1. 2016 vendor review c

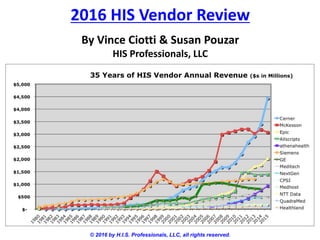

- 1. 2016 HIS Vendor Review © 2016 by H.I.S. Professionals, LLC, all rights reserved. By Vince Ciotti & Susan Pouzar HIS Professionals, LLC 1980 1990 2000 2010 2015

- 2. HIS-tory of Vendor Reviews • If you’ve been reading the few print magazines in our industry along with getting far more unvarnished insights from HIStalk, you’ve probably followed our annual review of the leading HIS vendors in order of their annual revenue for many years: – Original credit for the idea must go to Bill Childs who created this whole media when he started his Computers in Hospitals magazine in 1980 with a whopping 52 page first issue. • Bill’s magazines morphed & were renamed many times over the years, and subsequent rags expanded the vendor review from 25 to 100 vendors, in issues running 200+ pages. • We’ve been continuing Bill’s tradition of HIS vendor revenue reviews for about the past 20 years, recently listing it on HIStalk, the source today for the latest HIS vendor information.

- 3. Definitions • It’s important to define what one means by an “H.I.S.” vendor since some HIT print rag’s rankings include billion-dollar firms in their top 10 list like Optum, Dell, Cognizant, Phillips and Xerox, that don’t really offer an H.I.S. system, which we define as: - Hospital – acute care facilities are the primary market, not “just” physician practices, managed care, long term care, home health, PACS, etc. - Information – the full suite of apps needed to automate a hospital: both financial and clinical systems. Thus, specialty vendor like Sunquest for LIS and Oracle for ERP are excluded. - Systems - the complete package of hardware, software and implementation. This excludes giants like Dell, CSC, IBM, Leidos, HP, etc, who “only” offer hardware and/or consulting.

- 4. HIS Vendors Revenue for 2015 • We obtained the figures from year-end earning reports, SEC filings (K-10s) or written communications received from the vendors themselves. Estimates had to be made for only one company that is privately held: QuadraMed/ N. Harris.

- 5. 2015 vs. 2014 Revenue • This bar chart illustrates the increase/decrease in revenue per vendor from last year, as well as the huge disparity in dollar size:

- 6. 2015 Revenue Shockers • There are some surprises in this table that deserve highlighting: - Cerner – forged way ahead of #2 McKesson for the lead in the HIS industry by revenue for the second year in a row, due mainly to the ≈$1.2B they gained from Siemen’s largely remote-hosted client base, the deal closed in February of 2015. - McKesson, Meditech & Evident (CPSI) – actually declined in revenue by ≈10% each, reflecting the lack of HIS sales in this post-Meaningful Use market when so many hospitals are reluctant to switch systems again after costly upgrades for HITECH $s. - Slow Growth – most other vendors showed little or no revenue growth compared to previous years, such as Allscripts, Medhost and QuadraMed.

- 7. Newbies There is one new vendor in this year’s revenue review, and another who will be in it shortly, that are well worth highlighting: • athenaHealth – a huge physician practice vendor with ≈$1B in revenue that entered the HIS market by acquiring small (mainly CAH) hospital vendor RazorInsights (≈$2M in revenue) in 2015. – RazorInsights = a modern cloud-based EMR with a solid & integrated RCM, priced on an SaaS model, with ≈20 CAH hospital clients, and the hottest demo booth at HIMSS. – Athena also signed with Toledo Medical Center, a 200 bed AMC, as a pilot site for their new integrated HIS/MD system. • eClinicalWorks – also claims an integrated HIS is “in the works:” – They claim ≈80 hospitals in India are are already using the EMR from their extremely popular physician practice system in the US, with an integrated “total HIS” being developed…

- 8. MIA!? • Several HIS vendors are dropped since last year’s HIS vendor list: – Siemens/SMS - the leader in HIS revenue for decades before being acquired by Siemens circa Y2K, & then Cerner last year. – GE – this tech giant is a massive player in the physician practice and ancillary department (eg: OB) market niches, but their few remaining HIS clients on the ex-IDX “Centricity” HIS/EMR represent such a tiny slice of their total revenue, they will be covered when we review MD practice vendors next. – Healthland – this small hospital (<100 beds) giant with over 350 hospital clients on their aging “Classic” and modern “Centriq” systems was acquired by Evident (CPSI) this year. – NextGen – acquired the Opus hospital EMR and Sphere financials (RCM and ERP) several years ago, but couldn’t sell the interfaced systems, and sold out to QuadraMed in 2015.

- 9. 20 Years of HIS Vendor Revenue Here’s two decades worth of revenue for today’s leading vendors:

- 10. Next 3 Weeks • We’ll delve into the details of the 10 vendors’ performance over the next 3 episodes of the HIS review, broken down by the three major HIS market segments (in terms of beds and revenue): – Large – those vendors whose derive the majority of their revenue from large hospitals over 300 beds in size, including large AMCs & Multi-IDNS: Cerner, Epic, & Allscripts. – Mid-Size – vendors whose target market includes mainly mid- size hospitals of 100 to 300 beds in size, including Meditech (all 3!), Paragon, NTT Data, QuadraMed & Medhost. – Small – vendors whose client base consists of mostly under 100 bed facilities, including CAH (Critical Access Hospitals) of under 25 beds, where Evident (CPSI) is the leader. • For questions, comments, or legal action, please contact us at: vciotti@hispros.com, 505.466.4958 or spouzar@hispros.com, 407.321.1110