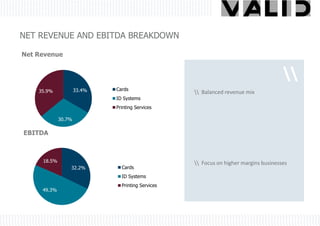

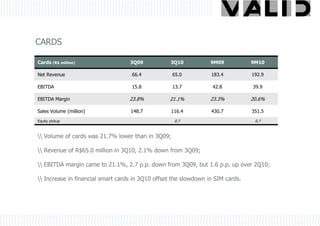

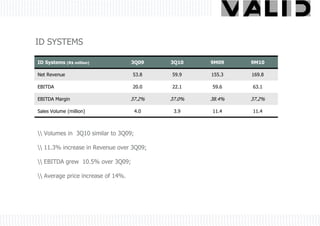

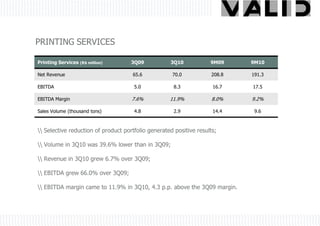

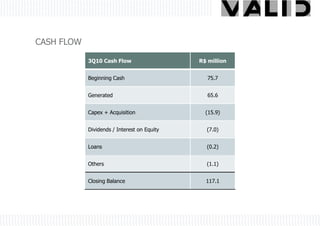

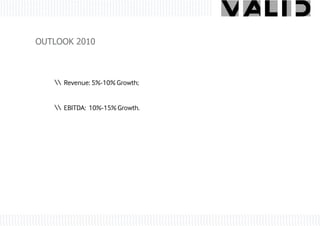

This document summarizes the key financial highlights and performance metrics for Valid S.A. for the third quarter and first nine months of 2010. Net income grew 21.6% in 3Q10 compared to 3Q09. EBITDA was highest in 3Q10 at R$44.8 million. The Printing Services division saw a strong recovery. Cash generation was a record R$65.6 million in 3Q10. Revenue was expected to grow 5-10% for the full year 2010 while EBITDA was projected to increase 10-15%.