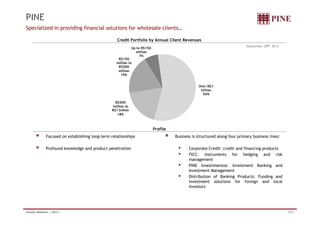

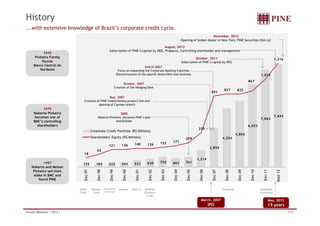

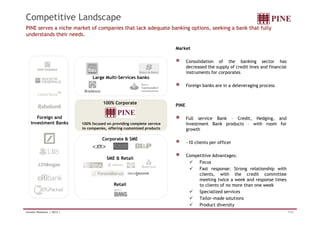

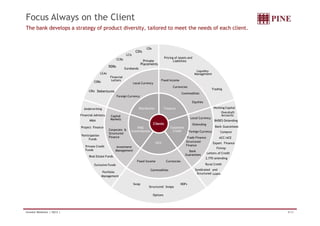

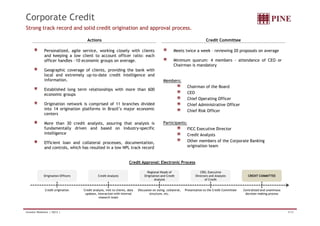

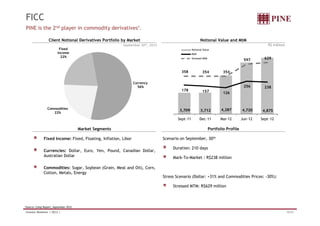

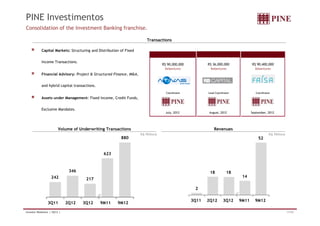

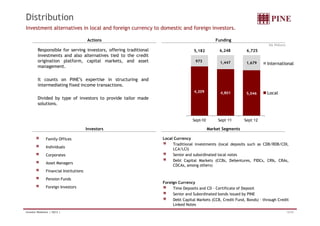

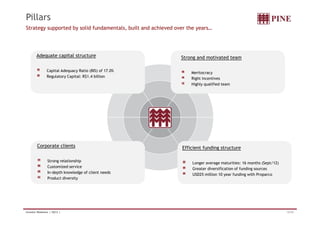

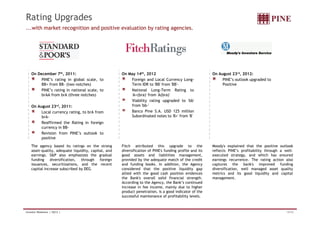

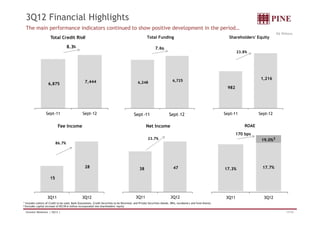

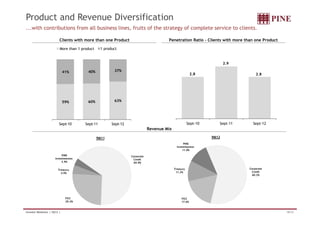

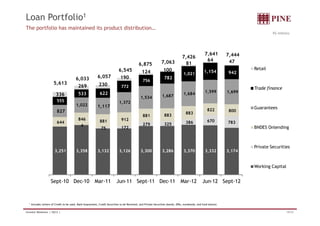

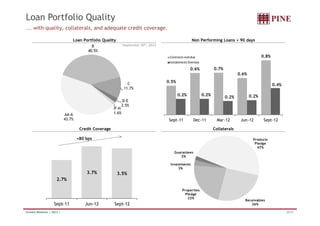

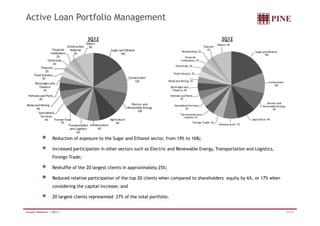

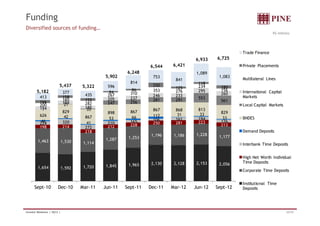

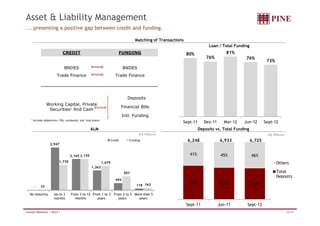

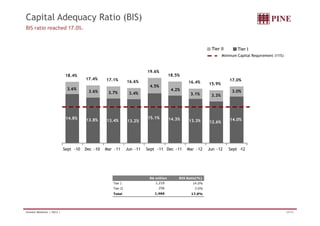

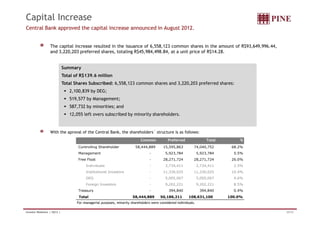

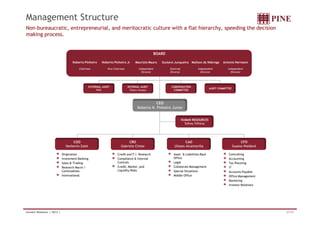

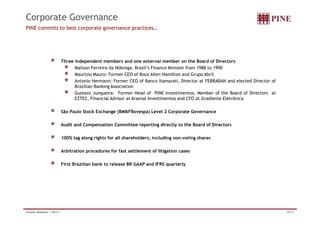

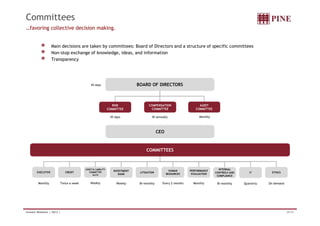

This document provides an overview of a Brazilian bank called PINE. It discusses PINE's history since 1939, business lines including corporate credit, treasury services, and investment banking. It also covers PINE's competitive advantages, focus on client relationships, solid financial position, and recent upgrades to its credit ratings. The document contains details on PINE's operations, strategic pillars, and financial performance in both text and graphical formats.