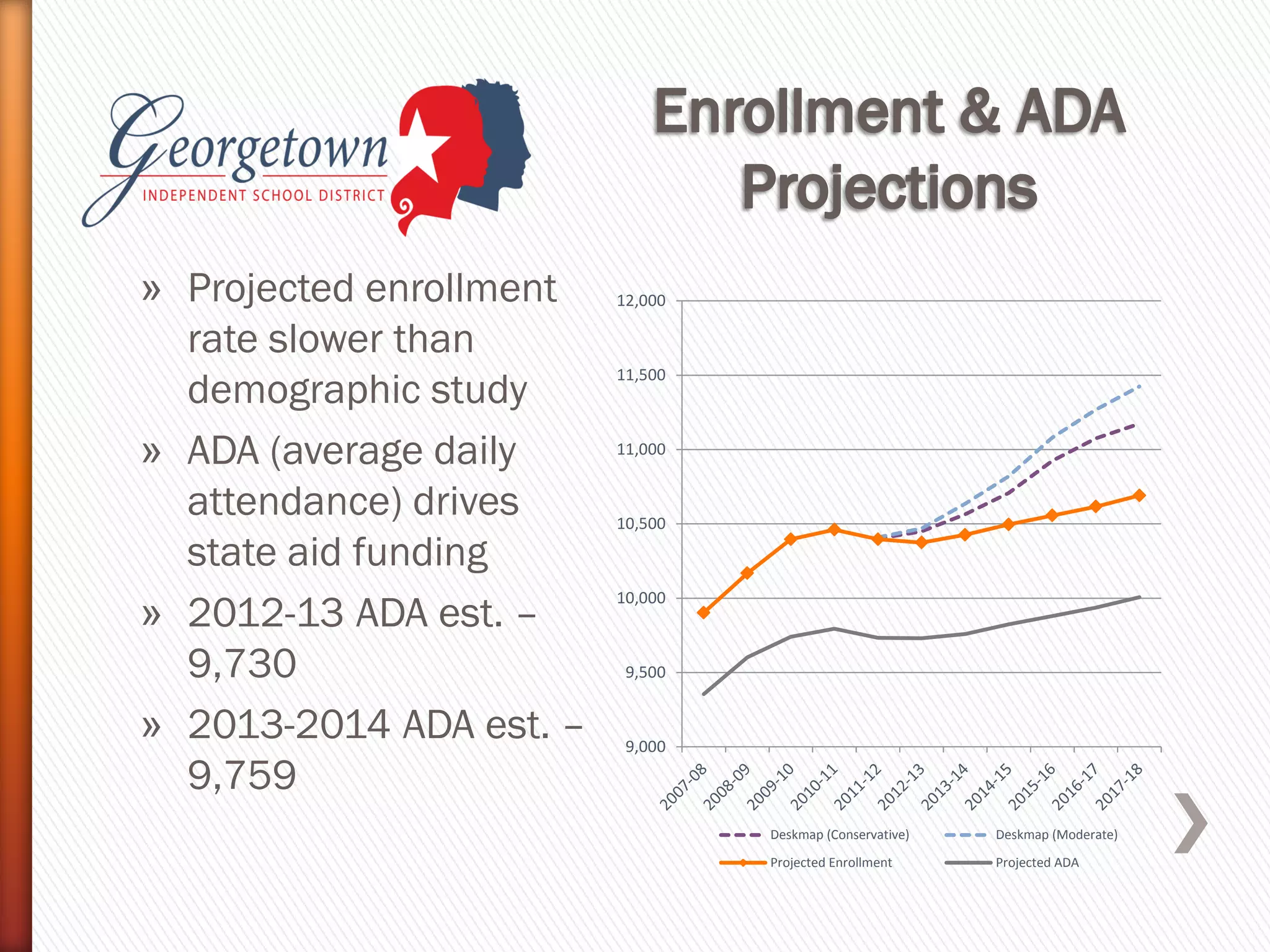

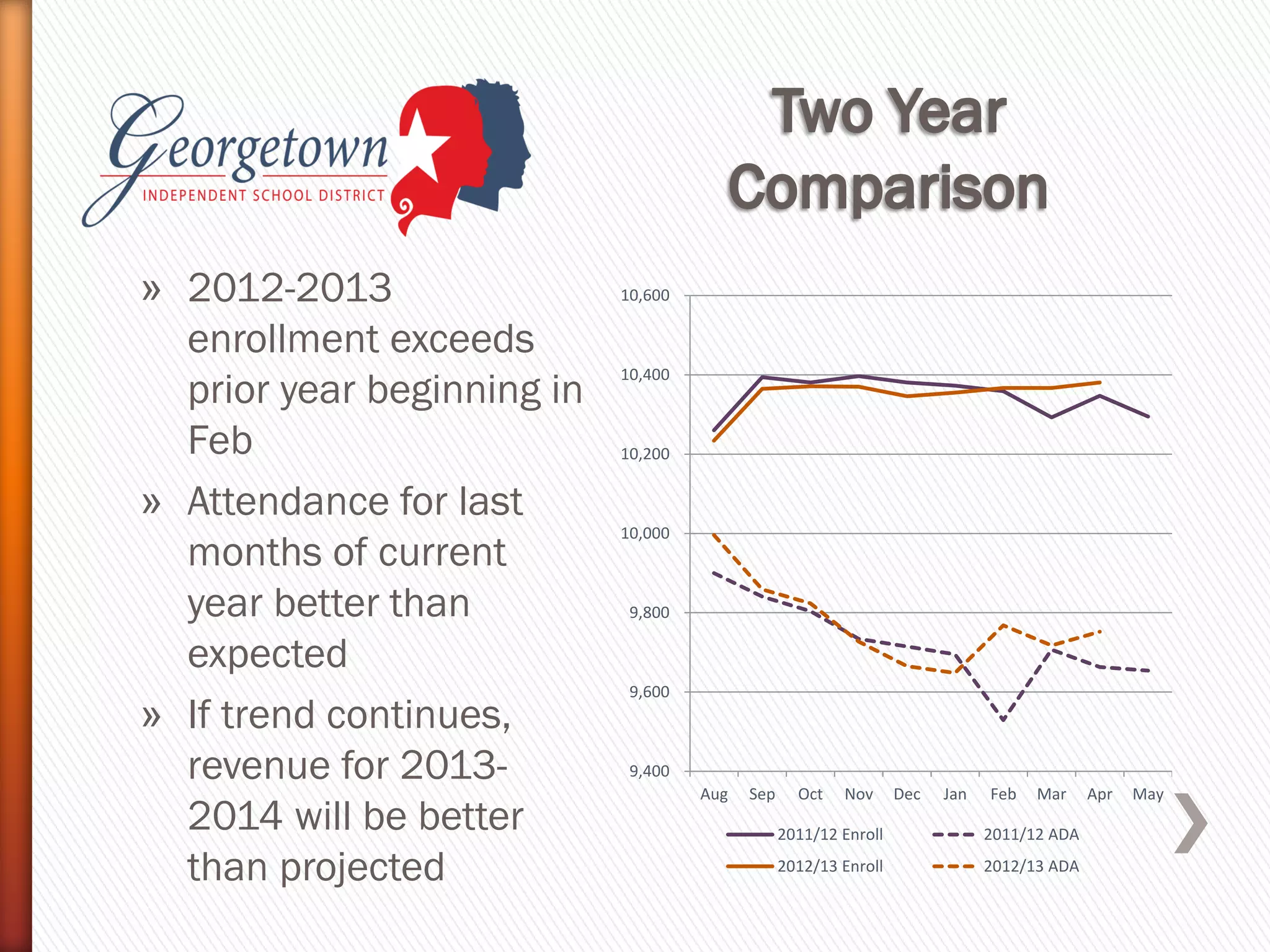

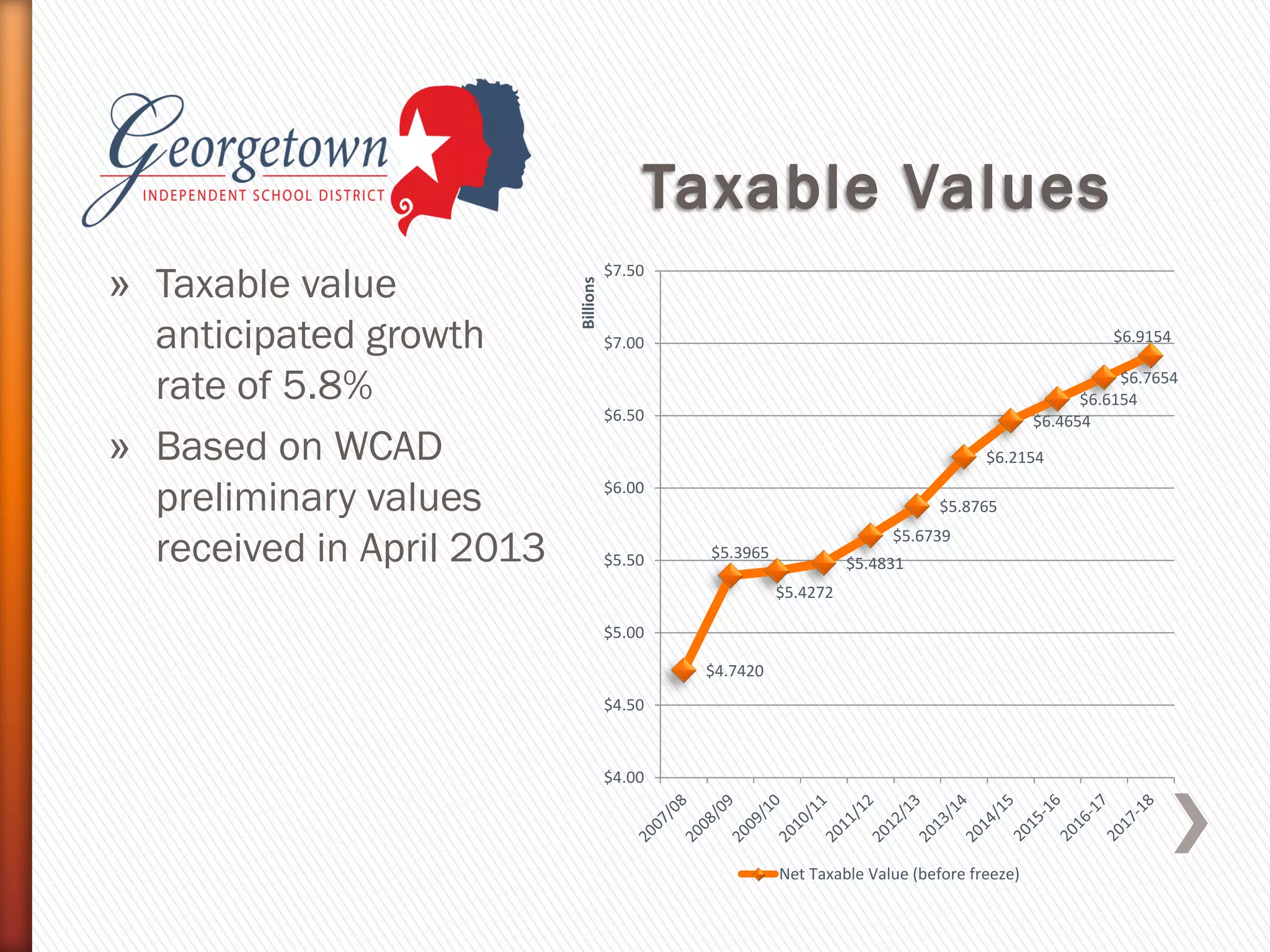

