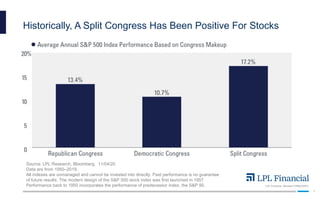

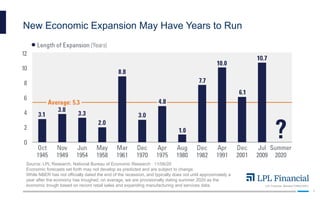

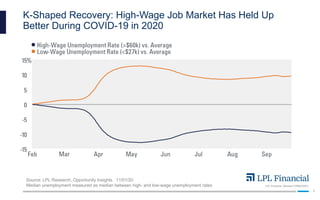

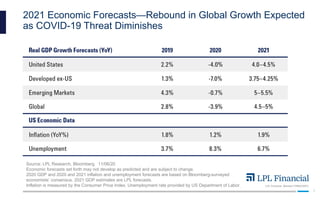

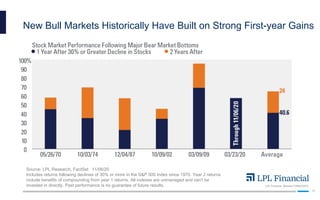

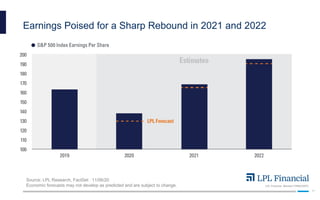

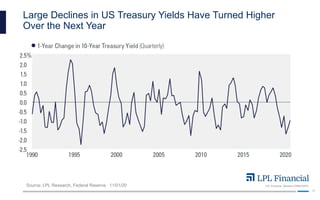

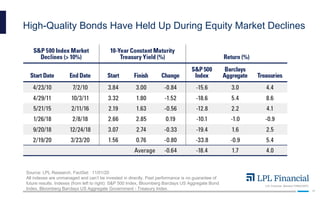

This document provides an outlook and forecasts for the US and global economies and markets for 2021 from LPL Financial. It discusses expectations that the new economic expansion may continue for years, earnings are poised for a sharp rebound in 2021-2022 which may fuel solid stock market gains, and Treasury yields are expected to rise over the next year. The outlook presents LPL Financial's views that the recovery remains uneven but global growth should rebound as the COVID threat diminishes.