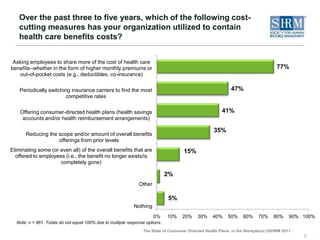

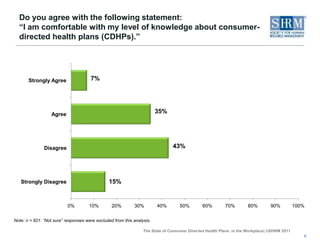

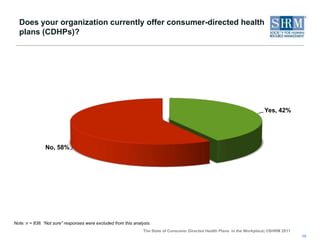

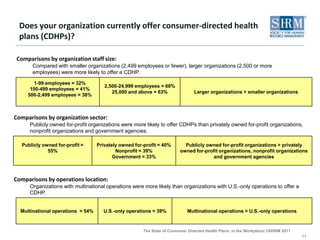

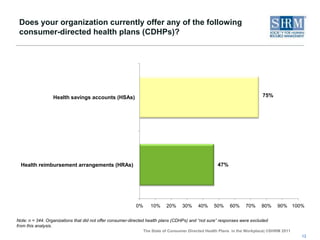

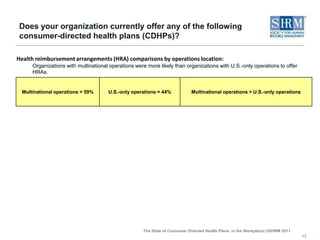

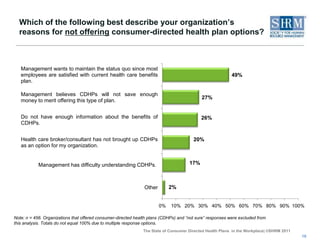

This document summarizes the findings of a SHRM poll on consumer-directed health plans (CDHPs) in the workplace. Key findings include that 42% of organizations offered CDHPs, with large organizations and those with multinational operations being more likely. While 42% of HR professionals felt comfortable with their CDHP knowledge, only 34% at organizations without CDHPs felt this way. Common barriers to offering CDHPs were maintaining the status quo and believing they would not save enough money.