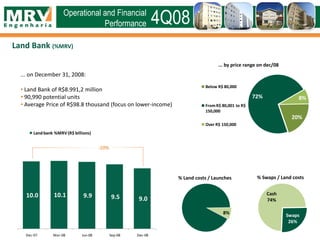

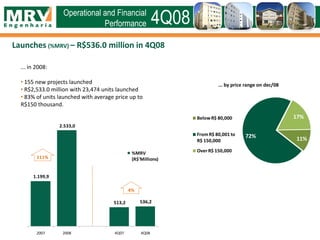

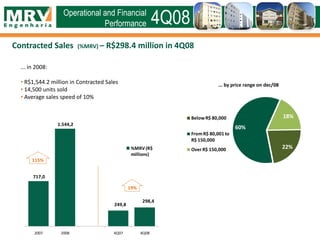

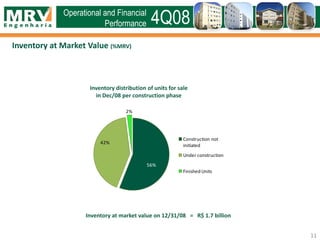

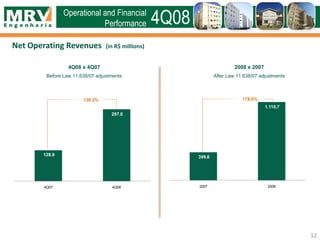

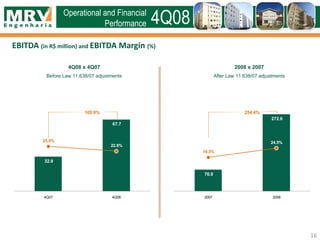

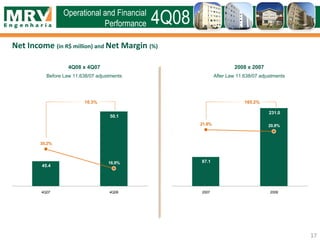

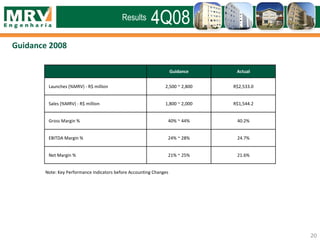

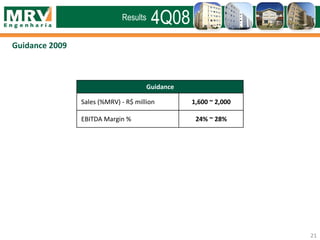

MRV Engenharia is a Brazilian real estate developer specializing in lower-income housing. In 2008, MRV launched over 23,000 units worth R$2.5 billion and contracted sales of over 14,500 units worth R$1.5 billion. Financially, net operating revenues increased 178% to R$1.1 billion due to accounting changes, while net income grew 165% to R$231 million. For 2009, MRV expects contracted sales between R$1.6-2 billion and to maintain EBITDA margins between 24-28%.