- Consumer driven health plans (CDHPs) can save employers 20-40% on premium contributions and lower long term costs through reduced trend and utilization. Employees also benefit by becoming healthier consumers of healthcare.

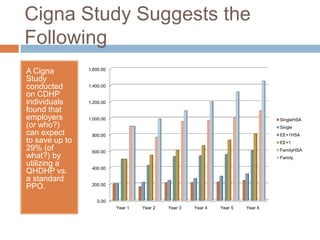

- A study found CDHPs can save employers up to 29% compared to standard PPOs due to decreased over-utilization, increased preventative care, and participation in wellness programs.

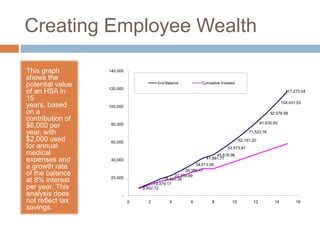

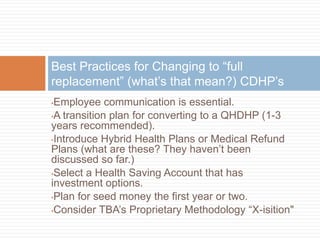

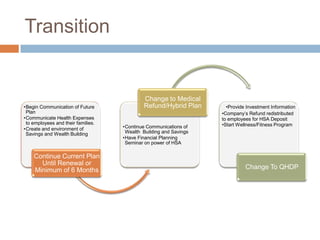

- CDHPs empower employees through health savings accounts that allow tax-free savings for current and future medical costs while also building wealth over time. However, a gradual transition plan is needed and lower-paid employees may not contribute.