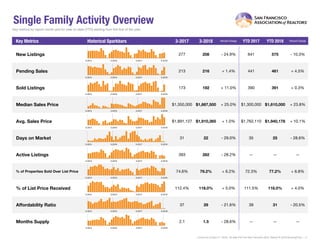

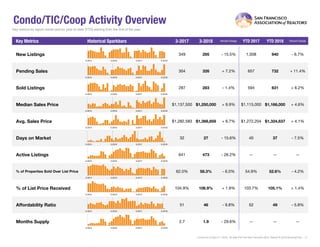

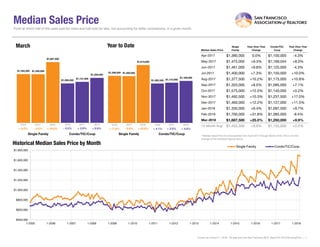

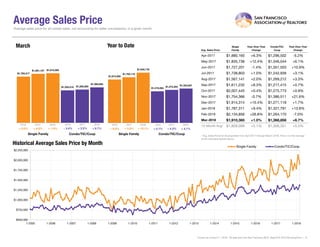

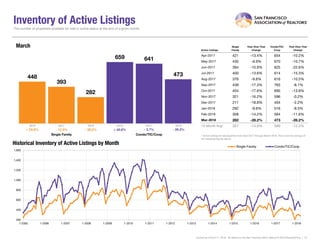

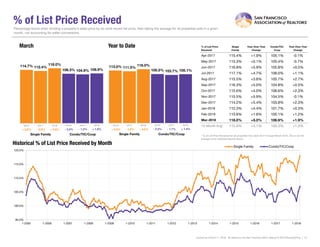

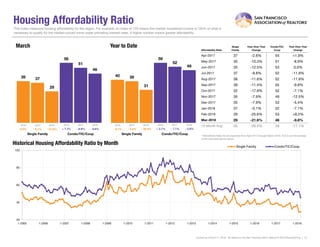

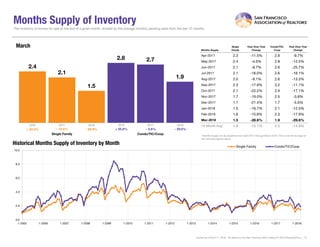

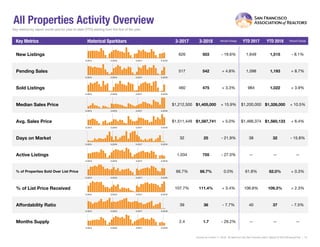

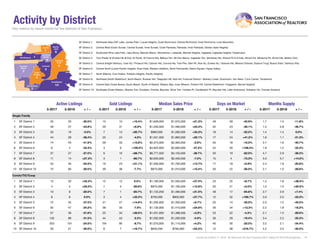

The monthly snapshot report summarizes real estate activity in San Francisco County for March 2018. Median home sale prices increased 25% year-over-year for single family homes and 10% for condos. New listings and pending sales were down compared to the previous year due to low inventory. Despite fewer homes for sale, buyer demand has kept prices rising and is expected to continue doing so.