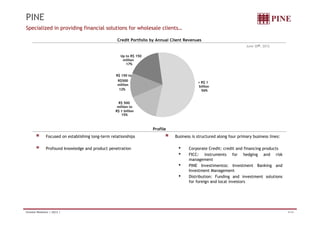

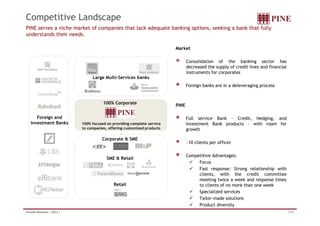

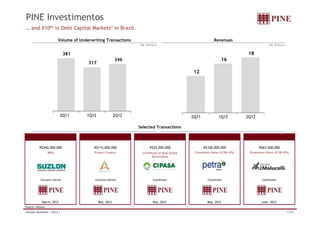

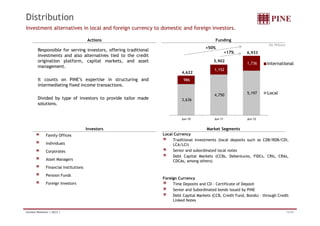

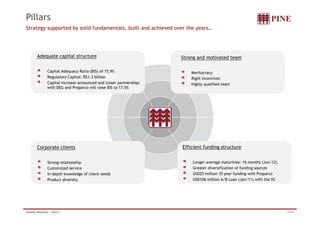

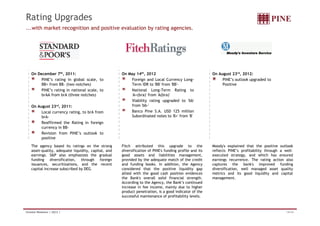

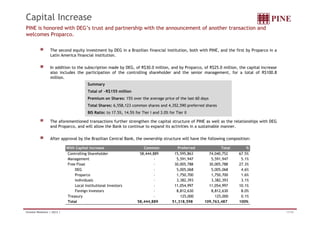

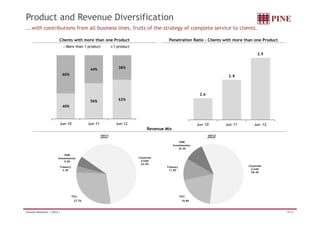

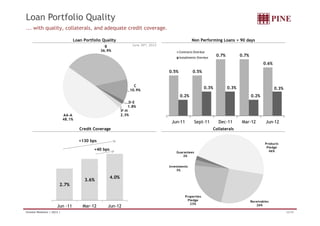

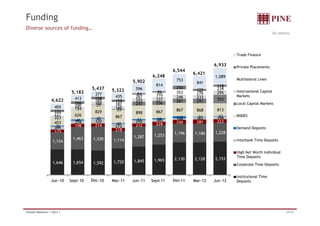

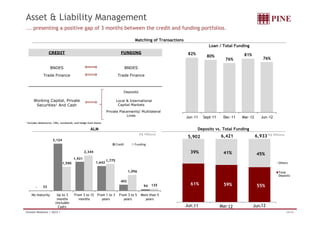

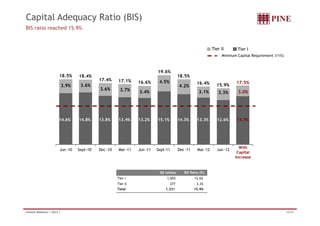

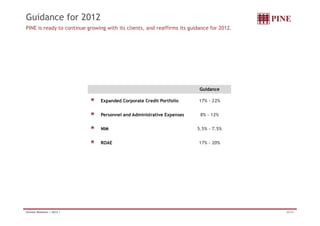

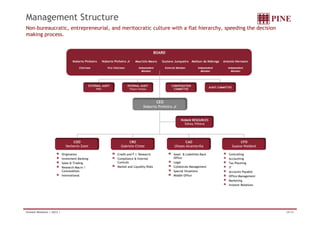

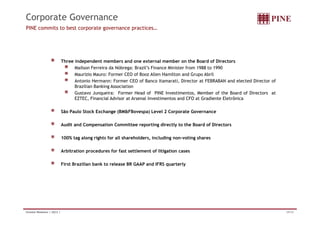

This document provides an overview of Institutional Presentation for 2Q12. It discusses PINE's history since 1939, business strategy focused on providing tailored financial solutions to corporate clients. It highlights recent capital increase of ~R$155M which will increase the BIS ratio to 17.5%, as well as solid results across all business lines in 2Q12 contributing to recurring profits. Rating upgrades in recent years recognize PINE's diversified funding profile and strong asset quality.