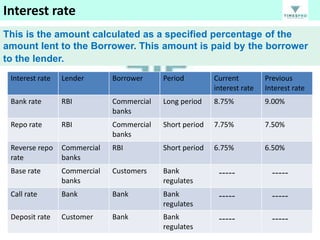

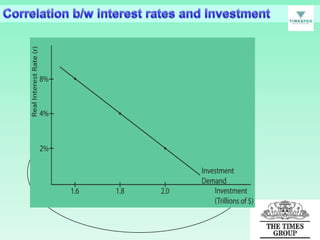

1) Knowledge of interest rates is important for retail bankers to guide customers on investment options and pitch products effectively. Interest rates impact the performance of investments and what options make sense for customers.

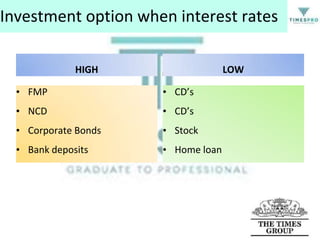

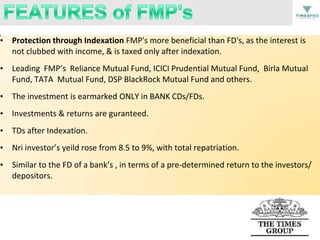

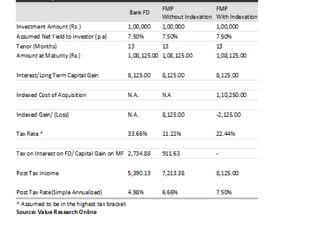

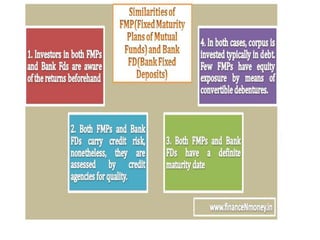

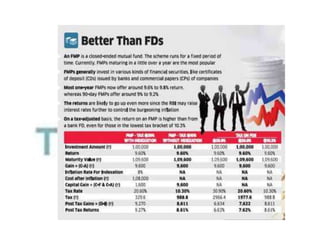

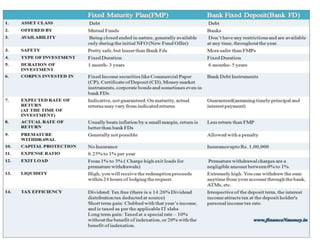

2) When interest rates are high, options like fixed maturity plans, non-convertible debentures, and corporate bonds provide higher returns. When rates are low, investments like certificates of deposits, stocks, and home loans allow taking advantage of cheaper borrowing costs.

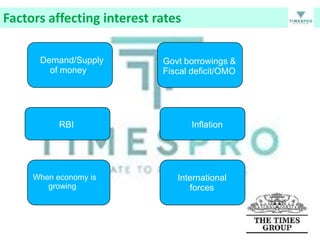

3) For bankers, understanding how interest rates affect the economy, the factors that influence them, and how the Reserve Bank of India uses them as a policy tool helps them advise customers appropriately.