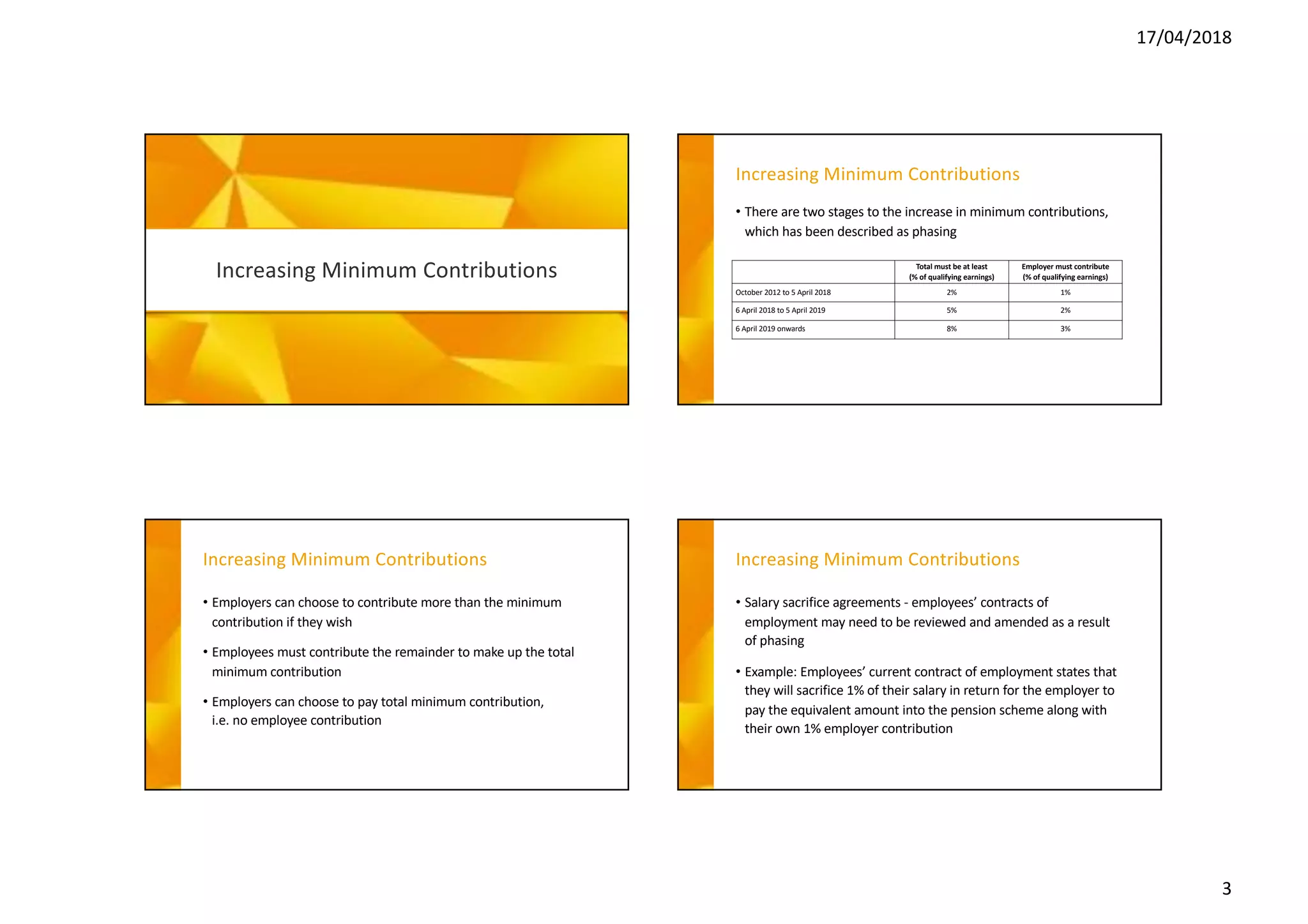

The document discusses the evolving landscape of automatic enrollment for new employers, outlining that their responsibilities begin as soon as their first employee starts work. It details the increasing minimum contribution rates for pension schemes and emphasizes the importance of integrating payroll with pension providers to streamline processes. Additionally, it covers re-enrollment procedures, compliance requirements, and highlights how Brightpay can assist in automating these tasks.