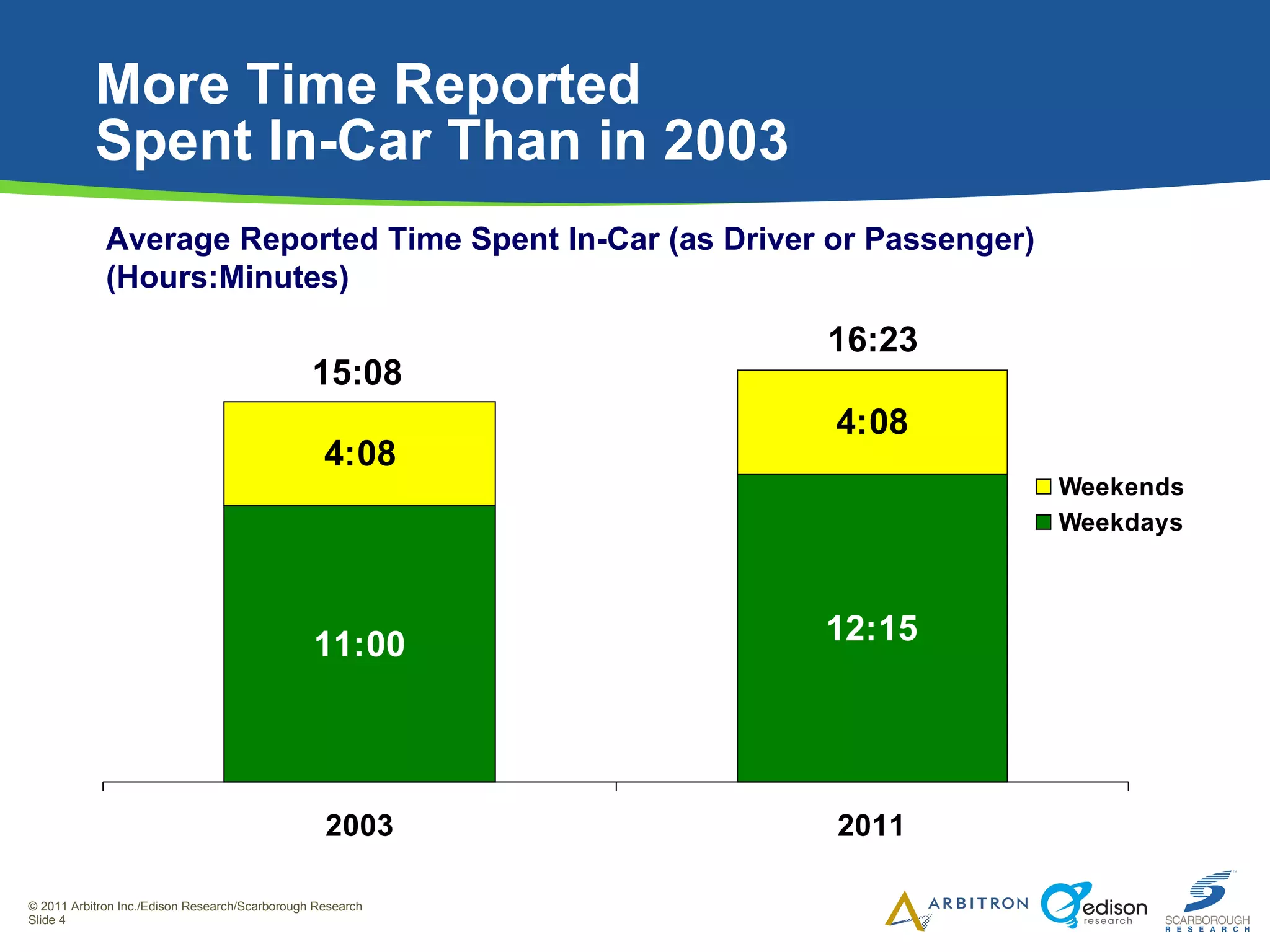

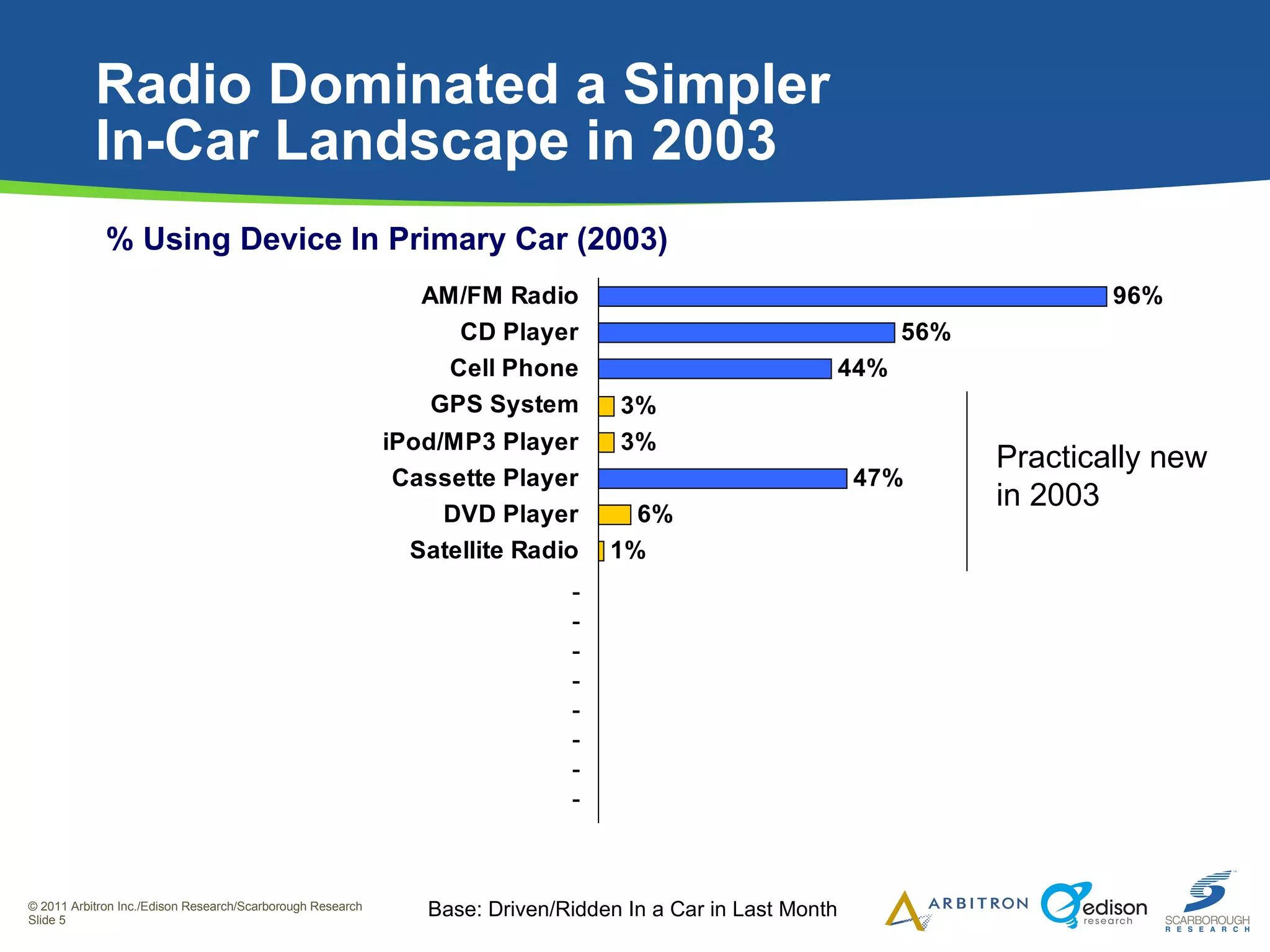

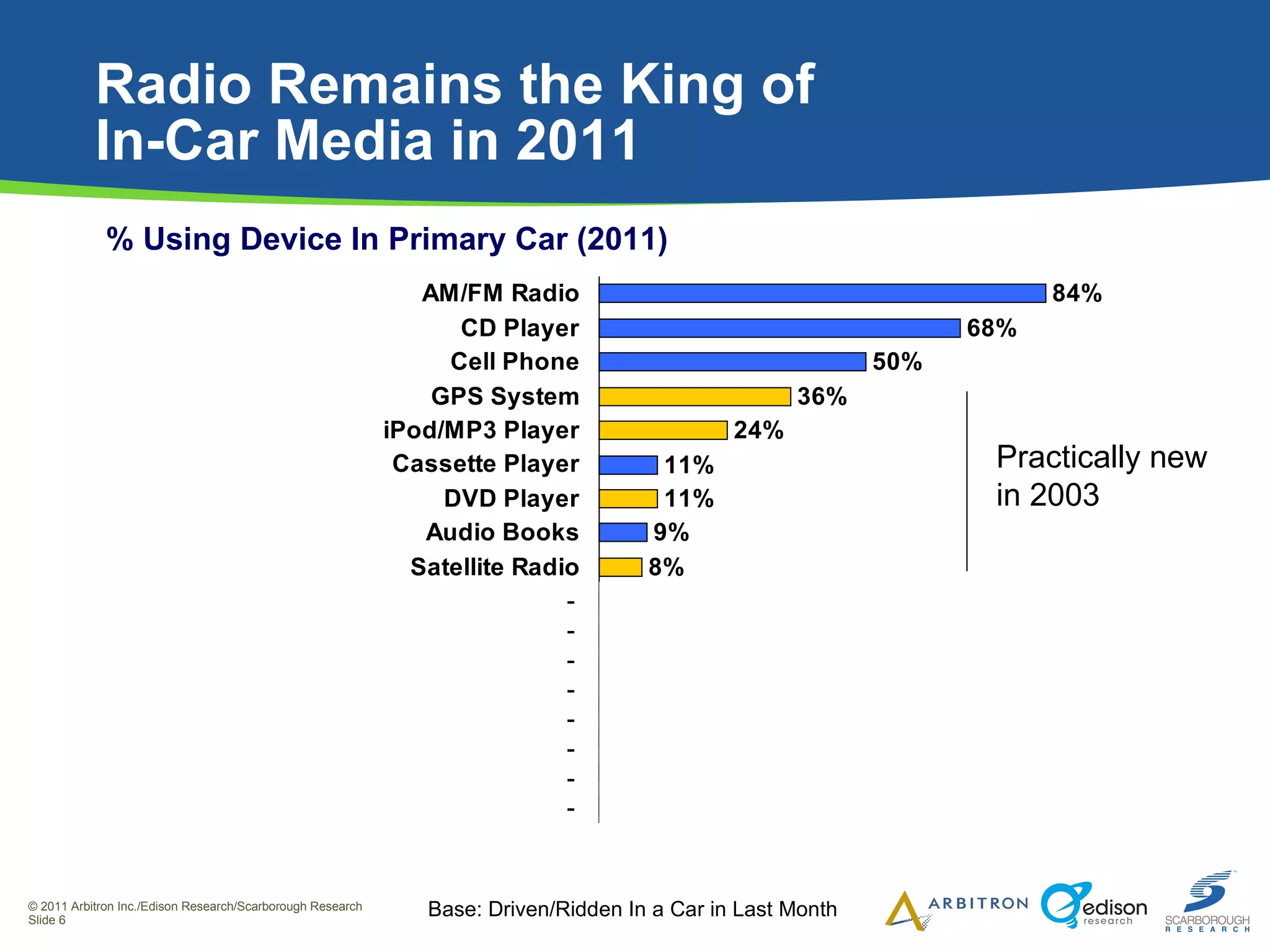

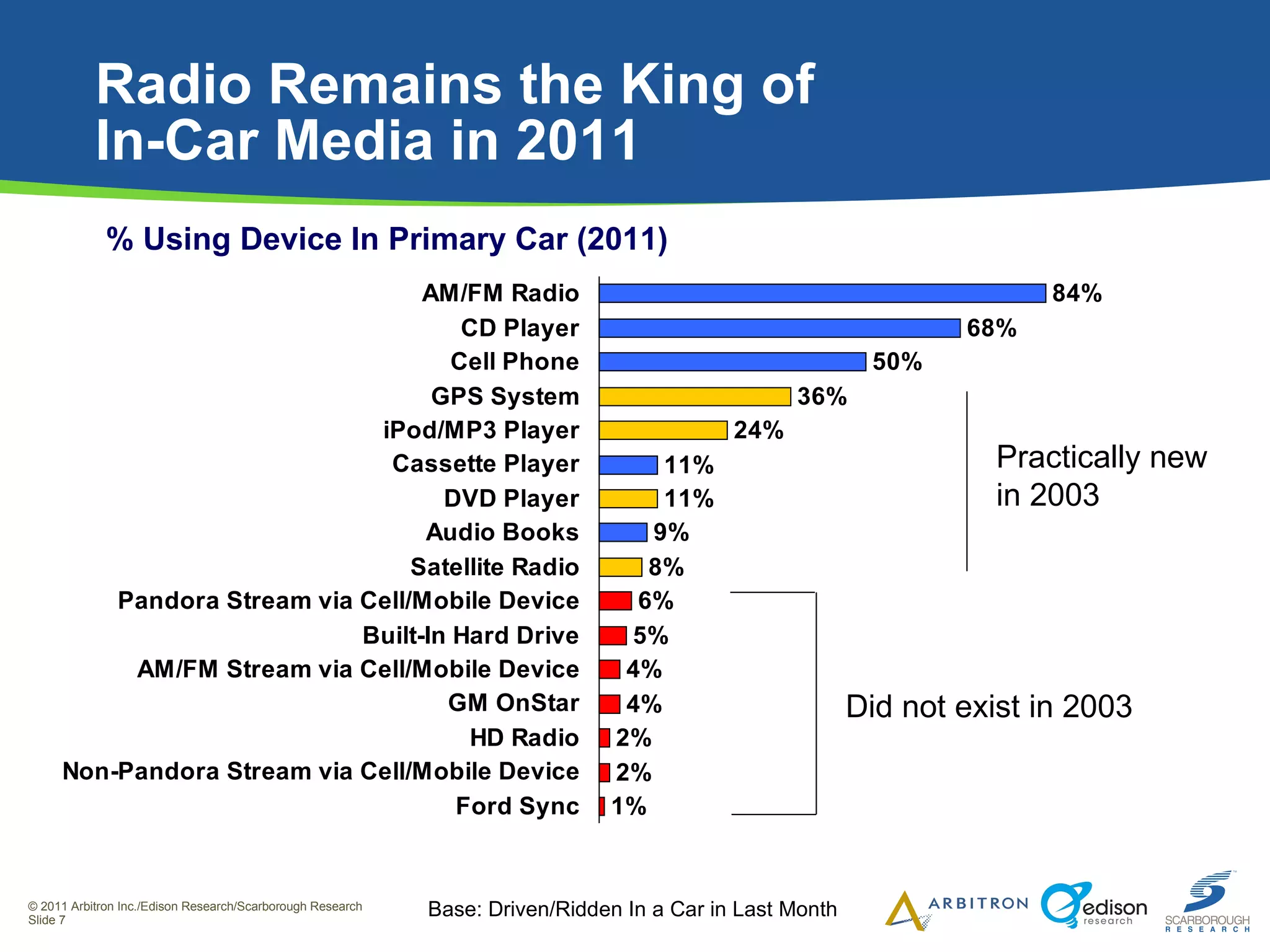

