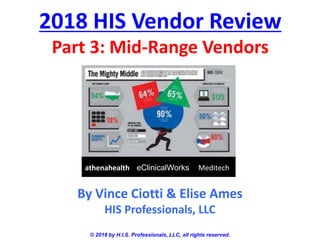

This document provides an overview and analysis of 3 mid-sized healthcare information system (HIS) vendors: athenahealth, eClinicalWorks, and Meditech. It discusses their annual revenues, product lines, client bases by hospital size, recent acquisitions and developments, and future prospects. Athenahealth has over $1 billion in annual revenue and offers both physician practice and hospital information systems. eClinicalWorks generates $490 million annually from its electronic health records for small physician practices but faced legal issues in 2017. Meditech has a long history and three distinct HIS products serving over 1,000 hospitals, and its prospects are positive with a new physician system and cloud offerings.