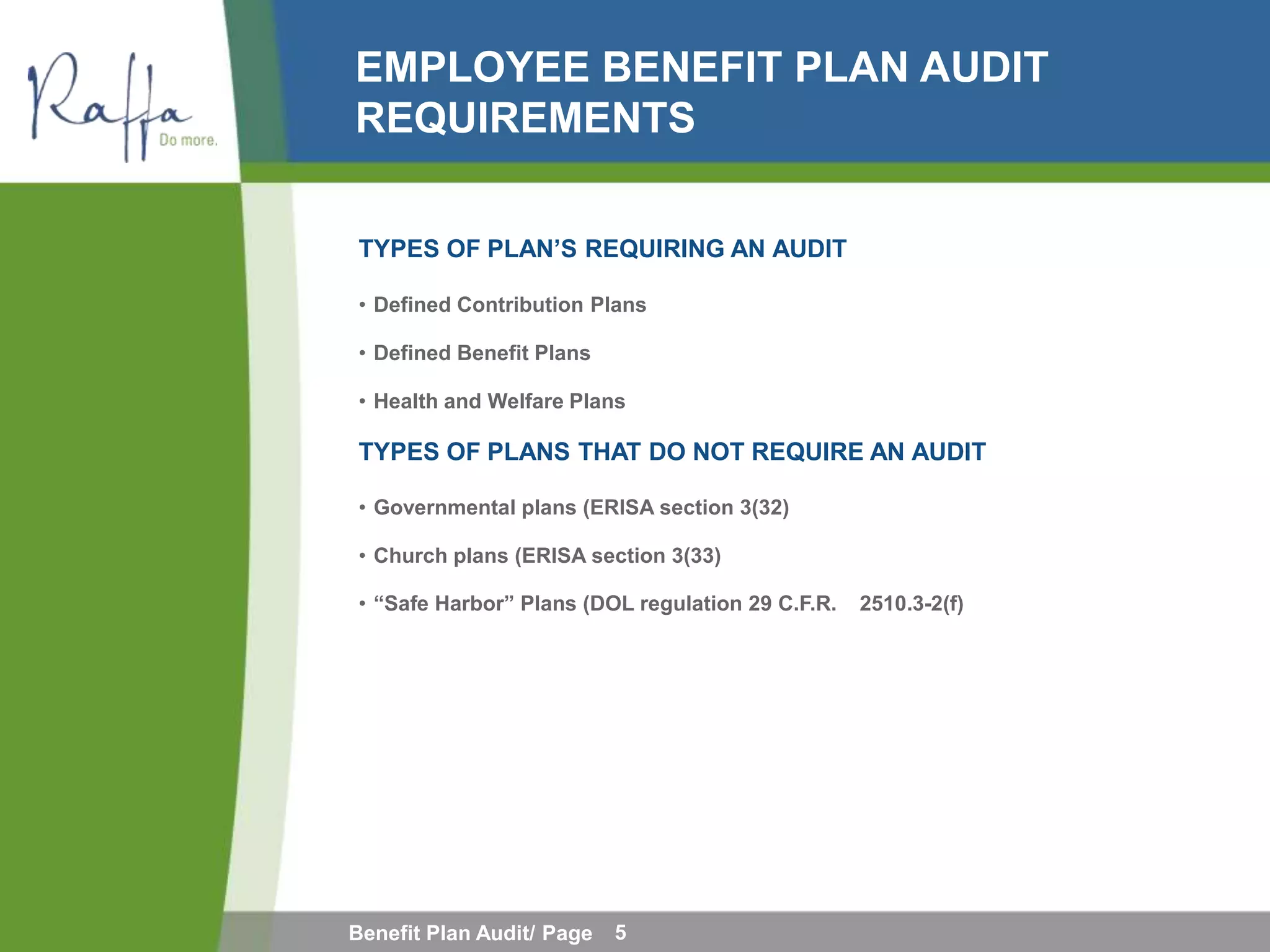

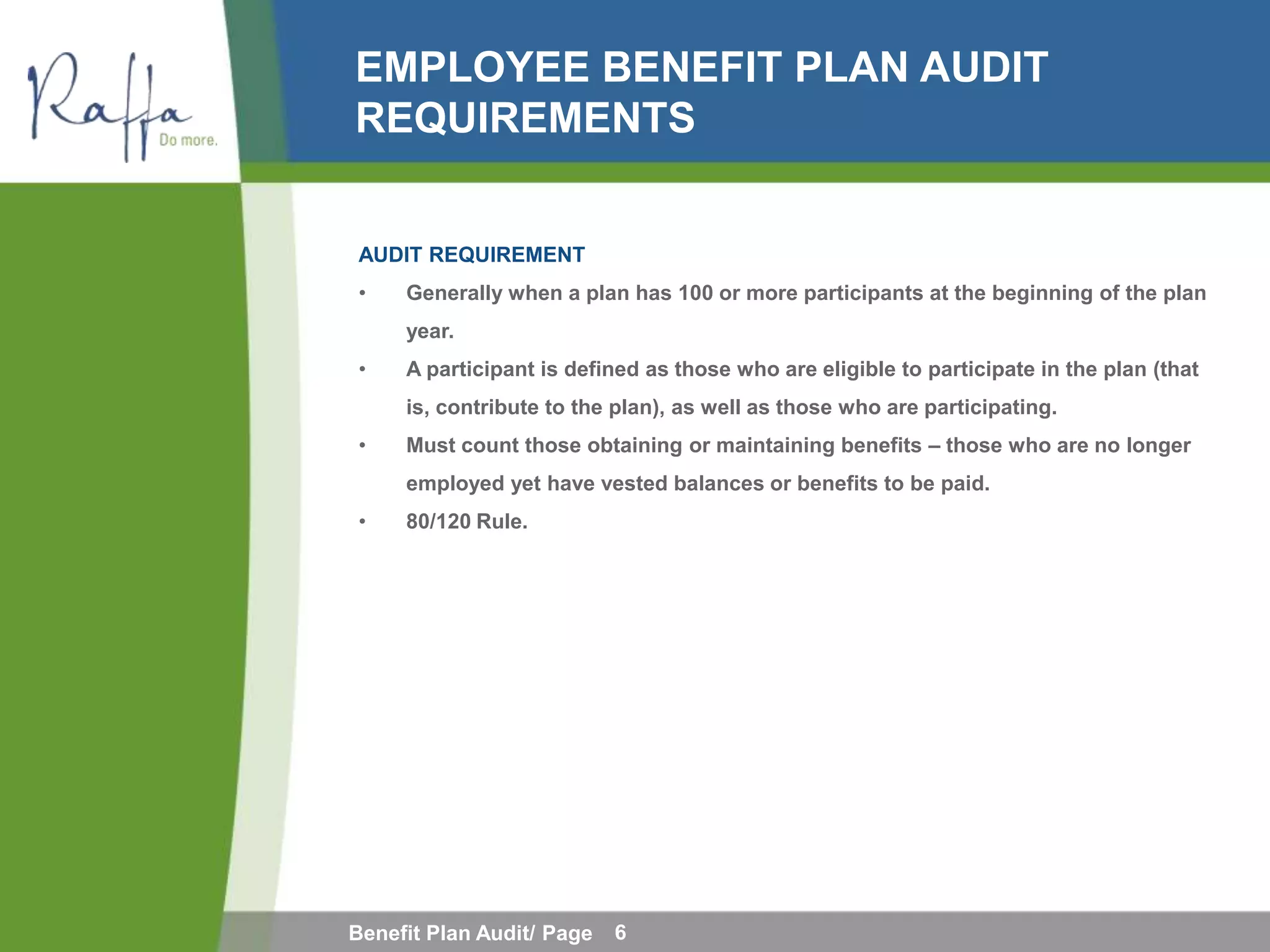

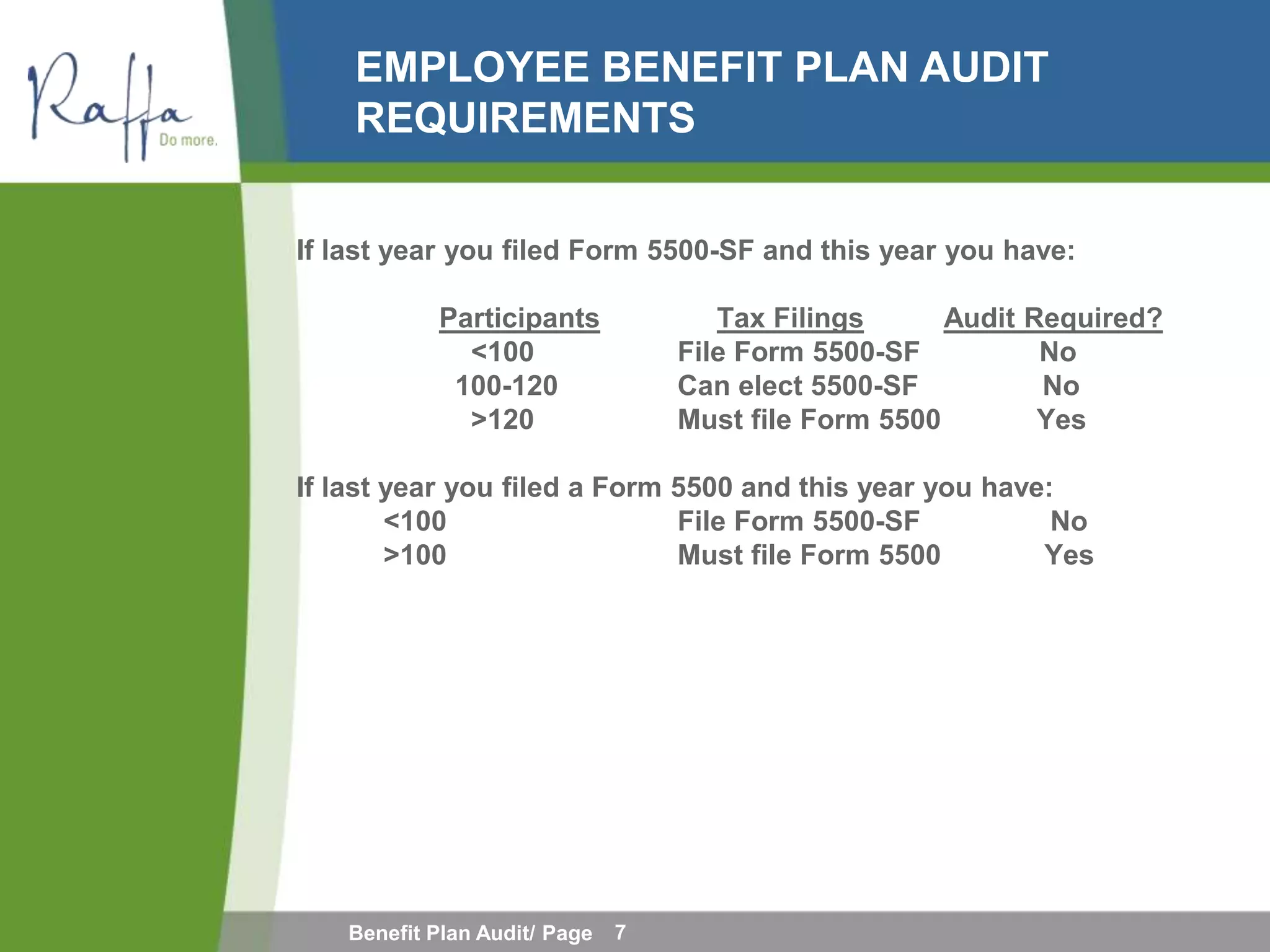

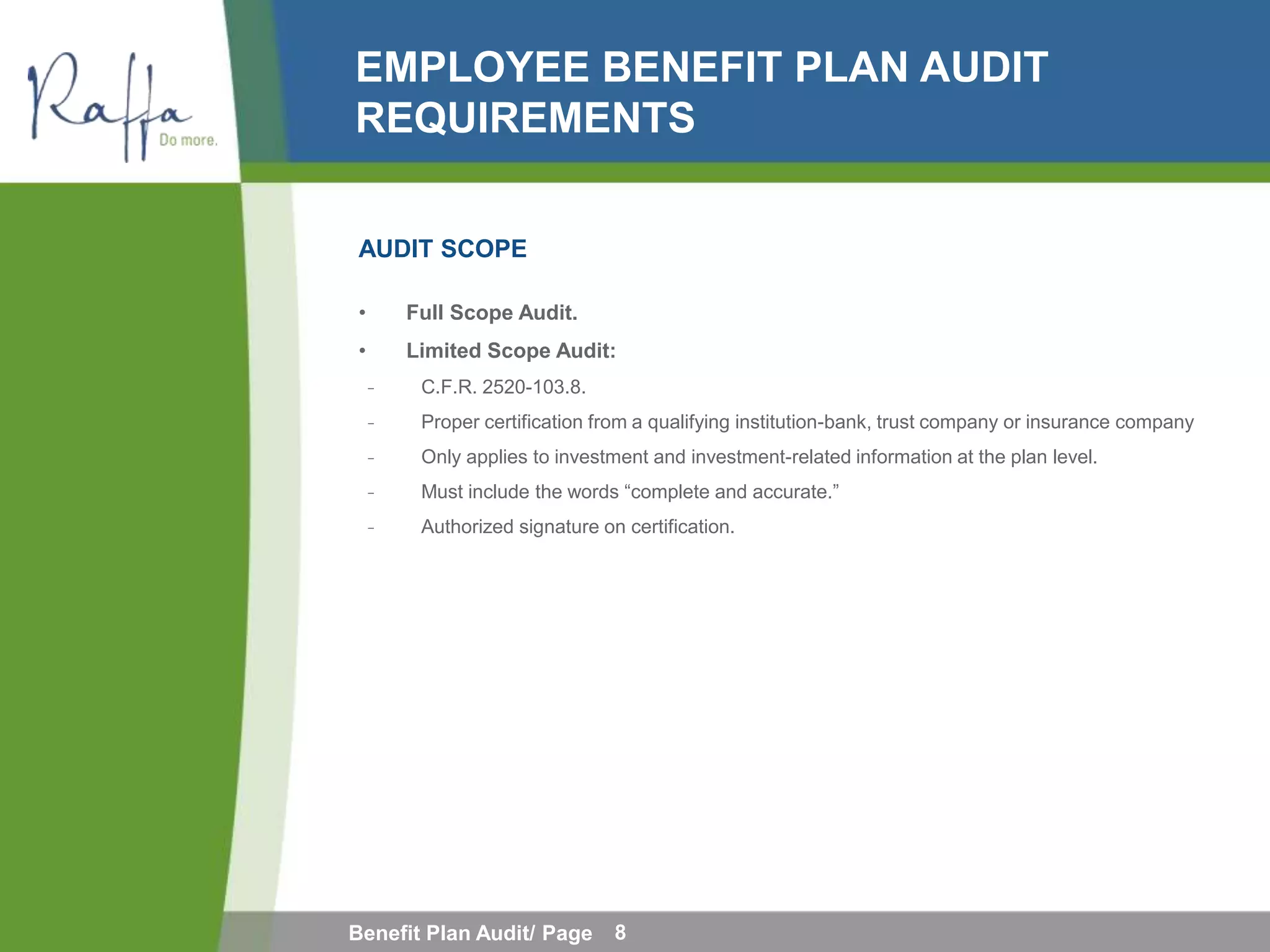

This document provides an overview of preparing for an employee benefit plan audit. It discusses who the key players are in a benefit plan audit, including the sponsor, participants, trustee, plan administrator, custodian and service providers. It outlines the audit requirements for different types of benefit plans and discusses topics like understanding the auditor's responsibilities, internal controls, common audit findings and working with the auditor. The overall goal is to help plan administrators better understand the audit process and make the audit more efficient.