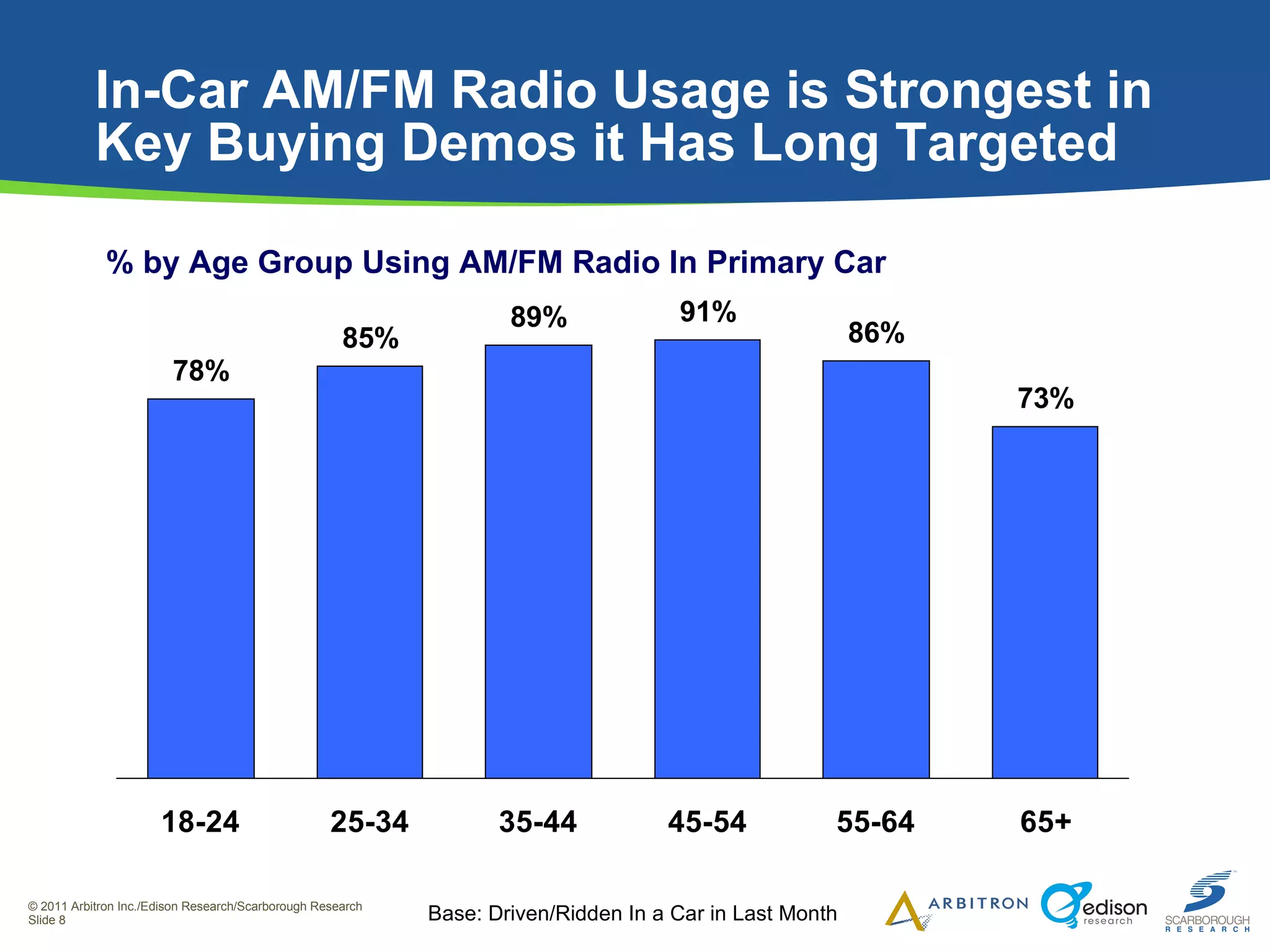

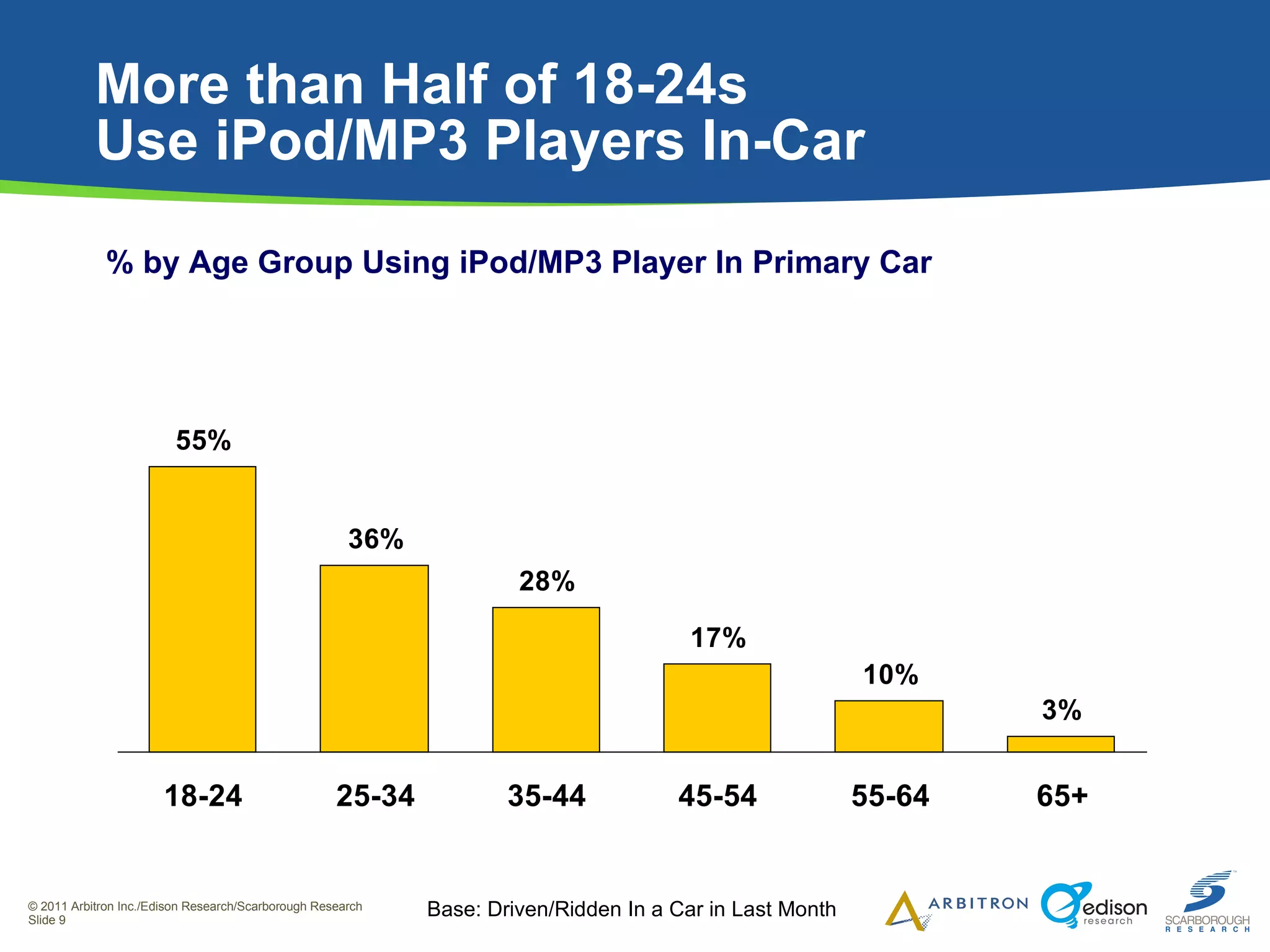

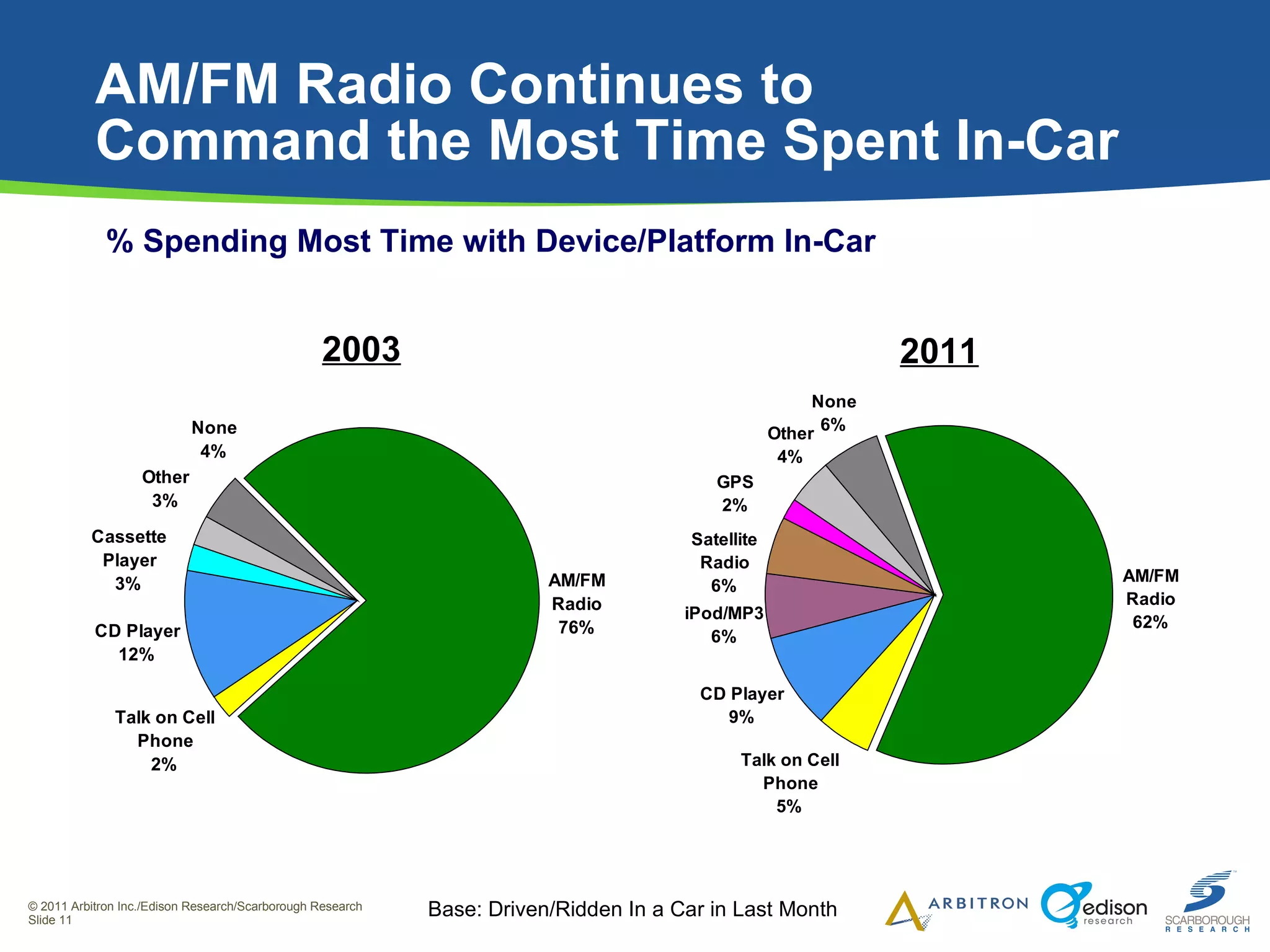

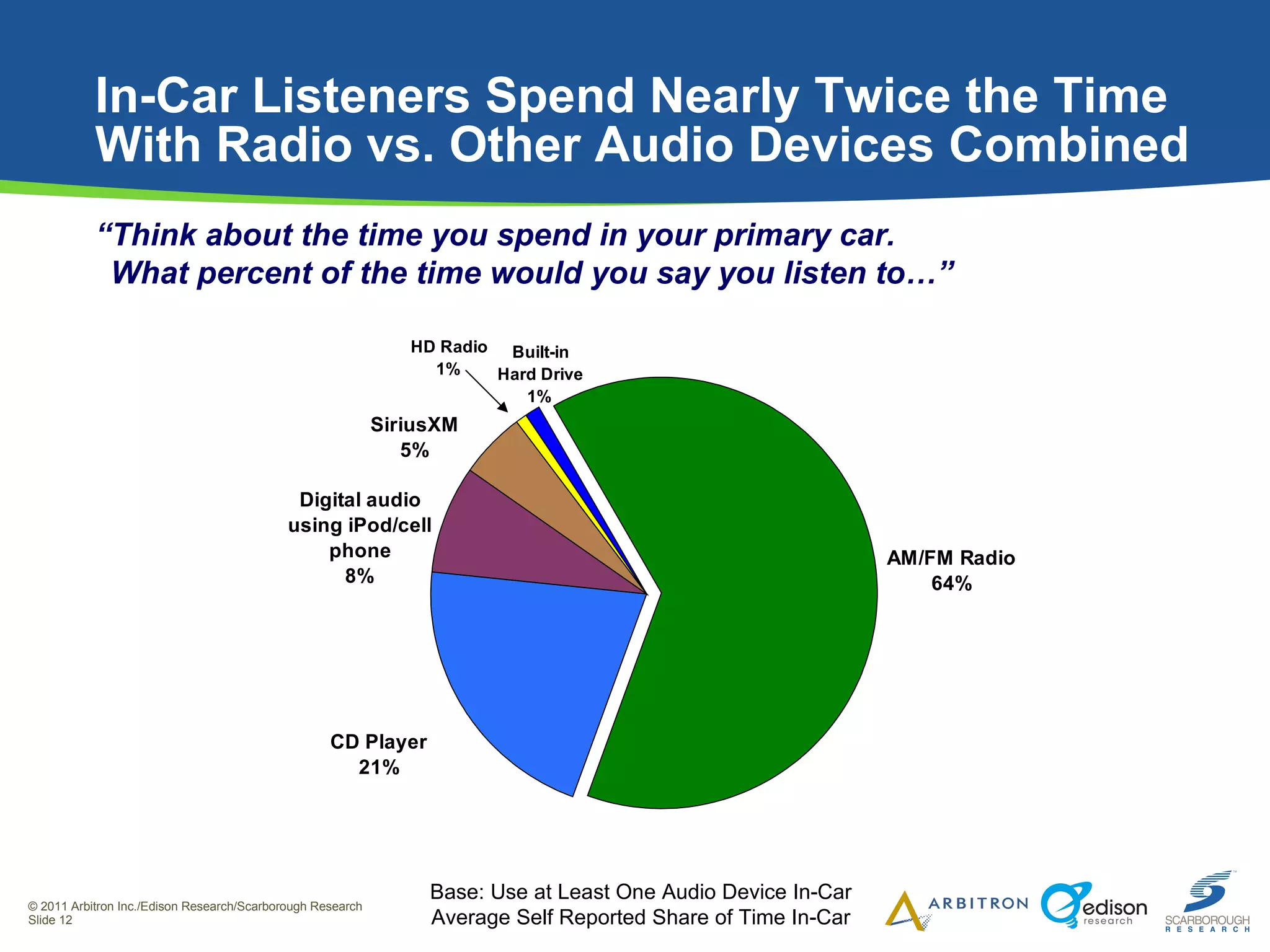

