1. 2018 top his vendors 3 26

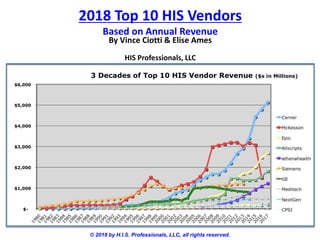

- 1. 2018 Top 10 HIS Vendors Based on Annual Revenue © 2018 by H.I.S. Professionals, LLC, all rights reserved. By Vince Ciotti & Elise Ames HIS Professionals, LLC

- 2. HIS-tory of “Top 10” Lists • If you subscribe to any of the few print magazines left in our industry or get far more unvarnished insights from HIStalk, you’ve probably followed our annual review of the Top 10 HIS vendors in order of their annual revenue for many years: – Original credit for the idea must go to Bill Childs who created this whole media when he started his Computers in Hospitals magazine in 1980 with a whopping 52-page first issue. • Bill’s magazine morphed & was renamed many times over the years, and subsequent rags expanded the vendor review from 25, 50 and now 100 “Top” vendors in 200+ pages. • We’ve been continuing Bill’s tradition of HIS vendor revenue reviews for about the past 20 years, now listing ours on HIStalk, the source today for unbiased vendor info & critiques.

- 3. Definitions • It’s key to define what one means by an “H.I.S.” since a recent magazine’s rankings include vendors in their Top 10 like Optum, Cognizant, Phillips, Xerox and Leidos, that don’t offer H.I.S. systems, but consulting & other services. We define an H.I.S. as: - Hospital – acute care facilities are the primary market, not “just” physician practices, managed care, long term care, home health, PACS, etc. - Information – the full suite of apps needed to automate a hospital: both financial and clinical systems. Thus, niche payers like Sunquest & Soft for LIS and Oracle & SAP for ERP are excluded. - Systems - the complete package of hardware, software and implementation. This excludes giants like IBM, Leidos, HP, NTT Data, etc, who “only” sell hardware and/or consulting services.

- 4. Top 10 HIS Vendors for 2018 • These revenue figures come from 2017 SEC filings (10-Ks) or info received from vendors executives. Estimates had to be made for companies who do not file 10Ks, have many divisions (e.g.: Harris Healthcare), or are privately held (e.g.: Medhost).

- 5. Top 10 Compara-chart • Visual comparison of 2017 revenue per vendor, illustrating the huge disparity in $ size (& market share) from top to bottom:

- 6. 2017 vs. 2016 Revenue • The change in revenue per vendor: last year every Top 10 vendor increased revenue through sales and/or acquisitions.

- 7. 2018 Top 10 Surprises • Major changes in vendor rankings last year that deserve noting: - Cerner – surged over five billion for the lead in the HIS industry by revenue for the fourth year in a row, thanks to selling “the Works” to Siemen’s clients (CommunityWorks, RevWorks, ITWorks, etc.), the DoD implementation, and huge VA win. - eCW – inched ahead of Meditech for 5th place, despite the major setback last year from a $155M Justice Department lawsuit over false E.H.R. attestations. Now offering its self-developed small- hospital system for only $599 per bed per month... - Meditech – increased revenue for the first time in 4 years, reflecting strong sales of the latest Release 6 version to Magic and Client/Server hospitals.

- 8. MIA/New Vendor Names Two adds/deletes in the Top 10 HIS vendors: • McKesson – gone after selling their EIS division to #3 vendor Allscripts for a surprisingly low $185M. The HIS products acquired include Paragon, which Allscripts will use to compete in the small to mid-size hospital market, selling their Sunrise high- end suite mainly to large hospitals and AMCs/IDNs. Allscripts promises to continue support for some legacy systems like Star & Healthquest RCM, while Horizon Clinicals & Series will be sunset. • Cantata – spun off from NTT Data after they acquired Dell’s $2B HIT consulting division for $3B (!?). Cantata’s product line is comprised of the former “Keane” HIS Division with “Optimum” as their strong RCM solution (based on “PatCom” from PHS/AMI), Ormed as their equally strong ERP suite (somehow also offered by Harris…), and very large LTC/SNF market client base.

- 9. 20 Years HIStory of Vendor Revenue Two decades of revenue ups & downs among the Top 10 vendors:

- 10. Vendor Ranking 20 Years Ago • If you ever wondered what rankings looked like in the past, here’s a gem from our files of who the leading HIS vendors were way back in 1998, based on their annual revenue for FY 1997. – Amazing that none of today’s Top 5 were even on the list! • Only Meditech and CPSI are still around and going strong – wonder how many of today’s vendors will be around in 2038?

- 11. Next Episodes • We’ll delve into the details of each vendors’ performance over the next few episodes, broken down by the three major HIS market segments (in terms of bed size and annual revenue): – Large – the 3 biggees who derive the majority of their revenue from large hospitals over 300 beds in size, as well as large AMCs & Multi-IDNS: Cerner, Epic, & Allscripts’ Sunrise. – Mid-Size – vendors whose target market is mainly mid-size hospitals of 100 to 300 beds in size, including: Meditech (3 versions!), Allscripts’ Paragon, Harris, Medhost & Cantata. – Small – vendors whose client base consists of mostly under 100 bed facilities, especially CAH (Critical Access Hospitals) of under 25 beds, where athena & eCW are challenging CPSI. • For questions, comments, or spiteful remarks, please contact: vciotti@hispros.com, 505.466.4958 or eames@hispros.com, 413.329.6925