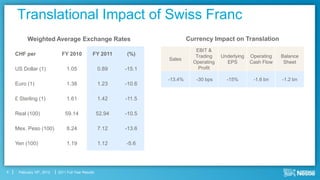

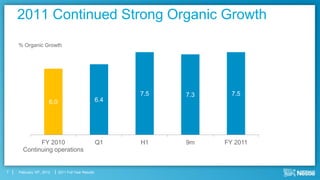

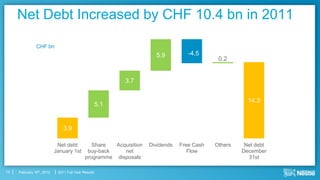

The document summarizes Nestle's 2011 full year results. Key points include:

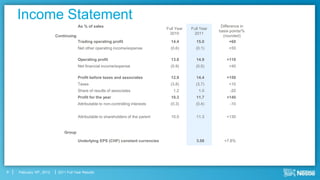

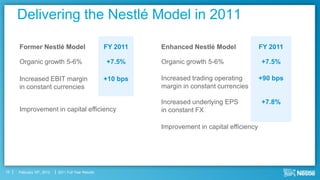

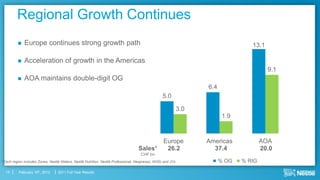

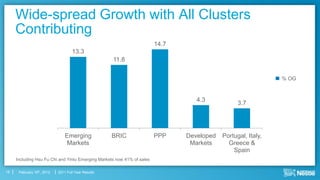

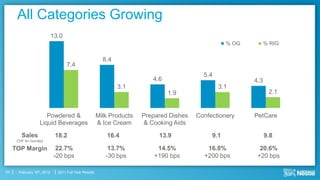

- Sales grew 7.5% organically to CHF 83.6 billion.

- Trading operating profit margin increased 60 basis points to 15%.

- Underlying earnings per share grew 7.8% in constant currencies.

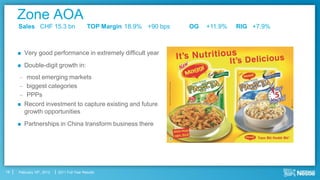

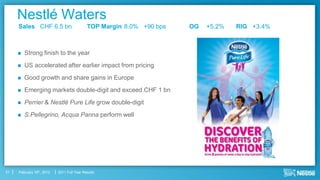

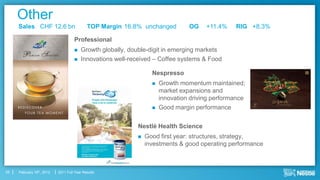

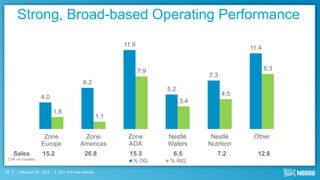

- All regions and most categories delivered growth, with emerging markets performing strongly.