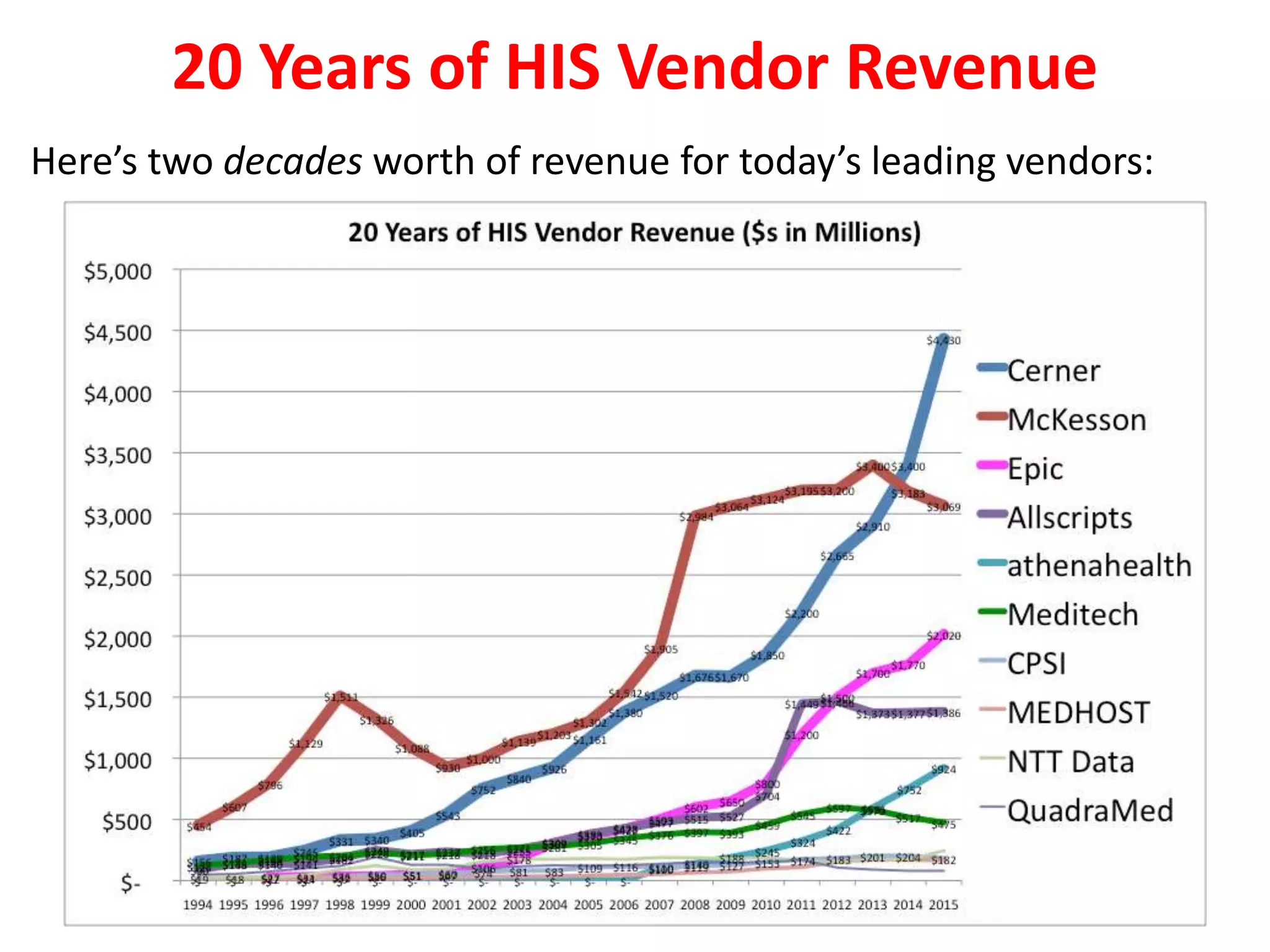

This document provides a summary of the 2016 annual review of leading healthcare information systems (HIS) vendors ranked by revenue. It discusses the long history of such vendor reviews dating back to 1980. Definitions of what constitutes an HIS vendor are provided, excluding large firms that do not offer complete hospital information systems. Revenue figures for 2015 are presented along with analysis of changes from 2014 revenue and notable trends among vendors. The review highlights new entrants athenaHealth and eClinicalWorks and notes several vendors that have been acquired or are no longer separately tracked. A breakdown of analysis for the top 10 vendors across large, mid-size and small hospital markets over the next 3 weeks is outlined.