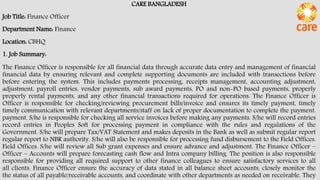

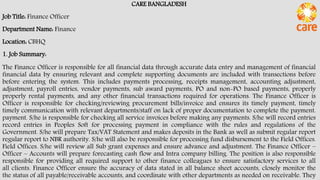

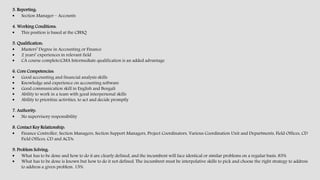

The job description is for a Finance Officer position at CARE Bangladesh. The Finance Officer will be responsible for managing financial data entry and ensuring all transactions have proper documentation. Key responsibilities include processing payments, managing receipts, payroll entries, and submitting regular reports to the National Board of Revenue. The position requires a Master's degree in accounting or finance, 2 years of relevant experience, and skills in accounting, financial analysis, and English and Bengali communication.