3rd Quarter Retail Report Livermore

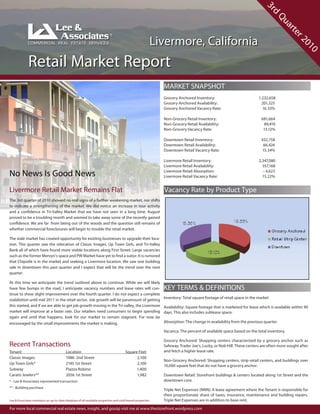

- 1. 3r d Qu ar te Livermore, California r2 01 0 Retail Market Report MARKET SNAPSHOT Grocery Anchored Inventory: 1,232,658 Grocery Anchored Availability: 201,325 Grocery Anchored Vacancy Rate: 16.33% Non-Grocery Retail Inventory: 681,664 Non-Grocery Retail Availability: 89,419 Non-Grocery Vacancy Rate: 13.12% Downtown Retail Inventory: 432,758 Downtown Retail Availability: 66,424 Downtown Retail Vacancy Rate: 15.34% Livermore Retail Inventory: 2,347,080 Livermore Retail Availability: 357,168 No News Is Good News Livermore Retail Absorption: Livermore Retail Vacancy Rate: - 4,623 15.22% Livermore Retail Market Remains Flat Vacancy Rate by Product Type The 3rd quarter of 2010 showed no real signs of a further weakening market, nor shifts to indicate a strengthening of the market. We did notice an increase in tour activity and a confidence in Tri-Valley Market that we have not seen in a long time. August proved to be a troubling month and seemed to take away some of the recently gained confidence. We are far from being out of the woods and the question still remains of whether commercial foreclosures will begin to trouble the retail market. The stale market has created opportunity for existing businesses to upgrade their loca- tion. This quarter saw the relocation of Classic Images, Up Town Girls, and Tri-Valley Bank all of which have found more visible locations along First Street. Large vacancies such as the former Mervyn’s space and PW Market have yet to find a suitor. It is rumored that Chipotle is in the market and seeking a Livermore location. We saw one building sale in downtown this past quarter and I expect that will be the trend over the next quarter. At this time we anticipate the trend outlined above to continue. While we will likely have few bumps in the road, I anticipate vacancy numbers and lease rates will con- KEY TERMS & DEFINITIONS tinue to show slight improvement over the fourth quarter. I do not expect a complete Inventory: Total square footage of retail space in the market stabiliztion until mid 2011 in the retail sector. Job growth will be paramount of getting this started, and if we are able to get job growth moving in the Tri-valley, the Livermore Availability: Square footage that is marketed for lease which is available within 90 market will improve at a faster rate. Our retailers need consumers to begin spending days. This also includes sublease space. again and until that happens, look for our market to remain stagnant. For now be encouraged by the small improvements the market is making. Absorption: The change in availability from the previous quarter. Vacancy: The percent of available space based on the total inventory. Grocery Anchored: Shopping centers characterized by a grocery anchor such as Recent Transactions Safeway, Trader Joe’s, Lucky, or Nob Hill. These centers are often more sought after Tenant Location Square Feet and fetch a higher lease rate. Classic Images 1986 2nd Street 2,100 Non-Grocery Anchored: Shopping centers, strip retail centers, and buildings over Up Town Girls* 2145 1st Street 2,100 10,000 square feet that do not have a grocery anchor. Subway Piazza Robino 1,400 Caratti Jewlers** 2056 1st Street 1,982 Downtown Retail: Storefront buildings & centers located along 1st Street and the * - Lee & Associates represented transaction downtown core. ** - Building purchase Triple Net Expenses (NNN): A lease agreement where the Tenant is responsible for their proportionate share of taxes, insurance, maintenance and building repairs. Lee & Associates maintains an up-to-date database of all available properties and sold/leased properties. Triple Net Expenses are in addition to base rent. For more local commercial real estate news, insight, and gossip visit me at www.thestorefront.wordpress.com

- 2. 3r d Qu Lee & Associates Livermore Retail Market Report ar te QUARTER IN REVIEW r2 01 0 Livermore Retail Vacancy and Rental Rates Vacancy Rate vs. Average Asking Rate Tri-Valley Vacancy Report Exclusive Lee Listings FOR SALE FOR LEASE FOR LEASE 3,000± Square Feet Available 2,290± Square Feet Available 600± Square Feet Available 260 N. “L” Street 39 S. Livermore Ave. 2074 1st Street Lee & Associates - Your Retail Connection Since 1979, our seasoned, motivated shareholders and professionals have been offering comprehensive quality service nationally and locally in a pro-active manner. We develop customized solutions for all of your real estates needs through our market-to-market knowledge in all property types. Our unique business model and extensive experience has helped us become one of the largest commercial real estate providers in the United States. Services Offered: Market Value Analysis Building Optimization Investment Sales Site Search Landlord Representation Tenant Representation Retail - Office - Industrial RETAIL OFFICE INDUSTRIAL Jessica is experienced in both Tenant and Landlord representation and has been active in the Easy Bay commercial real estate market since 2006. Prior to joining Lee & Associates in 2009, Jessica worked for Aegis Realty Partners in Oakland. As a retail specialist, she has worked with a number of local restaurants, retailers, and landlords in 5890 Stoneridge Drive, Suite 210 sales and leasing of shopping centers and storefronts. Pleasanton, CA 94588 (925) 460-2600 Jessica Stewart For the most up to date market information follow Jessica on www.lee-associates.com Retail Specialist her blog www.TheStrorefront.wordpress.com. * The property information/detail contained herein has been provided by the seller/lessor or has been obtained from other sources believed to be reliable, and Lee & Associates - East Bay, Inc. has not independently verified such information’s accuracy. Lee & Associates - East Bay, Inc. makes no representations, guarantees, or express or implied warranties of any kind regarding the accuracy or completeness of the information provided herein nor the condition of the property and expressly disclaims all such warranties, including but not limited to the implied warranty of suitability and fitness for a particular purpose. Buyer/Lessee should perform its own due diligence regarding the accuracy of the information upon which buyer/lessee relies when entering into any transaction with seller/lessor herein. Further, the information provided herein, includ- ing any sale/lease terms, are being provided subject to errors, omissions, changes of price or conditions, prior sale or lease, and withdrawal without notice. 2 * CoStar sourced for portion of market data