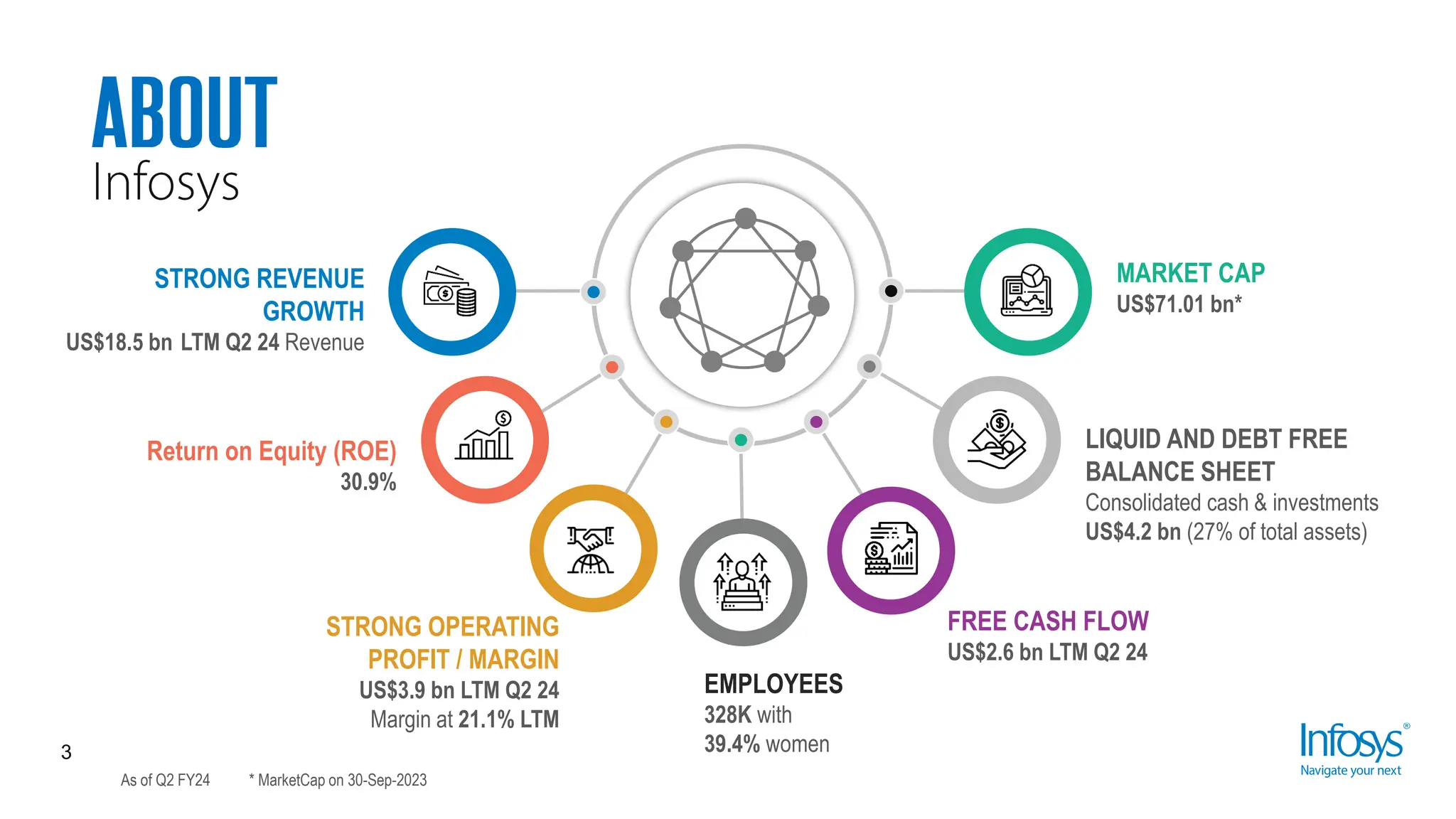

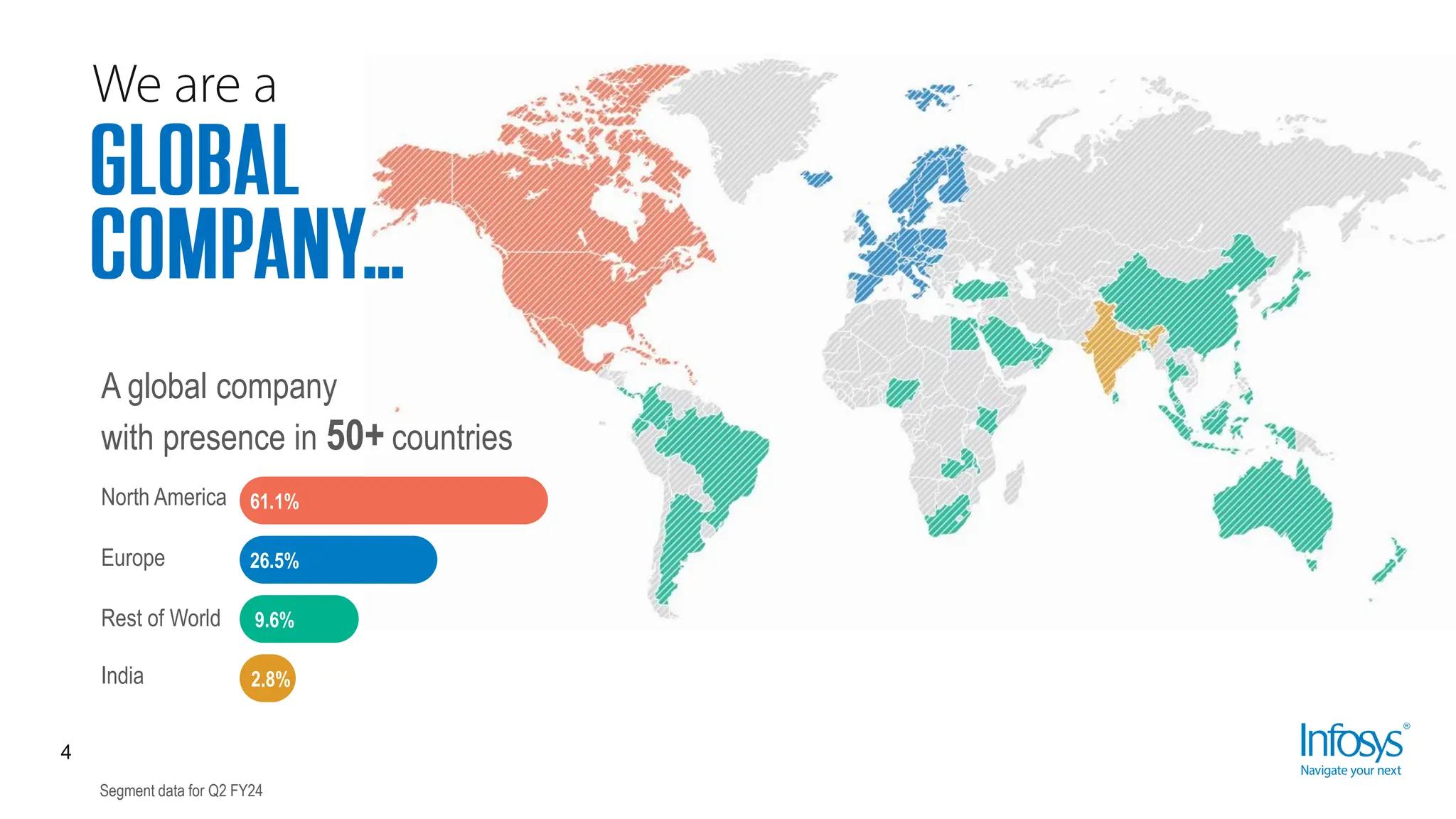

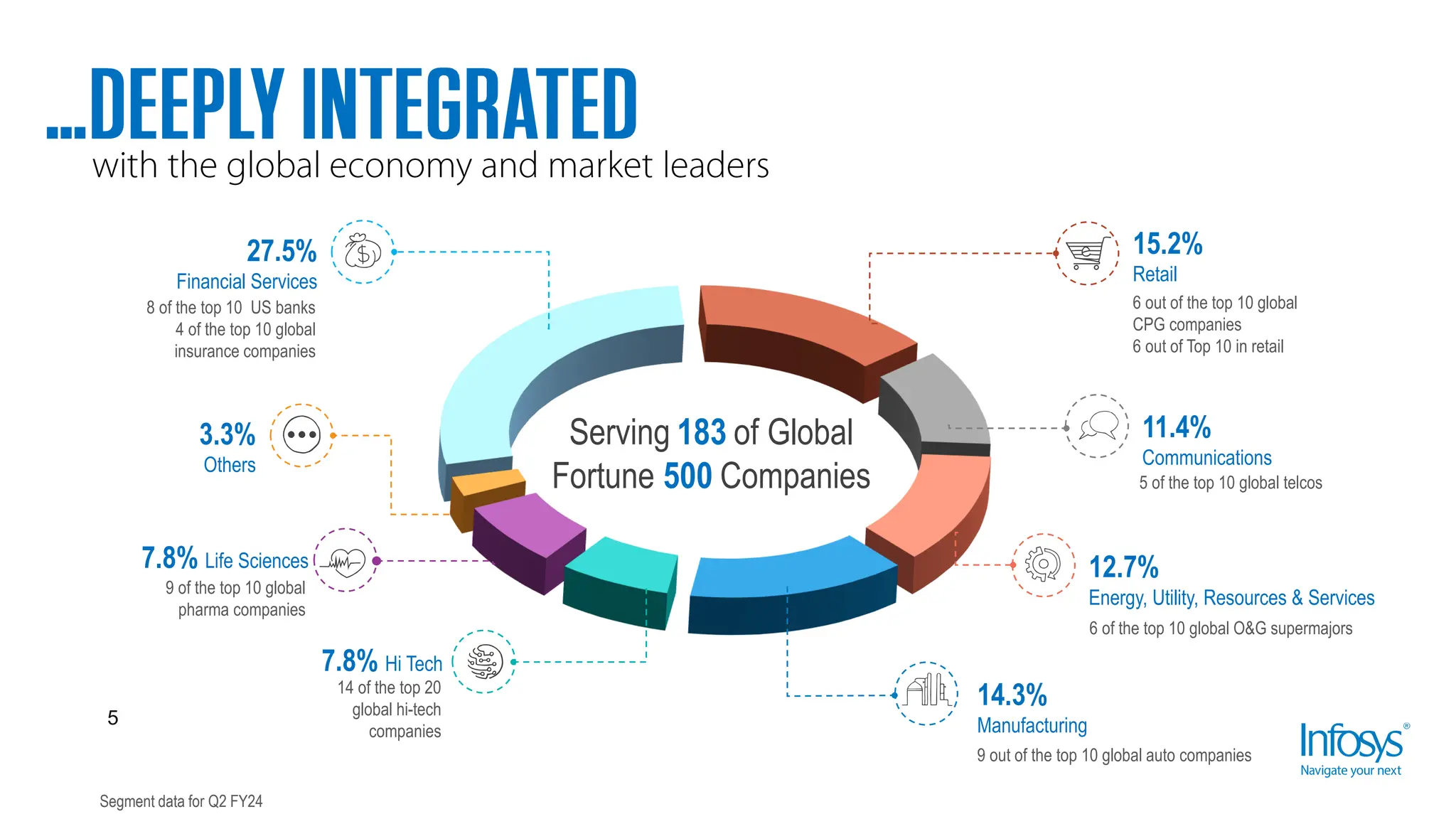

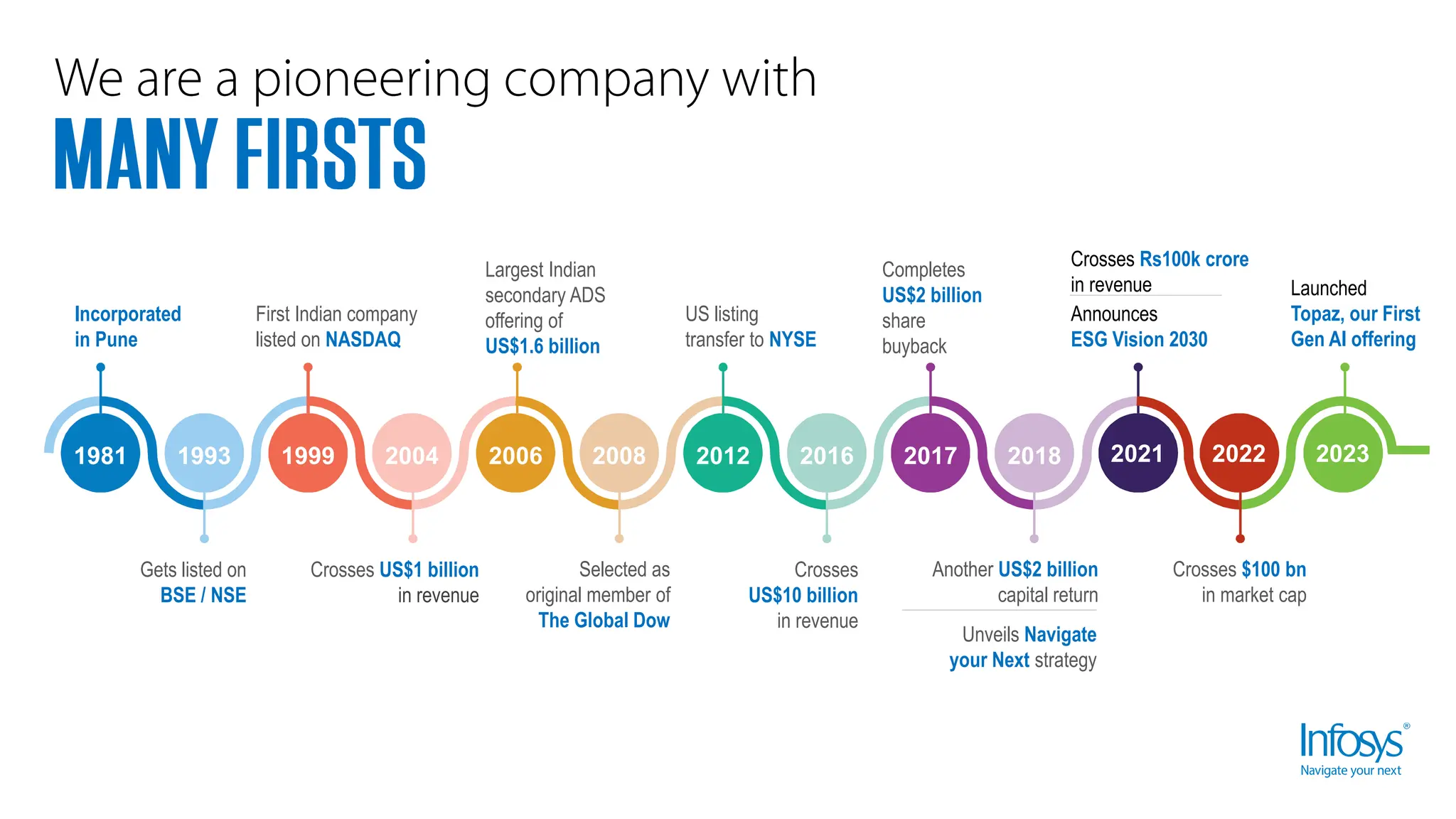

