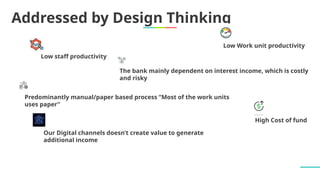

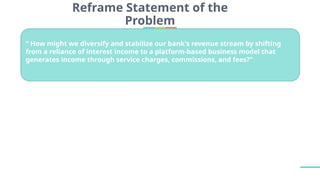

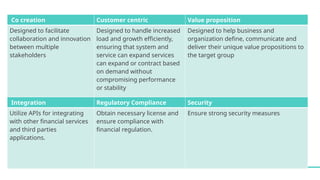

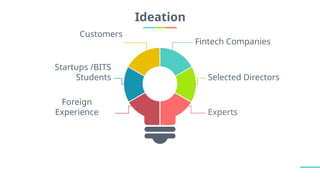

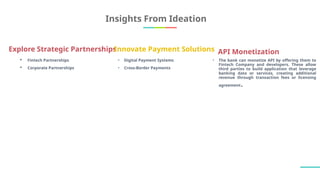

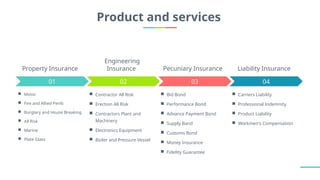

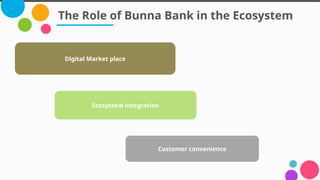

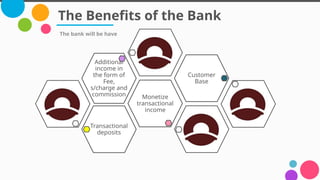

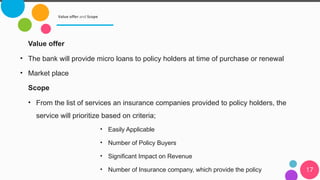

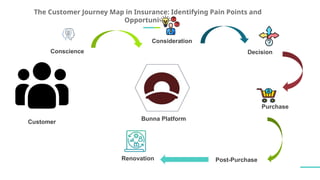

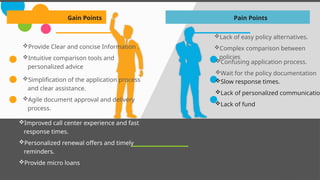

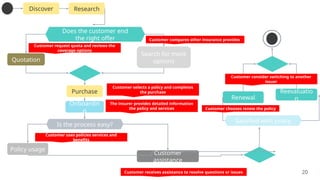

The document outlines innovative strategies for expense management and revenue generation for a banking business, emphasizing a shift from reliance on interest income to a platform-based model. Key components include design thinking, customer-centric features, strategic partnerships, and enhancing user experience through data analytics. The goal is to diversify revenue streams by integrating services that facilitate transactions and improve customer engagement while maintaining compliance and security.