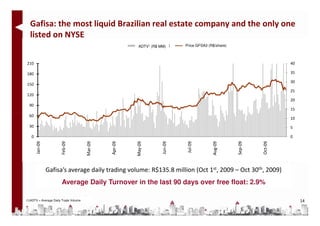

- The document summarizes Gafisa's third quarter 2009 results conference call.

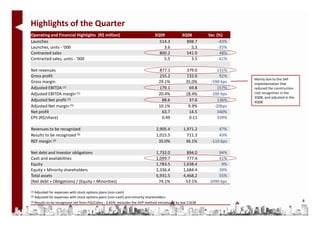

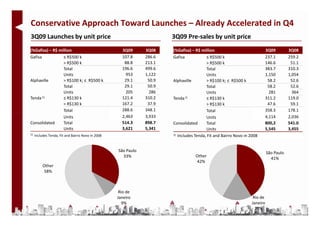

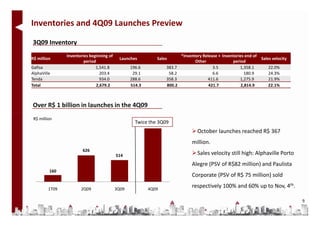

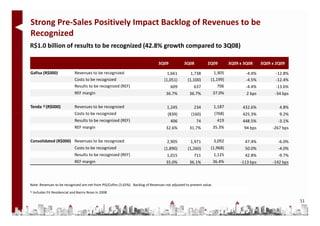

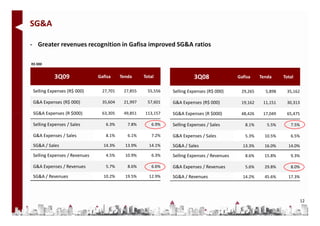

- Key highlights include a 43% decrease in launches but a 48% increase in contracted sales compared to the previous year. Net revenues increased 131% while gross margins decreased.

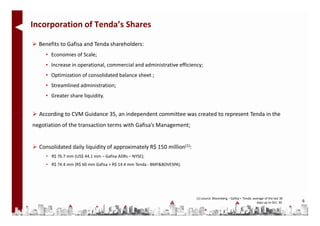

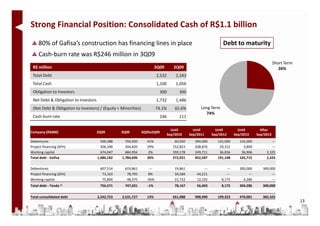

- Recent developments discussed include strong sales in mid-to-mid-high segments, expansion of the affordable housing program, and plans to merge shares of Tenda into Gafisa to increase scale and efficiency.

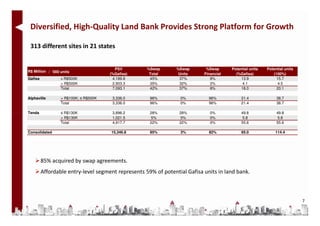

- Gafisa has a diversified land bank of 313 sites in 21 states representing over 15 billion reais in potential sales.