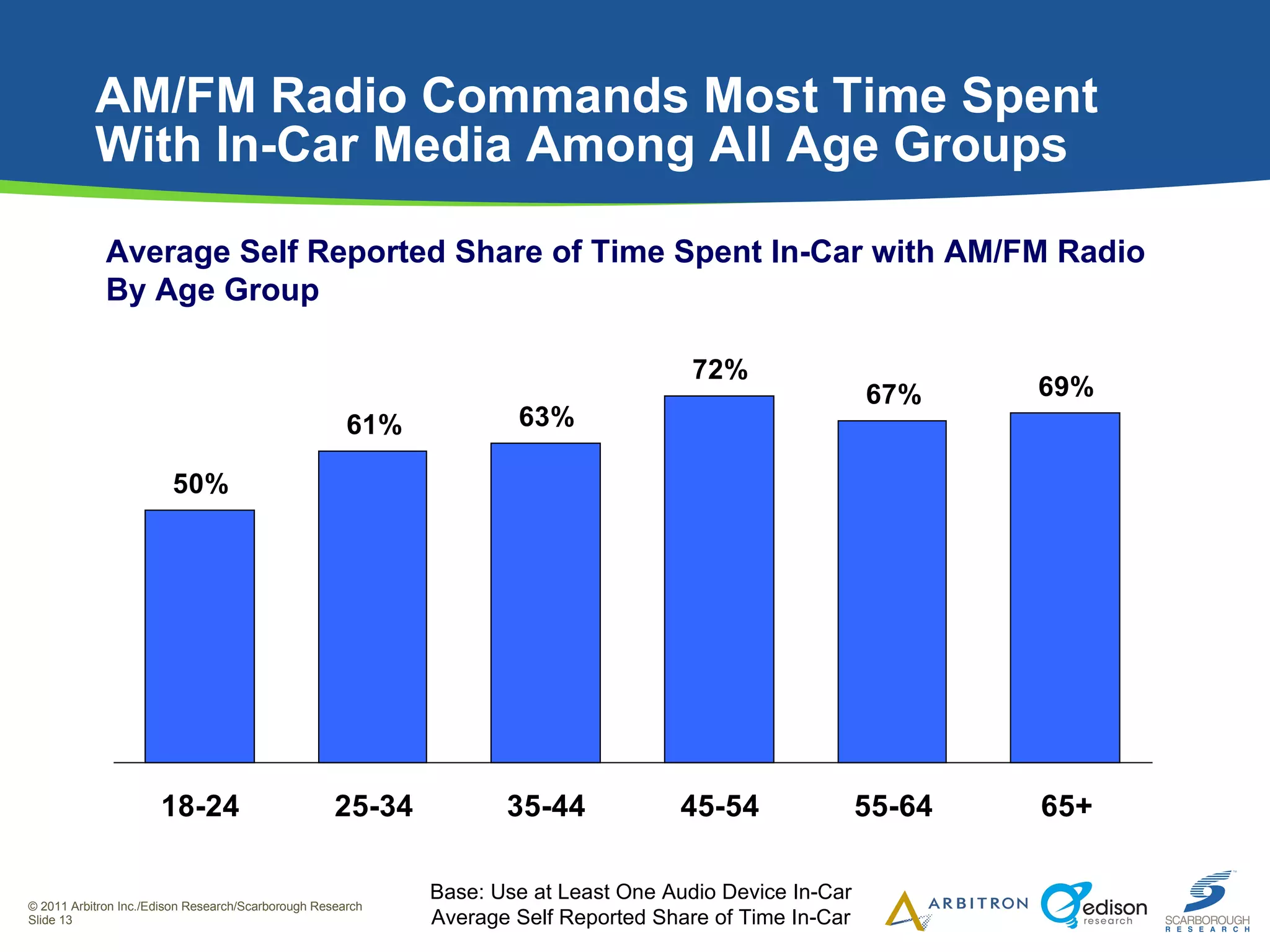

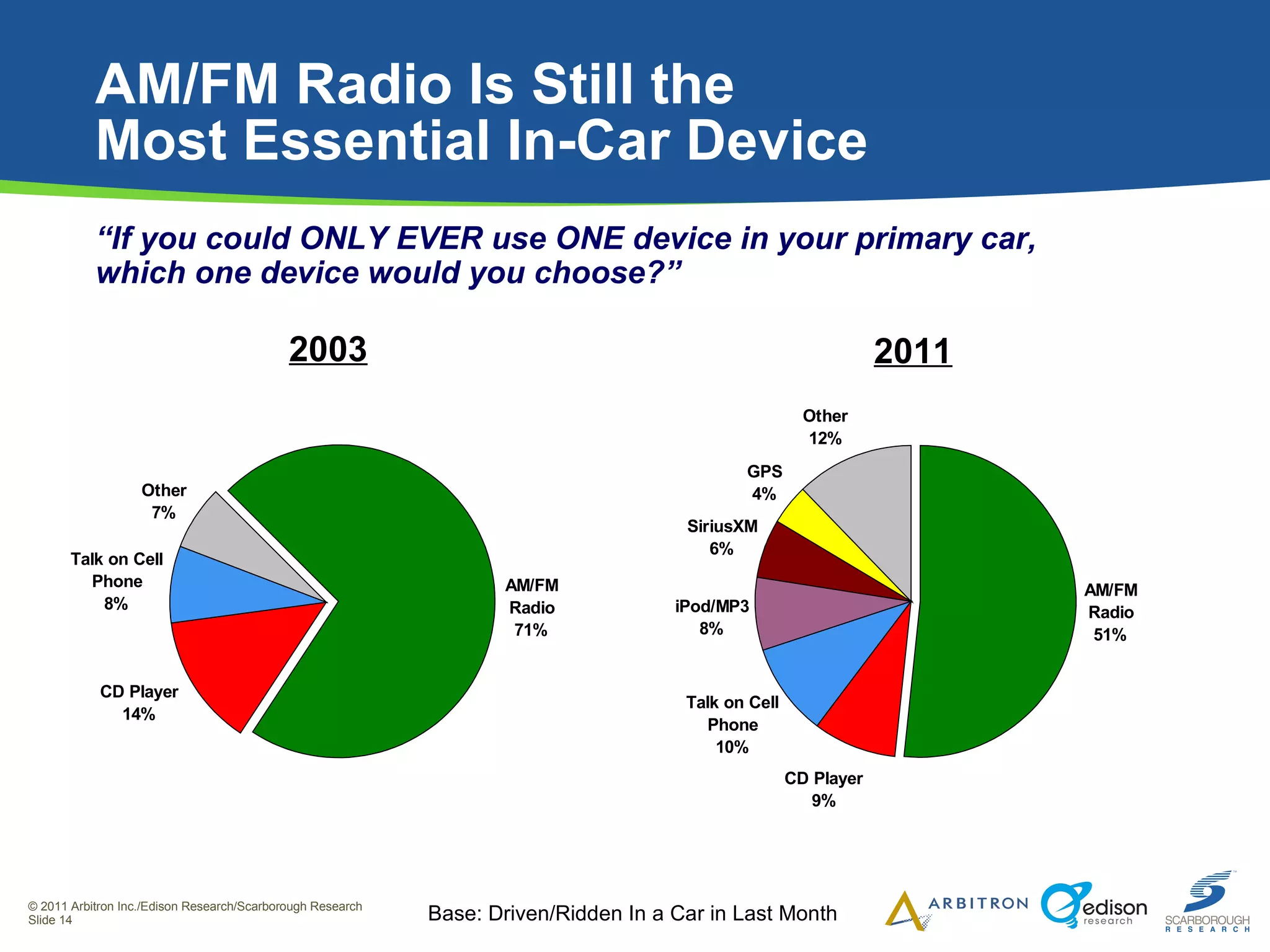

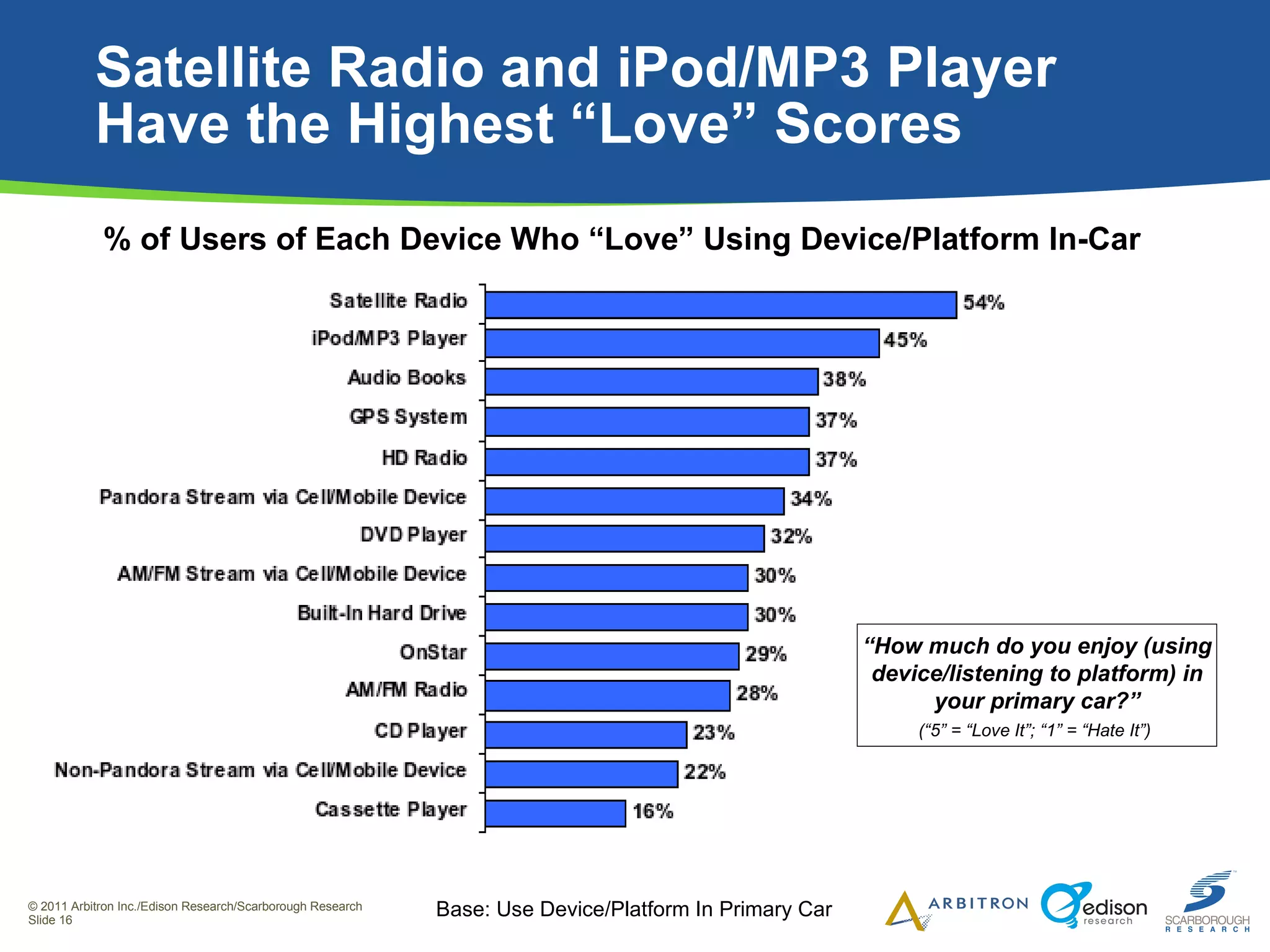

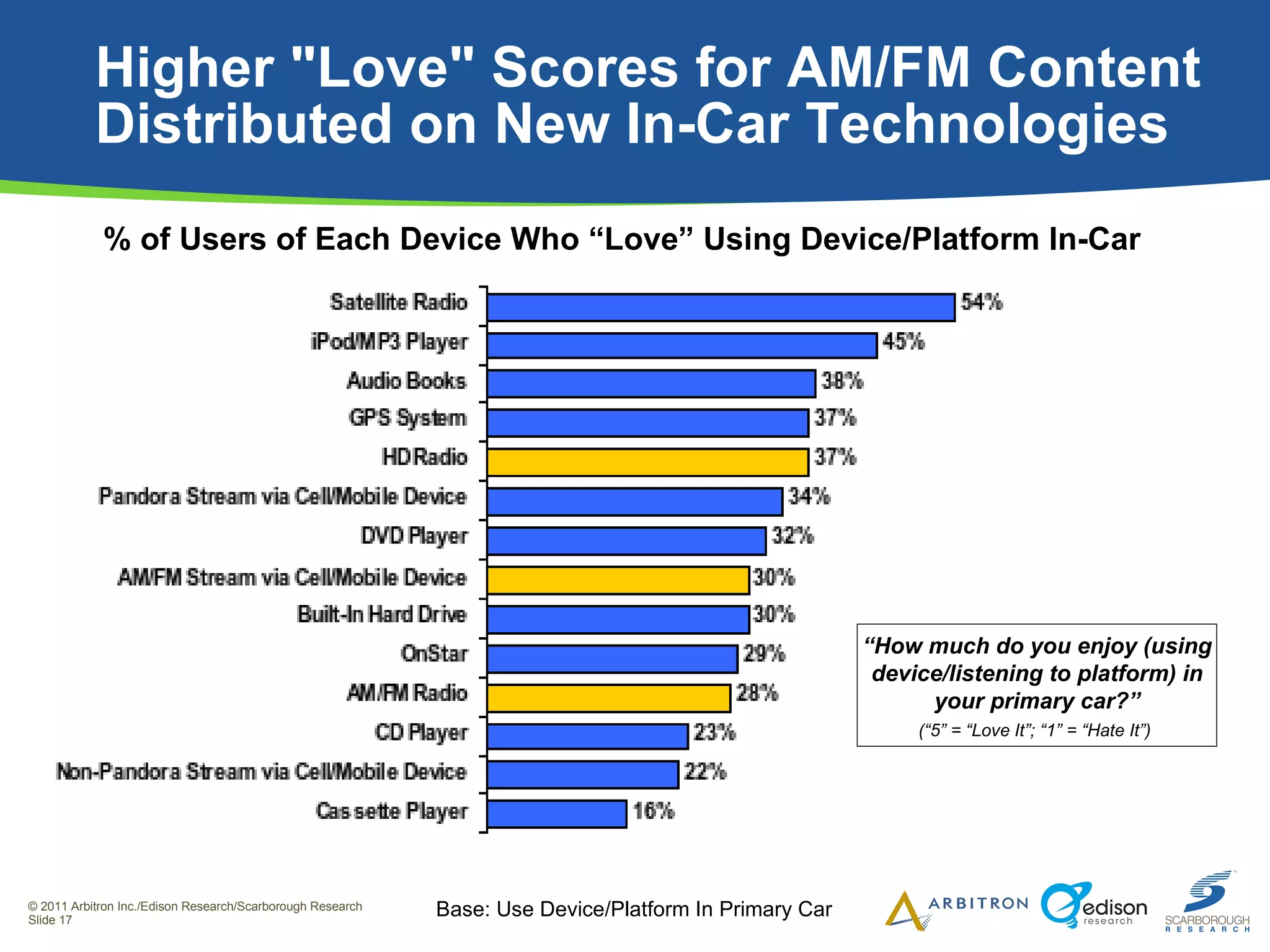

