The document is a survey report from Willis that summarizes the results of their 2015 Benefits Benchmarking Survey. Some key findings include:

- PPO/POS plans are offered by 87% of employers and are the most prevalent plan type. HSA-eligible CDHPs are the second most offered at 47%.

- On average, employers offer 3 or fewer medical plan options. The majority (85%) of employers offer 3 plans or fewer.

- Regionally, HMO/EPO plans are significantly more prevalent in the West, offered by 51% of employers in that region compared to 13-42% elsewhere.

![392015 Willis Benefits Benchmarking Survey

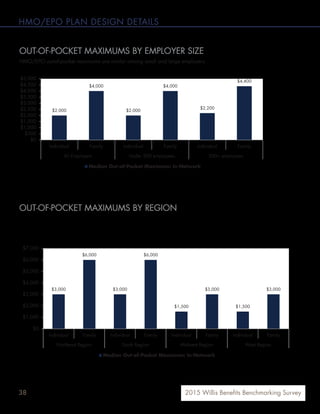

HMO/EPO PLAN DESIGN DETAILS

PHYSICIAN OFFICE VISIT COVERAGE

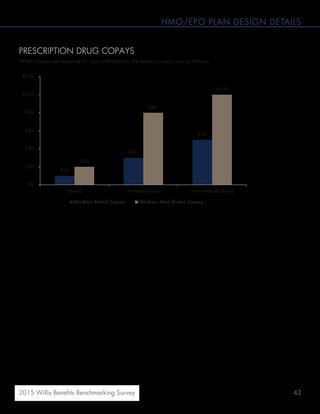

OFFICE VISIT COPAY

Across all employers, the median physician office visit copay is $20, and the median specialist visit is $30. The West

region has the lowest copays for both physician and specialist office visits.

95%

3%2%

Physician visit copay required (% of plans)

Coinsurance and deductibles apply for all

office visits

Office visits are covered by the plan (there

is no employee cost-sharing for this

coverage)

$20

$25

$20 $20

$40

$35

$25

$20

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

Northeast Region South Region Midwest Region West Region

Median Office Visit Copay Median Specialist Visit Copay

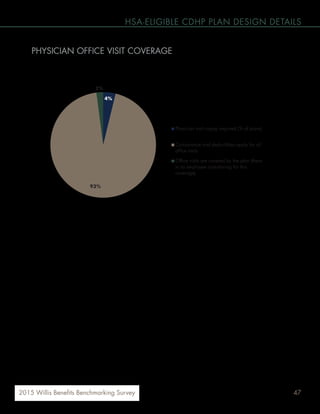

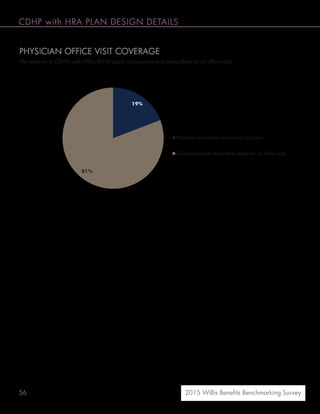

PHYSICIAN OFFICE VISIT COVERAGE

OFFICE VISIT COPAYS BY REGION

Across all employers, the median physician office visit copay is $20, and the median specialist visit is $30. The West

region has the lowest copays for both physician and specialist office visits.

[VALUE]

3%2%

Physician Visit Copay Required (% of plans)

Coinsurance and deductibles apply for all

office visits

Office visits are covered by the plan (there is

no employee cost-sharing for this coverage)

$20 $20

$25

$20 20

$30

$40

$35

$25

$20

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

$50

All Employers Northeast Region South Region Midwest Region West Region

Median Office Visit Copay Median Specialist Visit Copay

The majority of HMO/EPO plans (95%) require a copay for physician office visits.](https://image.slidesharecdn.com/2015willisbenefitsbenchmarkingsurveyreport-160104150854/85/2015-Willis-Benefits-Benchmarking-Survey-Report-39-320.jpg)