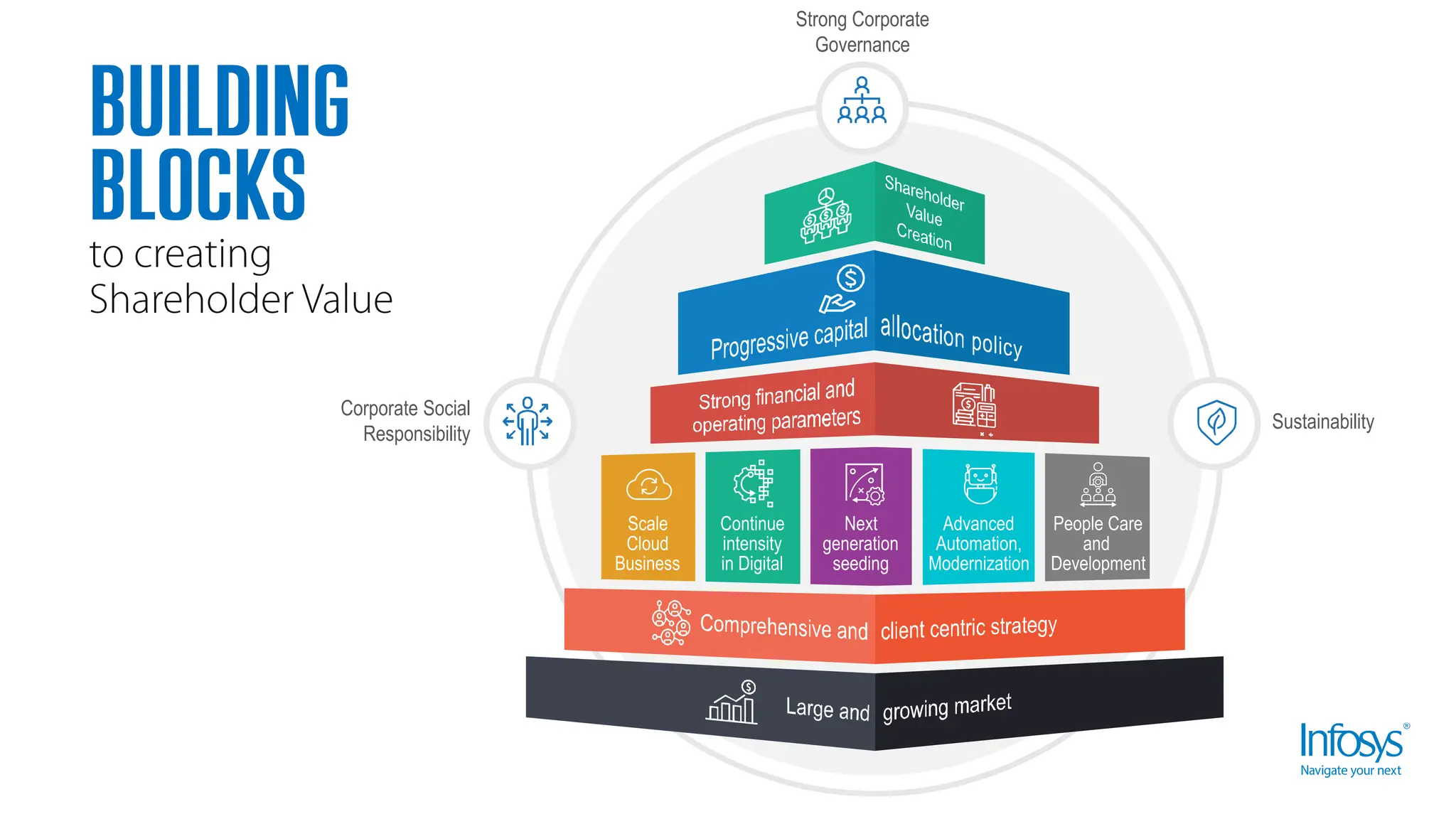

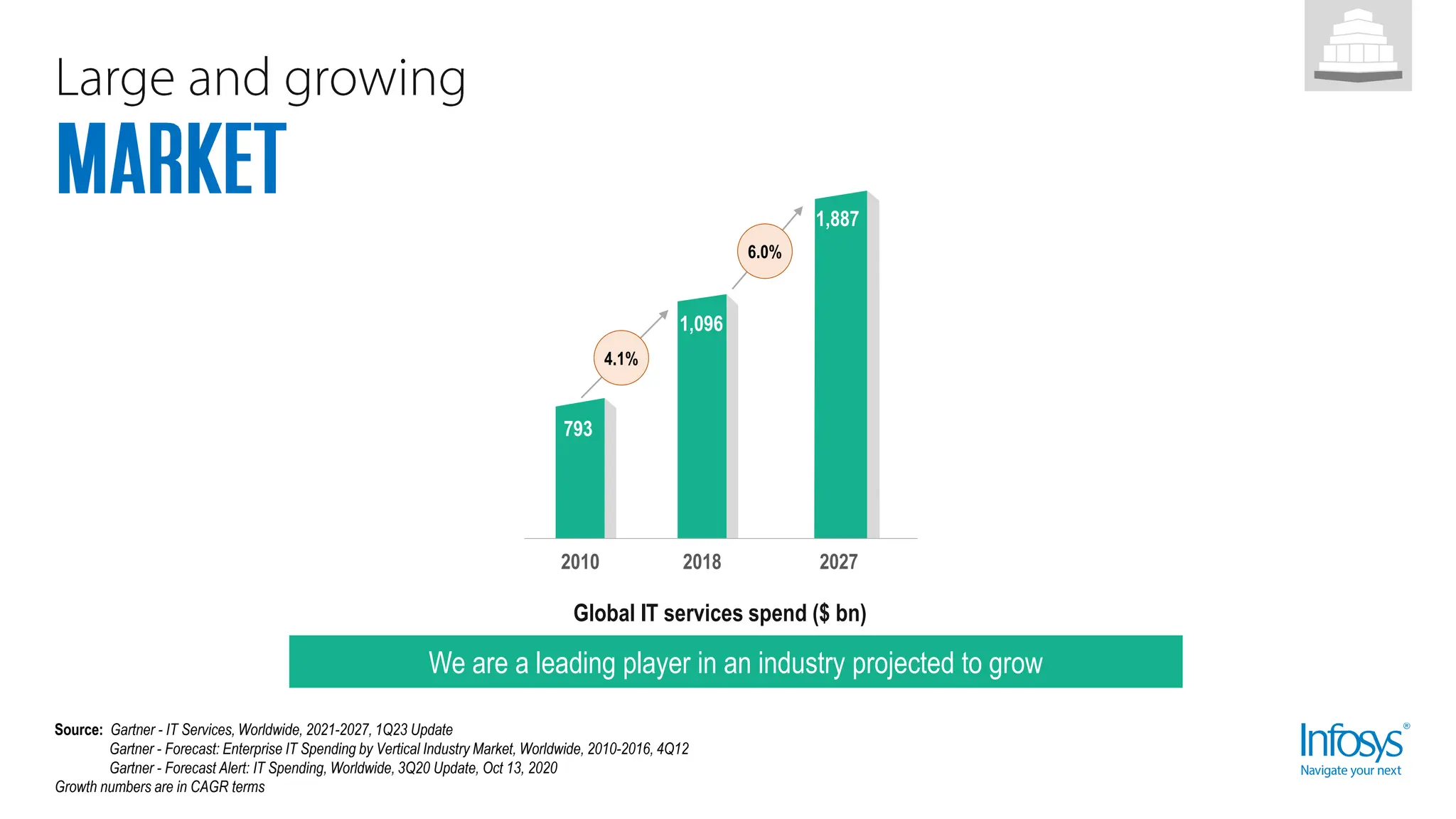

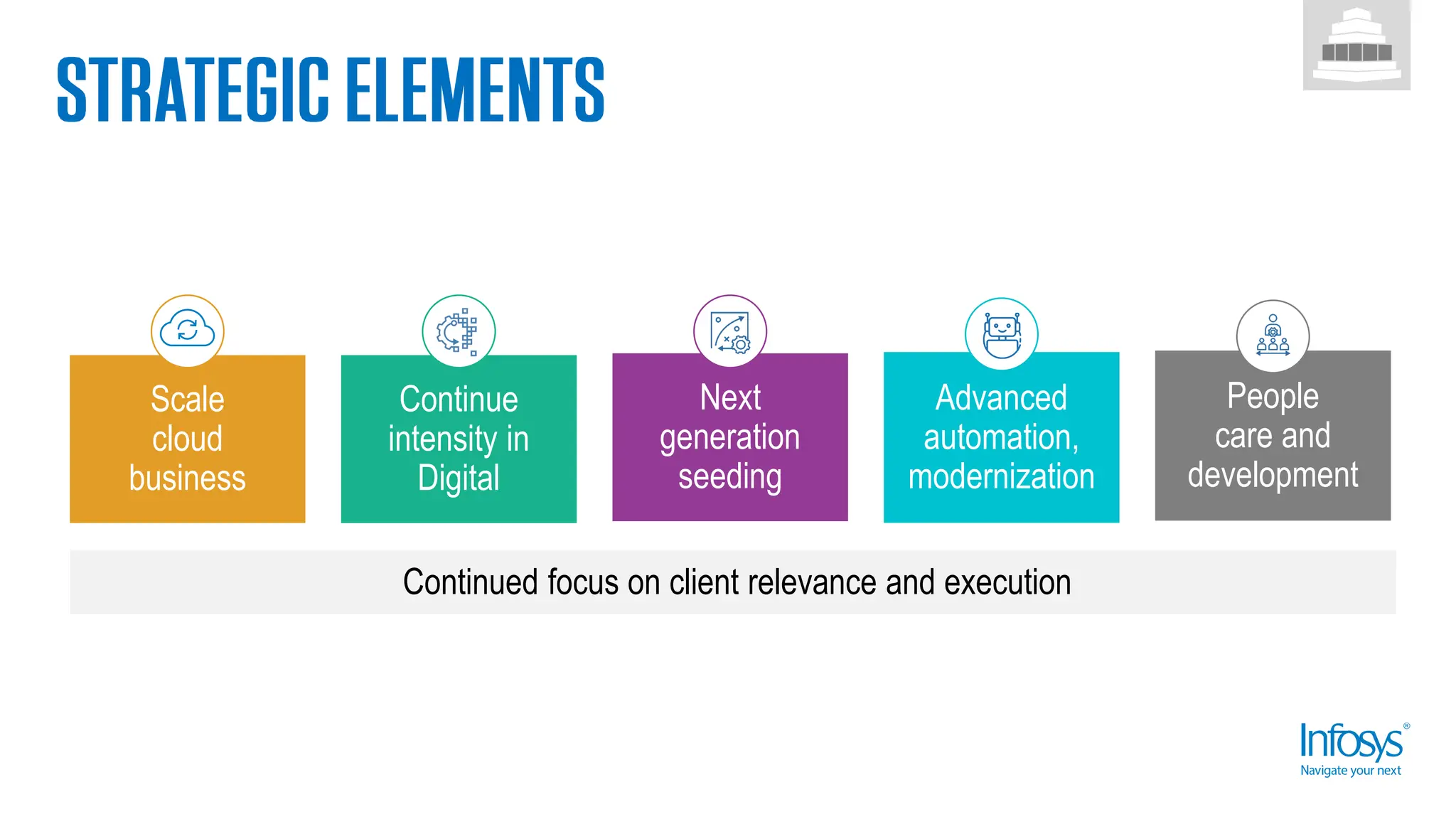

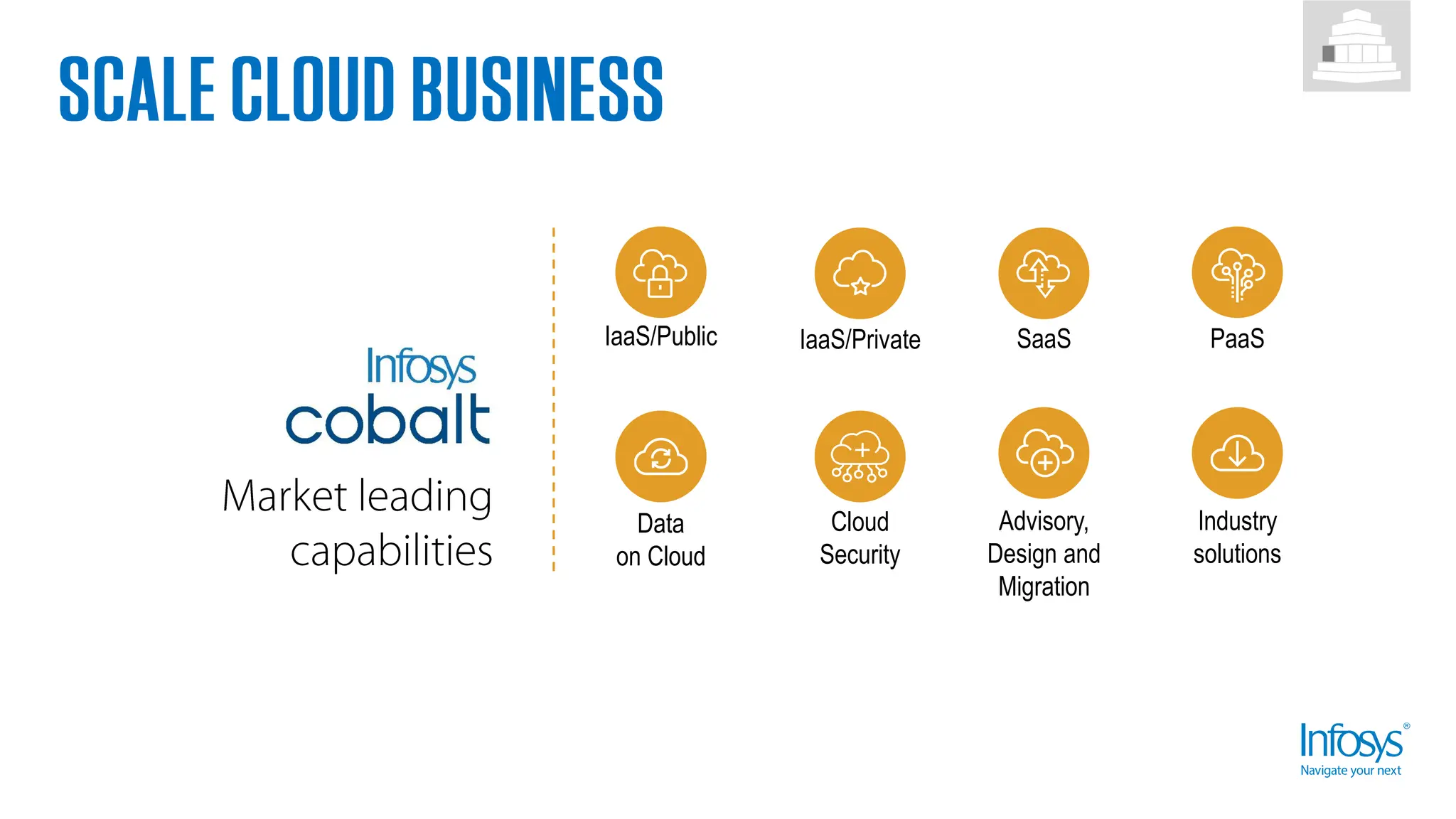

