This document provides an overview of 4Q17/2017 results for an unnamed company. Some key highlights include:

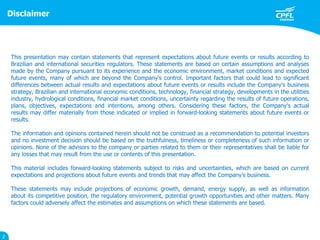

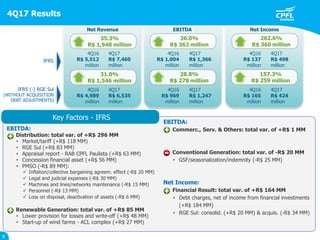

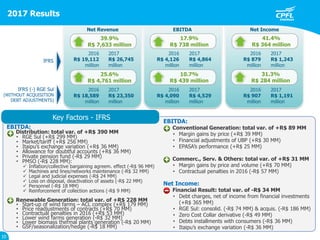

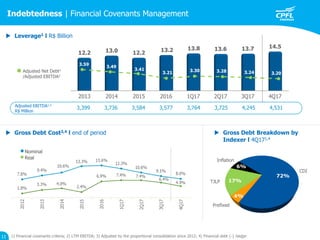

- Net income increased 35.3% in 4Q17 and 39.9% for 2017. EBITDA also increased significantly.

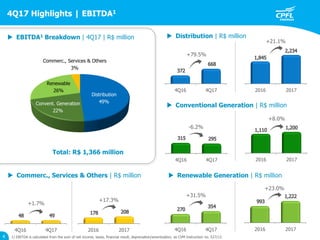

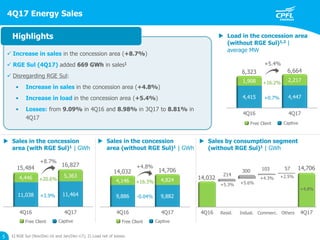

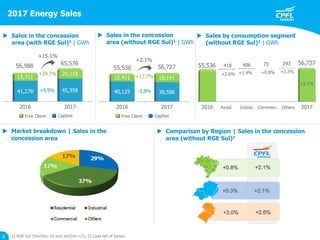

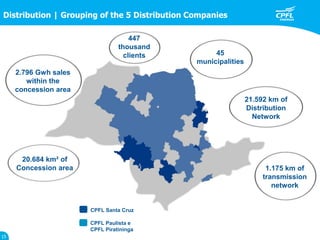

- Sales increased in the company's concession area due to higher demand and acquisitions.

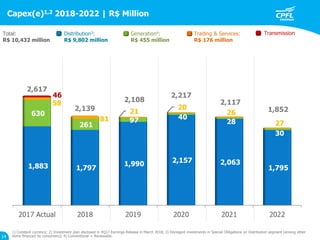

- Investments totaled R$694 million in 4Q17 and R$2.6 billion in 2017 to expand and maintain infrastructure.

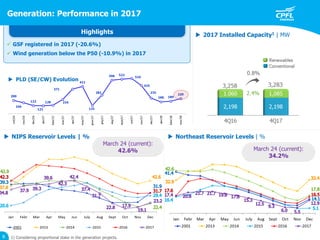

- Generation performance was impacted by lower reservoir levels and wind generation below expectations.