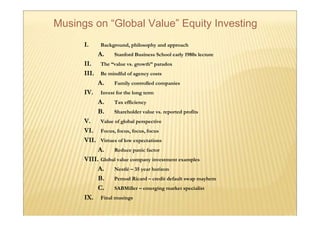

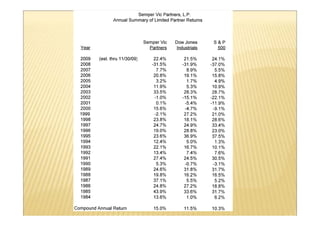

Thomas A. Russo gave a presentation on global value investing at a conference in Mexico City in December 2009. He discussed his background and philosophy of value investing, focusing on finding undervalued companies trading at discounts to their intrinsic value. He emphasized the importance of a long-term investment horizon, tax efficiency, and not being overly focused on short-term profits. Russo provided examples of large global companies he has invested in for decades, such as Nestlé and Pernod Ricard, and discussed some of their strengths and challenges over time.