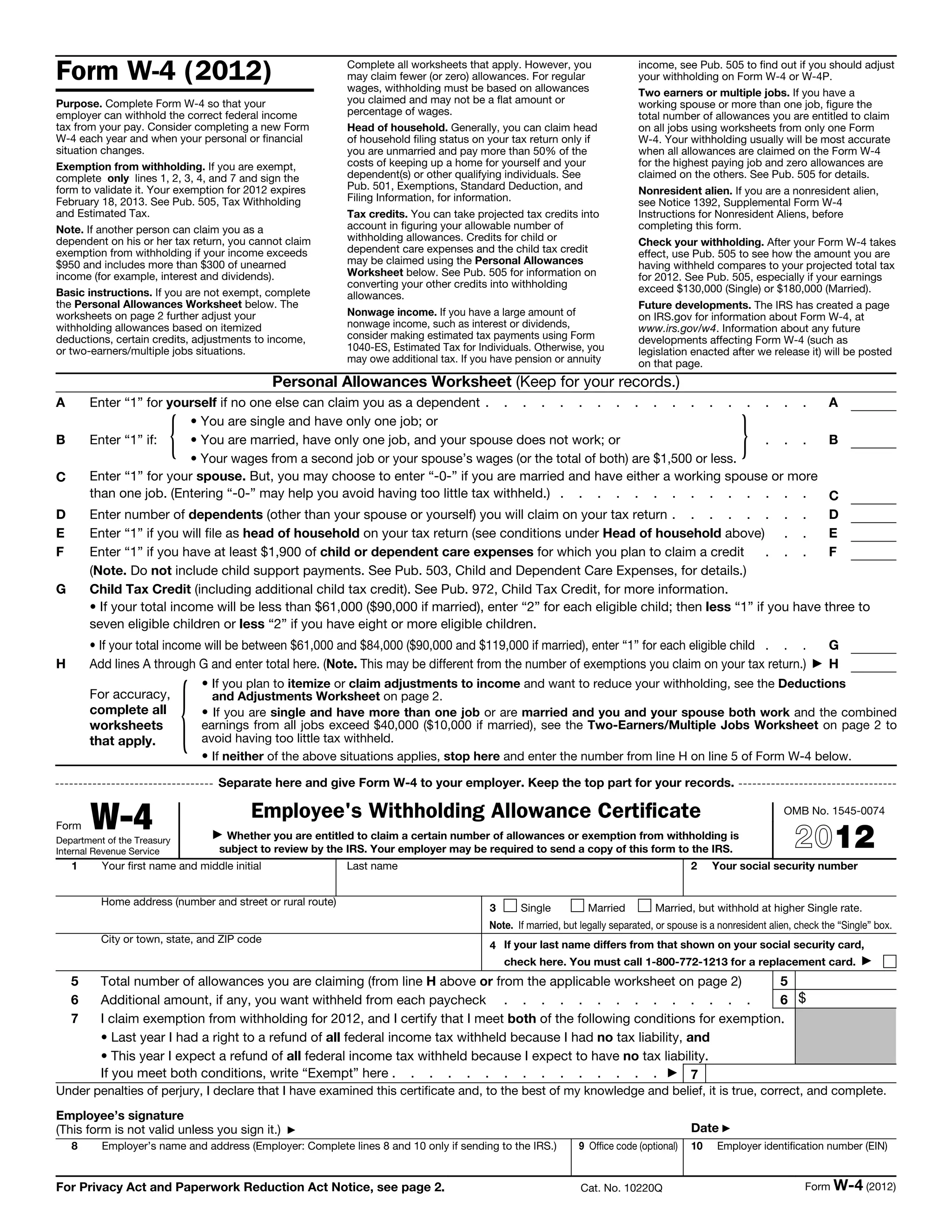

Form W-4 is used by employees to determine the appropriate number of withholding allowances to claim on their W-4. It contains worksheets to help calculate allowances based on filing status, deductions, credits, and other income. The number of allowances determines how much federal income tax is withheld from paychecks. The form and instructions provide guidance on filing requirements and withholding exemptions for various personal situations.