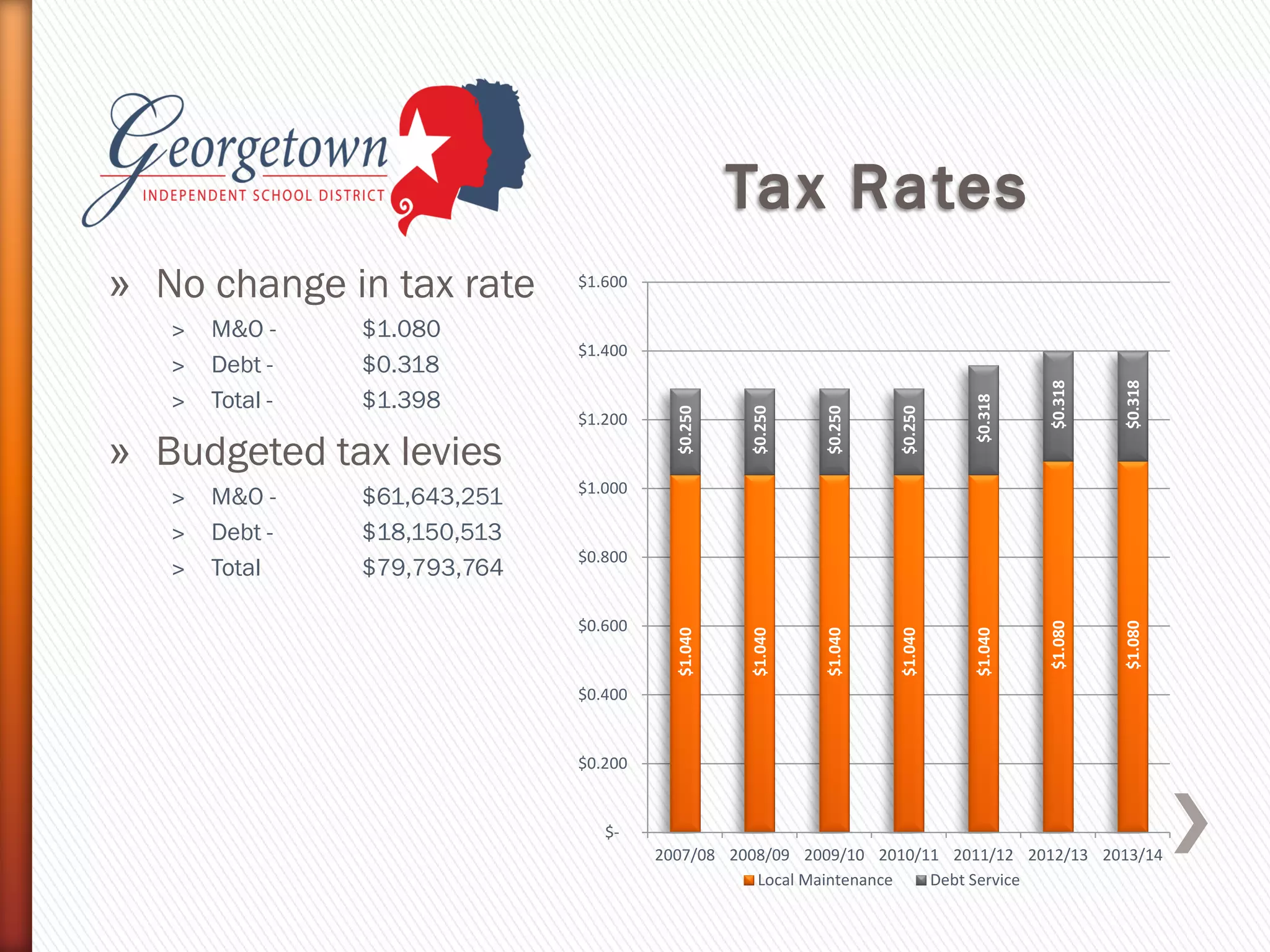

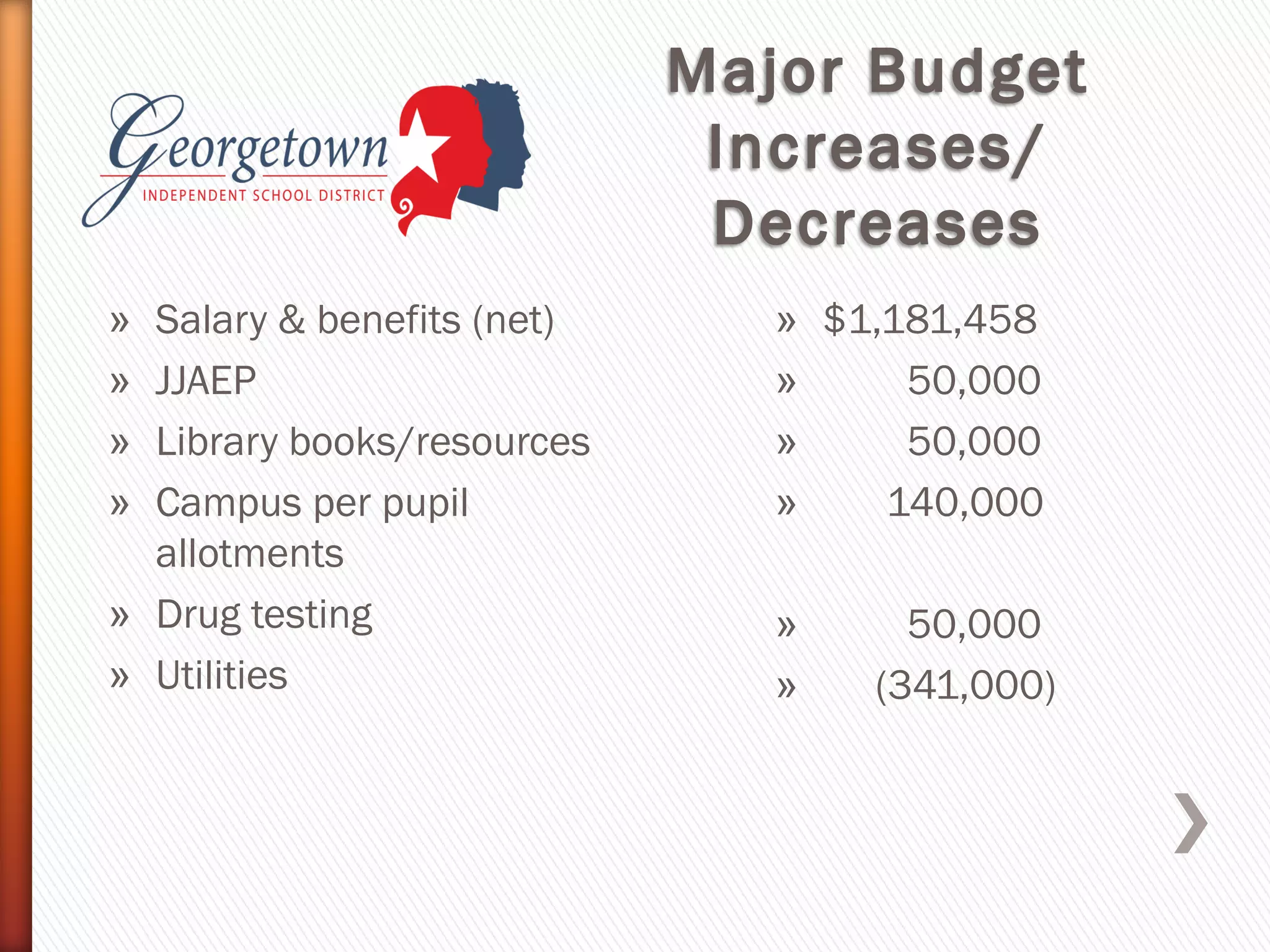

