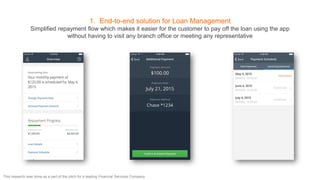

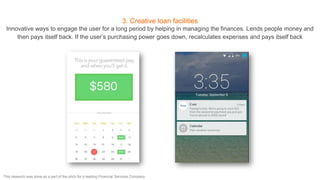

The document discusses 4 emerging trends in digital lending: 1) end-to-end loan management solutions, 2) smart tools that gather and analyze data, 3) creative loan facilities, and 4) ease of filling forms through smart user experiences. Examples are given of companies implementing each trend, such as Avant offering customized lending, Prosper using analytics to manage finances, Even adjusting payments based on variable income, and Earnest combining data and design for personalized experiences.