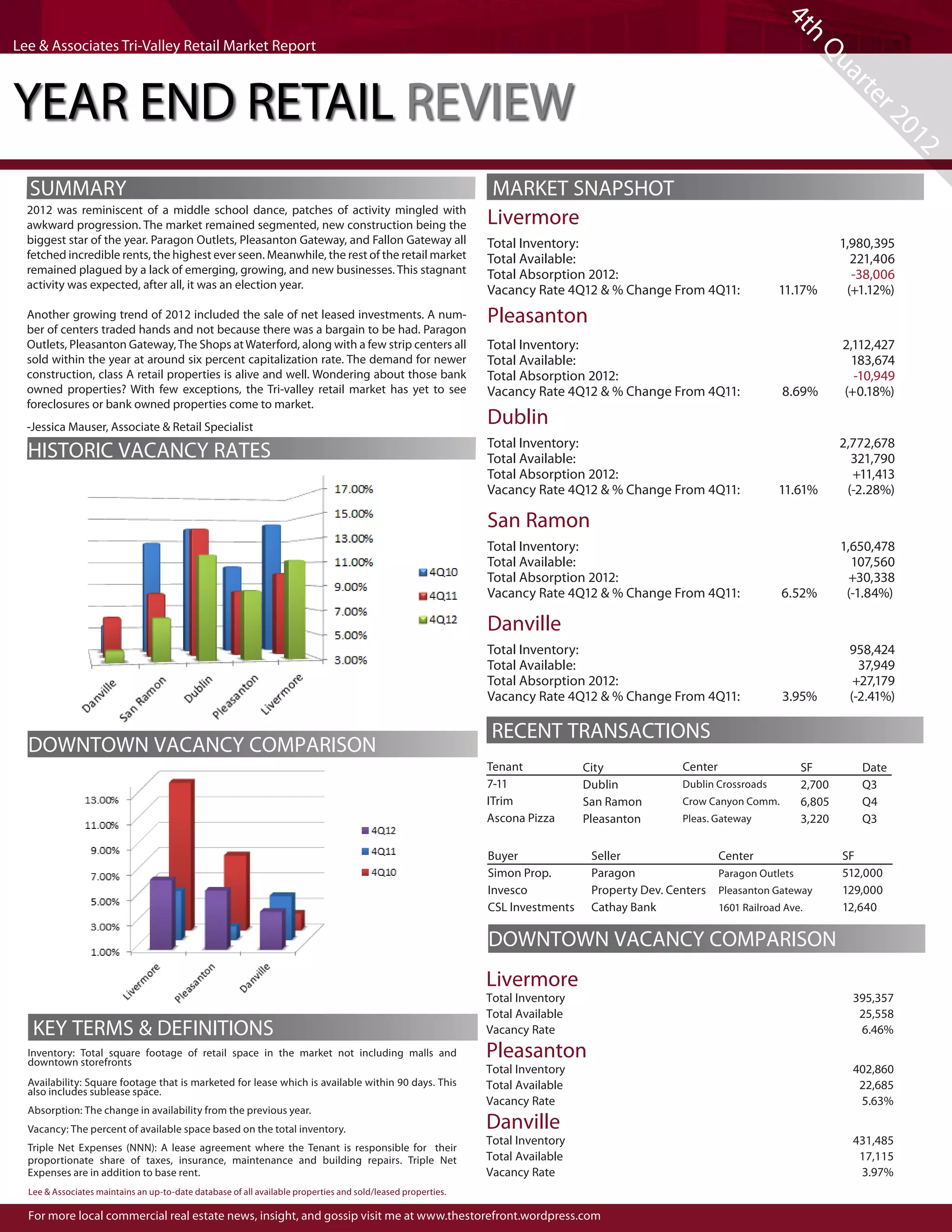

2012 saw a segmented Tri-Valley retail market, with new construction projects like Paragon Outlets, Pleasanton Gateway, and Fallon Gateway achieving high rents, but much of the market remaining stagnant. Vacancy rates increased slightly overall. Demand remained strong for newer class A retail properties, as seen in the sales of several centers. Downtown vacancy rates remained lower than other areas of the market.