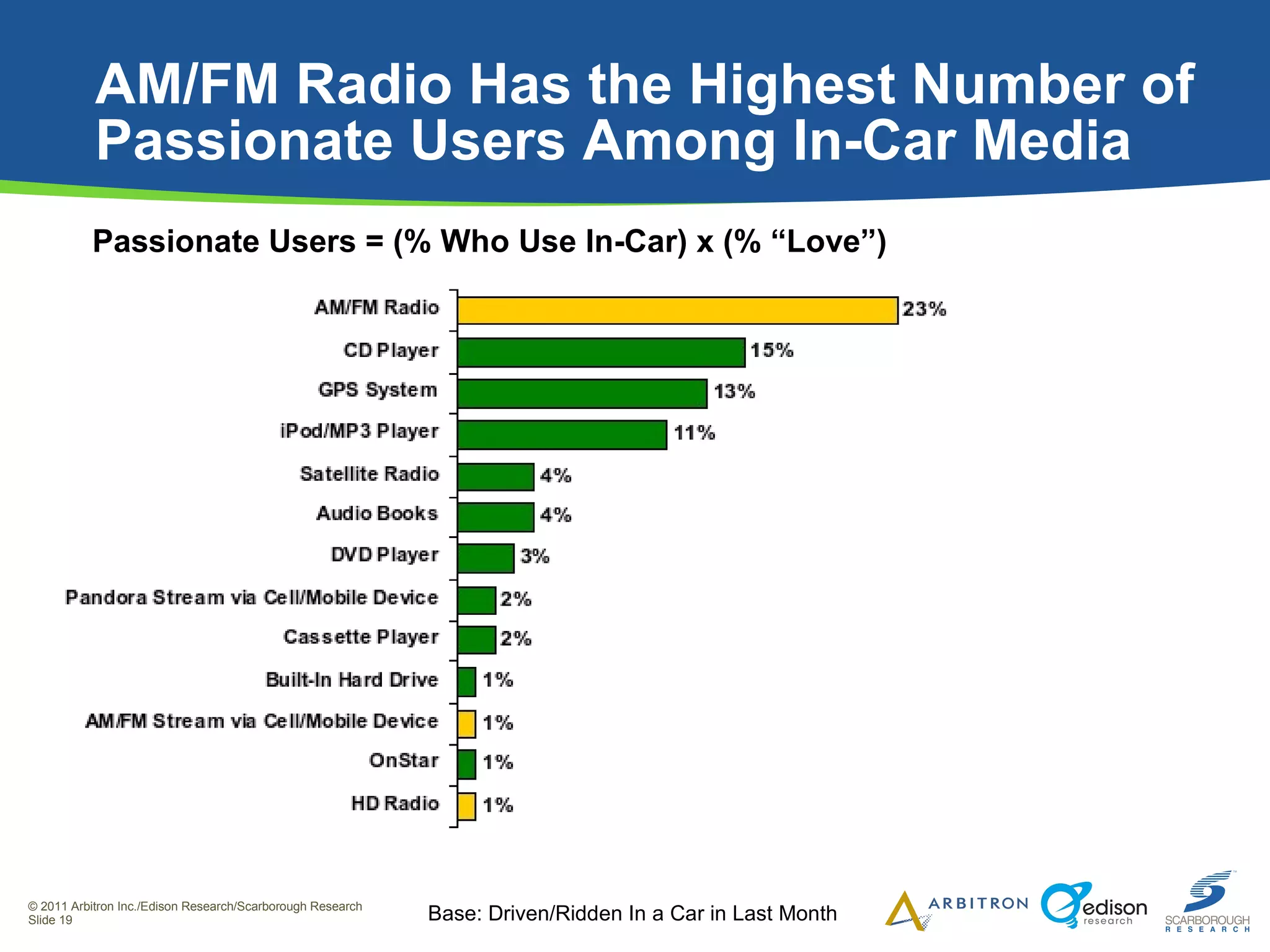

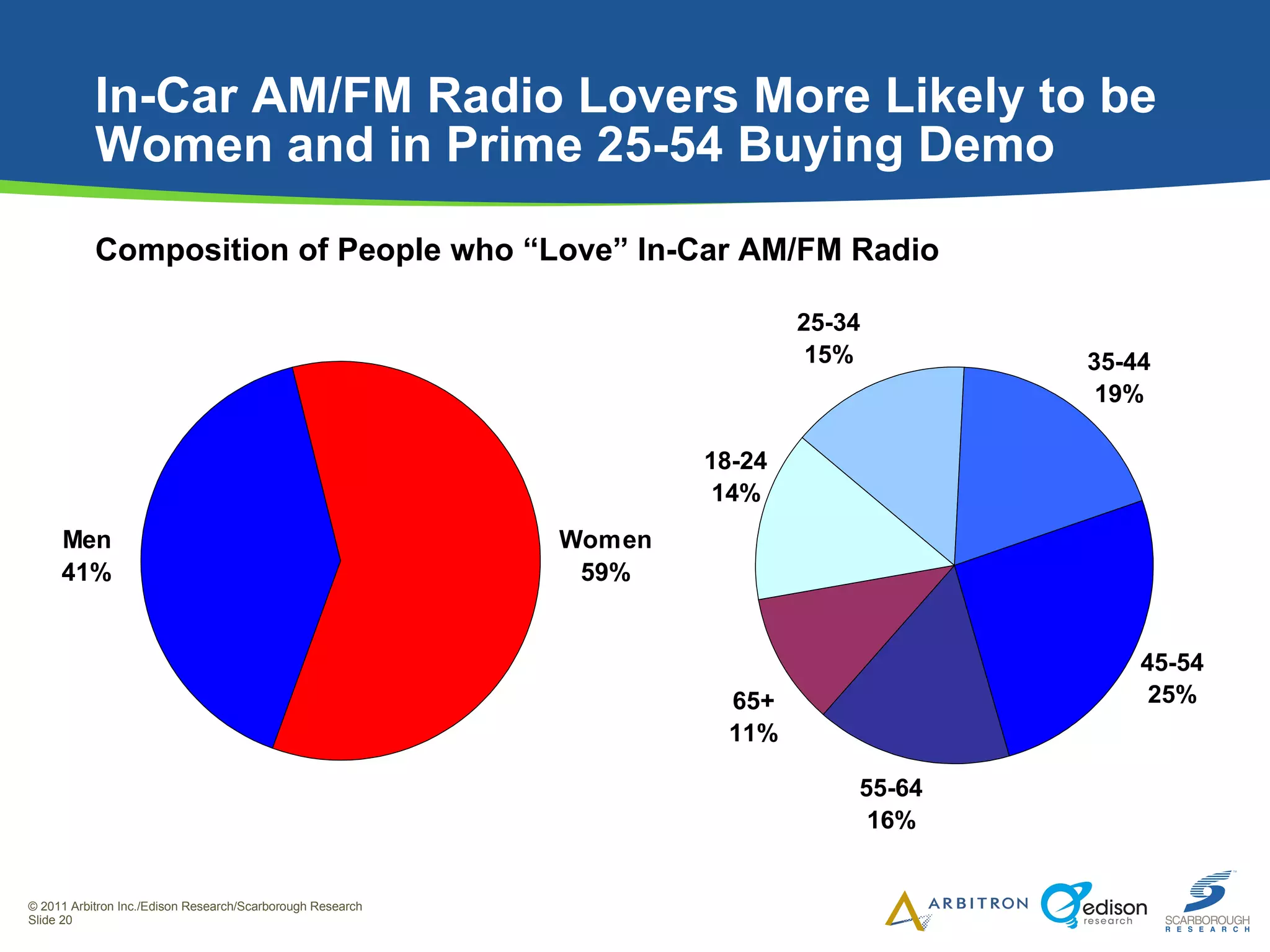

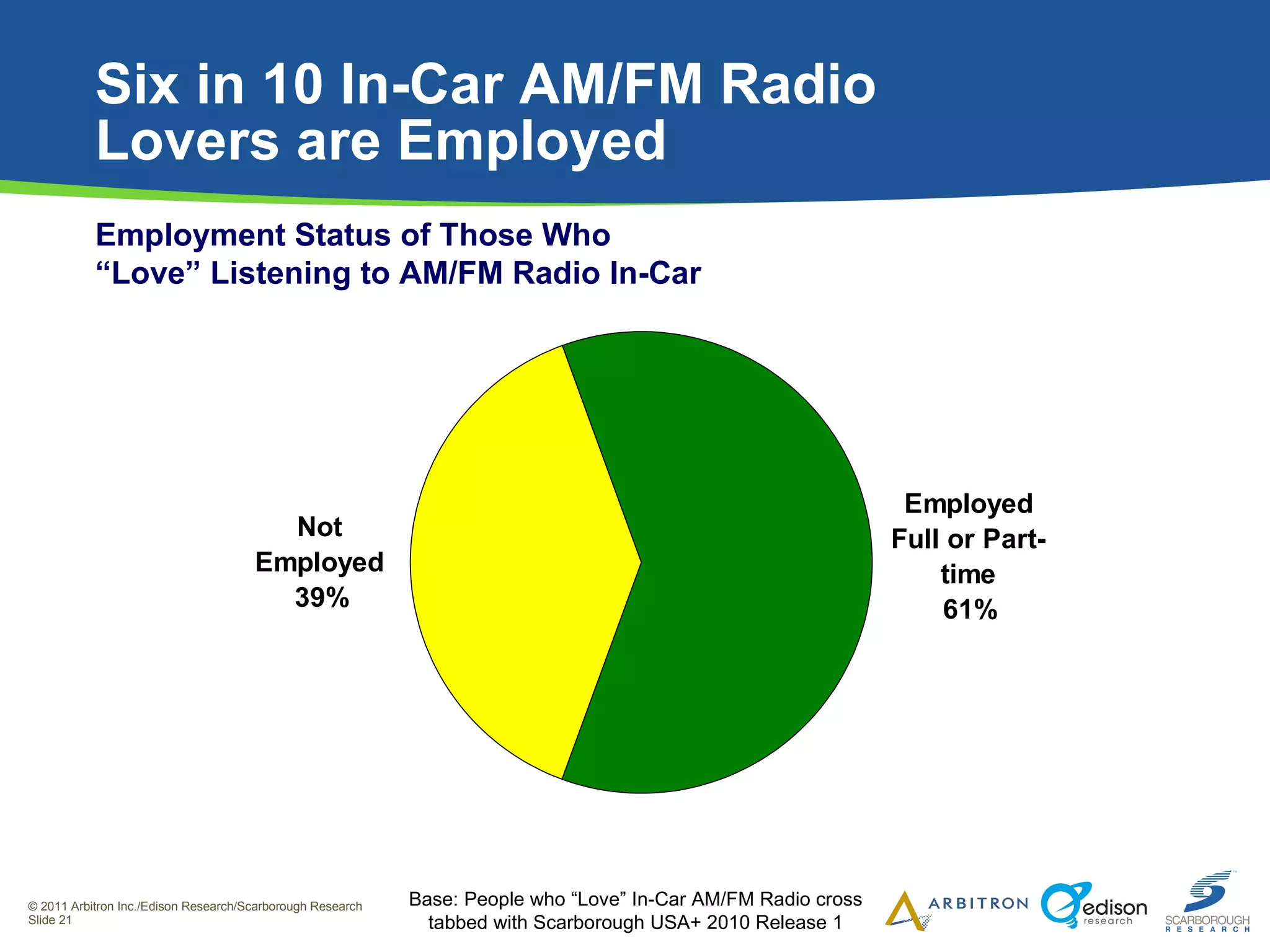

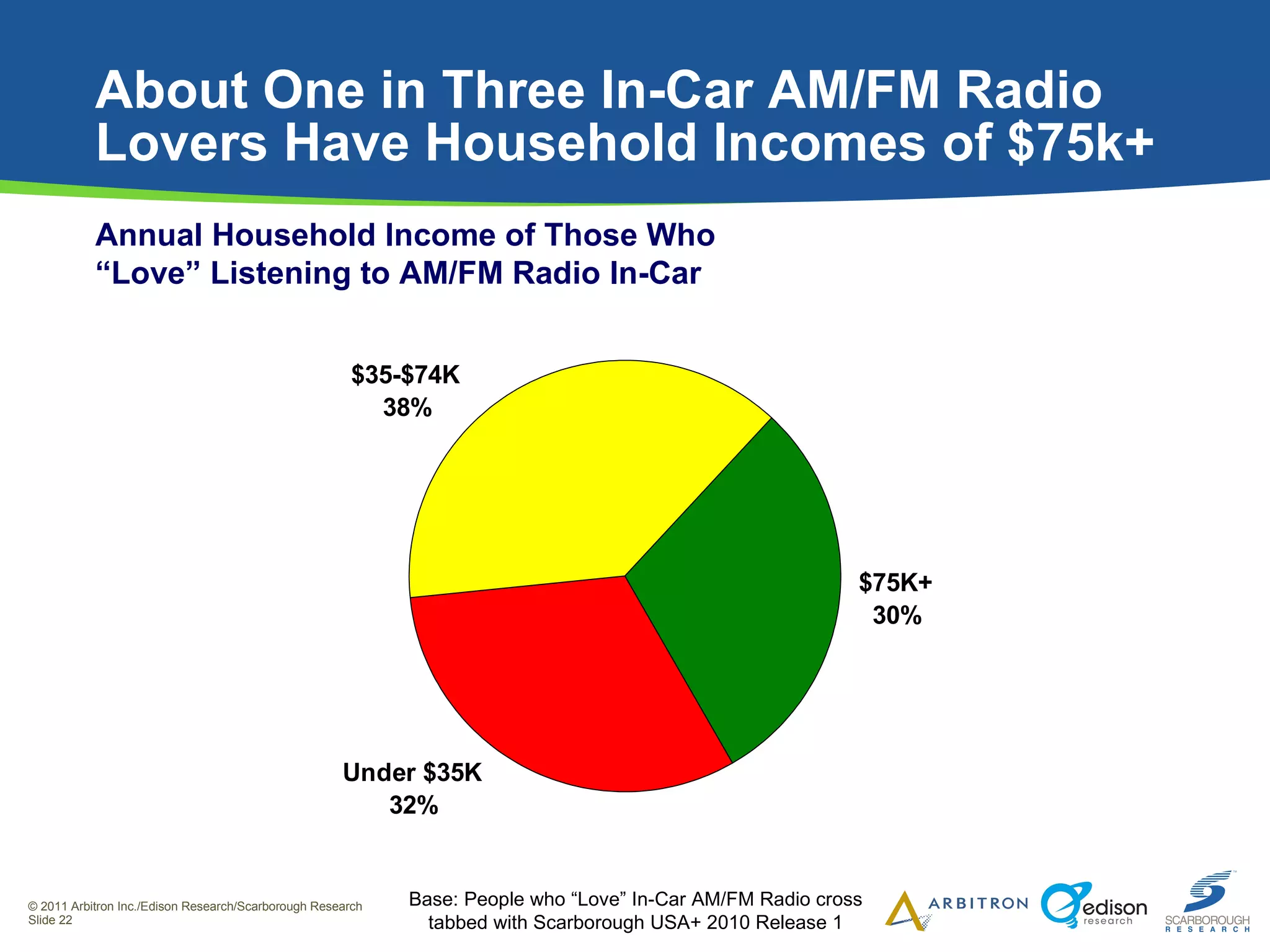

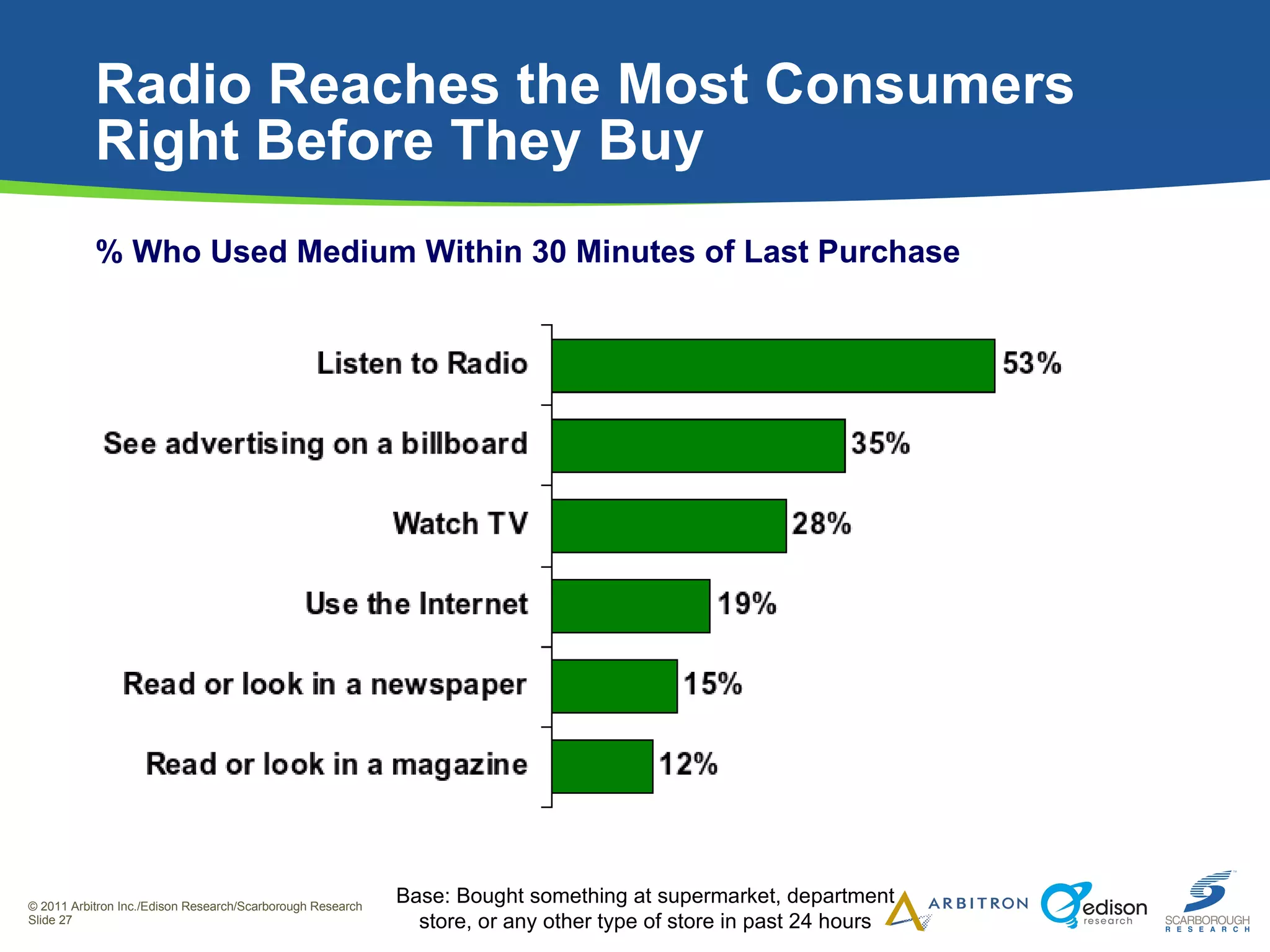