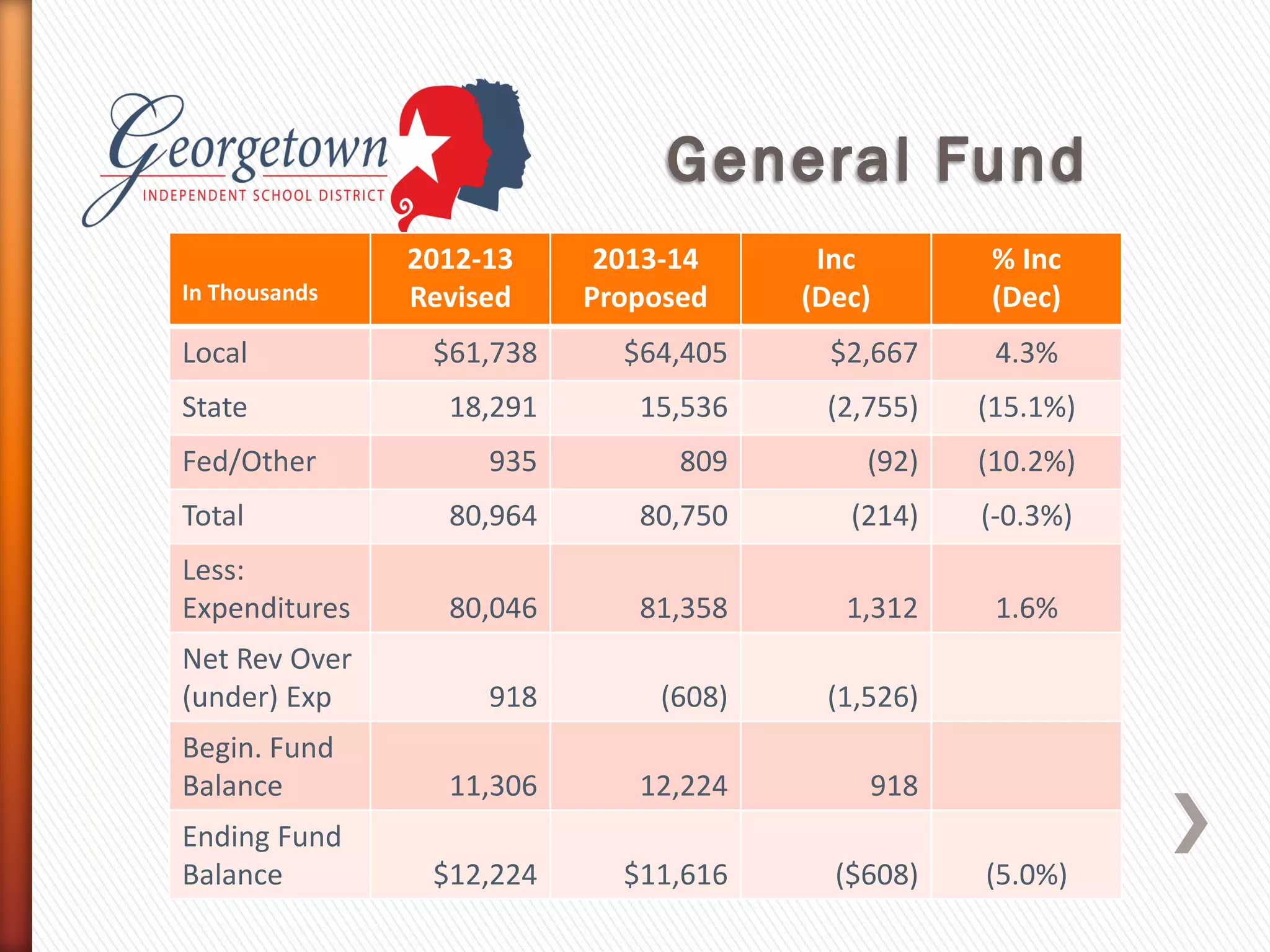

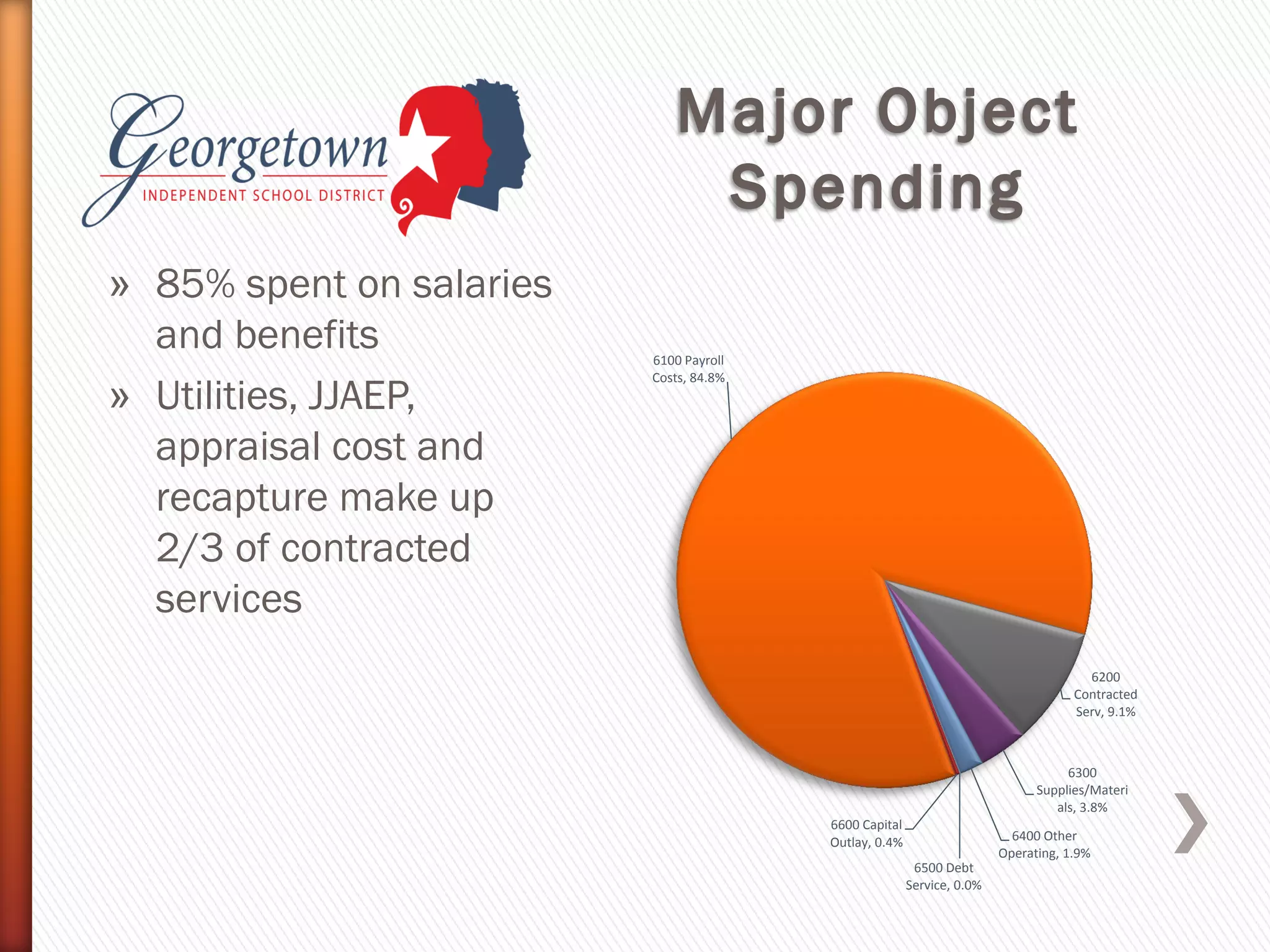

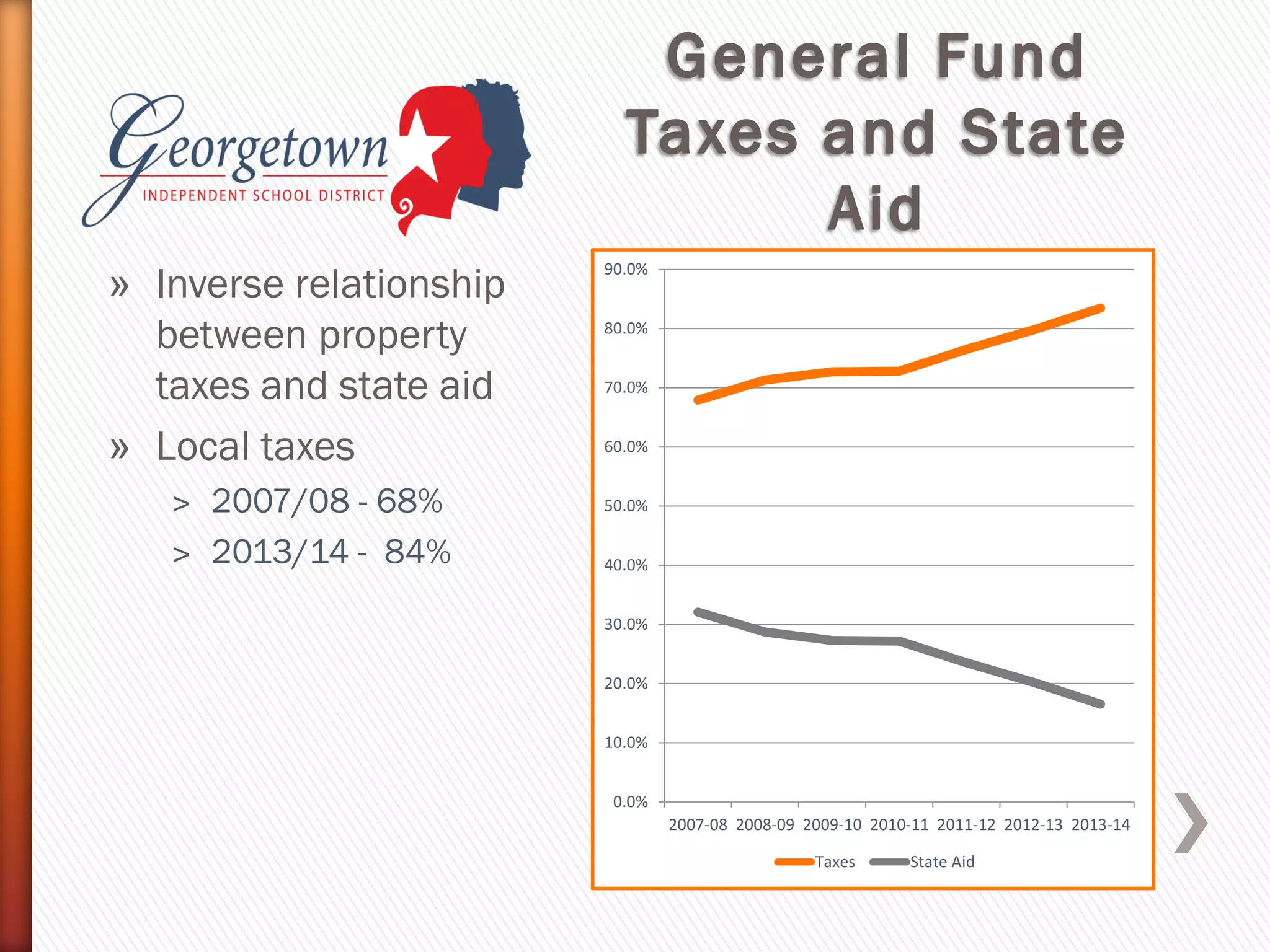

