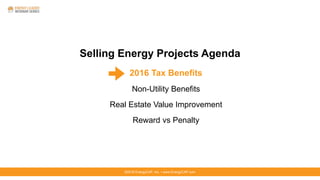

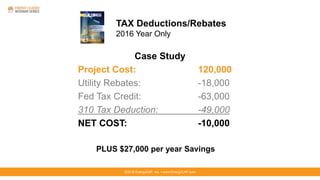

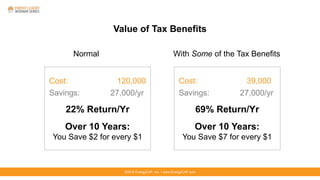

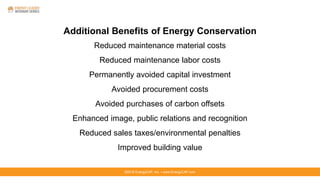

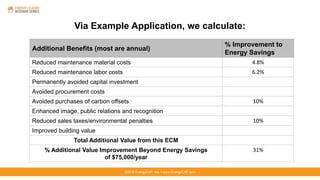

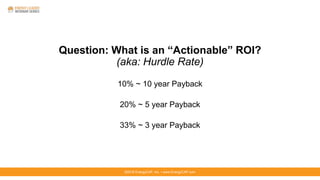

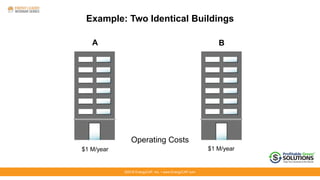

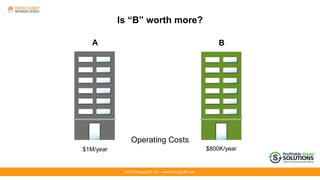

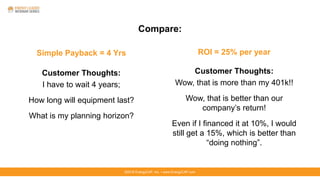

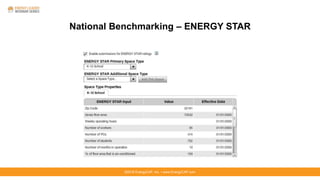

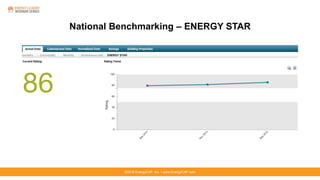

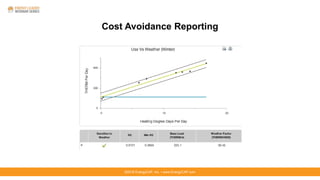

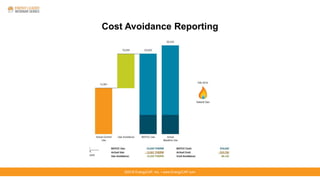

The document provides insights on selling energy projects, emphasizing the significance of tax benefits, non-utility advantages, and real estate value improvements. It highlights the financial impacts of energy savings, including case studies showing significant return on investment and additional benefits from energy conservation. Additionally, it discusses strategies for presenting projects to decision-makers, using utility bill data for benchmarking and verification of project success.