ Klshan Limited wishes to raise additional finance of? 20 lakh for meeting its investment pl ans It has, 4,20,000 In the form ofretained earnings available forInvestmentpurposes. Thefollowing d · are available. etaus 1. Debt/equity mix 30%: 70% 2. Costofdebtupto t 3,60,000-10% (Before tax) Costofdebtbeyond t 3,60,000 - 16% (Before tax) 3. Earning pershare: 4 4. Dividend payout: 50% ofearning 5. Expected growth rate ofdividend: 10% 6. Current marketprice: 44 7. Tax rate: 50% You are required: a) To determine the pattern forraising the additional finance. b) To determinethe post-tax average costofadditional cost. c) To determine the costofretained earnings and costofequity. d) Compute the overall weighted averageaftertax costofadditional finance. • Solution: a) Pattern for raising the additional finance: Debitors 30% on 20,00,000 Equity 70% on 20,00,000 The pattern offinancing with costs Source Debt Debt Retained earnings Equity(14,00,000 -4,20,000) Amount(() 3,60,000 2,40,000 4,20,000 9,80,000 20,00,000 = 6,00,000 = 14,00,000 20,00,ooo - Cost 10% 16%

- 10. b) Post tax average cost of additional debt: Formula: Kd (1-t) Kd = 3,60,000@ 10% = 36,000 = 2,40,000 @ 16% = 38,400 6,00,000 74,400 74,400 Cost= G,O0,000 X 100 = 12.4% Post-tax average cost of debt = 12.4 (1-0.5) = 6.2 % c) Costof retained earnings: D1 Ke= Po+g Toedividend pay outratio is 50% oH 4 i.e., 2.00 pershare. Growth rate being 10%.Hence, atthe end ofthe year, dividend will be=, 2+10% = 2.20 2.20 Kr= 44 +0.10 =0.50+0.10 = 0.15 or 15% d) Weighted Average After tax cost of Additional finance: sources Amount Proportion A~ertax cost WACC Debt 6,00,000 30.0% 6.2% .3x6.2=1.86 Retained Earnings 4,20,000 21.0% 15.0% .21x15=3.15 Equity 9,80,000 49.0% 15.0% .49x15=7.35 20,00,000 100 12.36 As a financial analyst of a large electronics company, you are required to determine the weighted average cost of capital (WACC) of the company using (a) book value weight and(b) market value weights. Toefollowing information is available for your perusal: The company's present books value capital structure is Preference shares Cf 100 pershare) f 2,00,000 Equity shares c,10 pershare) , 10,00,000 Debentures (f 100 pershare) f 8,00,000 Anticipated external financing opportunities are: (I) , 100 per debenture redeemable at par; 10 years maturity, 13% coupon 4% flotation costs, sale price~ 100 (ii) , 100 preference shares redeemable at par; 10 years maturity; 14% dividend rate, 5% floation costs, sale price t 100. (iii) Equityshares;, 2 persharefloation costs, sale price att' 22. In addition, the dividend expected on the equity shares at the end of current year is f 2 and the eamingsareexpected to increase by7% p.a. Thefirm has policy of paying all its eaming sin the form of dividends. the company's corporate tax rate is 50%.

- 11. Solllf:ion: f I{i-t)-il_ Cost ofdebt (kd) = F·, · S'J 2 4 13{1-0.5)- ;-;;- L ~ 6.5-0 ~ -~ iOO - 96 2 i(d = 7.04% F D-~ Costofprefshares (kp) = Fv - SV 2 Kp= 14.87% = 58 - 98 = 100-95 2 3- ·G - 2 -0 07 = o.:-0.07 Cost of Equity (ke) = Po - F - - (22 - 2; · Ke = 0.17 or 17% WACC using bookvalue weight Capital Cost Boolc-1a i..S I 8,0G,000 Debt entry 7.04% 8,00,000 7.04X 2C.C0,03: 2,c:,eoo Shares 14.87% 2,00,000 14·82 x 2C.GC,ODO :0,00,000 Equity Shares 17% 10,00,000 17x 20,00,oon WACC using book value is 12.803 - = 2.6:5 =: .!-S/ =55 WAW using market value weight cannot be calculated as mari<e: va,...e o-- :ec-e-:-_:'E =-: preference shares is not available in the question. Illustration-30 From the following capital structure ofa company, calailate the overall cost ofca:,~ -S -;: i) Book value weights and ii) Marketvalue weights. Source Book value Man<.e~ r'c.t.e Equity share capita1 (~ 10 shares) ~ 45,000 ?9C.J00 Retained earnings ~ 15,000 ~:. Preference share capital ~ 10,000 f 10,00J Debentures t 30,000 ~ 30,000 The after tax cost of different source of finance is as follows : Equity snare ca:,itaf l .!% ~er= -e,.: earnings 13% preference capital 10%. Debentures 5%