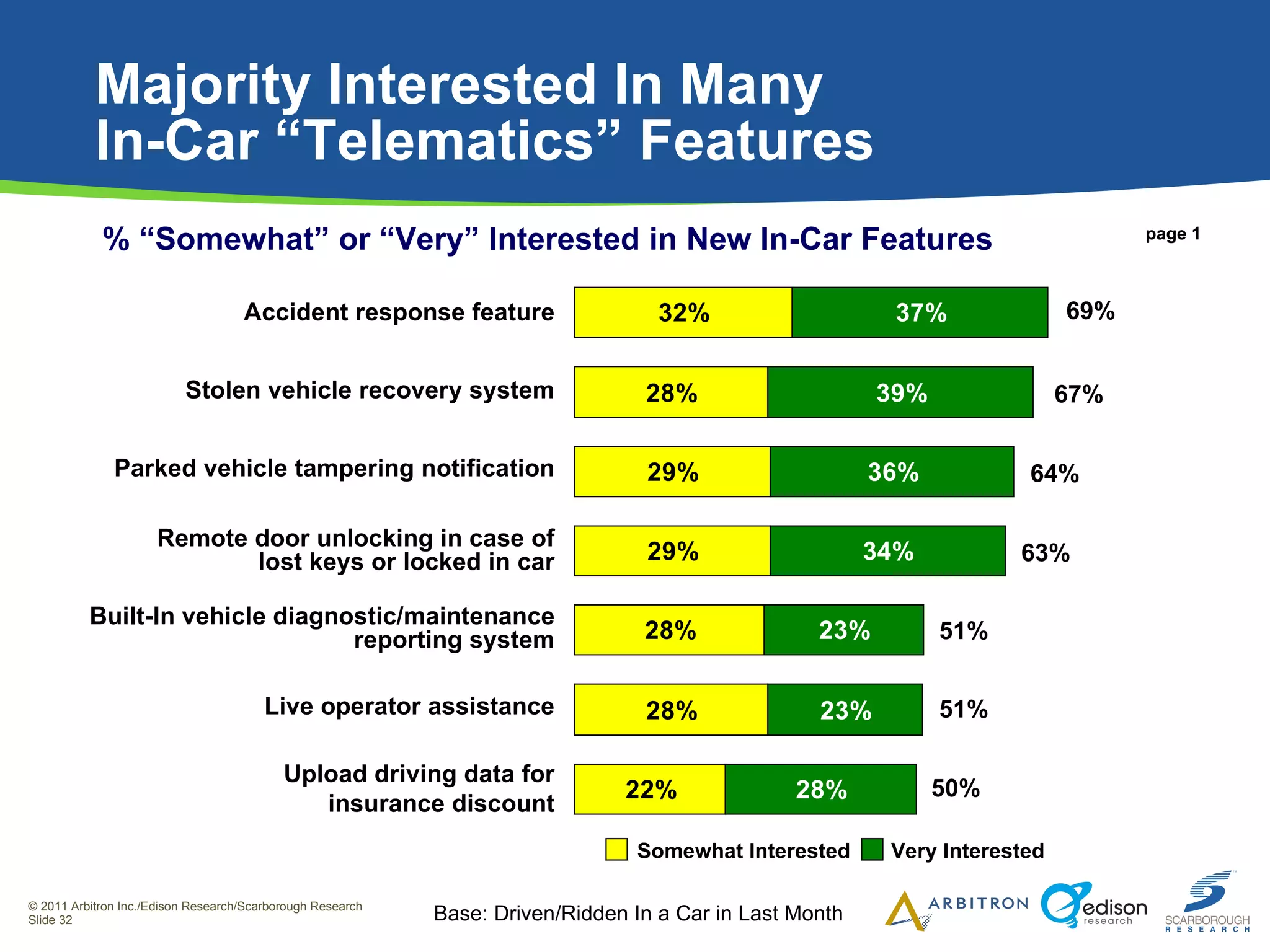

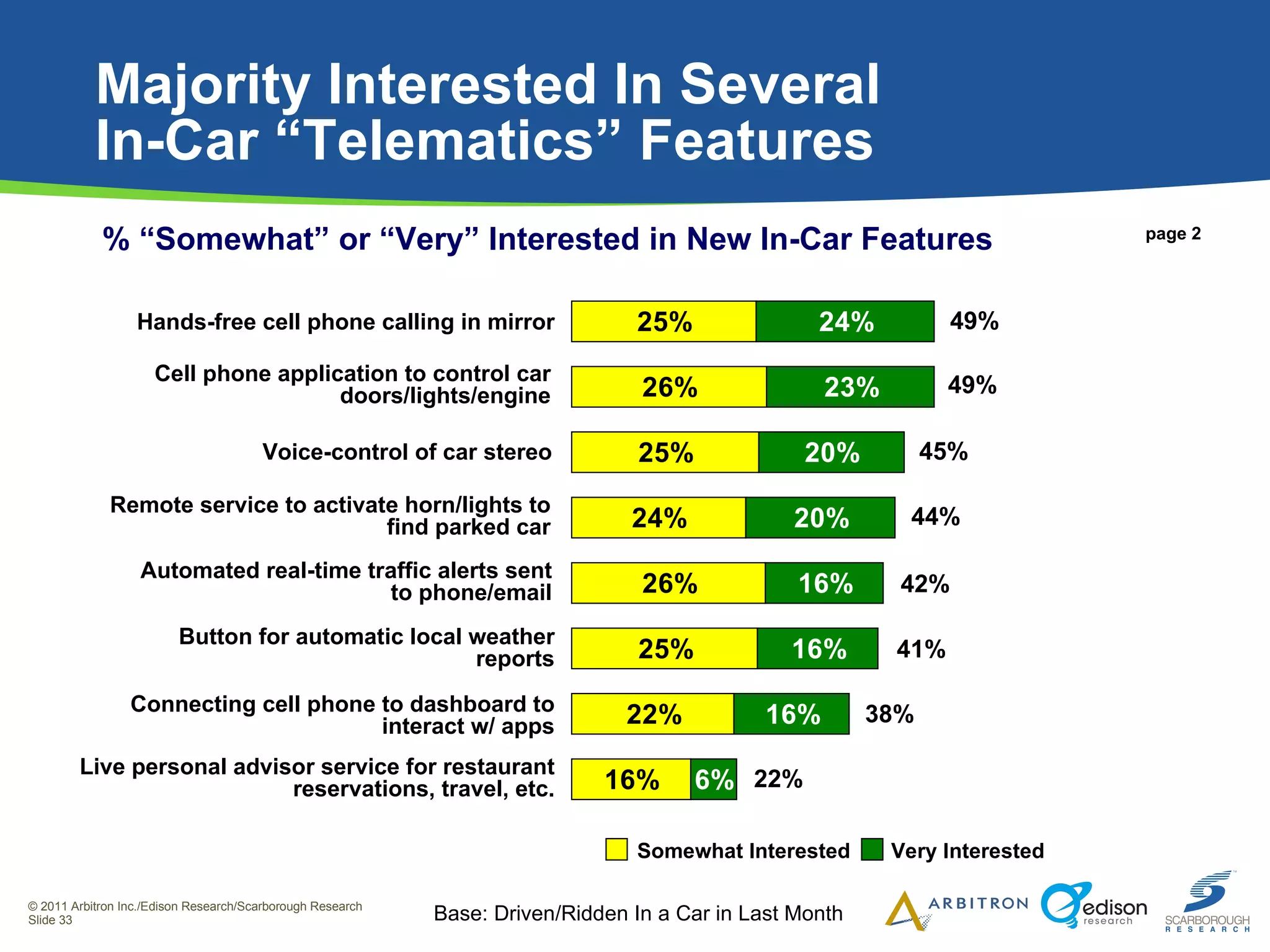

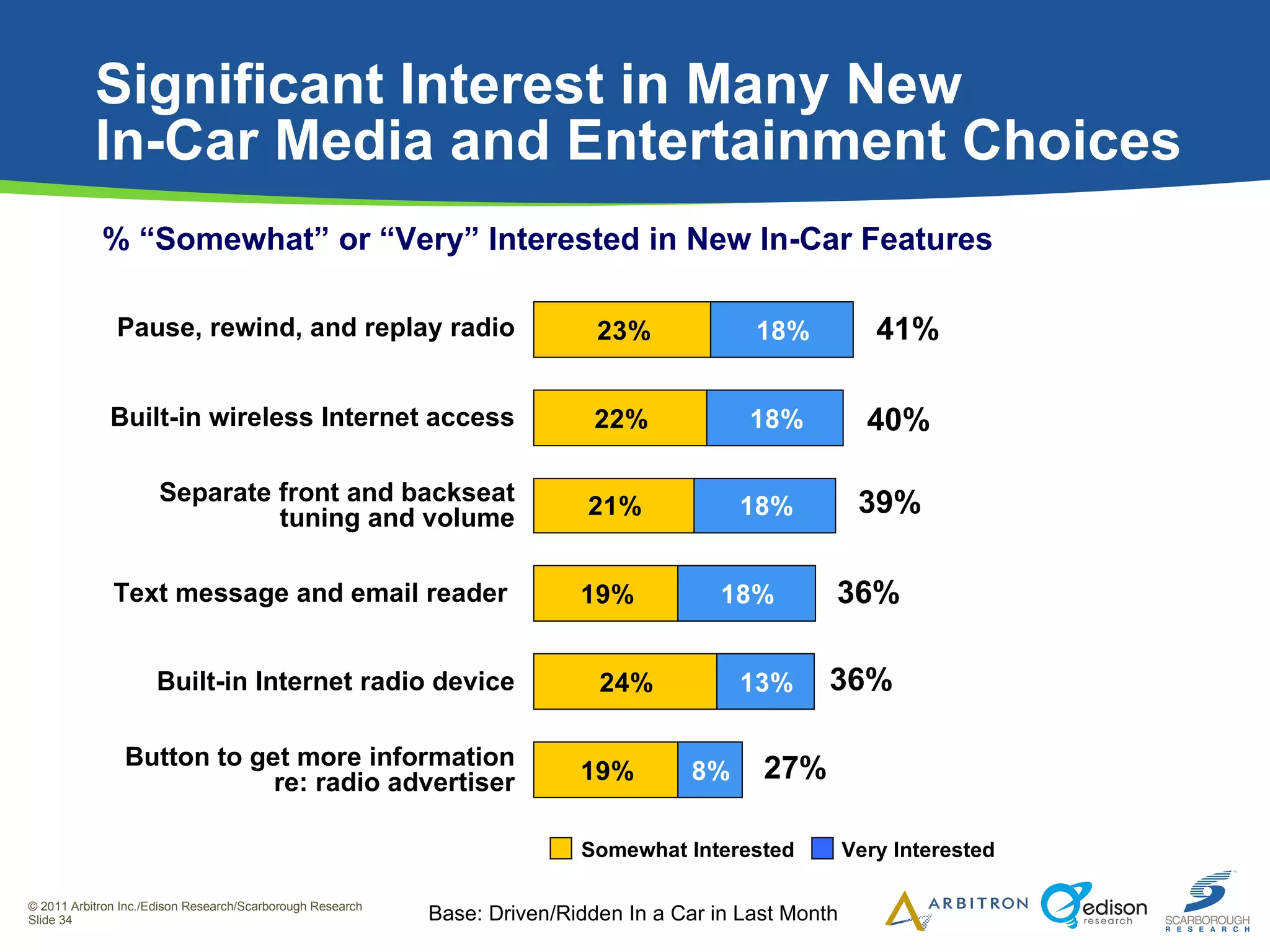

The document summarizes research on media usage and preferences in vehicles. It finds that while radio remains the most widely used and enjoyed in-vehicle media, there is growing adoption of digital devices like iPods and streaming services. Most consumers are open to new "telematics" features in cars like traffic alerts and vehicle diagnostics accessed through cell phones. Radio maintains its strong position despite increased digital options, though emerging platforms may threaten its dominance if radio does not embrace new technologies like HD.