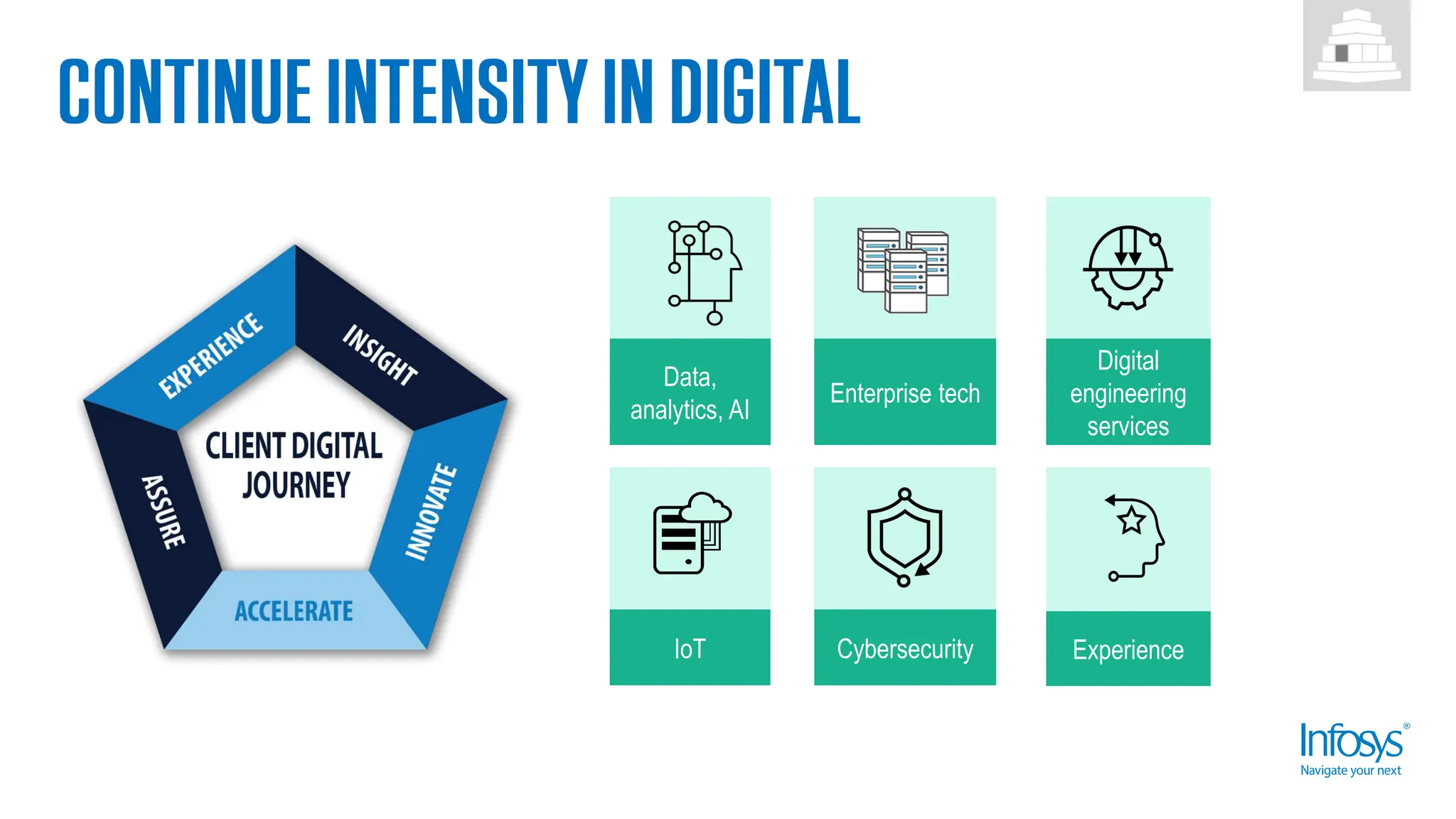

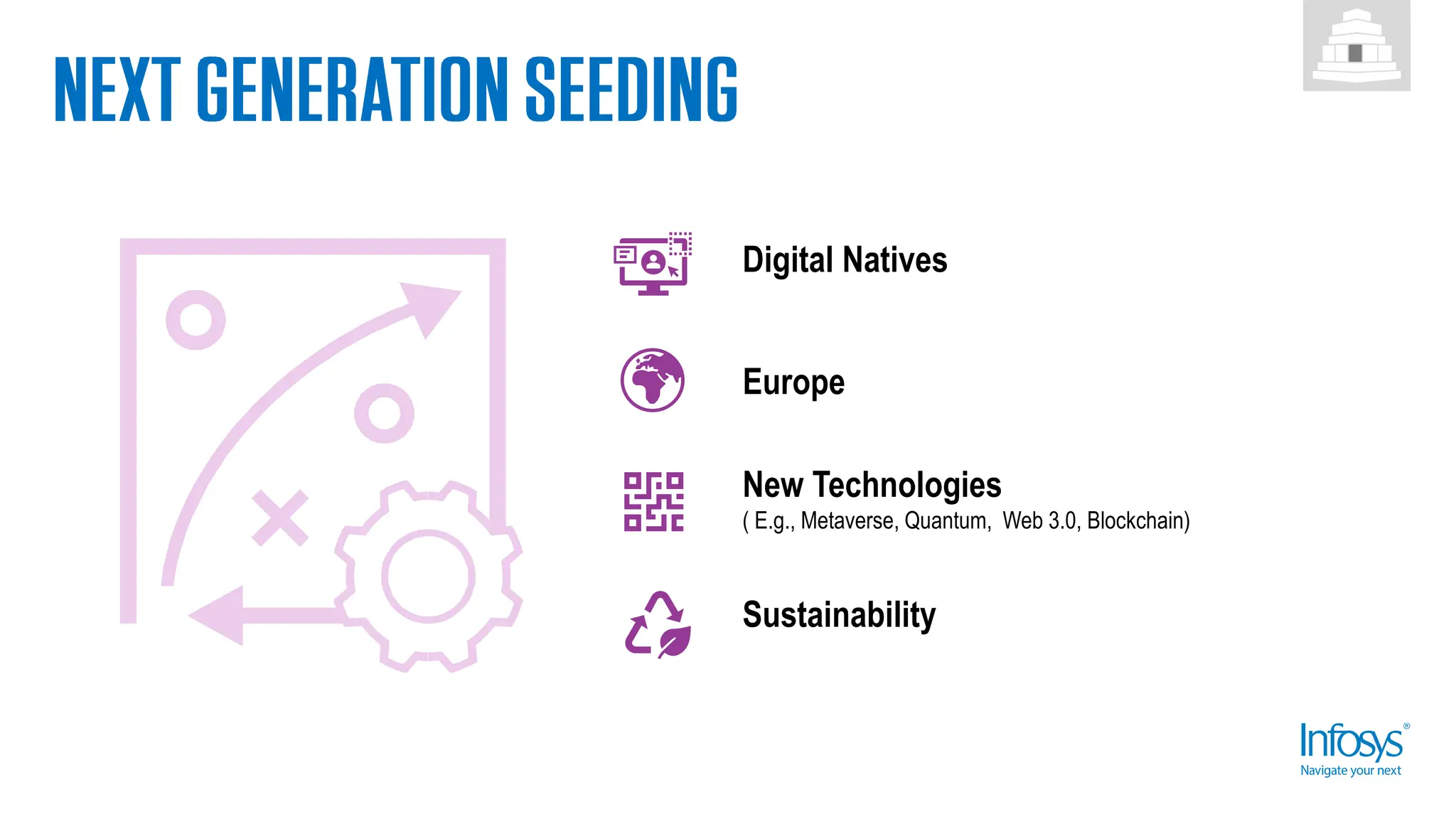

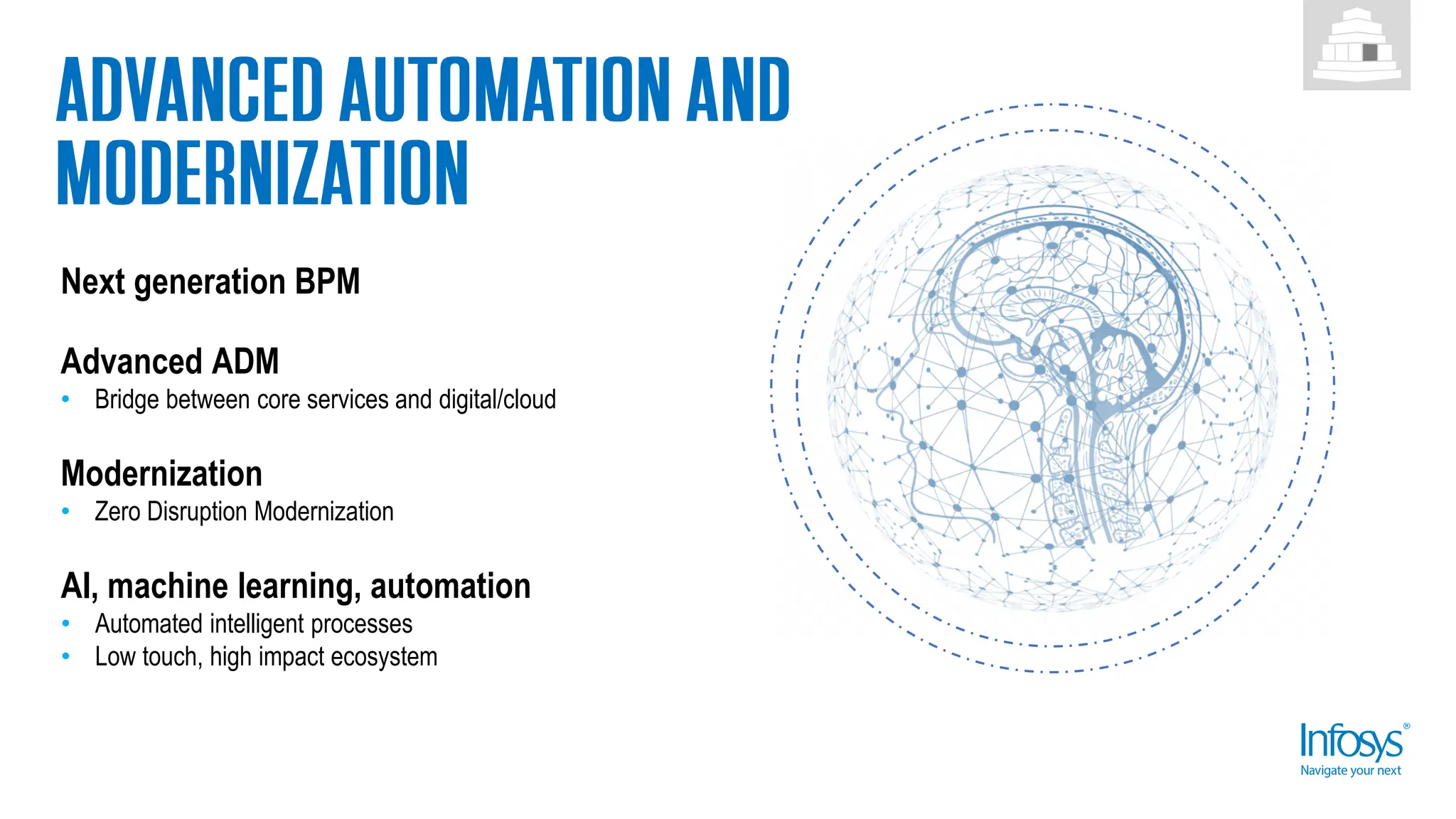

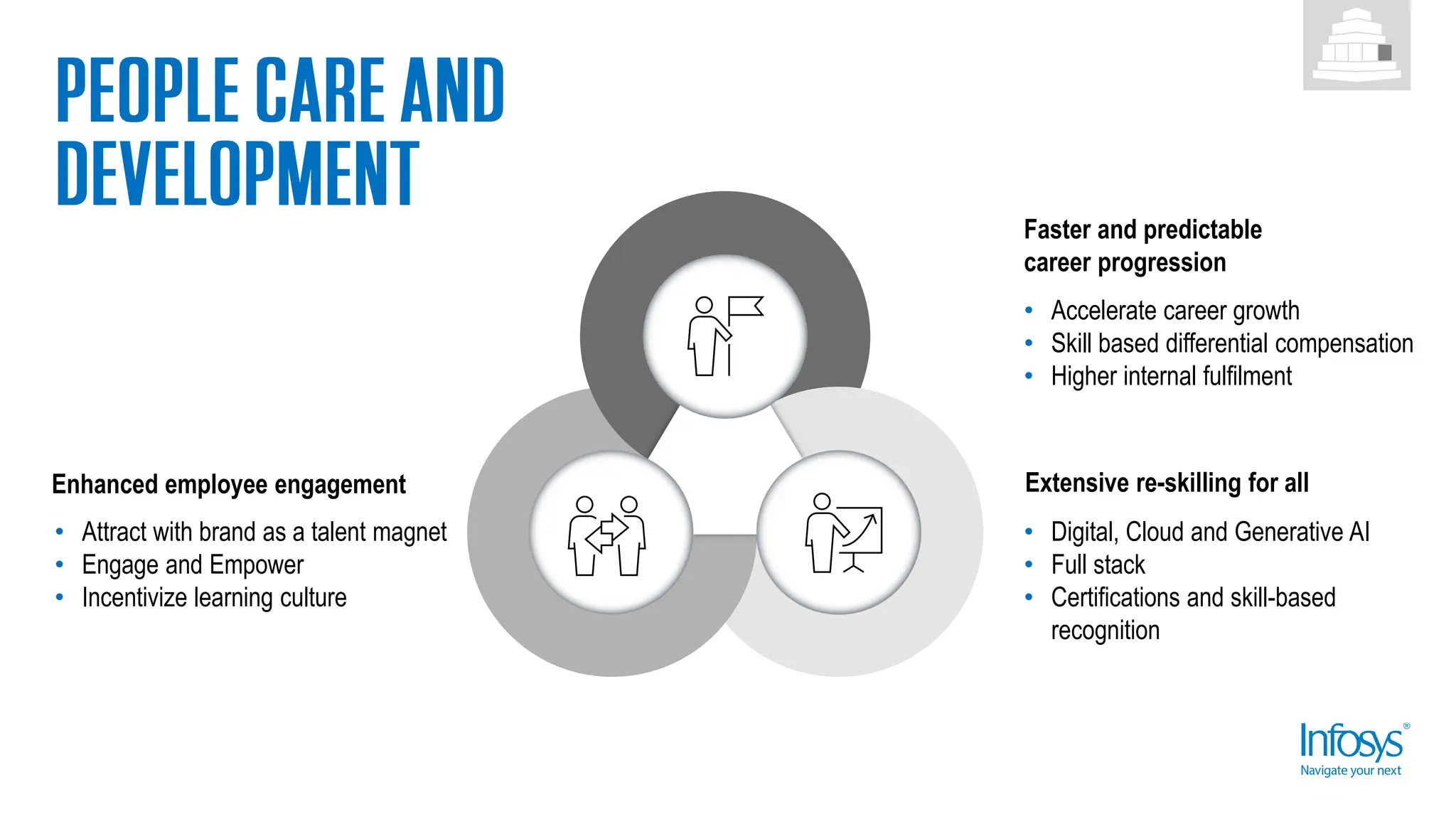

