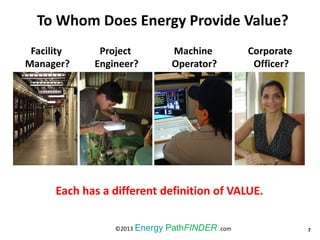

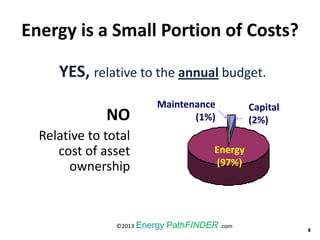

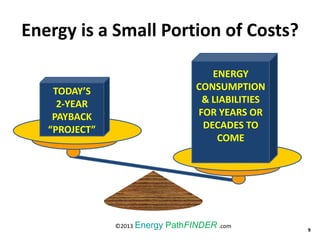

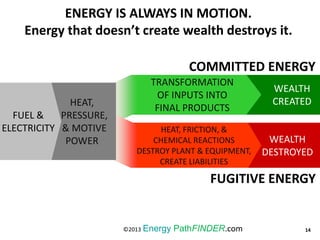

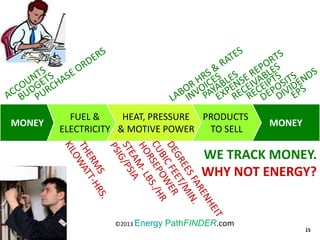

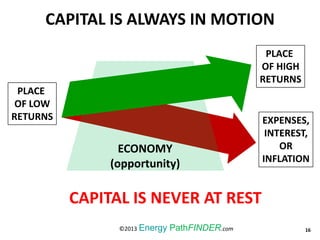

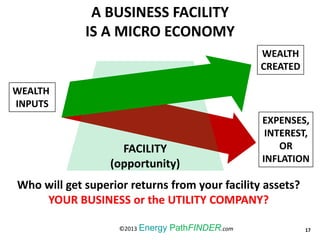

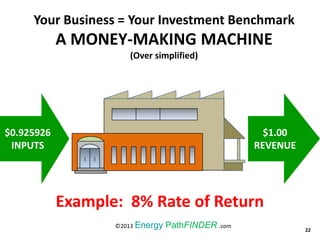

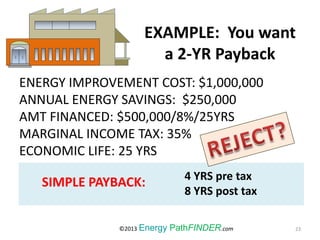

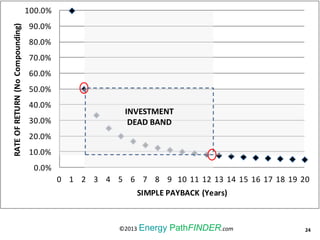

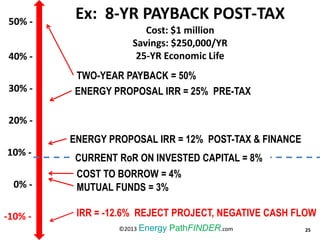

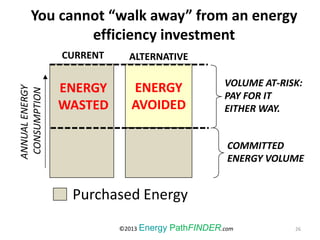

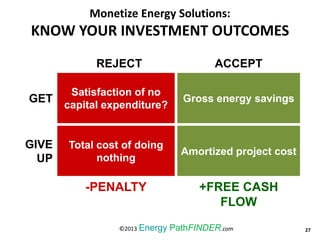

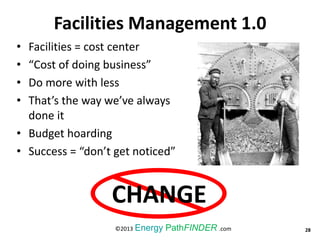

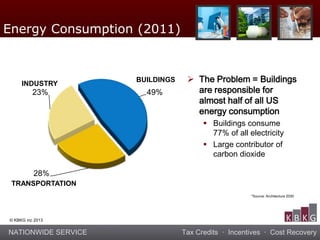

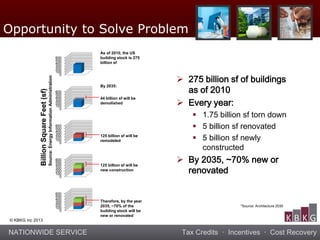

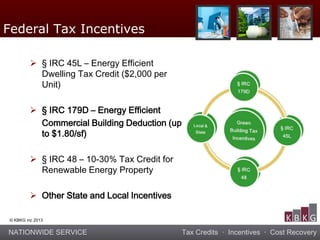

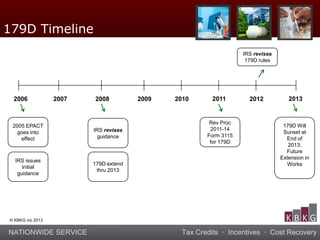

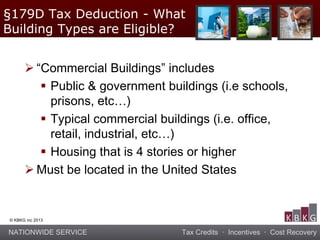

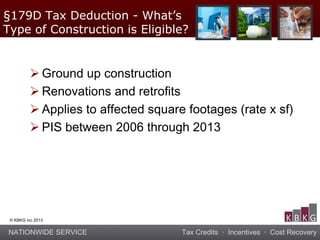

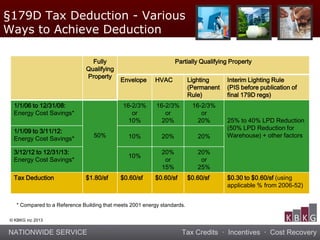

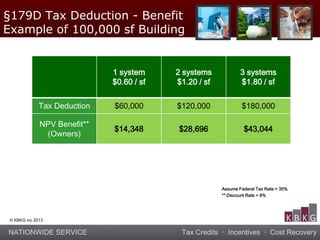

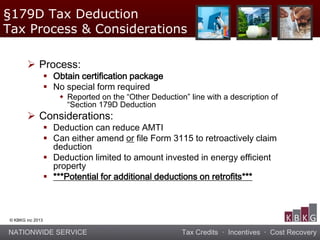

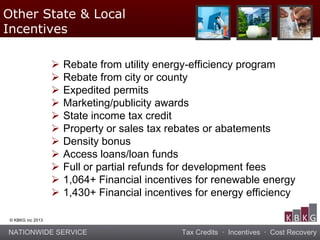

The document details a seminar focused on maximizing energy efficiency in business operations, featuring presentations on monetizing energy solutions, tax incentives, and the financial implications of energy costs. Key topics included understanding energy as a cost factor and strategies for leveraging efficiency in facilities management to create cash flow and enhance business performance. Additionally, it covered various tax credits and deductions available for energy-efficient buildings under IRC guidelines, especially the §179D deduction for commercial properties.