Embed presentation

Download to read offline

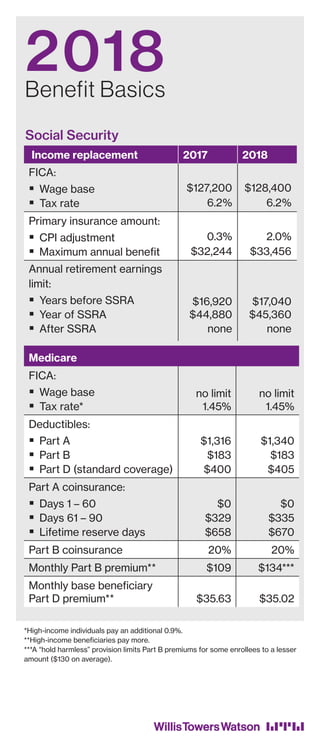

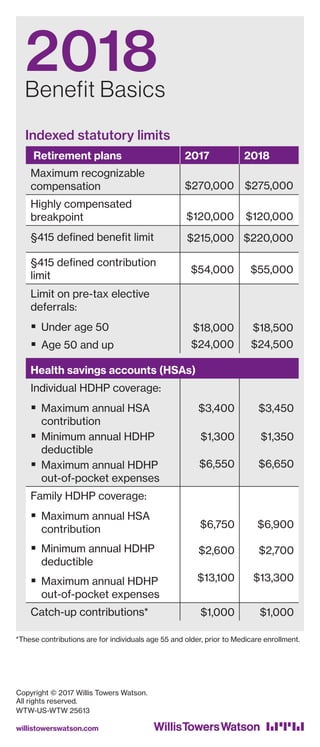

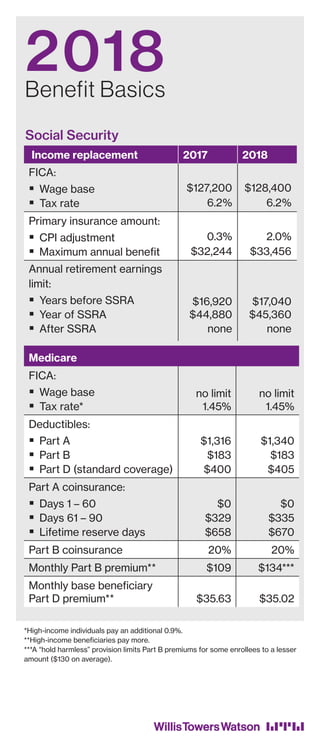

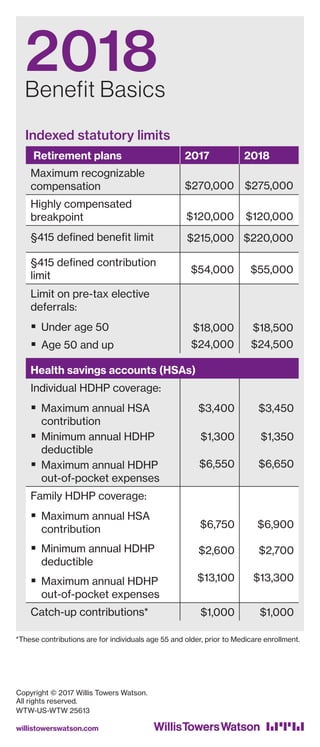

This document summarizes key Social Security, Medicare, and retirement plan limits for 2017 and 2018. For Social Security, the wage base and maximum annual benefit increased slightly, as did annual retirement earnings limits. For Medicare, premiums and deductibles increased modestly. For retirement plans, the compensation limit and contribution limits increased, with the defined benefit plan limit rising to $220,000. Health savings account contribution and deductible/out-of-pocket expense limits also increased for individual and family coverage.