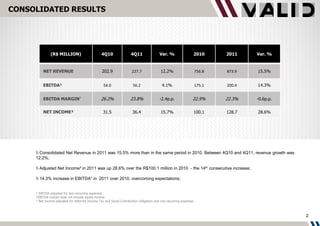

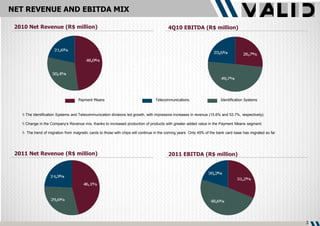

1) Consolidated net revenue grew 15.5% in 2011 over 2010, led by strong increases in the Identification Systems and Telecommunications divisions.

2) Adjusted net income increased 28.6% in 2011 to R$128.7 million, marking the 14th consecutive year of growth.

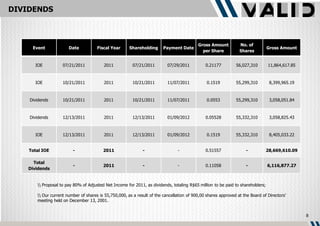

3) The company proposed paying 80% of adjusted net income for 2011 in dividends, totaling R$65 million to shareholders.