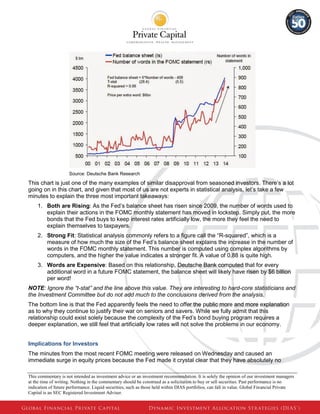

The document discusses the Federal Open Market Committee (FOMC) meeting minutes being released this week, which caused stock markets to surge. The minutes pointed to the likelihood of interest rates being kept low for longer than expected. The investment committee has been critical of the Fed's decision to keep rates artificially low for years, as it forces seniors and savers into riskier assets. A Deutsche Bank analysis found a strong correlation between the increasing size of the Fed's balance sheet from bond purchases and the increasing length of FOMC statements, suggesting the Fed feels a need to further explain their actions. The implications are that investors will continue facing challenges finding attractive income investments for the next few years.