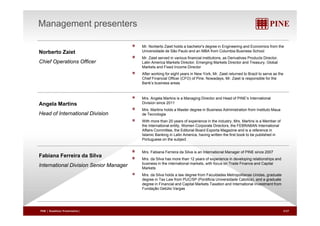

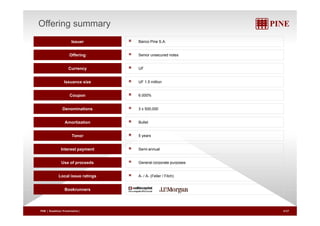

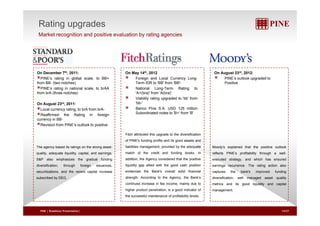

This document provides an overview of a roadshow presentation by Banco Pine S.A. for a bond offering. The key points are:

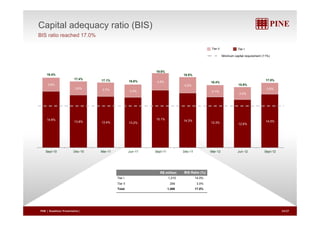

- Banco Pine is offering $1.5 million in senior unsecured notes paying 6% semi-annually over 5 years.

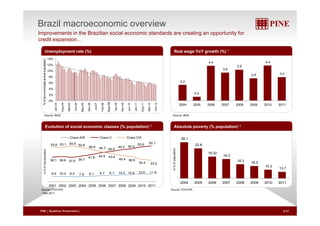

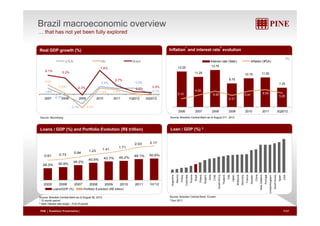

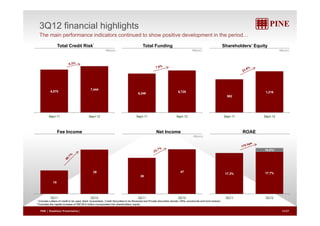

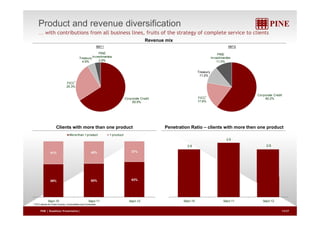

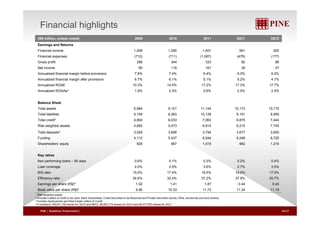

- The presentation covers Brazil's macroeconomic environment, Pine's business lines and financial performance, and an agenda for the roadshow.

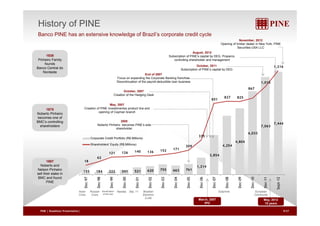

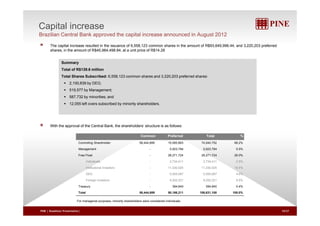

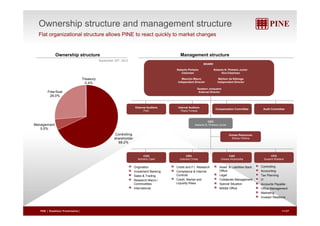

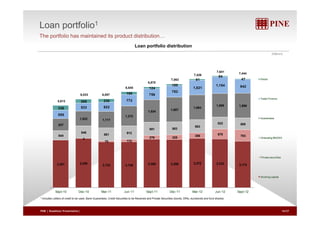

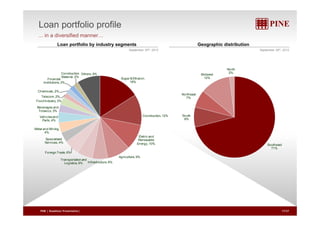

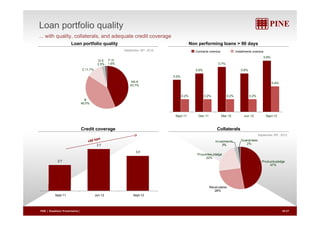

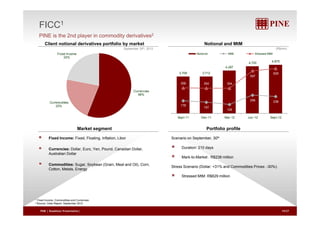

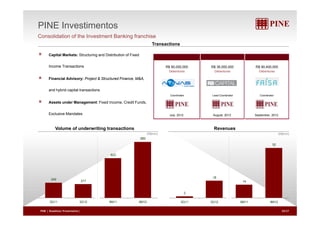

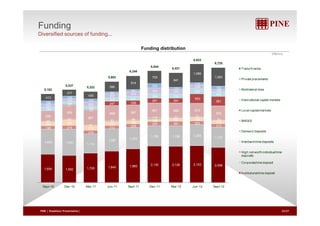

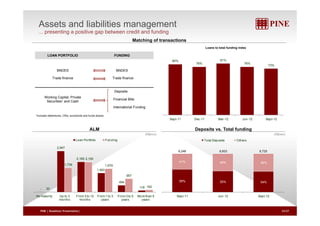

- Pine has a long history in Brazil and recently increased its capital through a share offering. It provides various banking services and has diversified revenues across business lines.