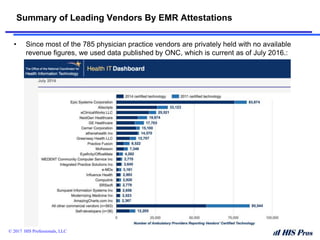

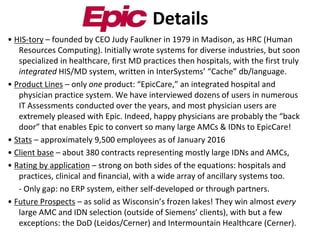

The document summarizes leading physician practice vendors ranked by number of eligible provider (EP) electronic health record (EHR) attestations reported by the Office of the National Coordinator for Health Information Technology (ONC) as of July 2016. It provides details on the history, products, employee and client numbers, revenue, application ratings, and future prospects of the top 6 vendors: 1) Epic, 2) Allscripts, 3) eClinicalWorks, 4) NextGen Healthcare, 5) GE Healthcare, and 6) Cerner.