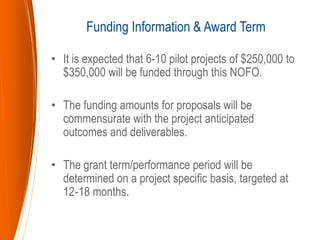

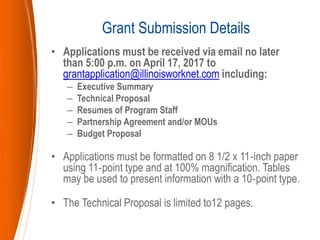

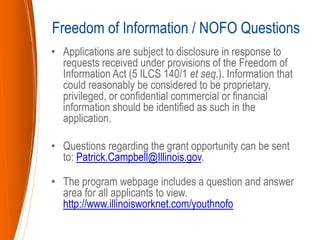

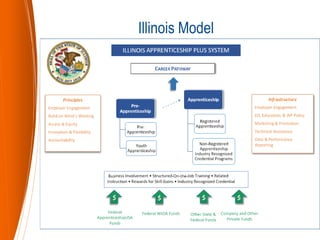

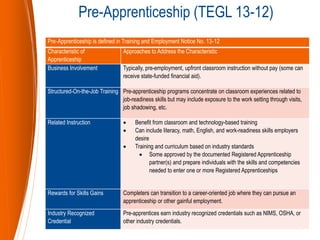

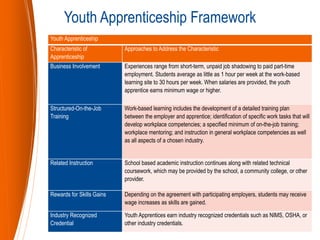

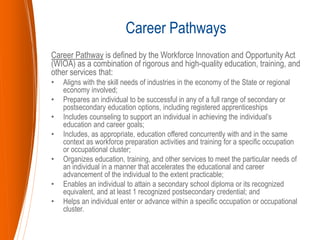

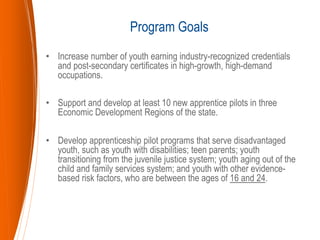

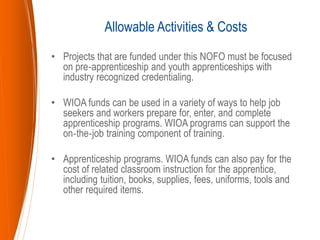

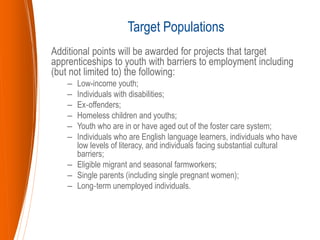

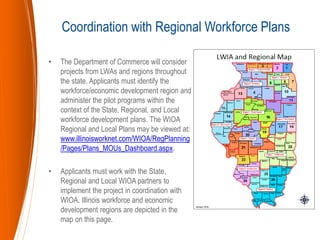

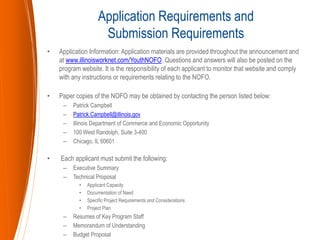

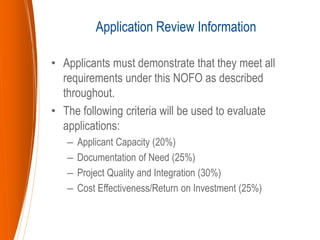

The Illinois Apprenticeship Plus Youth Program Notice of Funding Opportunity aims to support pre-apprenticeship and youth apprenticeship programs by providing funding to help youth gain industry-recognized credentials and enter career-oriented jobs. The program focuses on helping disadvantaged youth, including those with barriers to employment, across targeted regions and industries. Funding will be managed under the Workforce Innovation and Opportunity Act (WIOA), with detailed application and compliance requirements outlined for funding applicants.

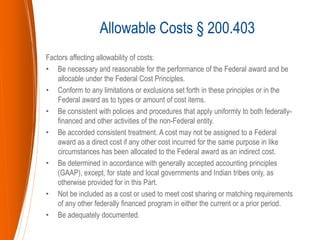

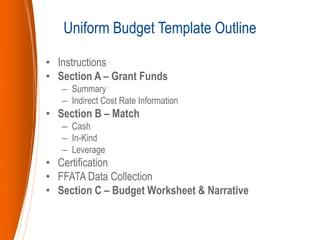

![• Uniform Budget Template for most State of Illinois

Grants (modeled after the SF-524 Federal Budget

template).

• Basic Budget Line Item Definitions based on the

Uniform Administrative Guidelines [Develop Budget

Line Items Sheet].

• General Requirements

– Allowable

– Reasonable

– Allocable

Uniform Budget Template - Overview](https://image.slidesharecdn.com/apprenticeshipplusyouth-nofoinfosession2-21-17final-170221204811/85/2017-Apprenticeship-Plus-Youth-Program-Grant-Application-Information-Session-27-320.jpg)