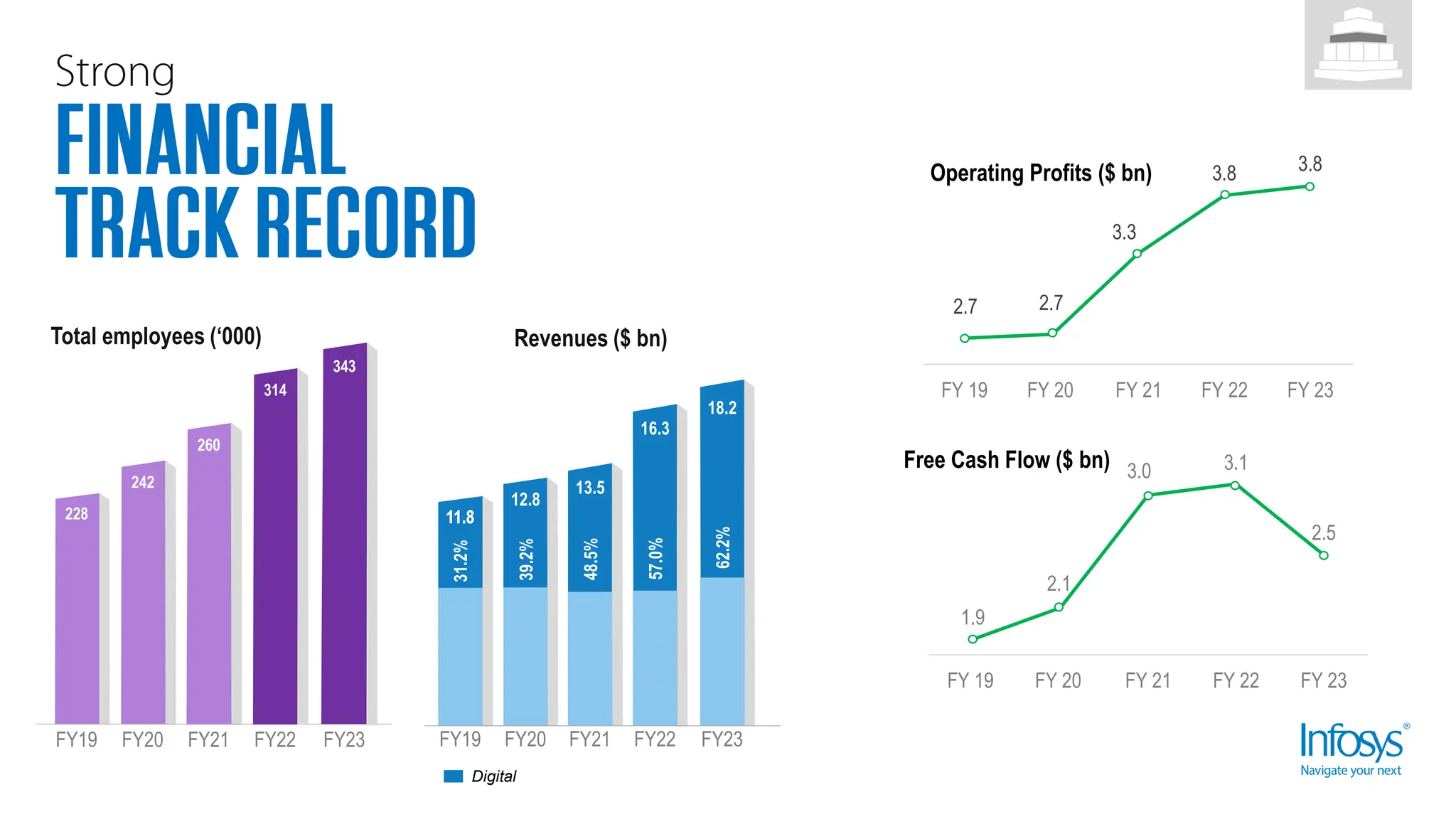

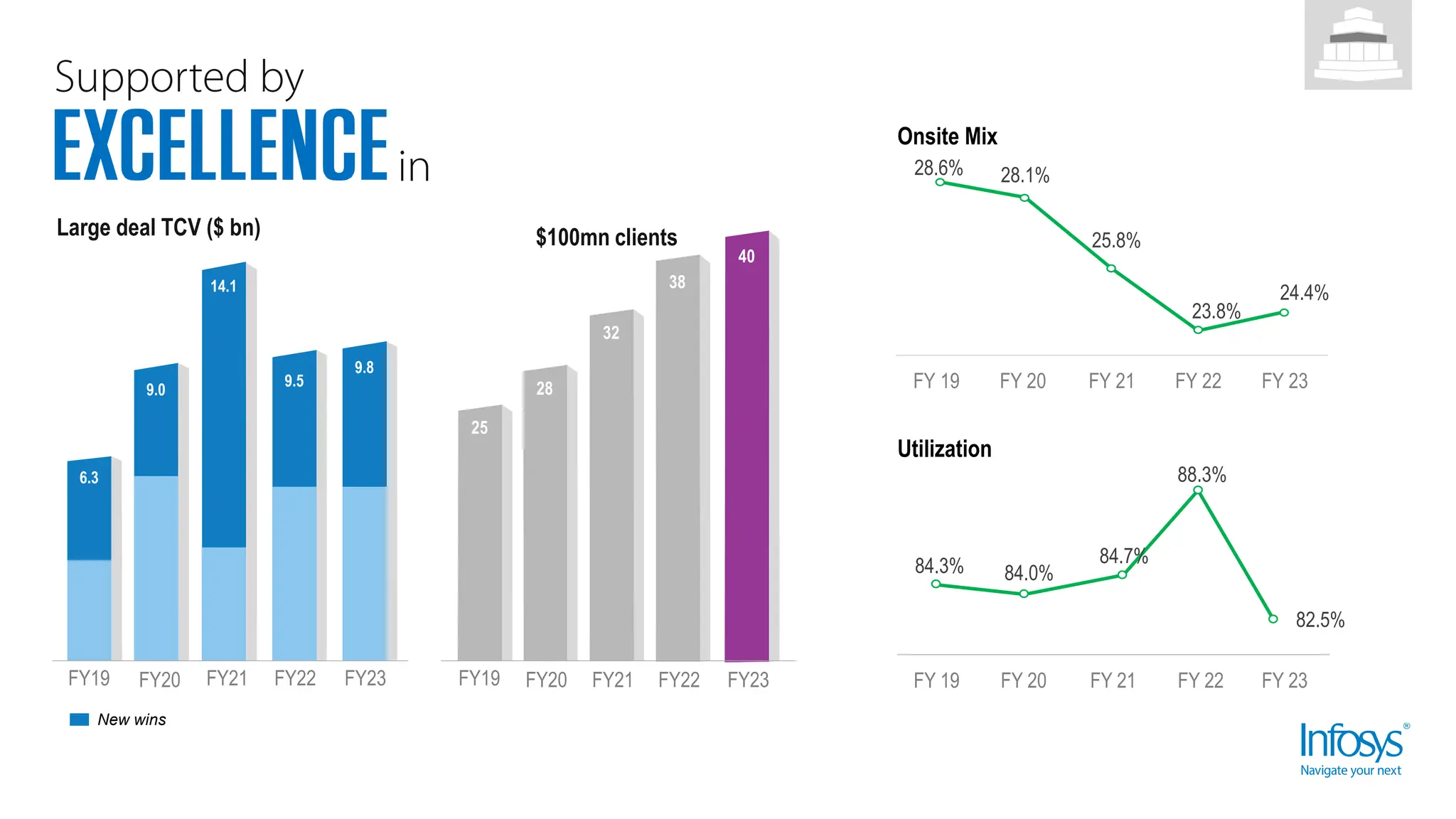

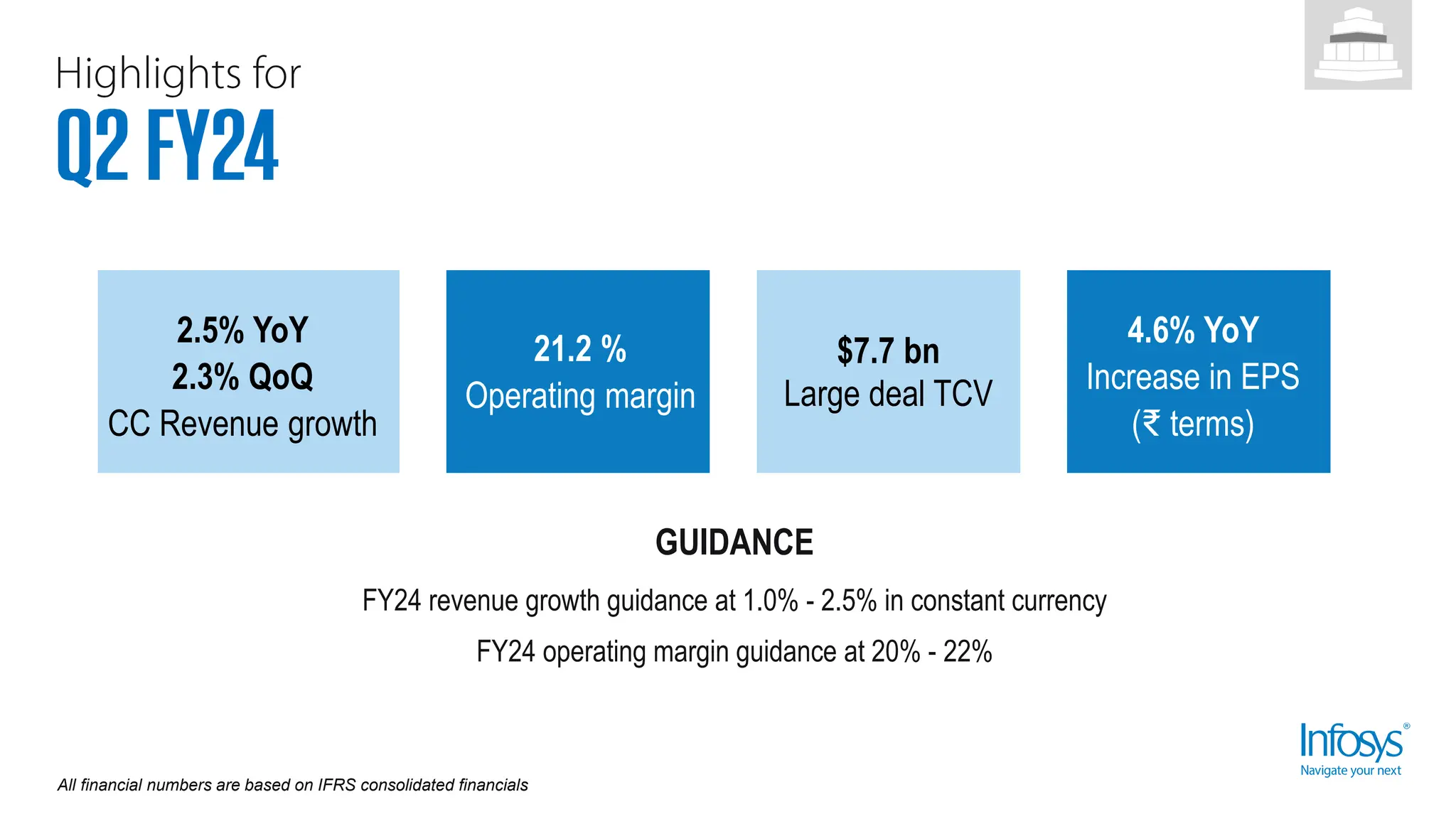

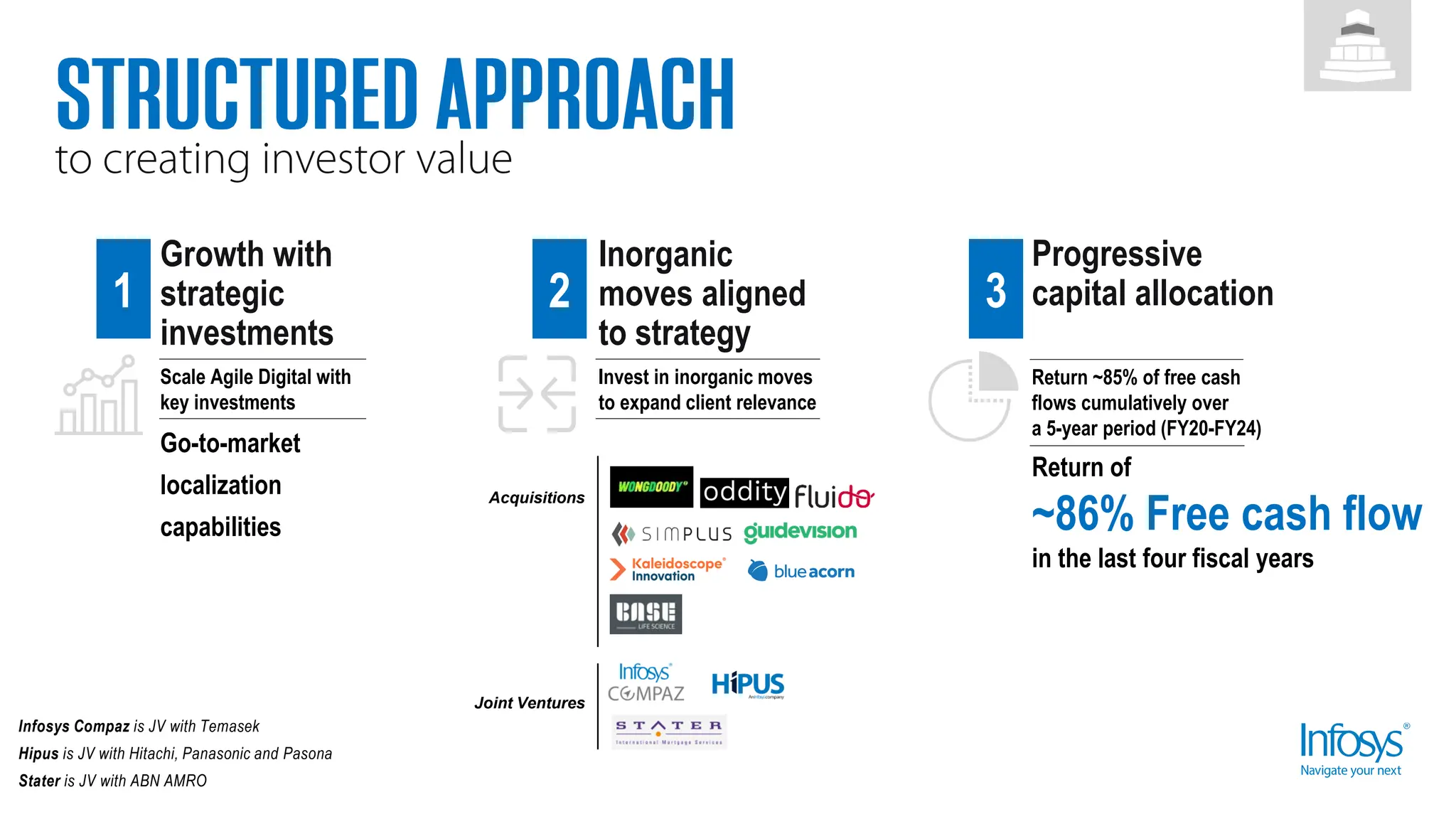

