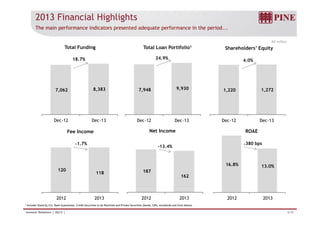

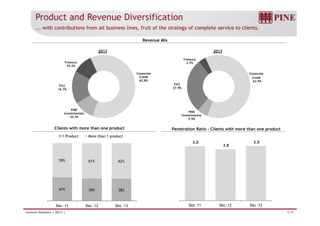

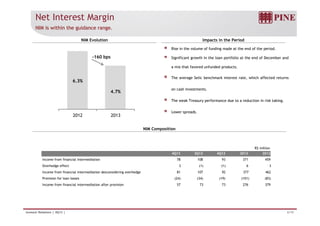

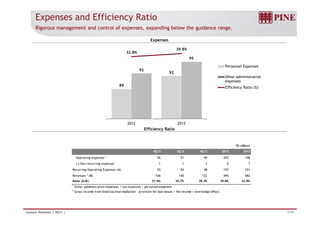

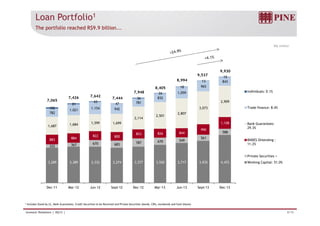

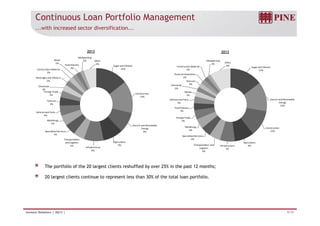

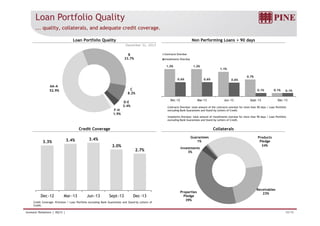

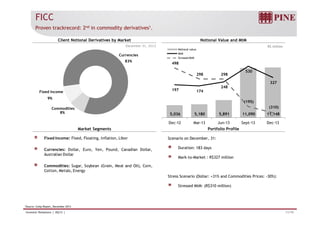

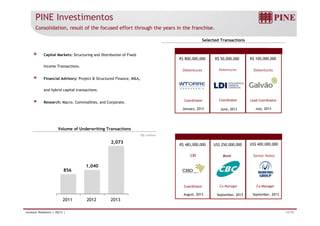

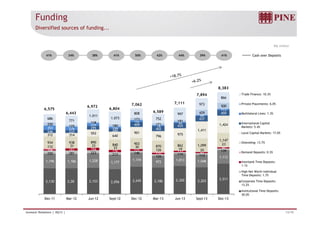

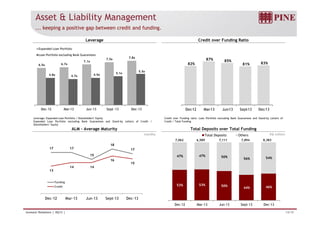

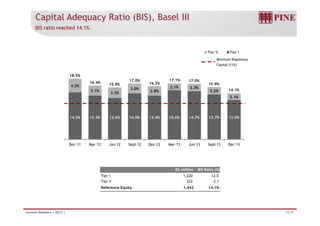

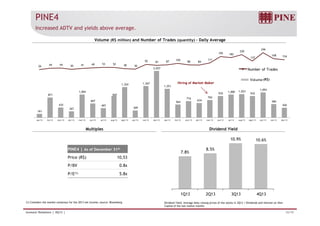

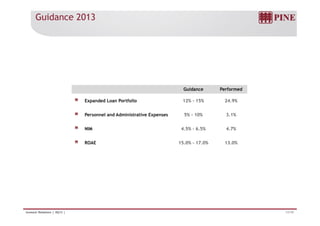

The document summarizes PINE's 2013 earnings release conference call. It provides an overview of key financial highlights and performance indicators for 2013, including an 18.7% increase in total funding to R$8.38 billion and a 24.9% increase in loan portfolio to R$9.93 billion. It also reviews business line contributions, product and revenue diversification, net interest margin, expenses, loan portfolio quality, the fixed income, currencies and commodities business, and PINE Investimentos. The document indicates that results were positive across all business lines due to a strategy of providing complete service to clients.