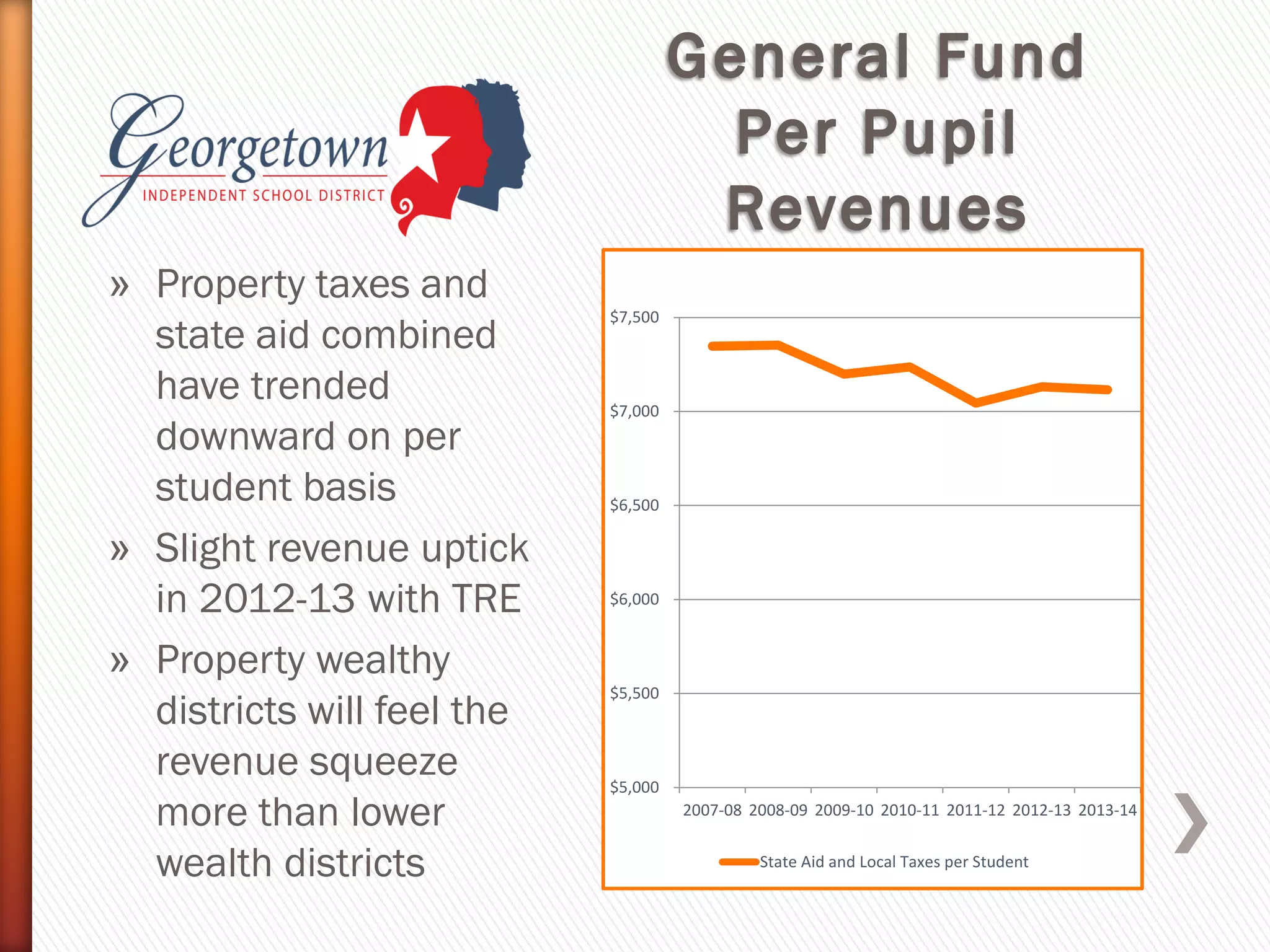

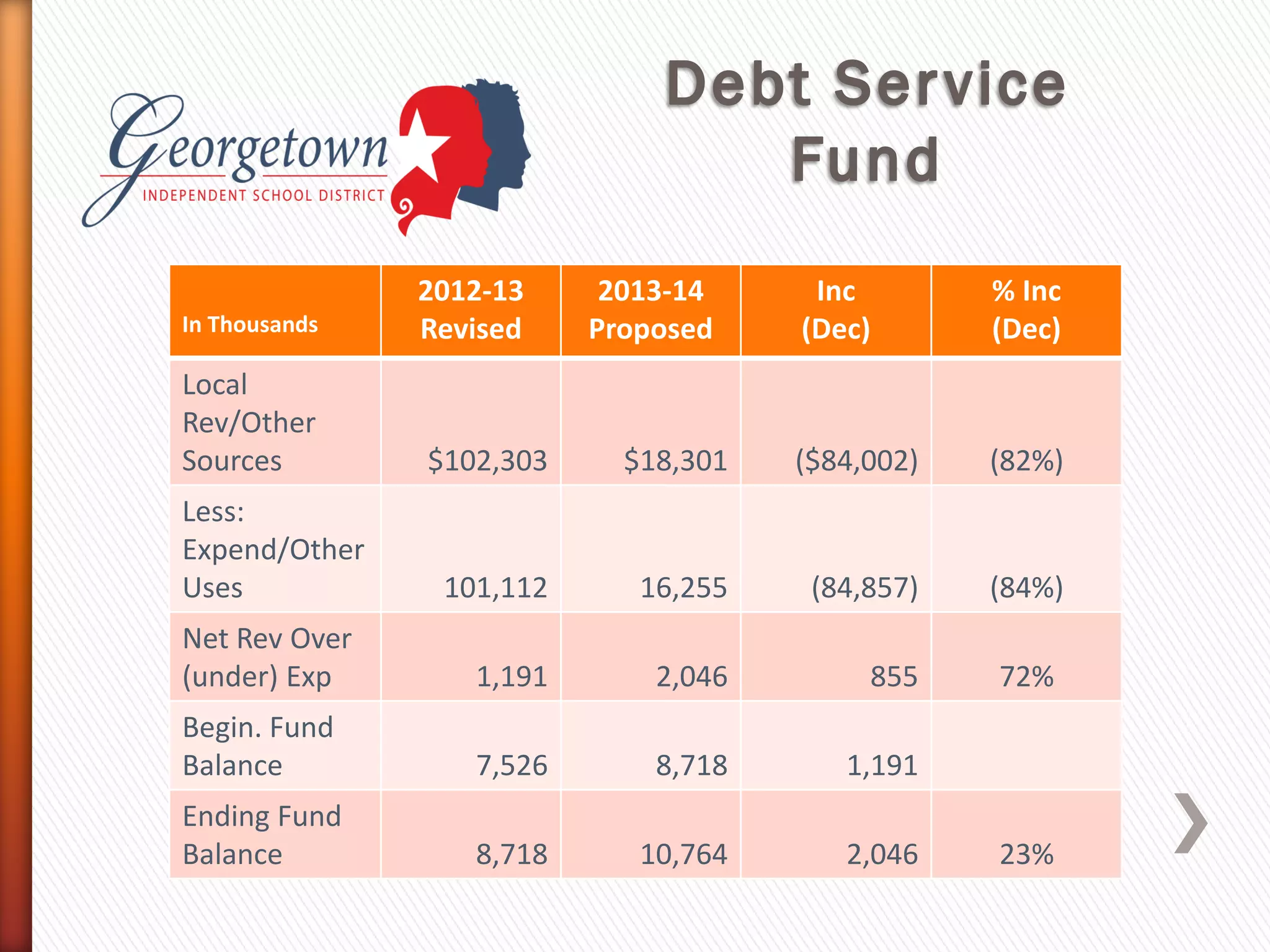

This document summarizes the financial status of a school district. It reports a projected budget deficit of $608,000 for the current year. Revenues are projected to be stable due to growth in taxable property values. Expenditures are also projected to increase modestly due to increases in salaries, utilities, and campus funding. The district relies heavily on local property taxes for funding, which cover 84% of the budget and are inversely related to state funding amounts.