Seasons earnings jan_18_13

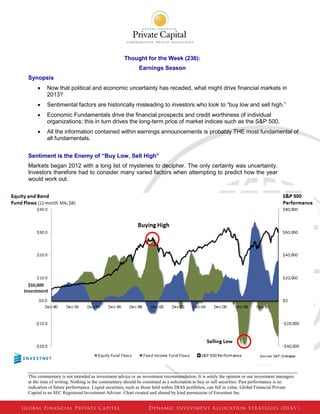

- 1. This commentary is not intended as investment advice or an investment recommendation. It is solely the opinion or our investment managers at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Past performance is no indication of future performance. Liquid securities, such as those held within DIAS portfolios, can fall in value. Global Financial Private Capital is an SEC Registered Investment Adviser. Chart created and shared by kind permission of Envestnet Inc. Thought for the Week (236): Earnings Season Synopsis Now that political and economic uncertainty has receded, what might drive financial markets in 2013? Sentimental factors are historically misleading to investors who look to “buy low and sell high.” Economic Fundamentals drive the financial prospects and credit worthiness of individual organizations; this in turn drives the long-term price of market indices such as the S&P 500. All the information contained within earnings announcements is probably THE most fundamental of all fundamentals. Sentiment is the Enemy of “Buy Low, Sell High” Markets began 2012 with a long list of mysteries to decipher. The only certainty was uncertainty. Investors therefore had to consider many varied factors when attempting to predict how the year would work out.

- 2. This commentary is not intended as investment advice or an investment recommendation. It is solely the opinion or our investment managers at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Past performance is no indication of future performance. Liquid securities, such as those held within DIAS portfolios, can fall in value. Global Financial Private Capital is an SEC Registered Investment Adviser. Chart created and shared by kind permission of Envestnet Inc. And yet, through all the doubt and volatility, 2012 handsomely rewarded long-term investors who resisted the temptation to sell their securities and flee to cash. Our conclusion: politics and sentiment only move markets in the short-term. They create short-term ups and downs which often result in opportunities for consistent investors. The previous chart illustrates how investors have a tendency to rush into equity funds (the green area) as the stock market reaches a high (the black line). Conversely, they also tend to sell out of equity funds when markets are falling. The first red circle shows that stocks reached the top of the “Tech Bubble” just as investors were on a buying frenzy. The second red circle shows investors dumping stocks just as the 2008/2009 Bear market came to an end. Yes, many investors saw their equity portfolios lose close to 50% of their value only to sell out as the market started the current 3-year upwards trend. This “buy high – sell low” phenomenon is driven by investor and media sentiment. The easiest time to like an investment is when it has gone up in value and everyone seems to think the trend will continue. The hardest time to want to buy is when prices have fallen and everyone thinks they’ll drop further. Volatile equity funds tend to experience this more than balanced diversified portfolios. Fundamentals in 2013 As we embark on the journey of the next twelve months, many of the doubts that drove markets up and down in 2012 have disappeared. Even the doomsday threat of the Mayans was debunked. So, what are we left with to drive market prices and company prospects? Apart from the imminent political debate over the U.S. Debt Ceiling, corporate earnings reports are now the focus of the informed investor. Earnings reports give us a direct line into the actual operating performance and future expectations of real corporations. In our opinion, this is much more relevant than the flip-flopping of political pundit opinion and their musing on the next argument on Capitol Hill. Stock markets are currently at or near five year highs and the fourth quarter of 2012 could have been adversely affected by uncertainty over the Presidential Election and Fiscal Cliff. Therefore, if we believe fundamental company performance and guidance will influence the stock market in the near future, don’t we expect the current earnings season to be poor and provide markets with a reason to fall? There is that potential, but the facts above are already known by investors. Current investor expectations are probably already priced into the market. Although we expect earnings and revenue growth to be muted for the next two quarters, we don’t necessarily expect it to hurt the market. Study Earnings Reports Carefully! Company directors are masters at managing investor expectations – never forget this simple rule when assessing corporate earnings reports. For many investors, the simple “Company X beat expectations…” or “Company Y missed expectations …” headlines are enough for them to form an opinion when reading a company earnings announcement.

- 3. This commentary is not intended as investment advice or an investment recommendation. It is solely the opinion or our investment managers at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Past performance is no indication of future performance. Liquid securities, such as those held within DIAS portfolios, can fall in value. Global Financial Private Capital is an SEC Registered Investment Adviser. Chart created and shared by kind permission of Envestnet Inc. But look beyond the headlines and remember: Company directors are masters at managing investor expectations. When reading an earnings report, there’s a strong chance the earnings (or revenue target that the earnings headline says they beat or missed) has already been changed by the company’s board. For example, approximately 70% of companies in the S&P 500 have previously lowered their fourth quarter “Guidance” (companies like to keep the market up to date with their prospects by issuing periodic revisions to what they feel their earnings will be). In short, the number they “beat” or “miss” may already have been changed to manage investor expectations. Similarly, corporate boards may feel that the uncertain political climate in the last quarter of 2012 gives them a free pass to declare lower earnings. After all, it was a difficult time for us all and who wouldn’t excuse a temporary profit hiccup? When a company lowers current quarter earnings, it makes it easier to meet or beat future earnings targets. In these cases, a board may miss expectations in the previous quarter but issue positive guidance for coming earnings reports. Bad news if all you read is the headline “Miss” or “Beat” but good news for company prospects. Additional 2013 Factors We expect 2013 to start with a weak quarter or two for corporate earnings - but we believe this to be of no great concern as the market is expecting it. There are also continued fears regarding corporate revenue growth – where will it consistently come from? Again, we are not too concerned in the medium term as we expect developing nations to return to economic growth. This will allow the corporations we favor; those with global reach and market dominance, to grow and profit. In DIAS, we have recently completed a repositioning called the “Pivot to Asia.” Our intention is to further benefit from those companies who may enjoy revenue growth from non-U.S. markets. One political factor that is overhanging markets and economies; a factor that is fundamental AND political. When do we start repaying our debts? Just as slow economic growth over the last few years has often been cheered by investors, when it has led to Quantitative Easing (Q.E.) and higher prices for most securities; when the U.S. Government feels economic growth has reached a point of self-sustenance, it may begin to turn off the Q.E. spigot. Therefore, we remain cautious that consistently good economic news may become bad news for market prices (both bonds and stocks). For a more complete description of our investment outlook, investors should read our 2013 Quarter 1 Investment Commentary.