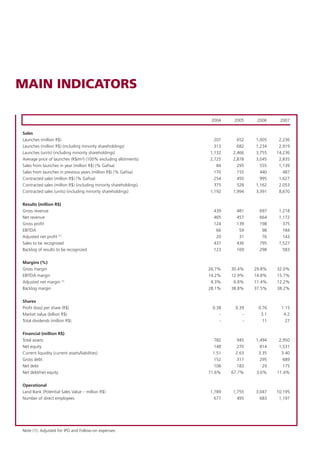

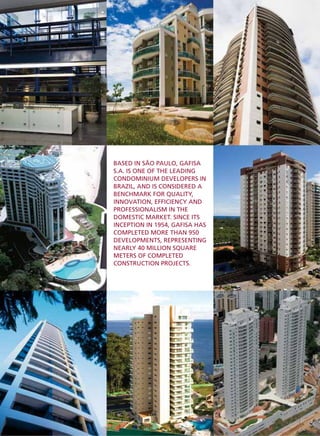

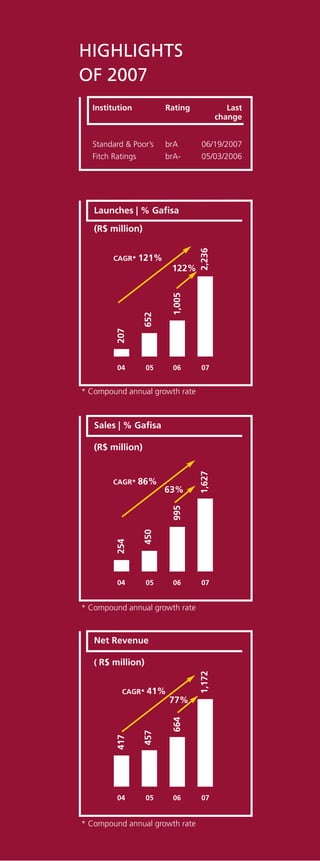

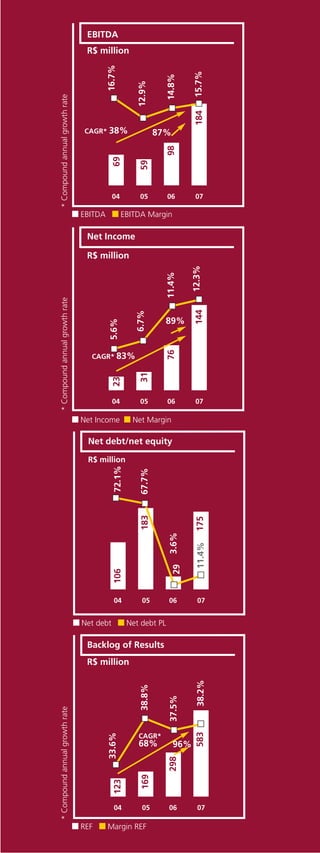

Gafisa had a strong year in 2007, with several highlights:

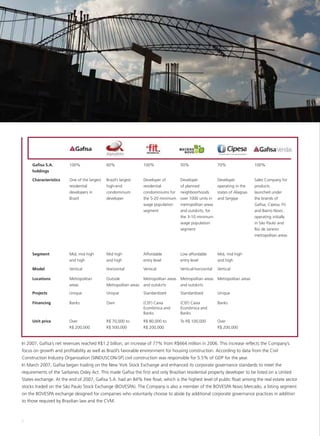

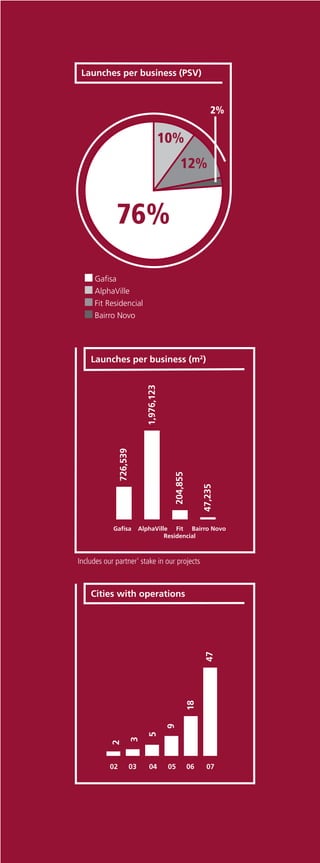

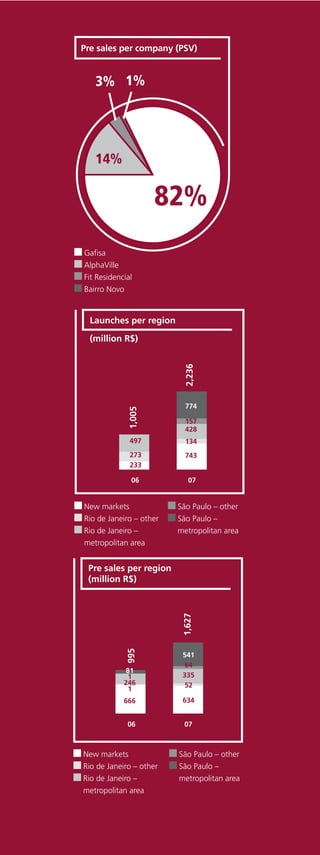

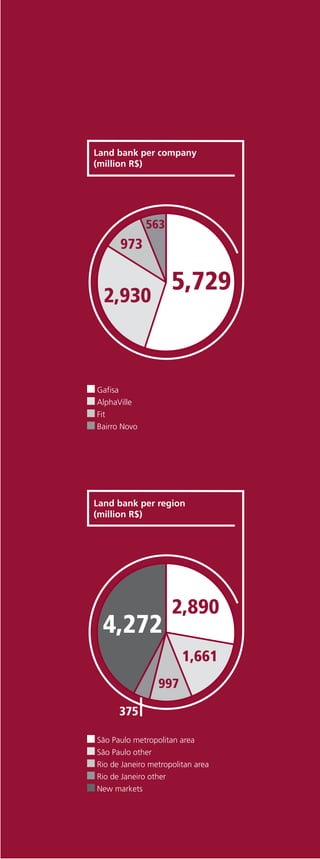

1) It acquired AlphaVille Urbanismo, Brazil's largest urban developer, expanding its presence to 35 new cities.

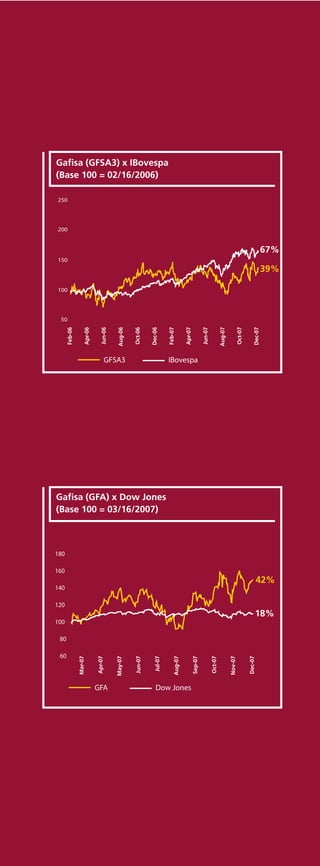

2) It listed on the New York Stock Exchange, becoming the only Brazilian residential developer listed in the US.

3) It acquired 70% of Cipesa, allowing it to operate in the states of Alagoas and Sergipe.

4) It launched several new initiatives like Bairro Novo, Fit Residencial, and a new mortgage product.