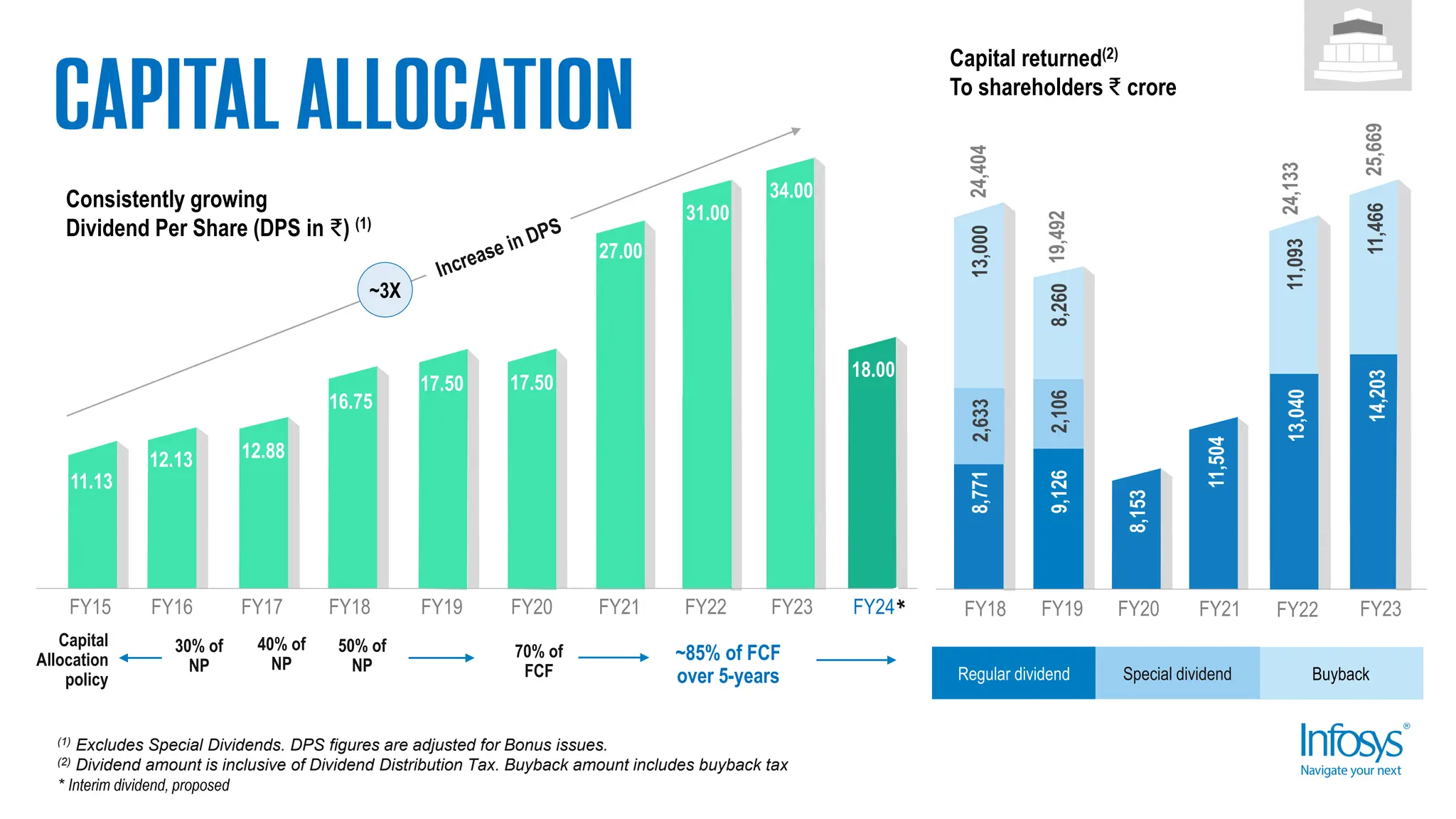

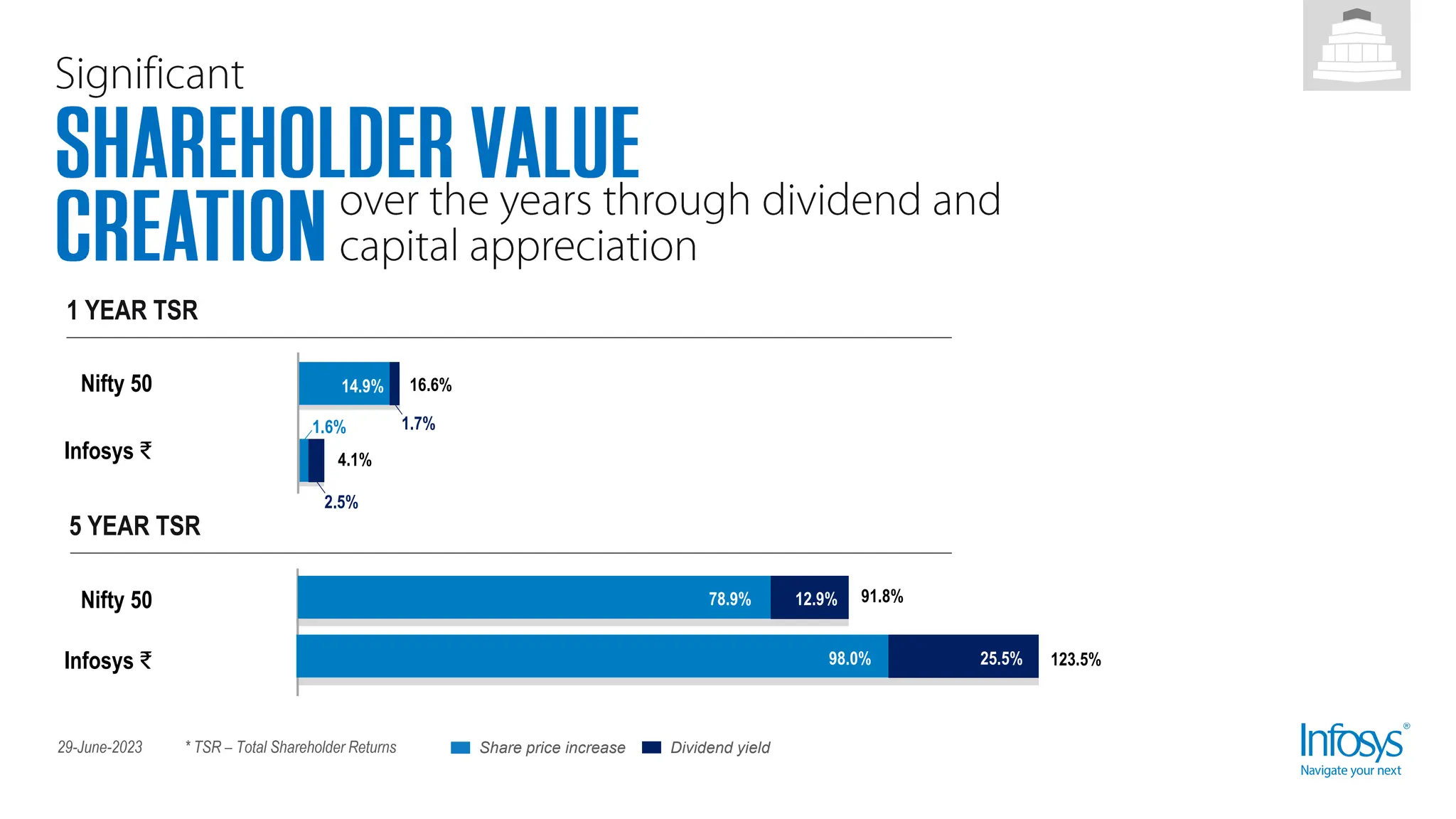

The document discusses certain forward-looking statements regarding Infosys' future growth prospects and financial performance that involve risks and uncertainties. It notes key risks such as execution of business strategy, attracting and retaining talent, transition to hybrid work model, economic uncertainties, and regulatory changes. The document provides Infosys' market position, business segments, and financial highlights. It also outlines the company's strategic priorities such as continuing digital intensity, next generation technologies, people development and sustainability to achieve continued growth.