- 12. SOiution: I) overall cost ofca 1 P tal using Book value weights securities Equity Retained earnings preference share capital Debentures Weighted average cost Proportion 45 15 10 30 Aftertax(%) 14 13 10 5 II) overall cost of capital using Market value weights securities Proportion ~~~ 69 Retained earnings preference share capital Debentures ~~•31 7.6 23 Aftertax(%) 14 13 10 5 WACC 45 X 0.14 == 6.3 1Sx0.13 == 1,95 10 X 0.10 == 1 30 x0.05 == LS 10.75 WACC 9.66 0.76 1.15 11.57 Alpha Ltd. hasthe following capital structure as per its Balance Sheet as at 31.3.2021: Equityshare capital (fully paid share of~ 10 each) 18% Preference share capital (fully paid share oft 100 each) Reserves and surplus 12.5%debentures (fully paid debentureoft 100 each) 12% term loans Additional information: Inlakhs 8 6 2 16 8 40 a) The current market price of the company's share is ~ 64.25. The prevailing default risk free interestrate on 10 yearGOI treasury bonds isS.5%. The average marketrisk premium is 8%. The beta ofthecompany ls 1.1875. b) The preference shares ofthe company which are redeemable after 10 years are currenty se11ing at90 perpreferenceshare. c) Thedebenturesofthe company which are redeemable after5 years are currently quoted at90 per debentures. d) Thecorporatetax rate is 30%. Rtquireci: Calculateweighted average cost ofcapital using I) BookValueWeights, MarketValue Weights

- 13. Solution: w ( ACC using book value weights) Sources of Amountof Proposition Aftertax cost Cap{t.a/ Sources ofsources ofsources A B C D Equity share capital 8 0.20 0.1500 Reserve and Surplus 2 0.05 0.1500 18% Preference shares 6 0.15 0.2000 12.5% Debentures 16 0.20 0.1000 12% Term loan 8 0.20 0.0840 40 1.00 - Weighted averagecost ofcapital - 0.1243 or 12.43% (WACC using marketvalue weights) Sources of Amountof Proposition Aftertaxcost Capital Sources ofsources ofsources A B C D Equity share capital 51.40 0.6425 0.1500 18% Pref. share capital 5.40 0.0675 0.2000 12.5% Debentures 15.20 0.1900 0.1000 12%Term loan 8.00 0.1000 0.0840 80 1.00 Therefore, 13.72% (i) Costof equity (ke) = Ri+ ~ (Average market risk) =5.5% +1.875 (8%) =15% (ii) Costofretained earnings (kr) =Ke= 15% (iii) Cost of 18% preference share = Preference dividend +(Reedemable value - Net sale proced)/w (Redeemable value + Net sale proced)/2 18 + (100 - 90) / 10 18 + 1 = (100- + 90) I 2 = 95 = 0.20 or20% (iv) Cost of 12% term loan Interest (1- Tax rate) = Net sale proceeds 96,000 (1 - 0.30) = 8,00,000 =o.oa4 Product E=CxD 0.0300 0.0075 0.0300 0.0400 0.0168 Product ~ E=CxD 0.09637 ~ 0.0135 0.0190 0.0084 You are required to determine the weighted average cost of capital of M/s Vinayaka Enterprises Ltd., Bengaluru using (i) BookValue Weights (ii) MarketValue Weights. The company's present book value capital structure is

- 14. Amount (t') Debenture (t 100 per debenture) 16,00,000 preference shares (t 100 per share) 4,00,000 Equity shares(? 10 pershare) 20,00,000 All these securities are traded in the capital markets. Recent prices are Debentures at f 110, preference shares att 120 and equity shares at' 22. Anticipated external financing opportunities are i) t 100 per debenture redeemable at par, 10 years maturity, 8% coupon rate, 4% floatation cost, sale pricer 100. fi) t 100 preference shares, redeemable at par, 15 years maturity, l0% dividend rate, 5% floatation cost, sale price t 100. iii) Equity shares' 2 per share floatation cost, sale price t 22. In addition the dividend expected on equity share at the end of the year t 2 per share, the anticipated growth rate in dividends is 5%. Thetax rate is 50%. soJution: 1 Kd== 8 + 20 (100 - 96) 8.2 .!:_ (100 - 96) = 98 2 x l00 = B.36% = 4.18% aftertax 10 + 0.33 10 + is(100 - 95) Kp== ! (100 + 95) =--- = 10.5% 2 2 Ke- - X 100 + 5 =15% - 20 sources Debtors Preference Shares Equity Shares Sources Debtors Preference Shares EquityShares 97.S BookValue Amount Proportion 6,00,000 40% 4,00,000 10% 20,00,000 50% 40,00,000 MarketValue Amount Proportion 8,80,000 15.9 2,40,000 4.3 44,00,000 79.7 55,20,000 Aftertax cost 11 10.5 15 WACC Aftertax cost 4.18 10.5 15 WACC Weighted cost 1.672 1.05 7.5 10.22% Weighted cost 0.66 0.45 11.9 13.065%