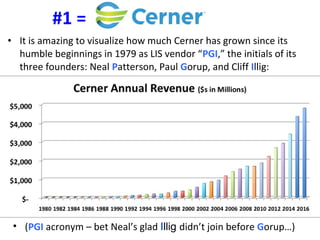

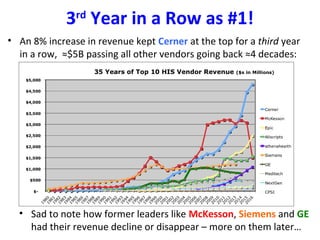

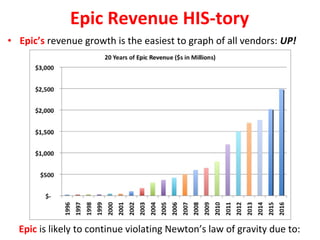

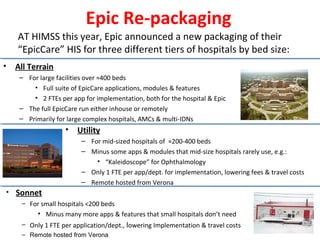

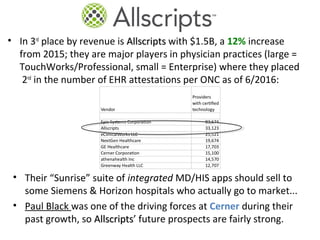

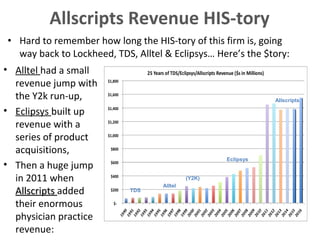

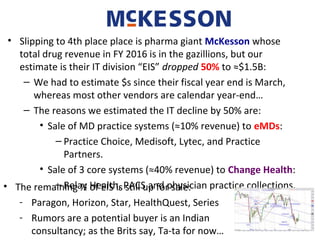

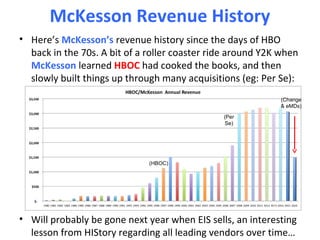

This document discusses the top 10 healthcare IT vendors by 2016 revenue. It focuses on the high-end vendors with over $1.5 billion in revenue that primarily target large hospitals of 300+ beds. Cerner maintained the #1 spot with around $5 billion in revenue, an 8% increase over 2015. Epic was #2 with $2.5 billion in revenue, up 23%. Allscripts was #3 with $1.5 billion, a 12% increase. McKesson dropped to #4 with around $1.5 billion in revenue from its IT division, a 50% decline from selling off parts of its business. The document outlines recent developments and future prospects for each of these top vendors.